On this page

UK Property Investor BoE Base Rate Report 2022 cost of living Interest rates Inflation rates Borrowing costs Property market Property investment opportunities The Bank of England base rate currently stands at 2.25%. How would you feel if the next base rate... What do you think the Bank of England base rate will be by the end of 2023? Finally, will increasing the Bank of England base rate help grow or negatively impact the economy? How many investment properties do you currently own? How have you previously sourced your investment properties? What types of finance have you used for your property investments?UK Property Investor BoE Base Rate Report 2022

Over 64% of UK property investors are “concerned” or “strongly concerned” about the Bank of England base rate increasing to 3%.

In October 2022, we conducted a survey of over 1,000 property investors that currently own at least one investment property. As well as concerns regarding the BoE base rate, we’ve discovered investors' predictions about base rates in 2023, how they feel about inflation, borrowing costs and interest rates, and indeed whether property investors plan to invest in the property market in 2023.

As Stephen Clark from Finbri, a bridging loan broker, comments, “In a nutshell, we wanted to know how property investors feel about the economy right now before another anticipated hike in the base rate and how that might impact their property investment decisions next year.”

How do investors feel about the state of UK financial circumstances and situations?

We wanted to know how property investors are feeling about the state of current financial situations in the UK. Asked to choose if they were Strongly Concerned, Concerned, Neither Concerned nor Optimistic, Optimistic or Very Optimistic, we discovered these key findings about how investors feel towards…

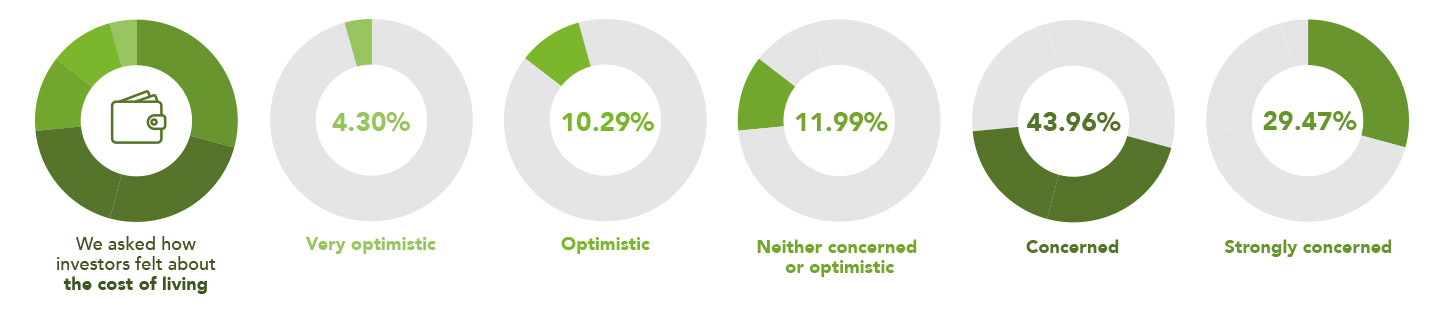

Cost of living

A combined 73.42% of investors are either Strongly concerned (29.47%) or Concerned (43.96%) about the current cost of living situation, widely called a crisis, in the UK.

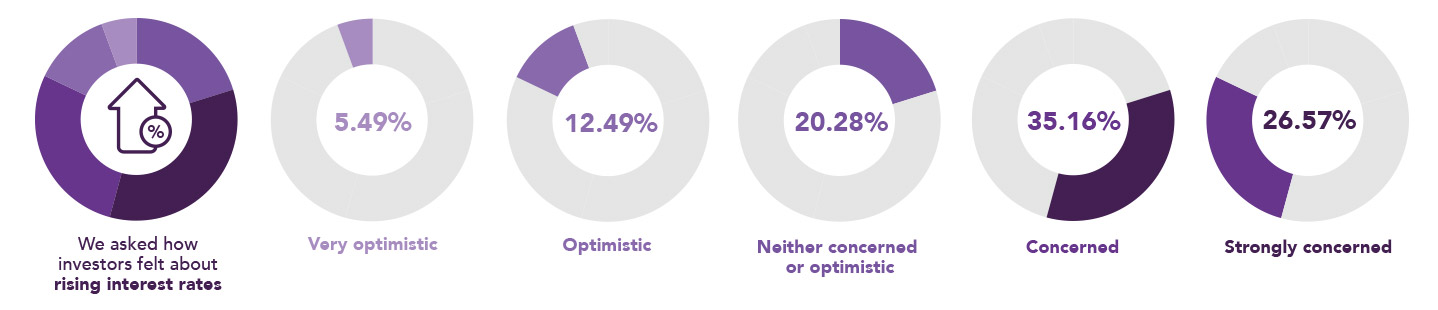

Interest rates

Our survey has identified that 61.73% of investors are Strongly concerned (26.57%) or Concerned (35.16%) about the rising interest rates. Despite mortgage rates hitting fresh 14-year highs this month, a cohort of property investors remains positive about interest rates, with 12.49% being Optimistic and 5.49% currently, Very optimistic.

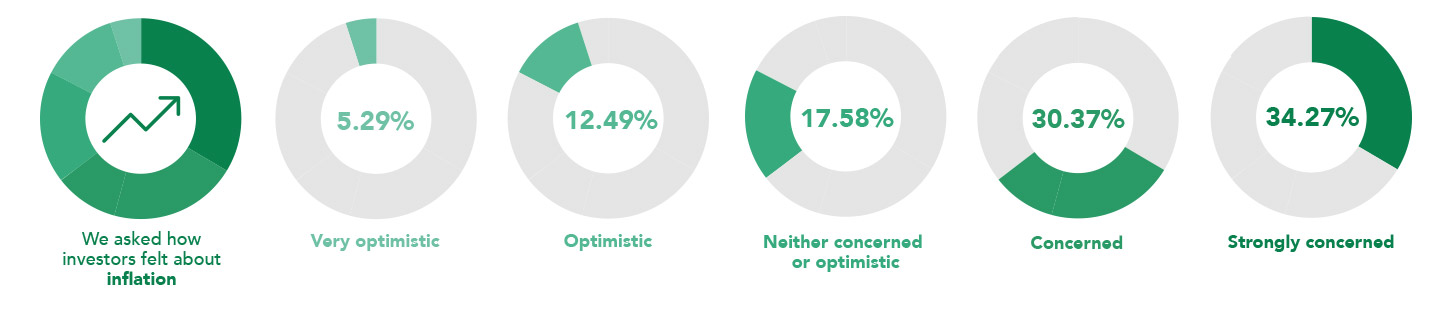

Inflation

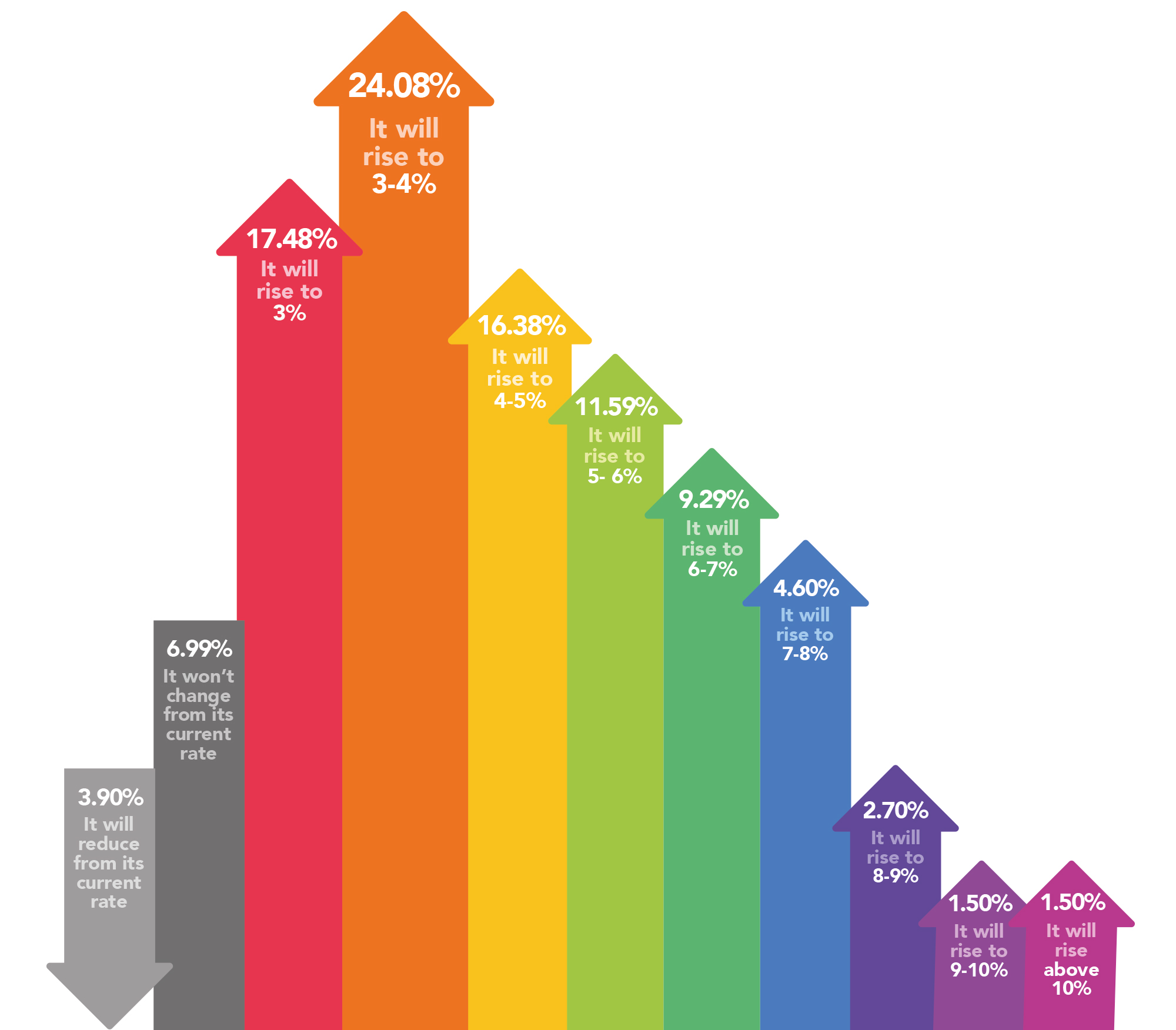

64.63% of respondents feel Strongly concerned (34.27%) or Concerned (30.37%) about inflation in the UK. At the time of our survey, inflation was 9.9%, which has since risen further to 10.1%, matching a 40-year high.

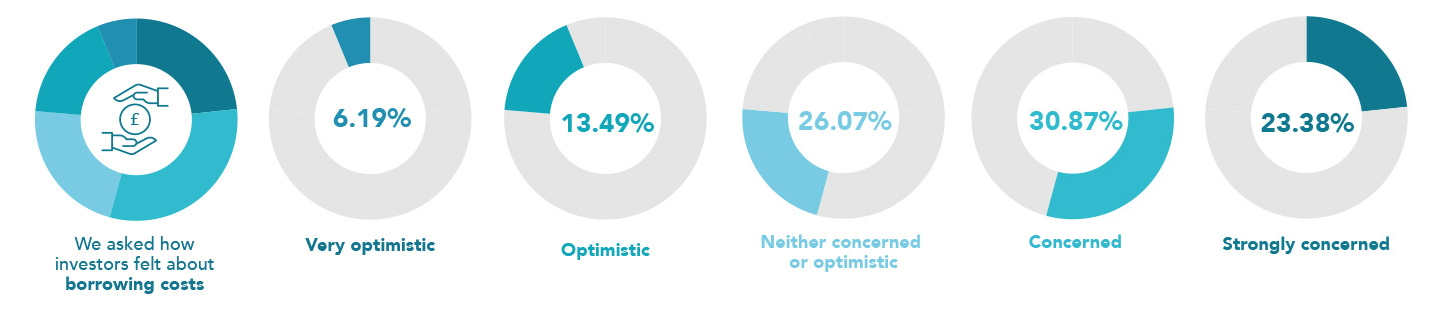

Borrowing Costs

Of all the current affairs we asked investors for their feelings about, Borrowing Costs had the most respondents answering that they were Neither concerned nor optimistic (26.07%). Concerned (30.87%) had the most responses overall, but borrowing costs had a larger proportion of people not feeling one way or the other. However, 23.38% were Strongly concerned.

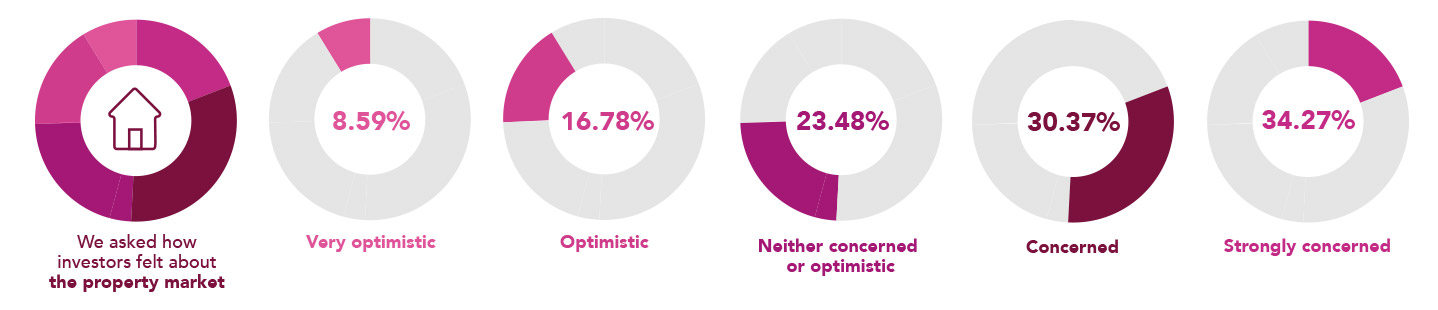

Property Market

31.77% of investors are currently Concerned about the property market, whilst 19.38% are Strongly concerned. An unsurprising response considering the volatile state of the housing and property market. But there is some positivity to be found amongst investors, with 16.78% Optimistic and 8.59% Very optimistic.

Property Investment Opportunities

The big one.. how do property investors feel about the state of investment opportunities? 48.05% of respondents were either Strongly concerned (18.58%) or Concerned (29.47%). 25.97% were Optimistic (18.28%) or Very optimistic (7.69%), and 25.97% were in the middle and felt Neither concerned nor optimistic.

Most responses per question:

- Cost of living - Concerned 43.96%

- Interest rates - Concerned 35.16%

- Inflation - Strongly concerned 34.27%

- Borrowing Costs - Concerned 30.87%

- Property market - Concerned 31.77%

- Property investment opportunities - 29.47%

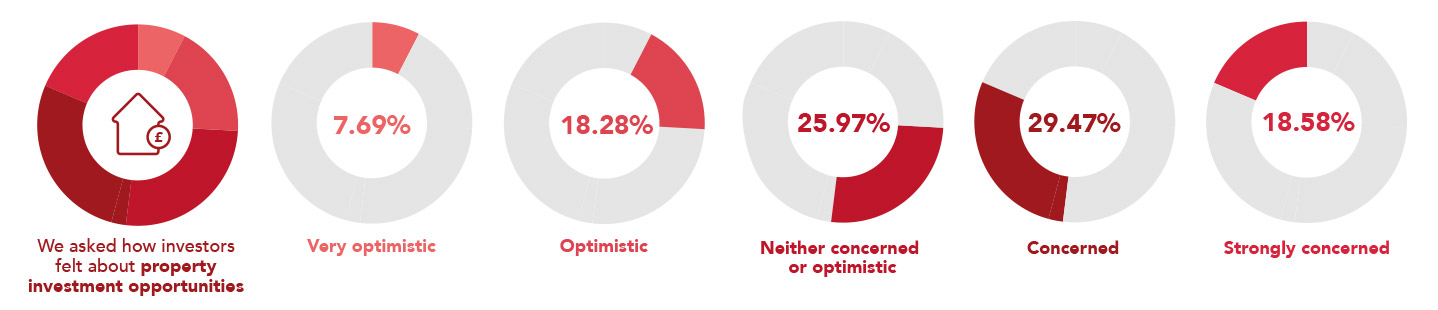

The Bank of England base rate currently stands at 2.25%. How would you feel if the next base rate…

64.23% of people said they would be Concerned (25.87%) or Very Concerned (38.36%) if the base rate increased from 2.25% to 3.00%. With the market predicting the base rate will rise above 4% by the end of 2022, that could leave many investors considering their portfolios sooner rather than later.

Most responses per base rate increase:

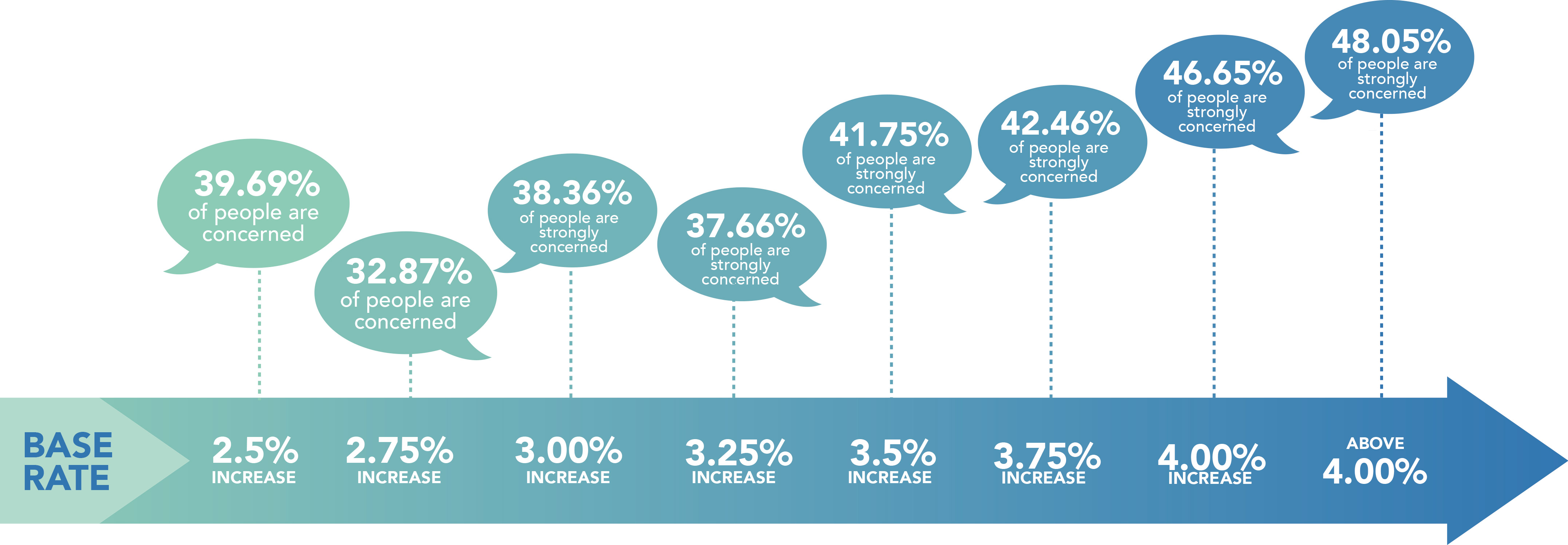

What do you think the Bank of England base rate will be by the end of 2023?

24.08% of investors predict that the Bank of England base rate will rise to 3-4% by the end of next year. A combined 47.55%, however, predicts that the base rate will increase anywhere from 4% to over 10%. Just 10.88% are predicting the base rate won’t change (6.99%) or will, in fact, reduce between now and the end of 2023 (3.90%).

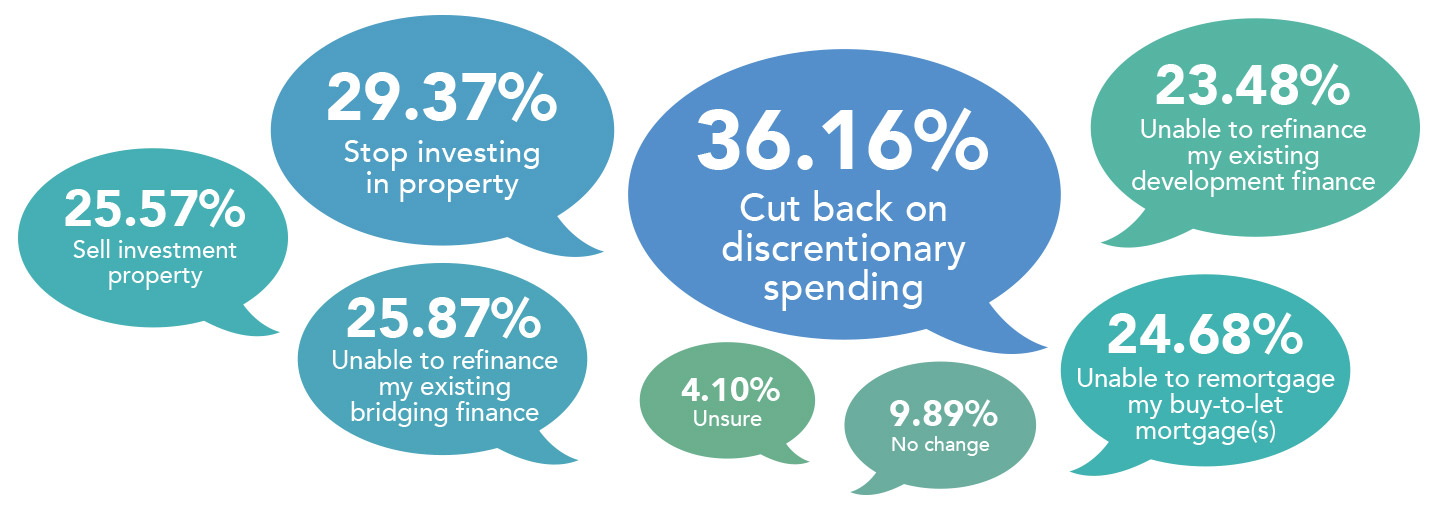

How would increasing interest rates personally affect property investors?

We gave property investors a multiple-choice list of how increasing interest rates would affect them, and discretionary spending is set to take a hit. 36.16% said they would cut back on this type of spending due to increasing interest rates.

Whilst 9.89% said the increasing rates would not change anything for them, and 4.10% were unsure, respondents did indicate the changing rates would mean they were unable to remortgage their buy-to-lets (24.68%), unable to refinance their existing bridging finance (25.87%), unable to renaissance their existing development finance (23.48%), or even stop them from investing (29.37%) or have to sell their investment properties (25.57%).

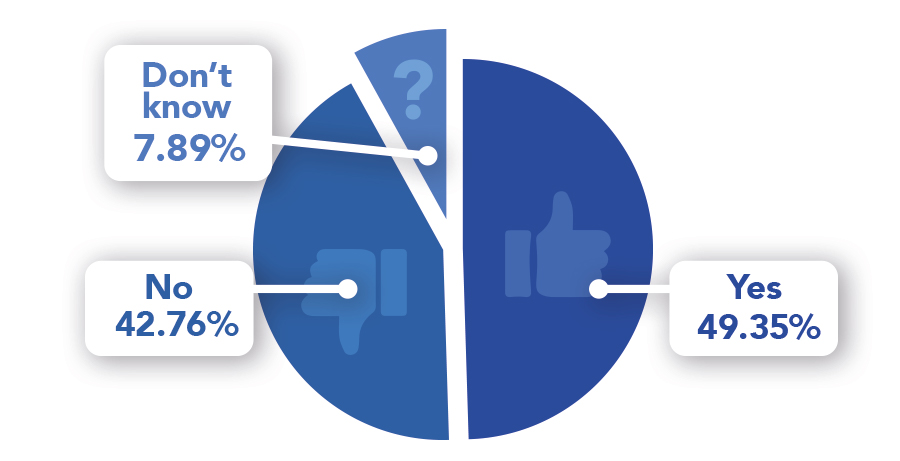

Is now a good time to invest in the property market?

Despite the uncertainty and concern regarding base rates, 49.35% said ‘Yes’, they believe now is a good time to invest in the property market. Of those that own 5 or more properties, 68.87% think now is a good time to invest, possibly demonstrating that those with the ability to invest will be looking to capitalise on those that might be in a situation where they feel they have to sell their properties.

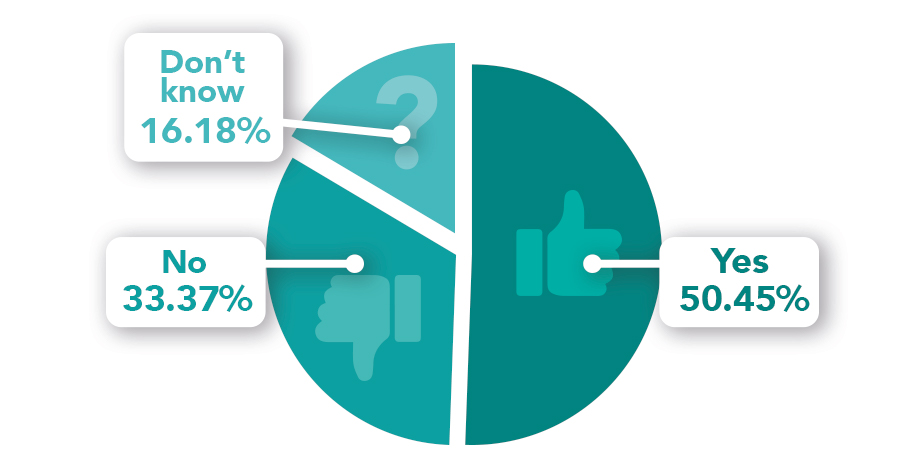

Do you plan to invest in 2023?

Looking ahead to next year, half (50.45%) of property investors think they will invest in 2023. 33.37% don’t currently think they’ll invest, and 16.18% don’t know. Investors with 5 or more properties are more likely to invest next year, with 67.92% stating they intend to invest in 2023.

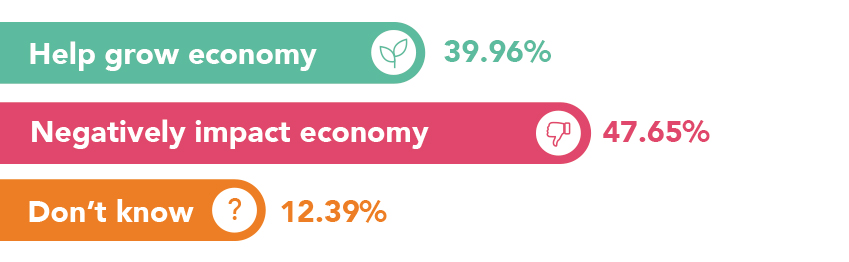

Finally, will increasing the Bank of England base rate help grow or negatively impact the economy?

47.65% said they think increasing base rates will negatively impact the economy, 39.96% said it would help to grow it, and 12.39% said they don’t know.

As Clark concludes: “Despite increasing interest rates leading to many deciding to cut back on discretionary spending and even resulting in investment properties being sold, 49.35% of investors think now is a good time to invest, and 50.45% think they’ll invest in property in 2023.

“We’ve discovered that 64% of investors are either concerned or very concerned about the rising base rates and the prospect of the rates hitting 3%. With the market predicting base rates may go as high as 5.5% by July.

“We also asked about their thoughts on the then UK chancellor Kwasi Kwarteng and whether they had confidence in him. Those results may no longer seem relevant as the day after the poll he was replaced by Jeremy Hunt, though for those of you interested - 45.45% didn’t have confidence in the now ex-chancellor (and 10.39% didn’t know).”

The report from Finbri also suggests that developers with larger property portfolios, those in excess of 5 properties, feel more confident about the opportunities to invest further in property in 2023.

We also found out…

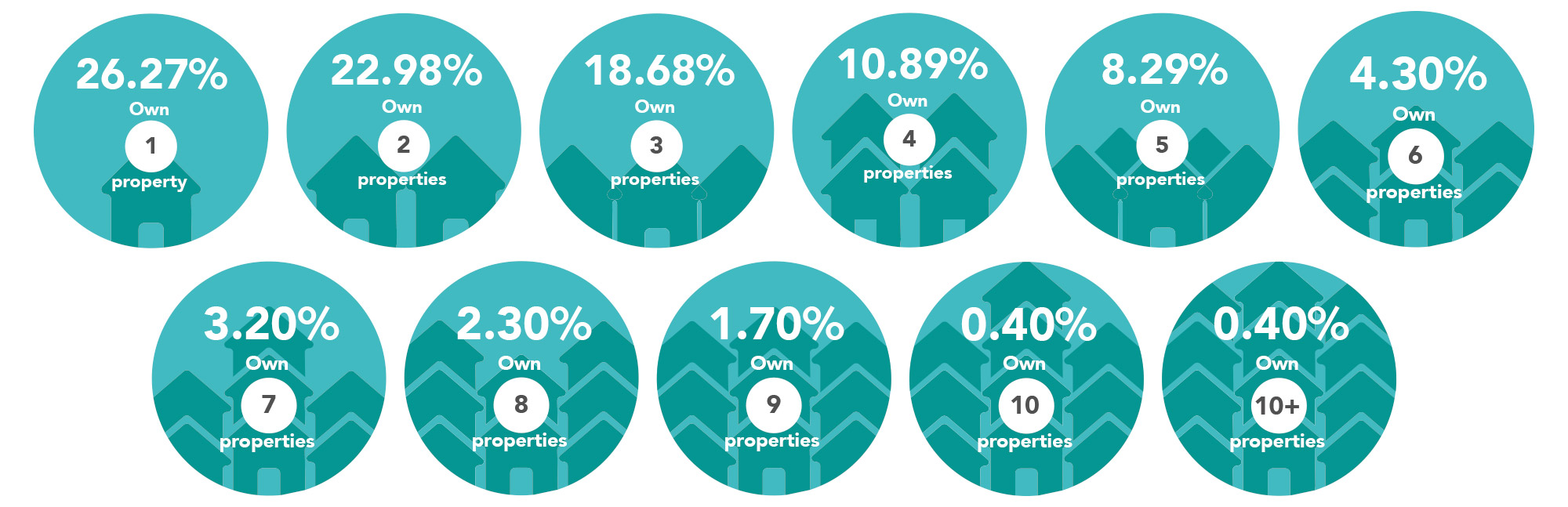

How many investment properties do you currently own?

The most popular choice for the number of investment properties owned was 26.27% of respondents owning 1 additional property that is not their main residence. A combined 60.8% own 2-5 properties, 11.8% own 6-9 properties with 1.4% owning 10 or more investment properties.

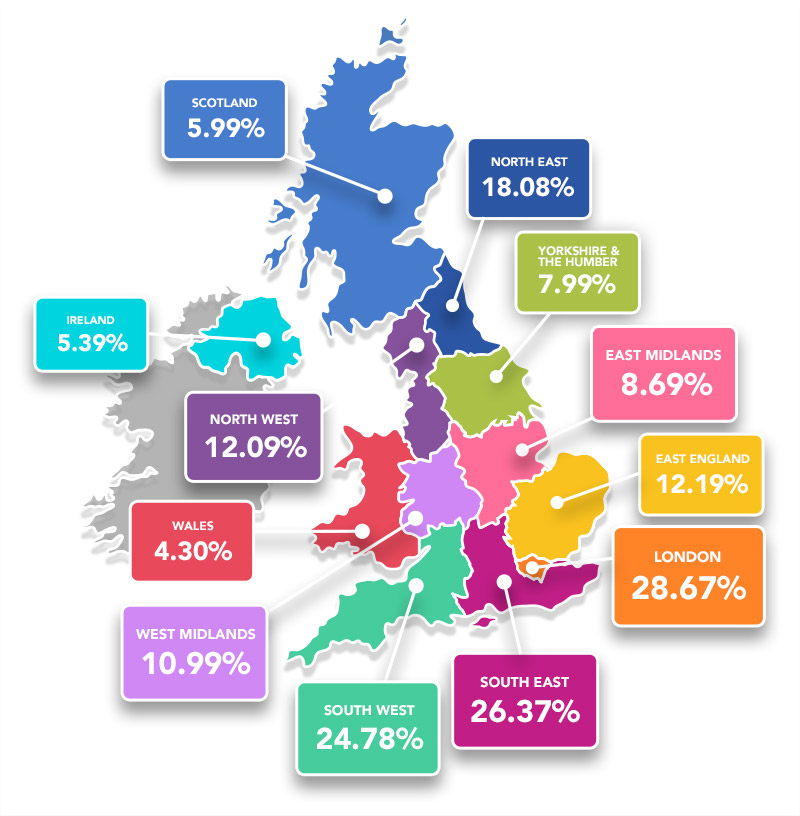

What regions do you own property in?

With weekly rental prices hitting a record £553 a week in London with nearly 30 applicants per property, it’s not surprising that the capital is home to the most investment properties. 28.67% of investors own property in London. But the South East and South West aren’t far behind with 26.37% and 24.78% of the UK’s investment properties respectively.

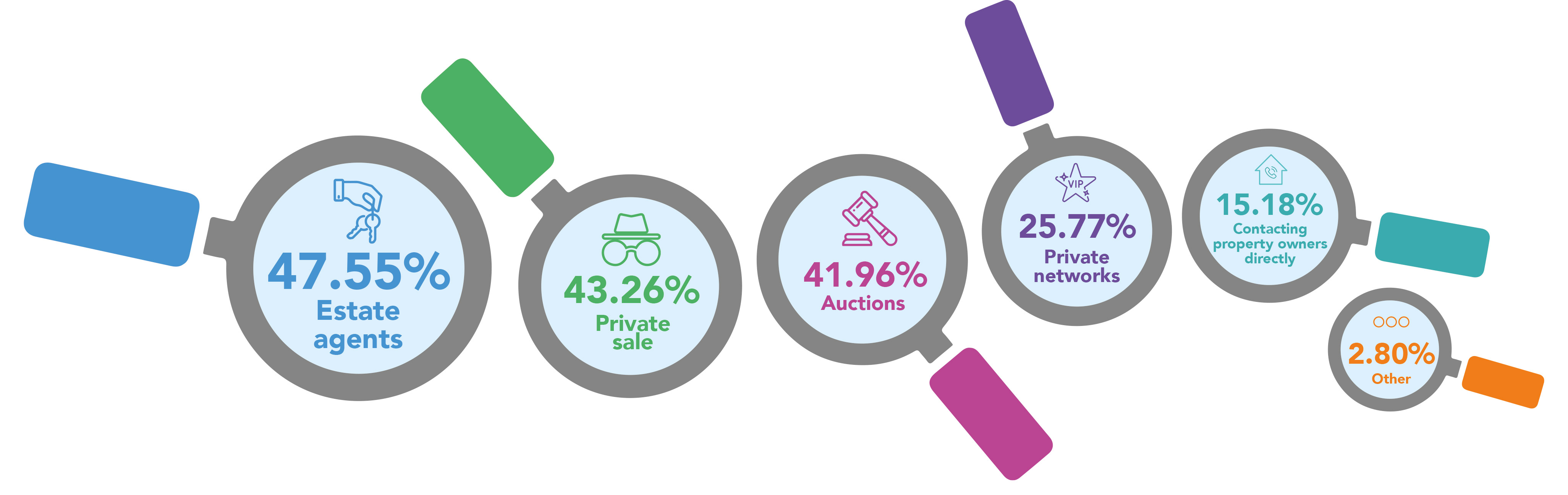

How have you previously sourced your investment properties?

47.55% of respondents have sourced investment properties through an estate agent, the most popular method. 41.96% have used auctions, and 43.26% purchased via a private seller. Private networks (25.77%) and going directly to property owners (15.18%) were other ways of sourcing property. Additionally, 2.80% of investments were sourced by different means, such as, purchasing family-owned property, inheritance, and family connections.

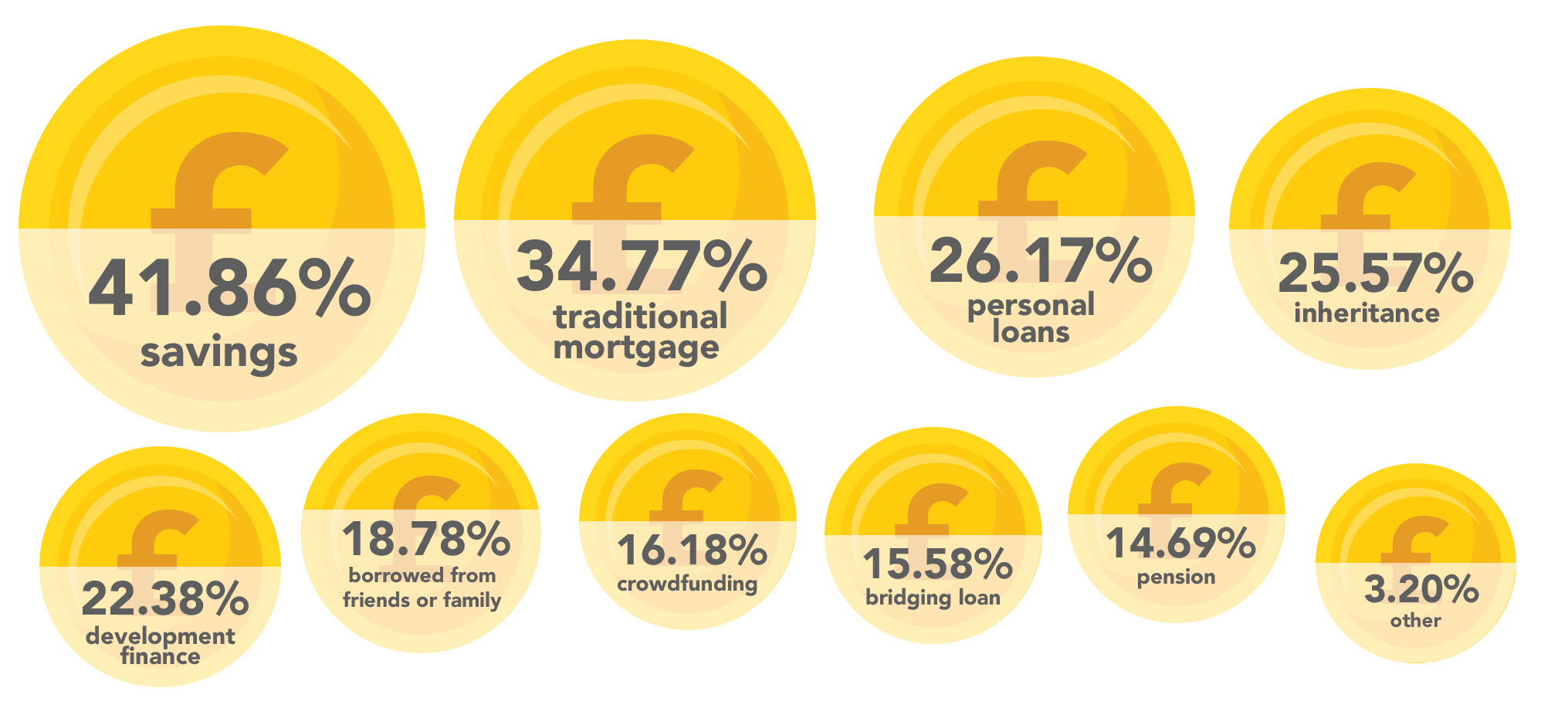

What types of finance have you used for your property investments?

We discovered that the most popular source of finance was savings (41.86%). Other sources included traditional mortgages (34.77%), personal loans (26.17%), inheritance (25.57%) and development finance (22.38%). Bridging loans had been used by 15.58% of respondents to finance property investments - investment purchases being the most popular use of bridging loans in the UK currently.

Access this survey's raw data in Excel format

Our survey statistics are available in the Microsoft Excel format. To access this please use the form below

| Poll Title: | UK Property Investor BoE Base Rate Report 2022 |

| Poll Objective: | To gain insights into the UK property investment market and BoE base rate rises from property investors that own at least one property which is not their main residence |

| Conducted: | Oct 11 2022 |

| All Respondents: | 3,698 randomly sampled people in the UK |

| Qualified Respondents: | 1,001 |

| Screening Question: | Which of the following best describes your connection with property investment? I own at least one property which is not my main residence |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 3,698, throughout the UK’s 68,710,687 population (worldometer) of which 1,001 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2022 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, or require an accessible unlocked version of this excel file, please in the first instance email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/blog/base-rate-property-investment-survey-2022 |