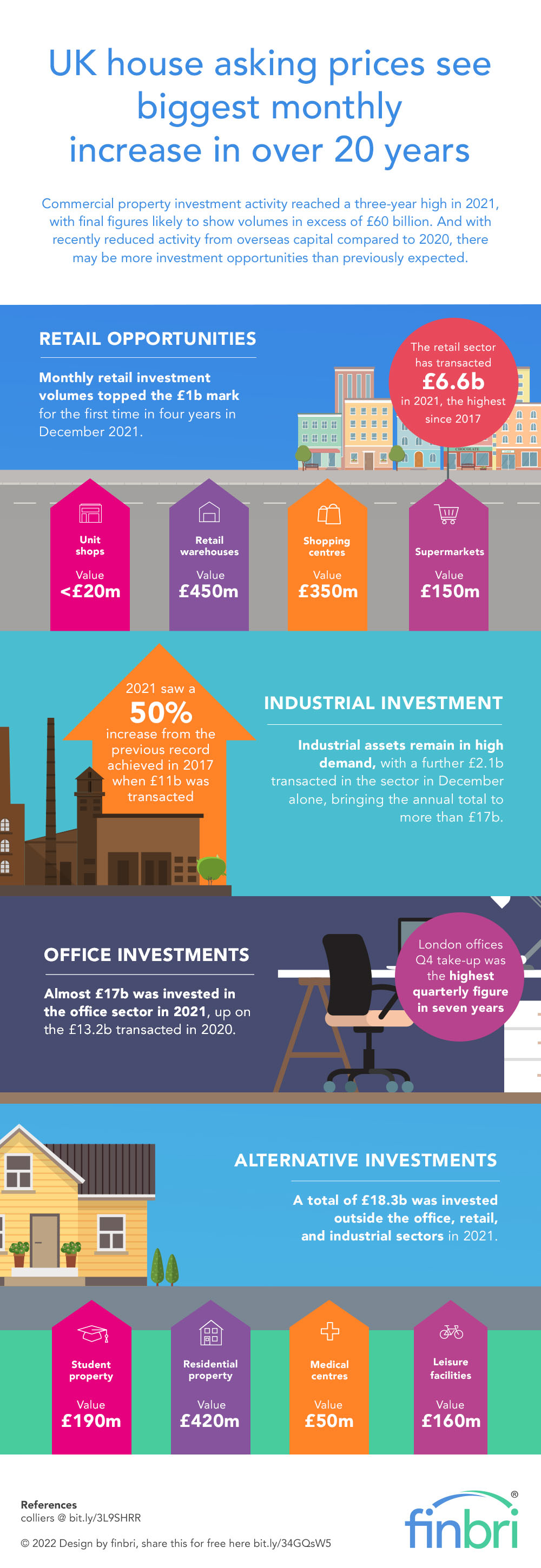

Commercial property investment reaches 3-year high

Commercial property investment activity reached a three-year high in 2021, with final figures likely to show volumes in excess of £60 billion. And with recently reduced activity from overseas capital compared to 2020, there may be more investment opportunities than previously expected.

The £60bn was up on both 2019 (£53.7bn) and 2020 (£46.9bn) levels and up 5% against the five-year average (£56.8bn).

There was record-breaking activity in the industrial sector (including distribution centres and multi-let parks) with over £17bn in transactions - almost double the five-year average. Office and retail investment volumes also improved on 2020 figures and investment in leisure markets also recorded increased activity.

Overseas capital accounted for 47% of all activity by value. Whilst in line with the five-year average, this was down on 2020’s 51%. US investors were the most active (£13.7bn), while Middle Eastern and Far Eastern buyers were found to be less acquisitive than in previous years - could this be an opening for more property investment opportunities?

References

colliers @ bit.ly/3L9SHRR

© 2022 Design by finbri, share this for free here @ bit.ly/34GQsW5

Commercial Bridging Loan

A commercial bridging loan is high-value short-term finance used to buy or refinance commercial property or semi-commercial property, finance renovation, conversion or refurbishment projects. Commercial bridges are also used in business to raise capital for resolving cash flow issues, investing in plant, machinery or stock, fund an expansion, or pay urgent bills. It's secured on commercial or semi commercial property.

Discover More