On this page

UK Landlords’ Report 2023 When looking to purchase an investment property what factors do you consider important? Do you intend to complete EPC improvement-related works to your investment properties in the next 12 months? How important do you think EPC ratings are to your tenants? How do you feel about the following in the UK? Inflation EPC legislation Property crash Property investment opportunities Capital Gains Tax Allowance Recession What alternative investments would landlords consider? If Yes, why? What regions do you own property in? What type of landlord are you? What are the typical tenancy terms for UK rental properties? What type of property/properties are currently being rented out? Are pets allowed in UK rental properties?UK Landlords’ Report 2023

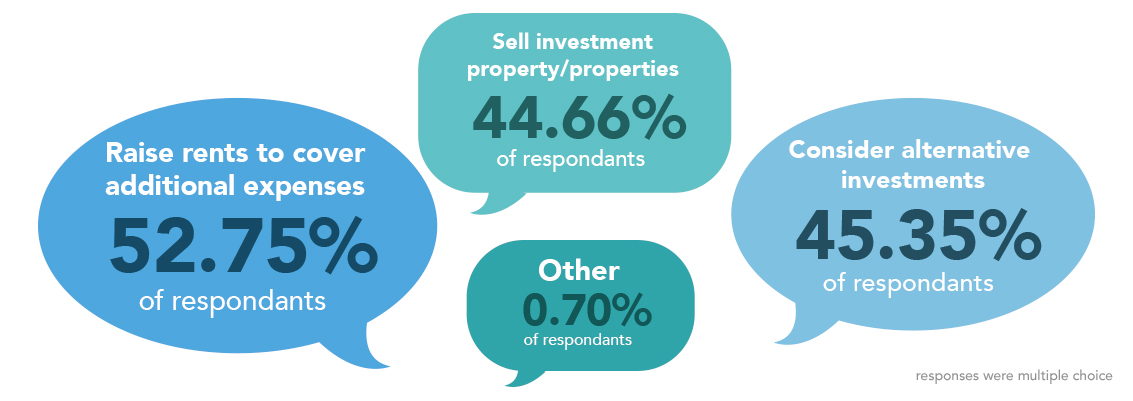

With the base rate expected to reach a high of 4.5% in 2023, 52.75% of UK landlords will look to raise rents to cover additional expenses.

This January, our survey of over 1,000 UK landlords found out how they feel about the proposed Renters’ Reform Bill, interest rates, inflation, and other pressing issues in the UK. We also discovered whether landlords believe now is a good time to invest in the property market, if they plan to invest in 2023, and their plans to react to increasing base rates. With direct responses from UK landlords, we found out more. A lot more.

As Stephen Clark from Finbri a broker specialising in fast bridging finance, comments, “We wanted to know how landlords feel as we start 2023. Whilst some are optimistic and pointing towards signs that the UK economy might recover better than expected, with a recession looming, these are uncertain times. With base rates set to rise further this year and increasing mortgage costs driving up rental demand, we’ve discovered landlords' current mindset and outlook for 2023.

“At the same time, we polled over 1,000 renters in the UK to discover their feelings and concerns and how they compare to landlords - this comparison makes compelling reading!”

Key data

- If the UK base rate hits the expected 4.5% in 2023…

- 52.75% of landlords will raise rents to cover additional expenses

- 45.35% will consider alternative investments

- 44.66% will sell their investment properties

- 40.36% of landlords are unaware of the proposed Renters’ Reform Bill

- 62.24% have seen increased demand for their rental properties in the last 12 months

- 45.15% think they’ll invest in property in 2023

When looking to purchase an investment property what factors do you consider important?

We wanted to know what is most important to landlords when considering an investment property. Asked to choose if the following factors were Not important at all, Somewhat important, Important, Very important or Extremely important, we discovered these key findings about how landlords feel about…

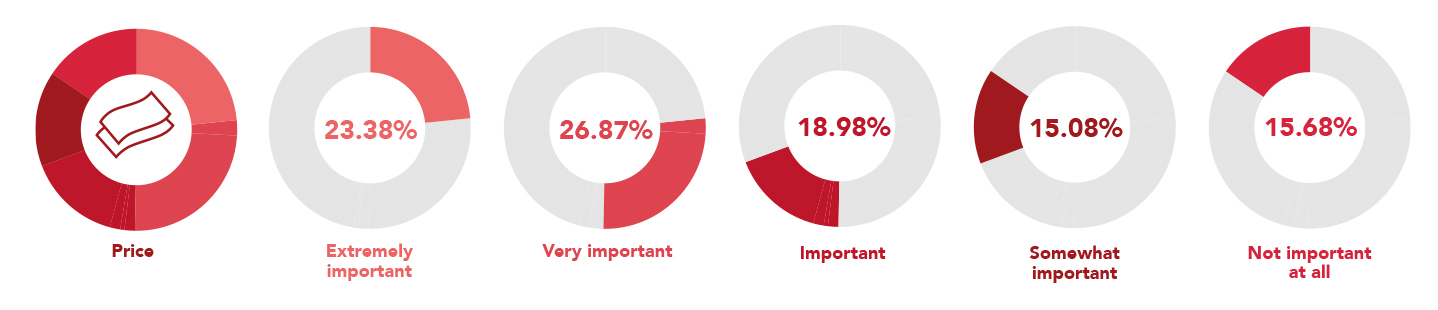

Price

Unsurprisingly, one of the most important factors when landlords are looking to invest in property is price. A combined 50.25% of landlords consider price to be Very important (26.87%) or Extremely important (23.38%) when looking to purchase an investment property.

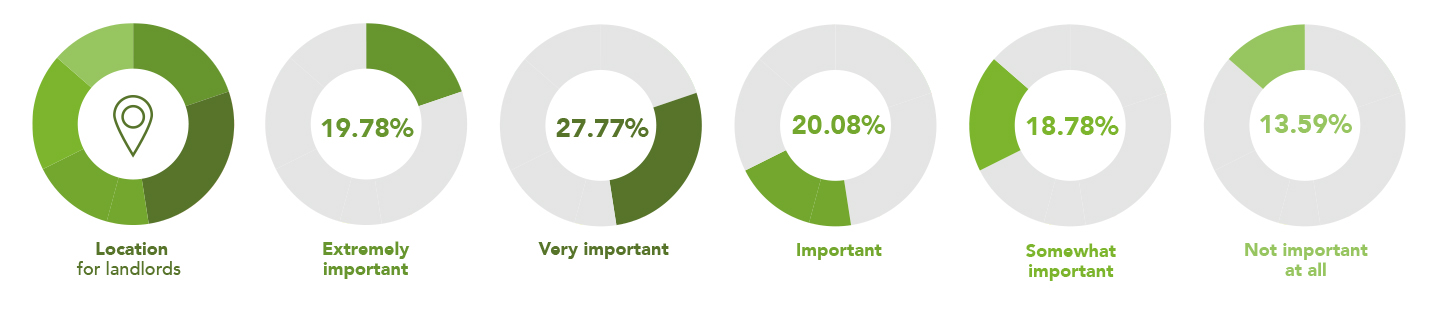

Location

47.55% of landlords consider location to be Very important (27.77%) or Extremely important (19.78%) when considering an investment property purchase, and with rental yields and property demand varying so much throughout the UK it’s no surprise.

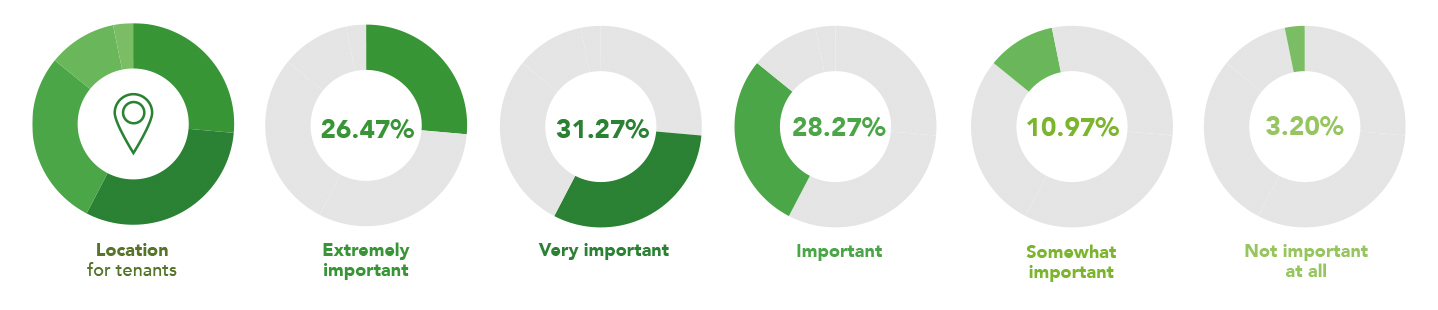

Additionally, our survey of over 1,000 tenants in the UK discovered that location was one of the most important factors for renters that influenced choosing their current rental property.

57.74% of renters said that location was either Very important (31.27%) or Extremely important (26.47%), compared to just 10.79% believing location was only Somewhat important or Not important at all (3.20%).

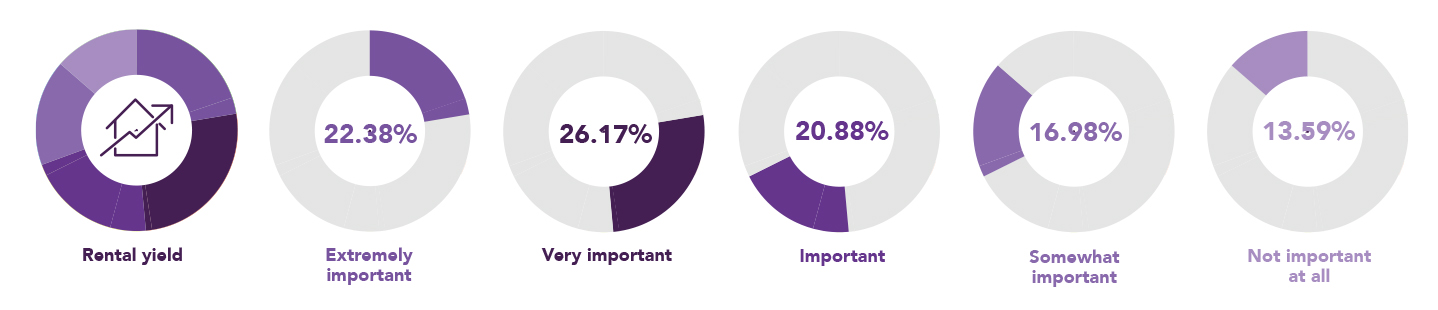

Rental Yield

A property's rental yield, the potential financial return, was Very important (26.17%) or Extremely important (22.38%) for landlords. Only 13.49% and 16.98% of landlords considered the rental yield of their investment property to be Not important at all or Somewhat important respectively.

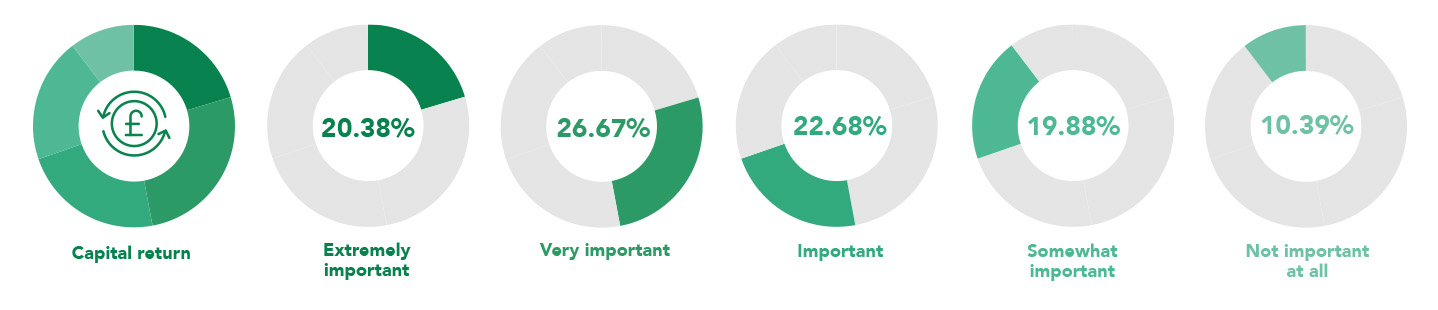

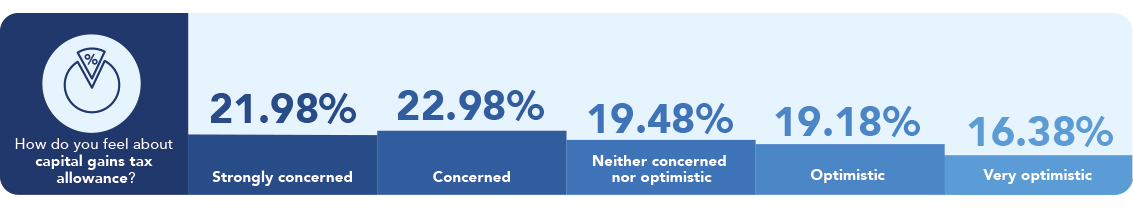

Capital Return

Sometimes known as capital appreciation or capital growth, 47.05% of landlords consider capital return to be Extremely important (20.38%) or Very important (26.67%). Essentially how much a property will increase (or decrease) in capital over the time of ownership and how much you could receive if landlords choose to sell in the future. With 44.96% of landlords Strongly concerned (21.98%) or Concerned (22.98%) about Capital Gains Tax Allowance and 44.66% of UK landlords possibly looking to sell their properties should the base rate hit the expected high of 4.5% mid-2023, this is a key factor for landlords when considering an investment in rental properties.

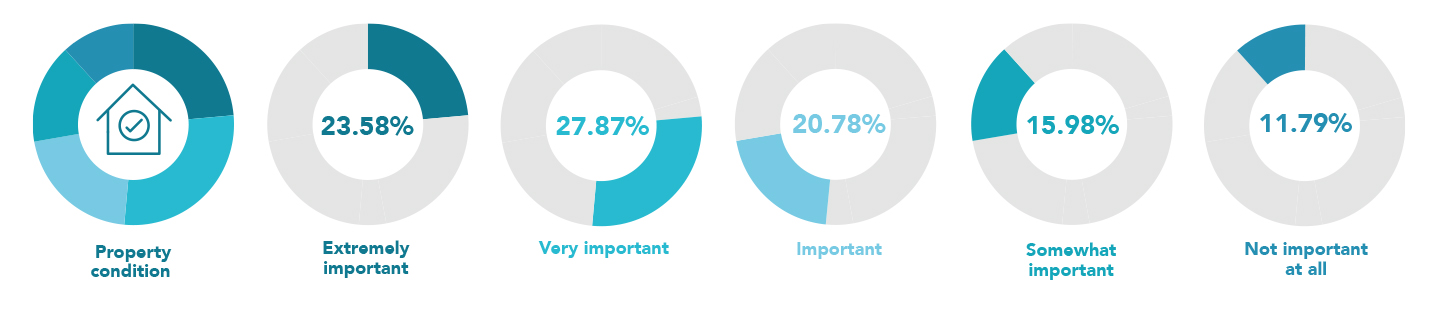

Property Condition

Another key factor for landlords when looking for an investment purchase is property condition. 51.45% said the current condition is Extremely important (23.58%) or Very important (27.87%, this demonstrates an opportunity for property developer flips to sell to landlords.

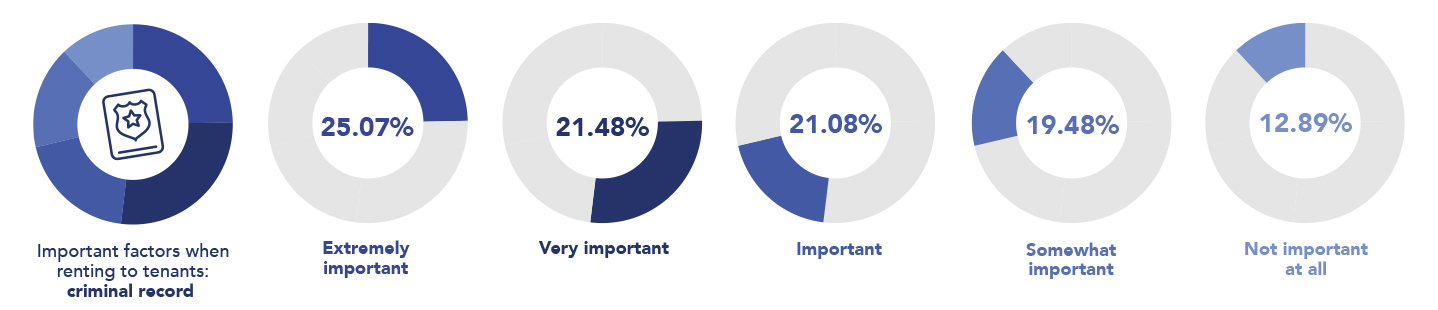

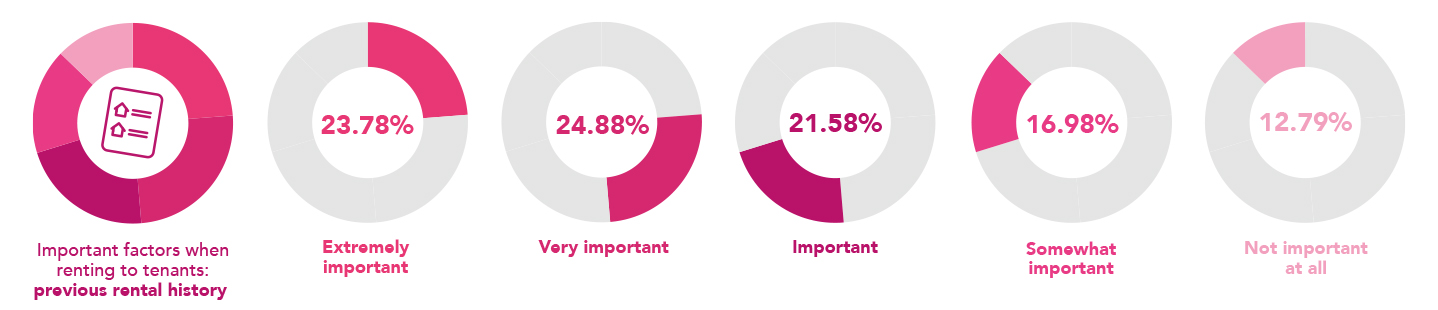

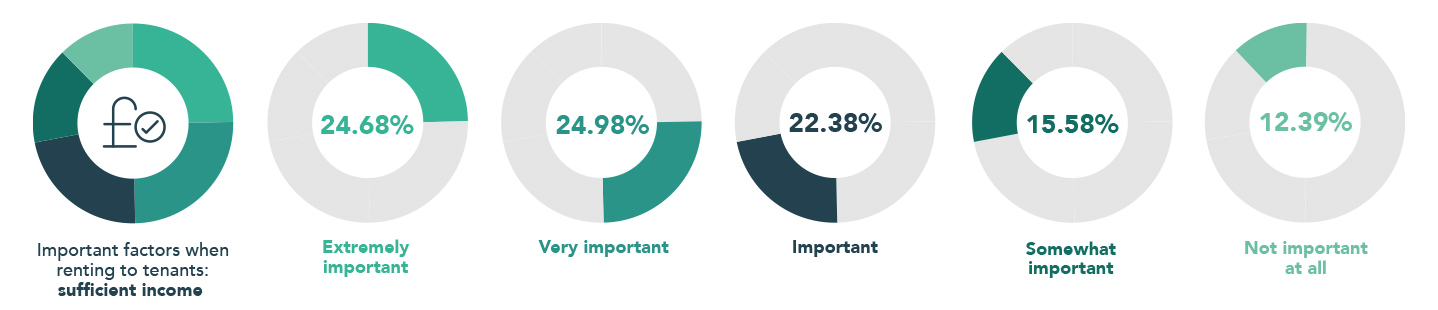

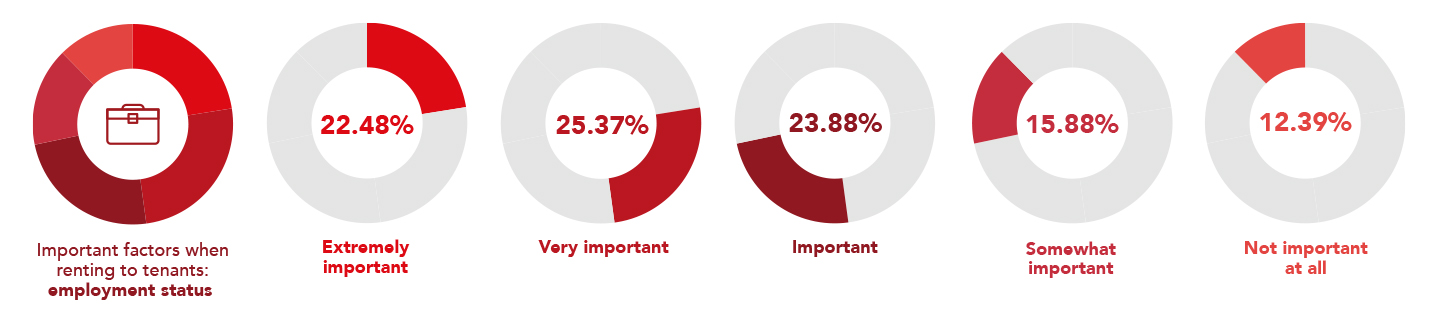

How important certain characteristics and attributes are when deciding on who to rent property to?

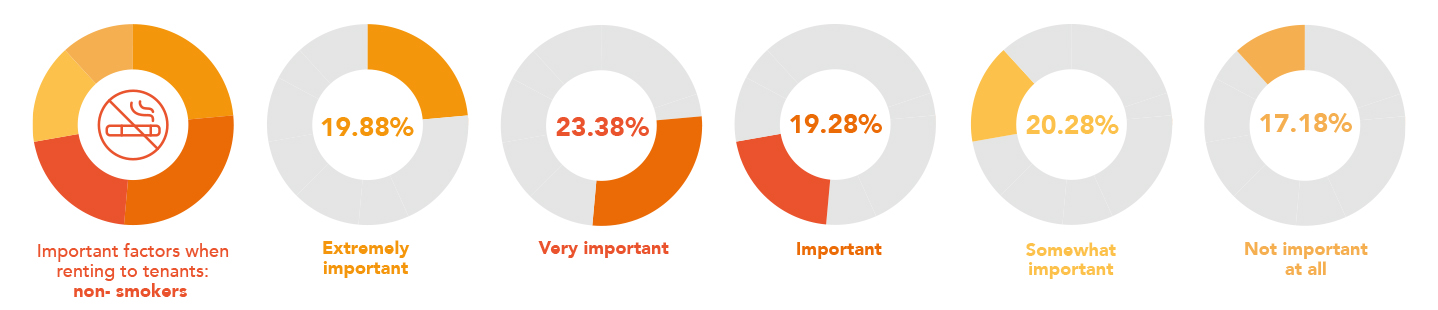

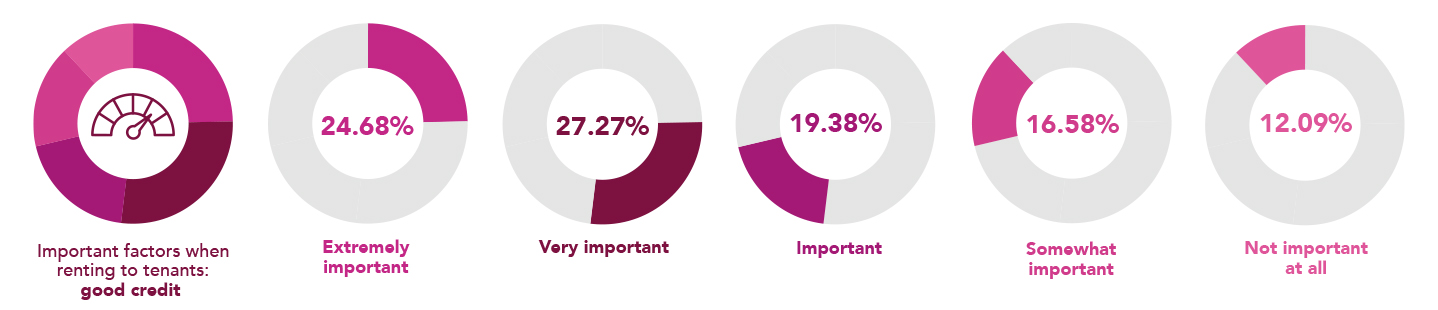

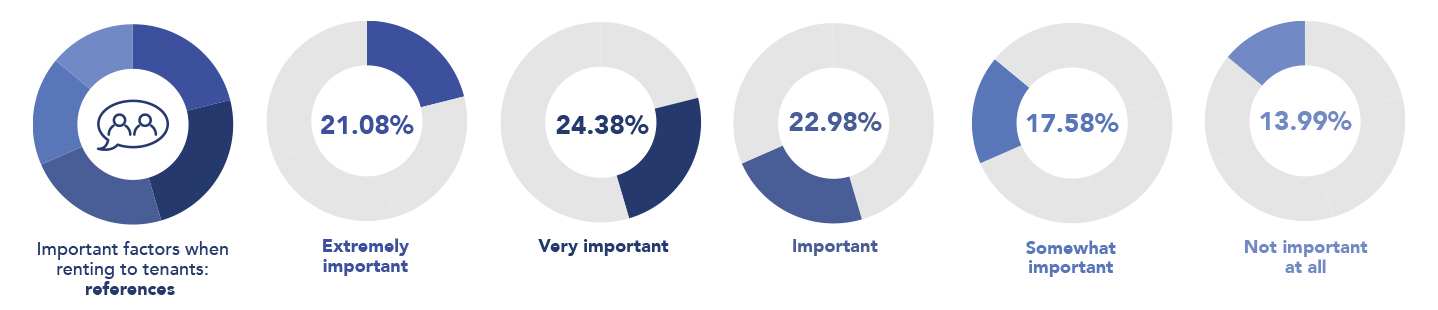

With the need for rental property reaching record numbers and 62.24% of landlords experiencing increased demand over the last 12 months, we’ve discovered what landlords feel is important or not important when letting their property to prospective tenants.

Good credit was the most important consideration. A combined 51.95% of landlords considered good credit to be either Extremely important (24.68%) or Very important (27.27%), compared to 28.67% feeling it was Somewhat important (16.58%) or Not important at all (12.09%).

Whether someone is a smoker or a non-smoker was the least important characteristic of a potential tenant. Whilst it is still Extremely important, Very important or Important to 62.53% of landlords, it was only Somewhat important (20.28%) or Not important at all (17.18%) to 37.46%. Good credit, criminal record, previous rental history, sufficient income, employment status and references, were all more important to landlords than whether someone smokes or not.

Non-smokers

Good credit

Criminal record

Previous rental history

Sufficient income

Employment status

References

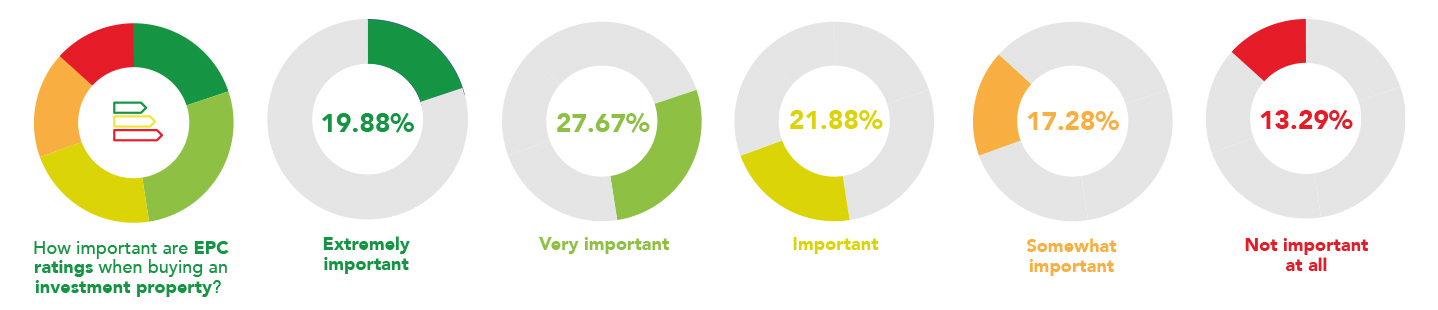

How important are EPC ratings to you when buying an investment property?

With soaring energy bills in the UK, Energy Performance Certificate (EPC) Ratings are a hot topic and a home’s energy performance is at the forefront of both landlord’s and tenant’s minds. EPC ratings range from A, the most energy-efficient properties with the lowest energy costs, to G, the least efficient.

The Department for Levelling Up, Housing and Communities have revealed nearly 14 million UK homes, 59% of all UK domestic properties have EPC ratings between D and G, making them more susceptible to higher energy bills.

A combined 47.55% of UK landlords consider EPC ratings to be Very Important (27.67%) or Extremely important (19.88%). Just 13.29% of landlords felt EPC ratings were Not important at all when buying an investment property.

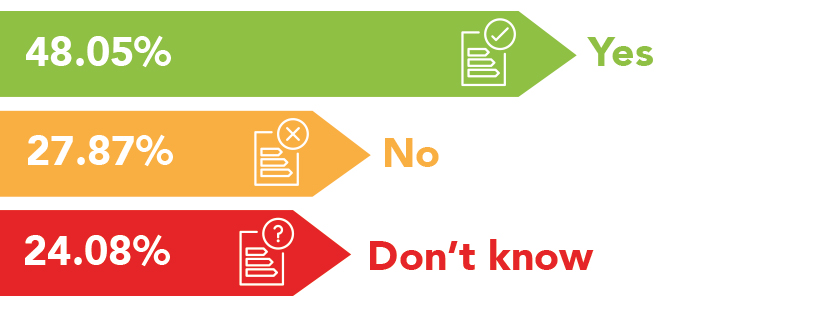

Do you intend to complete EPC improvement-related works to your investment properties in the next 12 months?

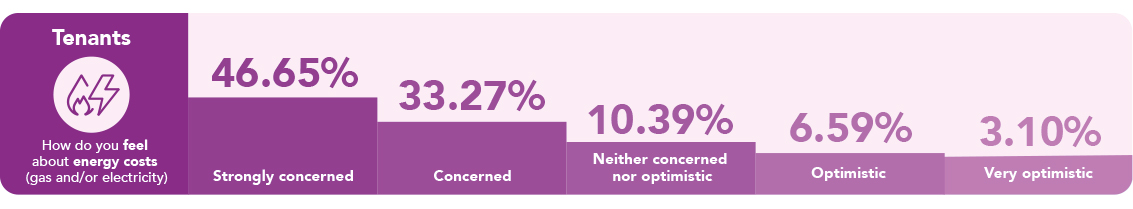

48.05% of landlords intend to complete energy-performance improvements to their properties over the next 12 months. And this will be a positive step for tenants as we have alarmingly discovered that 79.92% of UK renters are either Strongly concerned (46.65%) or Concerned (33.27%) about energy costs.

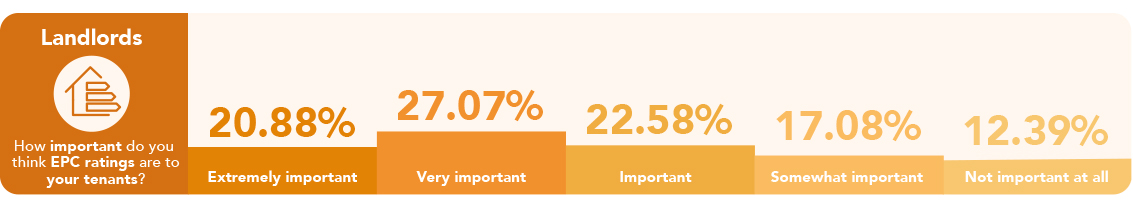

How important do you think EPC ratings are to your tenants?

Landlords are seemingly on the same page as tenants regarding the importance of EPC ratings and energy costs, even if they don’t quite realise the levels of concern for their tenants. 47.95% of landlords think EPC ratings are Extremely important (20.88%) or Very important (27.07%) to their tenants. Just 17.08% only think energy-performance ratings are Somewhat important, whilst 12.39% said they were Not important at all to tenants.

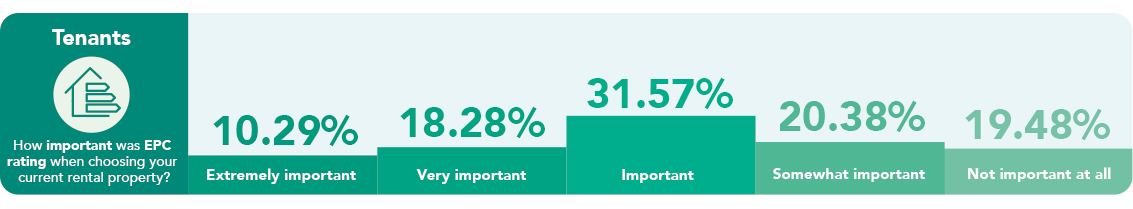

31.57% of renters considered EPC ratings to be 'Important' when choosing their current rental property, and a further 28.57% believe the ratings to be Very important (18.28%) or Extremely important (10.29%).

Landlords - How important do you think EPC ratings are to your tenants?

Tenants - How do you feel about energy costs (gas and/or electricity)

Tenants - How important was EPC rating when choosing your current rental property

How do you feel about the following in the UK?

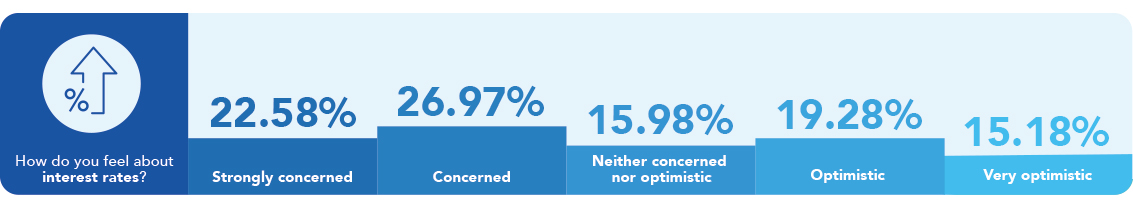

The Bank of England (BoE) increased interest rates by 0.5 percentage points to 3.5% in December. The ninth consecutive rate increase and the highest level in 14 years. As recently as December 2021, the base rate was 0.1%, and it’s a concern for landlords. Whilst landlords on fixed-rate mortgages won’t see their mortgage increase during their fixed-term, should the mortgage need to be renewed, it’s likely that the monthly payments will increase. Likewise, if the mortgage is on a tracker or standard variable rate (SVR), then monthly payments will increase in line with the increased rates.

These increasing rates have 49.55% of landlords Concerned (26.97%) or Strongly concerned (22.58%). However, there remains a selection of landlords that are Optimistic (19.28%) or even Very optimistic (15.18%) about interest rates.

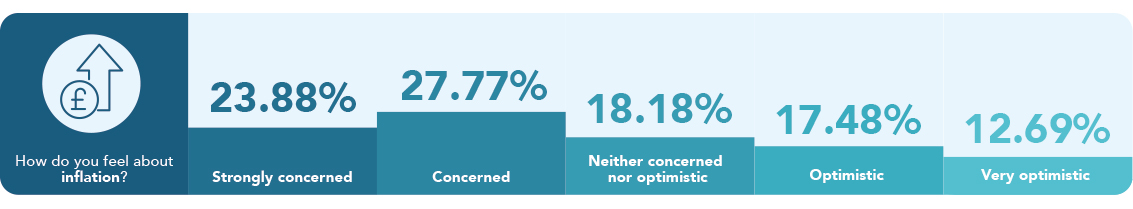

Simply put, inflation is the increase in the price of something over time - and our findings show it’s the thing most landlords are currently concerned about. As of January 2023, the rate at which prices are rising has dropped back slightly from the recent peak in November 2022, but inflation remains near a 40-year high.

51.65% of landlords are Strongly concerned (23.88%) or Concerned (27.77%) about inflation.

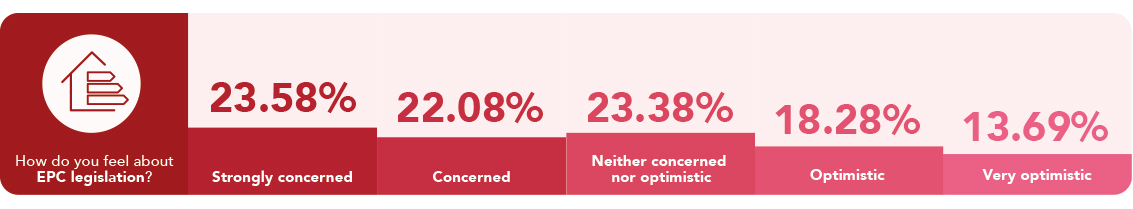

The government changed the Minimum Energy Efficiency Standards (MEES) for England and Wales in late 2021 stating that

- all rental properties will need an EPC rating of ‘C’ or above as of 2025

- similar changes will come into effect to include all tenancies in 2028

With 59% of all UK domestic properties have EPC ratings between D and G, 45.65% of landlords are Strongly concerned (23.58%) or Concerned (22.08%) about this new legislation and the prospect of the cost and time required for the EPC rating improvements for their properties.

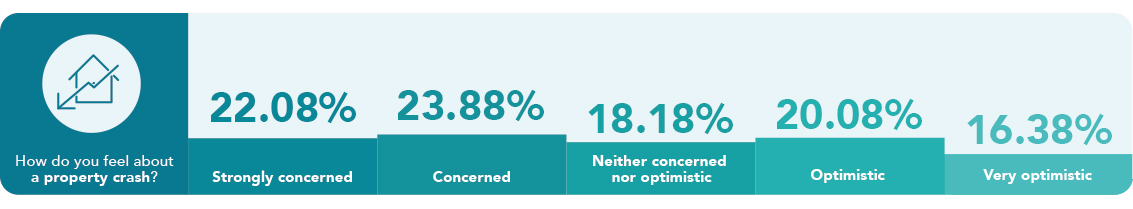

There is a valid concern that the recent economic issues in the UK will lead to a property market crash which would see house values drop, property investments depreciate in value and a rise in negative equity, House prices hit extraordinary highs following the COVID-19 pandemic and the introduction of the Stamp Duty Land Tax (SDLT) holiday. This provided a significant tax break for buyers and was responsible for a huge surge in demand pushing prices up.

However, the high prices excluded many first-time buyers from entering the market, compounded by the recent cost-of-living crisis and all homeowners being affected overnight when 40% of mortgage products were withdrawn following the mini-budget disaster in September 2022.

With increased interest rates and falling house prices, negative equity will rise and more homes will be repossessed, likely to be sold at lower prices at auction.

There is widespread concern about the prospect of a housing market crash. A combined 45.35% of landlords are Concerned (23.28%) or Strongly concerned (22.08%).

However, there are landlords that remain Optimistic (20.08%) or Very optimistic (16.38%). If prices drop by 8% over 2023 (some predictions range from a price decline of between 5% and 12%), there will be opportunities for investors to capitalise ahead of prices increasing in 2024.

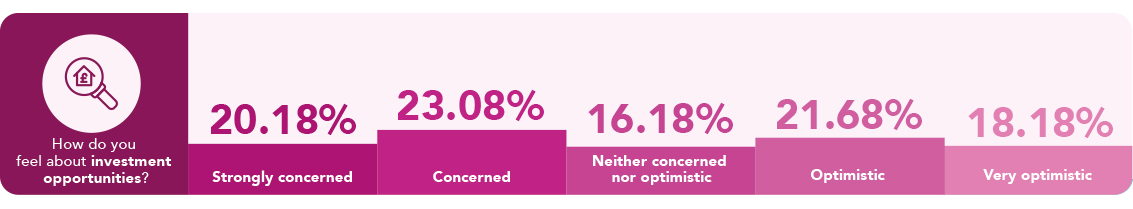

Property investment opportunities

Whilst falling property prices could make property investment more affordable, it could also mean homeowners delay selling until prices improve and thereby reducing the number of property available on the market.

The sense of uncertainty about property investment is reflected in landlords' responses when asked how they feel about investment opportunities. 43.26% were Strongly concerned (20.18%) or Concerned (23.08%), whilst 40.56% were Optimistic (21.68%) or Very optimistic (18.18%). 16.18% of landlords felt neither concerned nor optimistic.

Capital gains tax (CGT) is charged on the profits made from selling an asset, such as a second property, but also could include other investments or valuable non-essential assets (such as antiques).

Last year, Chancellor Jeremy Hunt announced that the amount you can earn from dividends without paying tax will be cut to just a quarter of its current value over the next two years.

The tax-free allowance is £12,300 for 2022-23, but from April this will be dramatically cut to £6,000. From April 2024, it will be reduced again to just £3,000. Effectively increasing people's tax bills and this has 44.96% of landlords Concerned (22.98) or Strongly concerned 21.98%,

The government aims to raise £440m in 2027-28 with this policy.

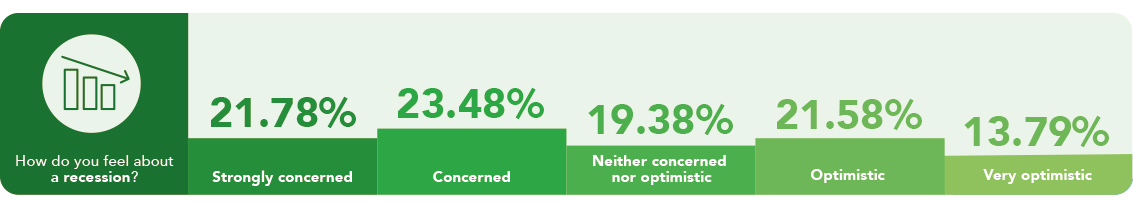

Experts are predicting that recession is coming for the UK. A recession is defined as two quarters of consecutive Gross Domestic Product (GDP) contraction. It’s a downturn in economic activity. The rising cost of living, higher interest rates and gloomy economic outlook for UK may even already have us in a recession.

With the economy shrinking during a recession, the likely outcomes include:

- Pay cuts and recruitment freezes

- A fall in business profits

- Loss of consumer confidence

- Job losses

- Businesses closing

- Reduced demand for property

A recession has 45.25% of landlords either Strongly concerned (21.78%) or Concerned (23.48%). Since the 1960s there have been seven recessions in the UK, with an average length of 10 months and there are predictions the UK economy will return to growth during the summer. These signs show that whilst it may be a deeper recession than originally predicted, it won’t necessarily be a longer one, and 35.36% of landlords are Optimistic (21.58%) or Very optimistic (13.79%).

With the base rate expected to reach a high of 4.5% in 2023, how will you react?

At the end of last year, UK interest rates raised to the highest level in 14 years. The latest increase from 3% to 3.5% was the 9th time in a row interest rates increased, leading to higher mortgage payments for homeowners.

With the UK base rate predicted to reach a peak of 4.5% in mid-2023, we asked landlords how they intend to react to the increasing rates, and their responses will be difficult for renters.

52.75% of landlords plan to raise rents to cover the additional expenses resulting from the increasing rents. 46.66% will look to sell their properties, and 45.35% will consider alternative investments.

Tenants in properties owned by private landlords have faced the highest rise in rent since comparable records began seven years ago according to the Office for National Statistics (ONS). With a combined 73.92% of renters in the UK Strongly concerned (36.86%) or Concerned (37.06%) about rent increases and 31.07% Concerned about property security, the reaction of landlords to the increasing base rate will have a huge impact on the lives of their tenants.

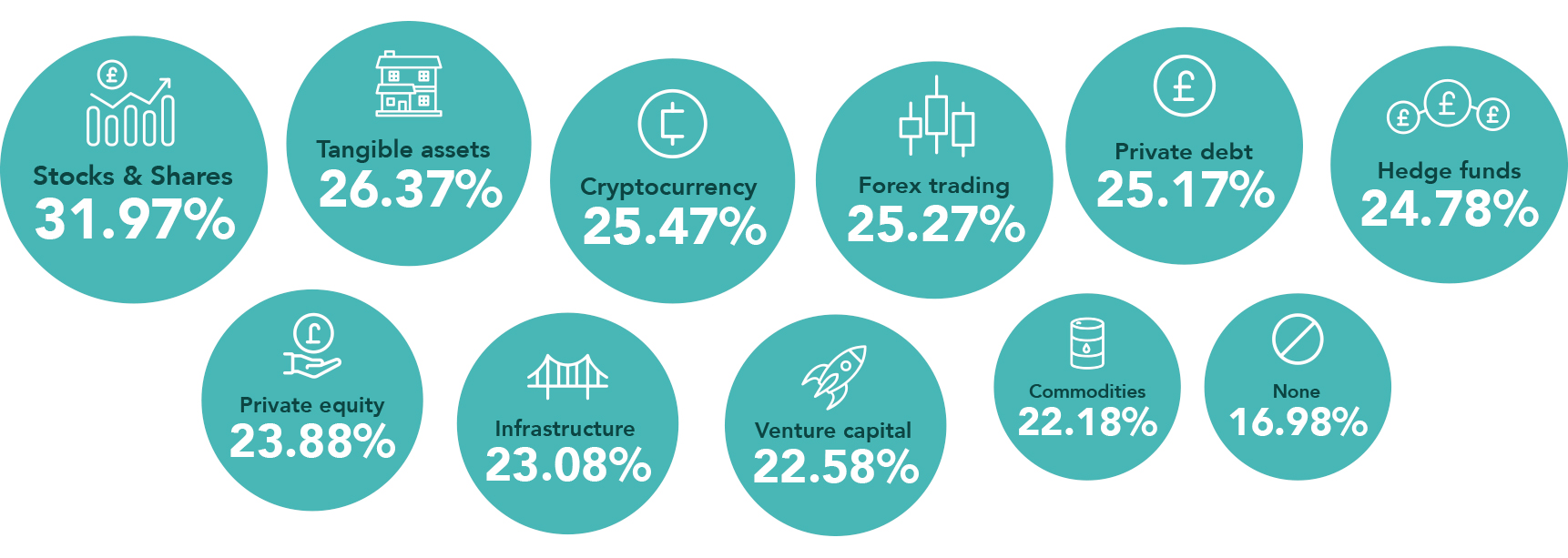

What alternative investments would landlords consider?

Stocks and shares are the most likely alternative investment landlords would consider. 31.97% of landlords would look at stocks and shares to diversify their investment portfolios. Other popular selections were tangible assets (26.37%), cryptocurrency (25.47%), forex trading (also known as foreign currency exchange trading - 25.27%) and private debt (25.17%). 16.98% said there were no alternative investments they’d consider.

Are you aware of the proposed Renters’ Reform Bill act that is to be voted on before May 2023?

Despite proposing significant changes that will significantly impact private landlords and their tenants, only 59.64% were aware of the upcoming bill.

Scheduled for later this year, the bill will be the biggest change in residential letting laws for a quarter of a century providing greater protection to tenants, and with 27.07% of renters experiencing anxiety due to renting, the changes will be welcome. Additionally, a combined 46.25% of renters were either Concerned (31.07%) or Strongly concerned (15.18%) about their property security in the current rental market.

19.38% of tenants have experienced unaffordable increases in rent and a combined 73.93% are either Concerned (37.06%) or Strongly Concerned (36.86%) about future rent increases, therefore increased rights over rent increases will be a relief.

The new rules provide tenants with a higher level of protection with restrictions on rent increases and stricter housing standards.

Landlords must be aware of the coming changes: no-fault evictions will be banned and tenants will be given more power to challenge landlords who fail to meet their obligations. This could result in penalties for landlords including fines. The new rules also risk overburdening landlords which could result in their leaving the rental market.

How do you feel about the proposed Renter’s Reform Bill?

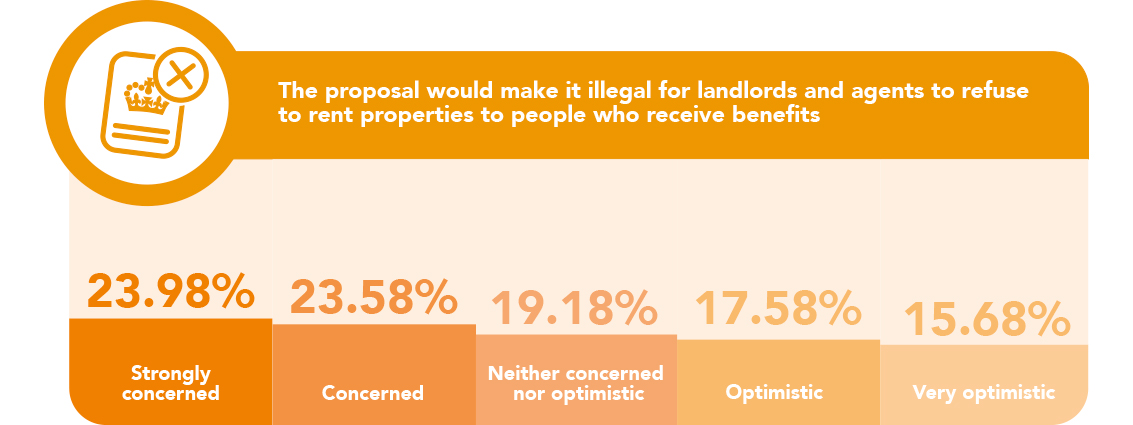

Whilst only 59.64% of UK landlords were even aware of the Renters’ Reform Bill, our survey provided details about the changes the bill proposes and this is how landlords feel about them…

The proposal would make it illegal for landlords and agents to refuse to rent properties to people who receive benefits

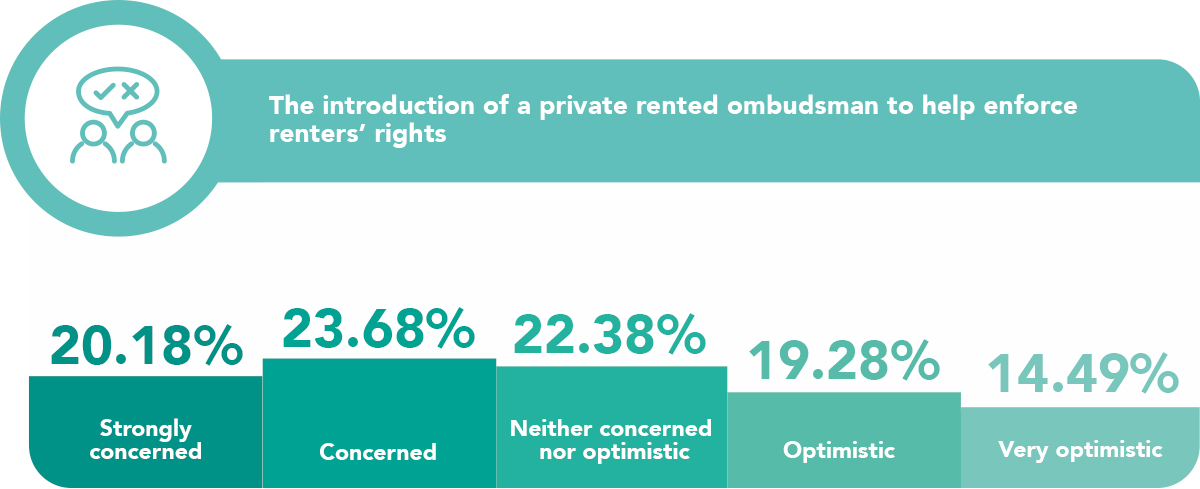

The introduction of a private rented ombudsman to help enforce renters’ rights

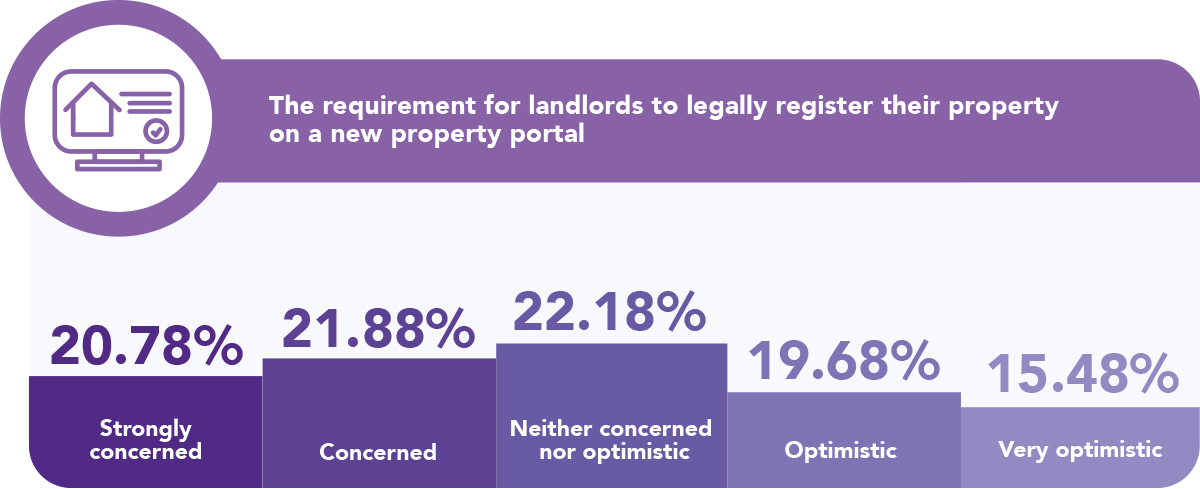

The requirement for landlords to legally register their property on a new property portal

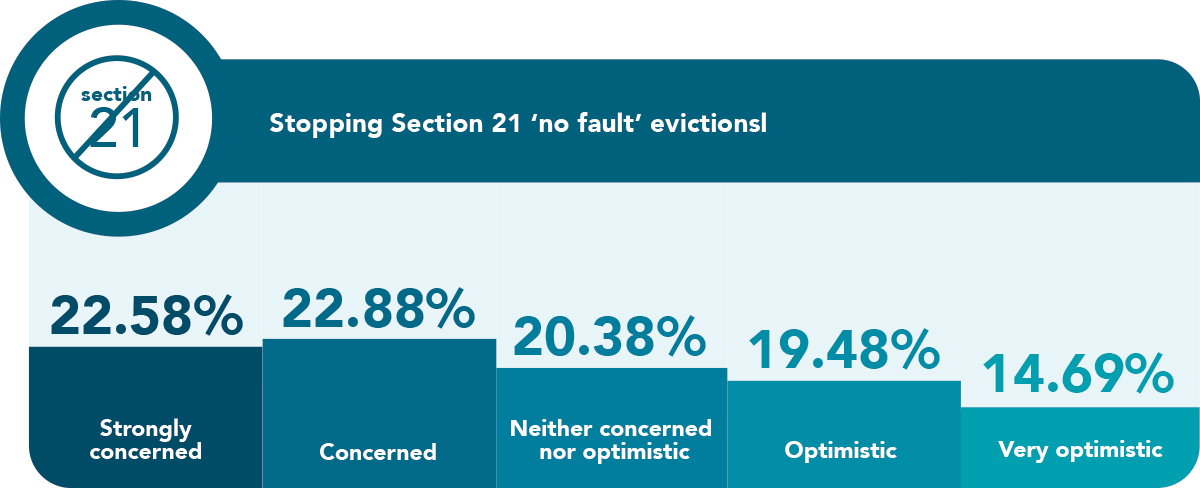

Stopping Section 21 ‘no fault’ evictions

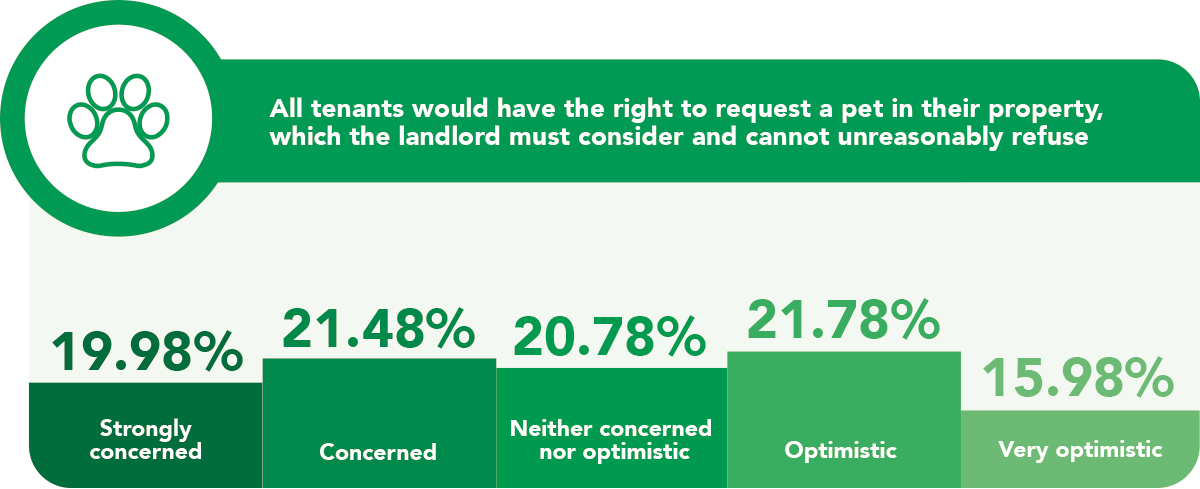

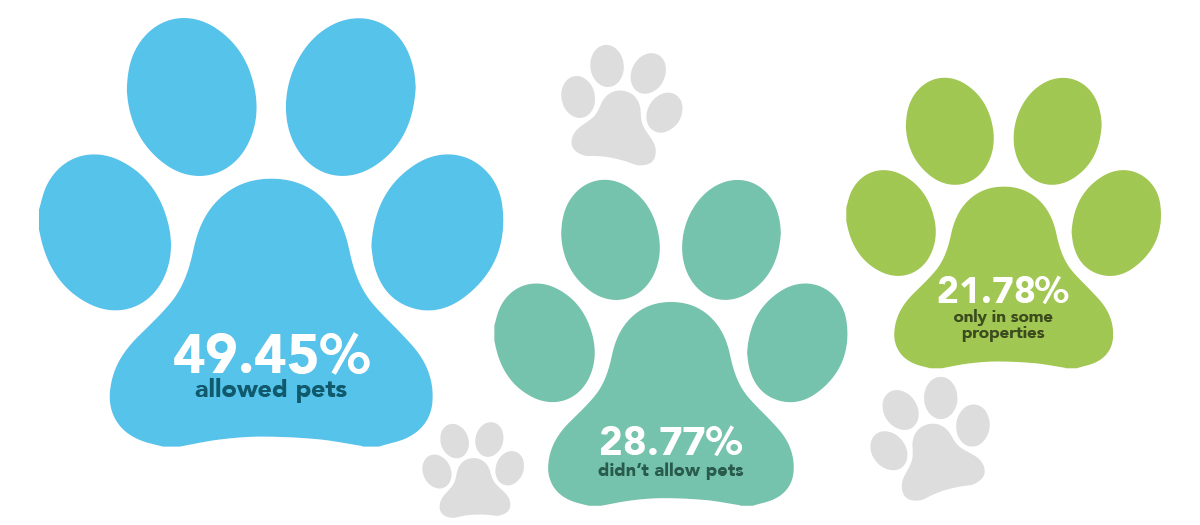

All tenants would have the right to request a pet in their property, which the landlord must consider and cannot unreasonably refuse

Have you seen increased demand for your rental properties in the last 12 months?

At the end of 2022, the demand for rental homes across the UK was up 23% year-on-year and we discovered 62.24% of UK landlords had seen increased demand for their rental properties in the last 12 months.

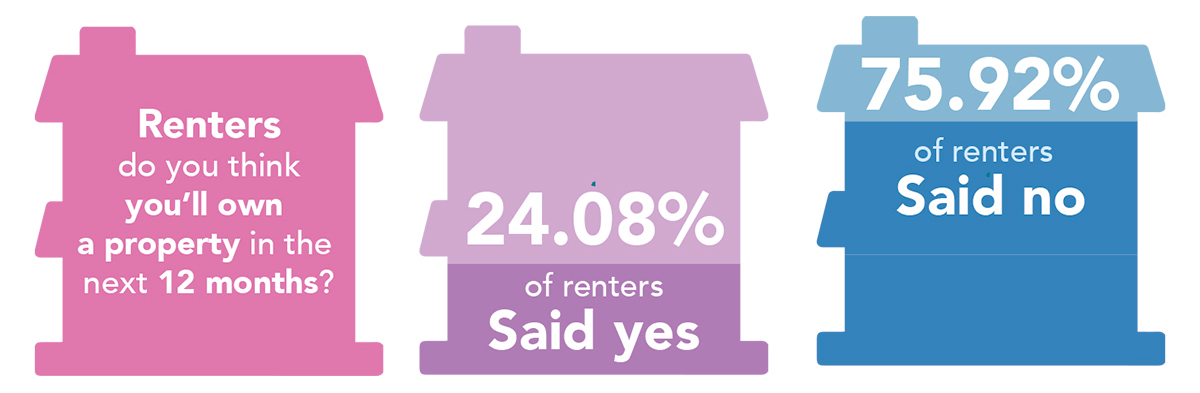

Additionally, over three-quarters of renters (75.92%) don’t think they’ll be able to own a property in 2023, with 53.82% unable to save enough for a deposit amongst other reasons, so the demand for rental properties is set to continue throughout the next 12 months.

Renters - do you think you’ll own a property in the next 12 months?

Additional issues renters have experienced when securing a rental property:

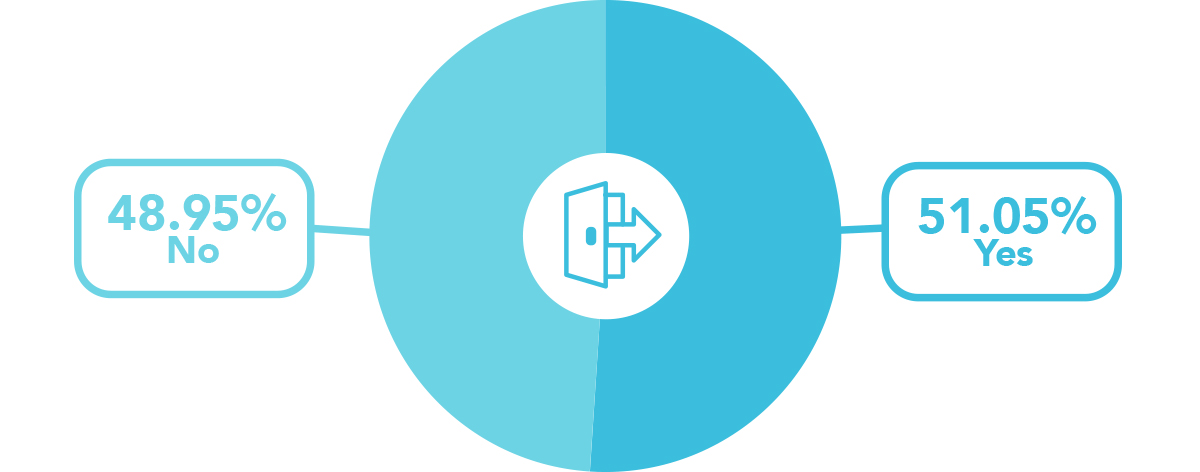

Have you ever had to evict tenants from your rental properties?

Just over half of UK landlords (51.05%) have had to evict tenants from their properties.

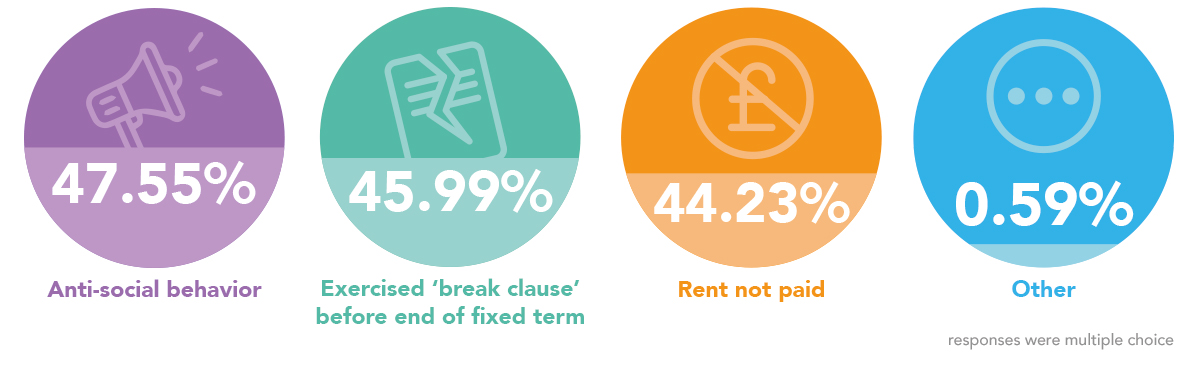

Of those landlords that have evicted tenants, the most common reasons chosen were antisocial behaviour (47.55%), the exercising of a ‘break clause’ before the end of the fixed term (45.99%) and rent not being paid (44.23%).

Our survey of over 1,000 renters discovered that 11.59% have experienced the threat of eviction, whilst 12.89% have felt they’ve been unable to complain about poor property conditions for fear that it might lead to eviction.

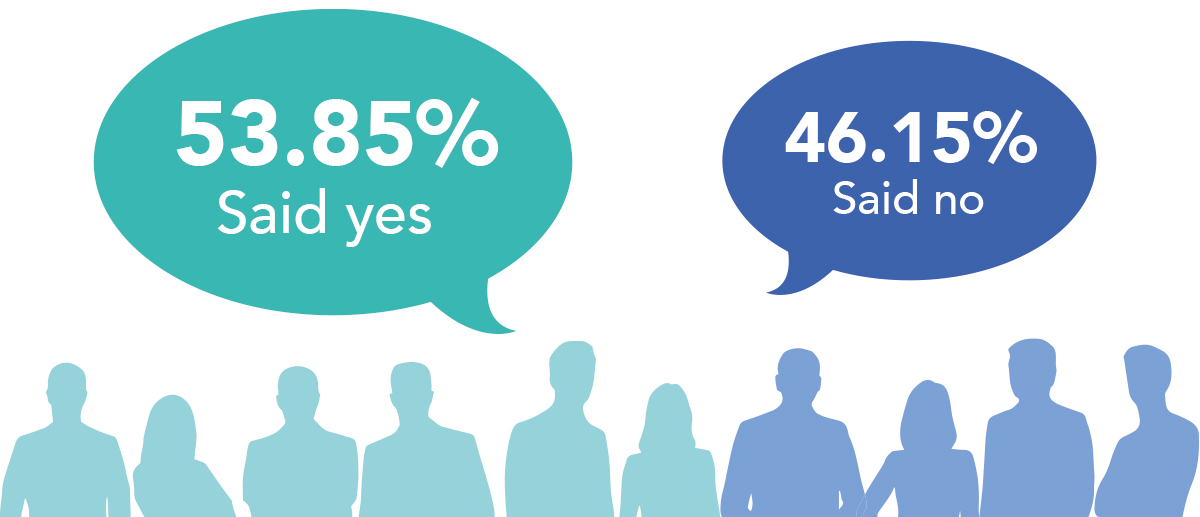

Have you had trouble sourcing new investment properties?

In a fairly even split, 53.85% of landlords said they’d had trouble sourcing new investment properties, whilst 46.15% hadn’t experienced any trouble.

Do you believe now is a good time to invest in the property market?

Despite economic uncertainty and concern regarding base rates, 44.66% of landlords said ‘Yes’; they believe now is a good time to invest in the property market.

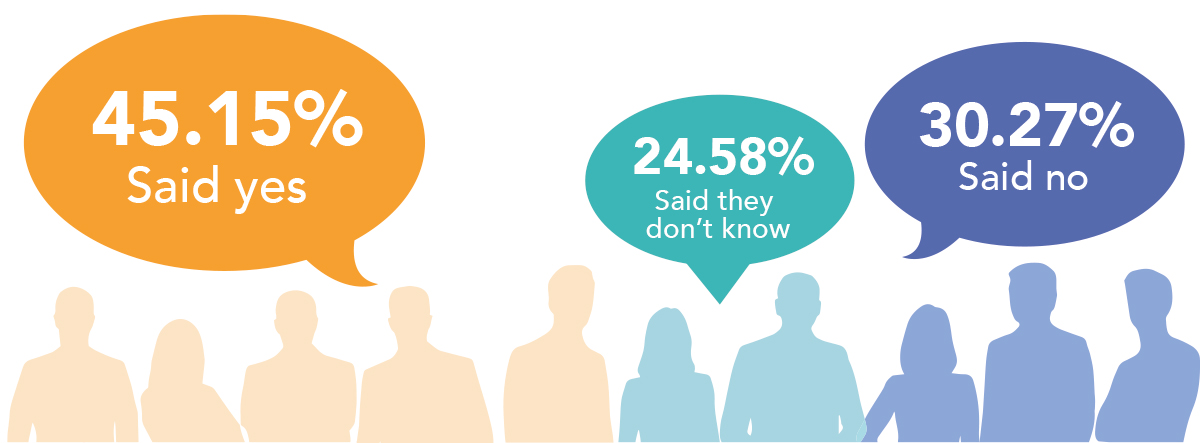

Do you think you’ll invest in property in 2023?

Looking ahead to next year, 45.15% of landlords think they will invest in 2023. 30.27% don’t currently think they’ll invest, and 24.58% don’t know.

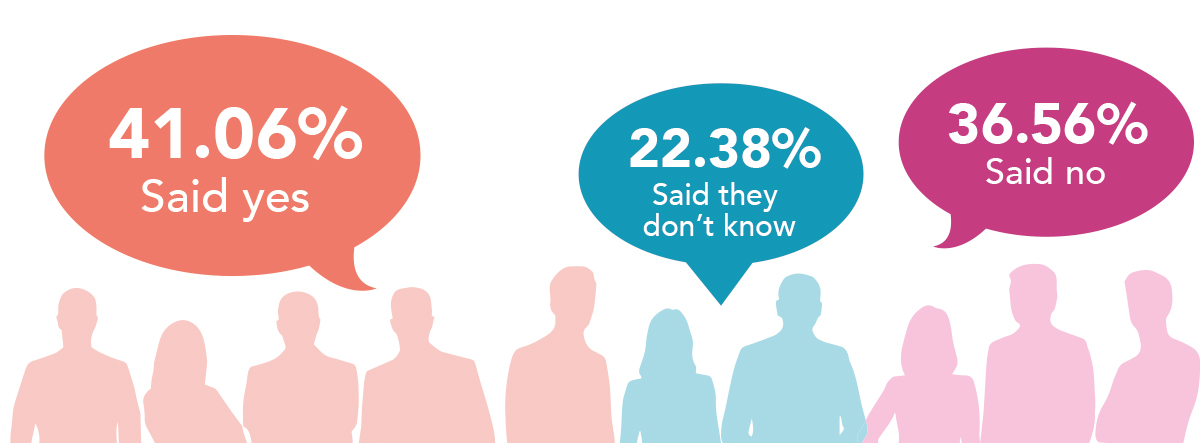

Do you think the current UK government are supporting landlords?

There is uncertainty amongst landlords whether they feel supported by the UK government. 41.06% said, Yes, they do feel supported. However, a combined 58.94% said they don’t know (22.38%) or they don’t feel supported by the government (22.38%).

We also found out…

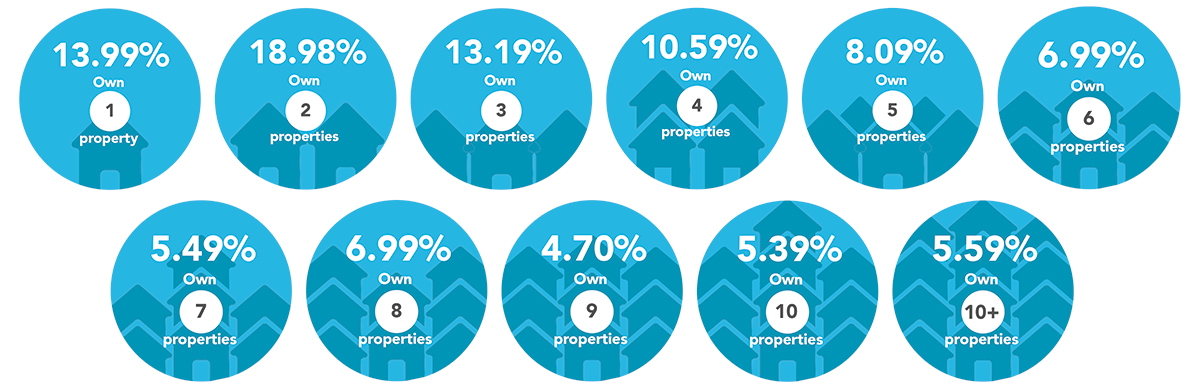

How many investment properties do UK landlords own?

The most popular choice for the number of investment properties owned was 18.98% of respondents owning 2 additional properties that are not their main residence. A combined 56.74% own 1-4 properties, 37.66% own 5-10 properties, whilst 5.59% of landlords own more than 10 investment properties.

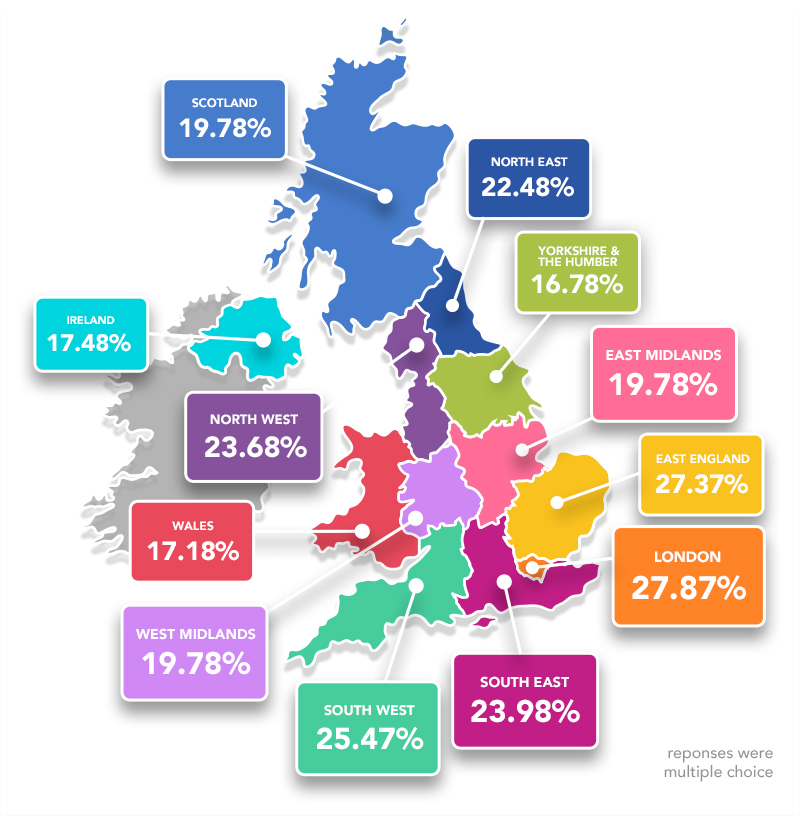

What regions do you own property in?

With weekly rental prices hitting £2,011 a month in Greater London and competition for rental accommodation soaring, it’s not surprising that the capital is home to the most investment properties. 27.87% of investors own property in London. But the East and South West aren’t far behind, with 27.37% and 25.47% of the UK’s investment properties, respectively.

What type of landlord are you?

Simply put, a private landlord manages the letting of their property, or properties, themselves. Whereas a letting agent is responsible for managing properties on behalf of landlords for a fee based on the service provided.

With 86% of landlords surveyed owning more than one investment property, they can rent their properties privately, via a letting agent, or a blend of the two depending on their properties.

We discovered that 66.53% of properties are privately rented, whilst 55.14% are via a letting agent.

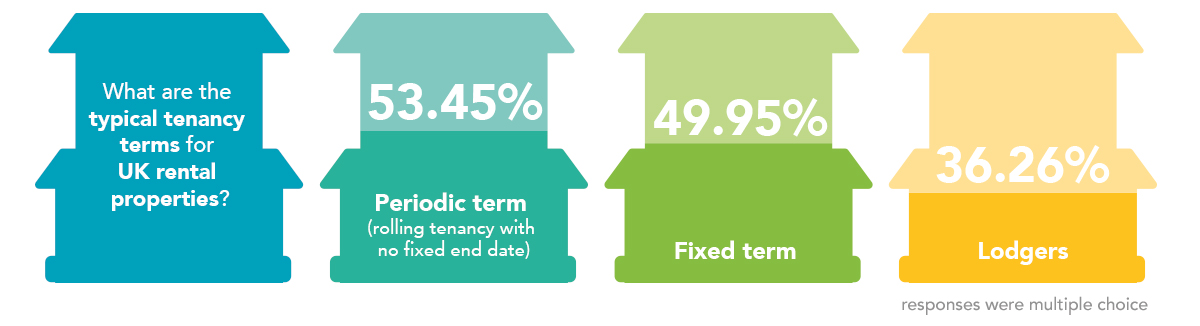

What are the typical tenancy terms for UK rental properties?

Periodic term (rolling tenancy with no fixed end date was selected by 53.45% of landlords as the tenancy term for their properties. This was closely followed by fixed term with 49.95% of rented properties whilst.36.26% of landlords have lodgers. Our survey of over 1,000 renters discovered that 14.09% of UK tenants don’t know the type of tenancy they have!

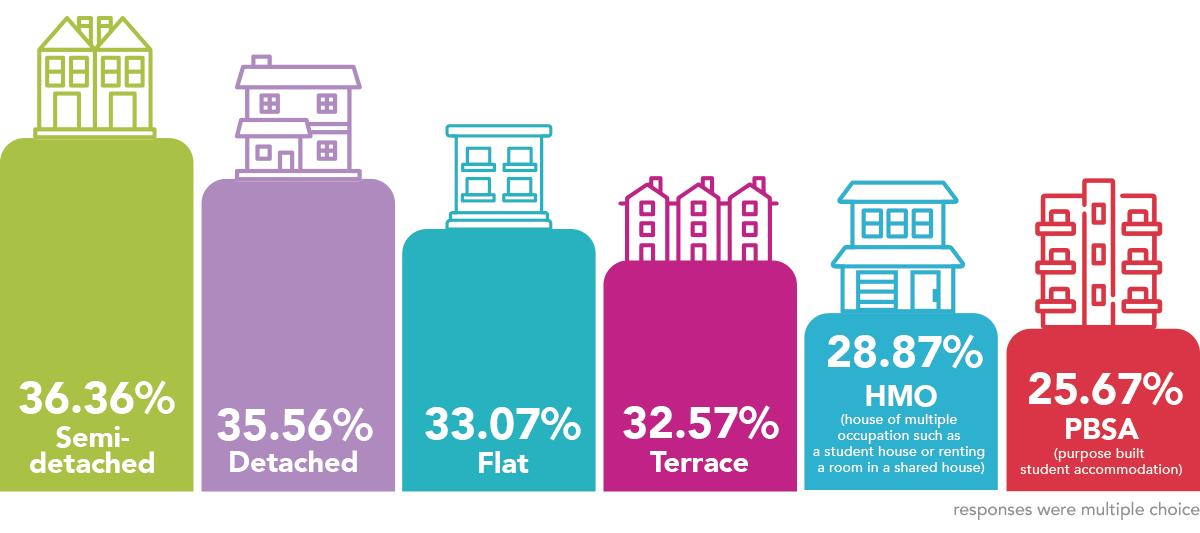

What type of property/properties are currently being rented out?

Are pets allowed in UK rental properties?

Nearly 50% of UK landlords allow pets in all their rental properties. 28.77% of landlords don’t allow pets, whilst 21.78% of landlords will allow pets in some of their properties but not others.

Access this survey's raw data in Excel format

Our survey statistics are available in the Microsoft Excel format. To access this please use the form below

| Poll Title: | UK Landlords' Report 2023 |

| Poll Objective: | To gain insights into the UK private rental market from landlords of at least one UK property that is not their main residence which they rent to tenants |

| Conducted: | Jan 13 2023 |

| All Respondents: | 3,108 randomly sampled people in the UK |

| Qualified Respondents: | 1,001 |

| Screening Question: | Which of the following best describes your connection with property ownership? I own at least one UK property which is not my main residence of which I am a landlord |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 3,108, throughout the UK’s 68,810,873 population (worldometer) of which 1,001 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2023 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, or require an accessible unlocked version of this excel file, please in the first instance email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/blog/uk-landlords-report-2023 |