We're Bridging Loan Specialists

We arrange fast bridging finance secured on residential, semi-commercial, commercial property and land used for almost any purpose.

Our Bridging Loan service

- Market-leading bridging loans from £26,000 to £250,000,000

- Monthly interest rates from 0.44% to 2.00% per month

(Lower rates for £700,000+ loans or less than 50% LTV) - LTVs up to 80% (up to 100% finance if additional collateral is available)

- Quick automated valuation options and dual legal representation

- No monthly payments with interest rolled-up options

- Terms up to 24 months

We provide a fast, reliable service that gets the bridging finance you need at the best rates.

Our extensive network of top UK lenders includes specialist bridging finance lenders, family offices, private investors and private equity firms, meaning we're confident in securing your bridging loan requirements:

Up to £300k loans in 3 days

Up to £750k loans in 7 days

Up to £250m from 14 days

We consider all types of credit history, including non-status and bad/adverse. We don't perform automated credit checks, so there's no footprint from enquiring with us.

When your timeline is critical and short, we're the experts who will get your bridge loan in place. Get your best no-obligation quote today.

Bridging Loan uses

Residential property bridging loans

Bridging finance for property purchases, such as

fixing chain breaks or mortgage delays, buy to let, HMO, student lets, buying a property with a short lease, property flips and investment purchases.

Commercial property bridging loans

Commercial bridging loans for property purchases, including semi-commercial properties.

Fast auction bridging loans

Bridging finance for fast property auction purchases of residential, semi-commercial and commercial, safeguarding your 28-day completion.

Light refurbishment bridging loans

Bridging finance for purchasing uninhabitable property, financing permitted development, loans for modernising & doer-upper properties.

Heavy refurbishment loans

Financing change of use, extensions, HMO conversions, basement developments, rooftop development, loft conversions, commercial to residential conversions & barn conversions.

Development Finance

Financing Land purchases, property development finance and development exit finance.

Bridging loans for business purposes

Paying tax bills, raising capital for investing in plant machinery, purchasing a business premises, property portfolio purchases, working capital or simply for business cashflow.

Second charge loans

Such as second-charge bridging loans or mezzanine finance

Bridging loans for UK ex-pats and foreign nationals

What are the types of Bridging Loans?

Residential Bridging Loan

A residential property bridging loan is fast, flexible bridging finance for property purchases. Buy-to-lets, HMOs, properties with short leases, property flips, investment purchases can all be financed, as can fixing chain breaks or mortgage delays, and refinancing an existing property loan. These loans require residential property or a group of properties as security.

Commercial Bridging Loan

A commercial bridging loan is high-value short-term finance used to buy or refinance commercial property or semi-commercial property, finance renovation, conversion or refurbishment projects. Commercial bridges are also used in business to raise capital for resolving cash flow issues, investing in plant, machinery or stock, fund an expansion, or pay urgent bills. It's secured on commercial or semi commercial property.

Land Bridging

Loan

A Land Bridging Loan is a fast financing solution for purchasing land, with or without planning. It enables investors, developers and speculators seize time-critical land opportunities, such as: purchasing Residential land, Commercial land, Agricultural land (pasture and arable) and Development land (including Greenfield and Brownfield sites, garden plots, ransom strips, woodland and carparks).

Fast Bridging

Loans

A Fast Bridging Loan is multi-purpose short-term finance urgently arranged in as little as 72 hours (3 working days) for loans up to £300,000 and 7 days for loans up to £750,000. This bridging loan is used as emergency finance, where time-critical funding is required, and comes with instant decisions in principle, free no obligation quotes within 30 minutes and terms within 2 hours.

Auction

Finance

Property Auction Finance is short-term finance used to purchase property at auction, including: uninhabitable properties, doer-upper's, short-lease, refurbs, flips, buy-to-lets (BTLs), conversions, renovations, development, land & commercial opportunities. It enables investors to take advantage of below market value (BMV) properties being sold at auction providing the finance to complete purchases within the 28-day limit.

Property Refurbishment Loans

Property Refurbishment Bridging Loans finance both light and heavy property refurbishment projects, including: Loft conversions, Airspace/Rooftop development, Extensions or Basement digs on residential investment properties such as Student Let, HMO refurbishments and renovations. This finance is also suitable for commercial renovation projects such as Hotels, Offices, Pubs, Retail and Warehouses.

Second Charge

Bridging Loan

Second Charge Bridging Loans, also known as junior debt or subordinate debt financing are used to extract additional cash out of a property that already has a senior debt obligation, such as a 1st charge mortgage. It enables borrowers who already have a mortgage or other loan secured against a property but require further short term financing to raise additional finance fast accessing the equity quickly in as little as 3 days.

Rebridging

Loan

Re-bridging Loans, also known as bridging loan refinancing, enables existing borrowers to refinance their bridging facility to: cash-out more equity, gain more favourable terms, secure better rates, consolidate debt or extend their repayment date. It's typically used when the original exit strategy has been delayed, or anticipated to be, due to a change of circumstances, project over-runs or an asset taking longer to sell. For those nearing their term end we can arrange your re-bridge, helping you to avoid default.

Large Bridge

Loans

Large Bridging Loans is a bridging finance facility in excess of £1,000,000 up to a value of £250,000,000 and is used by property investors, high net worth and ultra high net worth individuals for both private & commercial purposes such as: luxury property purchases and refinancing and commercial ventures.

Farm

Finance

Farm finance enables farmers and agricultural business owners finance purchases of livestock, new plant and machinery, fund diversification, buy additional property and land, invest in renewable energy development, organise generational transfers or develop property. They also can be used to refinance existing loans. Farm finance releases the capital required to achieve the borrowers' goals.

Business

Finance

We help UK SMEs access the funds for a multitude of purposes from cashflow, stock, expansion, or to facilitate a new opportunity. We're experts in urgent, specialist business finance securing the right deal so business owners achieve their goals. Whether its bridging or development finance, second charges, asset or invoice finance we can help.

Tax Bridging

Loan

We arrange tax bridging loans to settle time-critical debts and tax demands, be it your personal tax such as inheritance tax, capital gains, income tax or your company's tax liabilities including corporation tax, value added tax (VAT) or staff PAYE obligations.

Bridging Loan lending criteria

| Loan to value (LTV) | Up to 80% maximum (Up to 100% where additional security is available) |

| Loan term | 1-24 months |

| Loan amount | £26,000-£250,000,000 |

| Interest types | Rolled-up, retained or serviced |

| Interest rates | 0.44%-2% per month |

| Charge | 1st, 2nd & 3rd charges |

| Decision | Immediate decision in principle (DiP/AiP) Terms within 1 hour |

| Completion | 3-14 days |

| Early repayment fees | None |

| Availability | England, Scotland, Wales and Northern Ireland & Europe Individuals, Companies, SPVs No credit & adverse credit considered |

| Exit strategy | Sale or refinance |

2024 Bridging Loan guide

If you're unsure what a "bridging loan" is and how it's used or works, we've created an easy-to-understand guide that explains it.

Contents

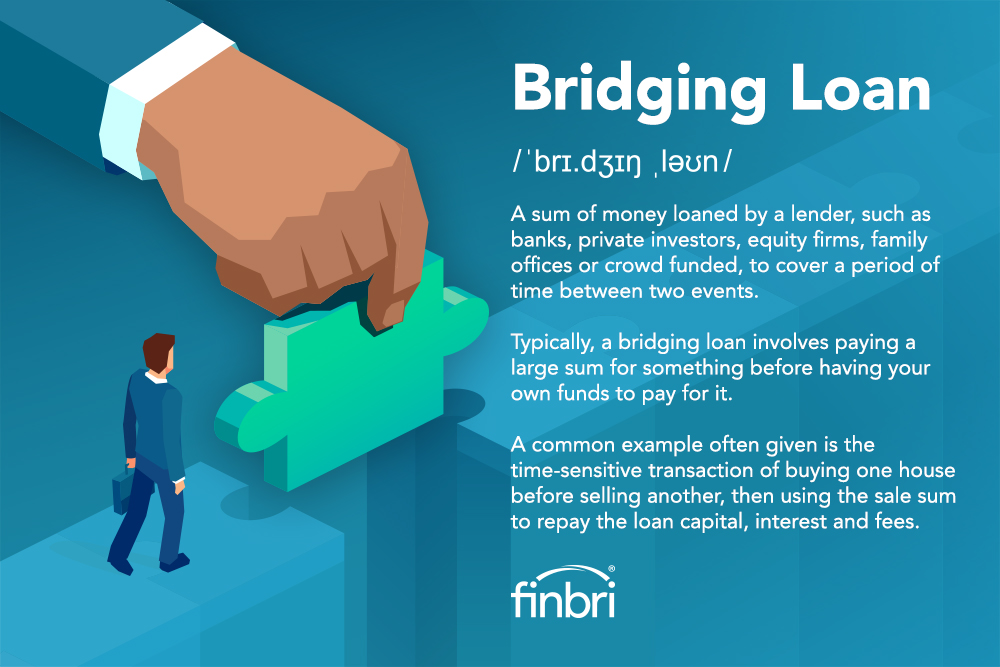

What is a Bridging Loan?

A bridging loan is short-term finance typically borrowed to bridge a gap in financing. In the UK, it's also sometimes called a "bridge loan" or "bridging finance".

A bridging loan is used for almost any purpose. A survey of over 1000 people showed that it's usually used to finance property transactions. 38% of people used it to purchase a main residence, and 31% used it to purchase an investment property or property development.

Bridging loans are typically secured against one or more properties, although other assets, such as land, qualify as security.

How does a bridging loan work?

Most people don't have large sums of liquid cash immediately available, as that cash is usually already tied up in another investment, such as a property.

There are many instances when you might need to access the property's equity quickly, and this is where bridging loans are useful. A bridging loan works by a lender loaning you their cash temporarily in return for:

- a charge on your assets, typically property, and

- a payment for arranging the loan by way of fees and interest;

- and agreed method of how the debt will be repaid.

The repayment will usually be by freeing up cash from selling other assets or securing a long-term financing arrangement, such as a buy-to-let mortgage.

A detailed explanation of the bridging loan process is found a bit further down on this page, but if you’re short on time, here’s a quick summary:

There are several benefits of using a bridging loan broker. If you use one, they'll listen to what you’re trying to achieve, offer advice, package up your application, source the right bridging lenders for your situation and find the best rates available. You’ll then choose from the options presented and decide which lender and loan proposal best meets your needs.

After the lender completes their checks (due diligence) on you and the property you’re offering as security, they’ll complete a valuation and instruct lawyers to complete the legal work. The bridge loan will then be ready for you to draw down. The money is now available for the purpose you’ve agreed with the lender. Bridging loans have many uses, but they’re typically used for property investment, i.e., Purchasing, refurbishing, or converting property.

How long can a bridging loan be borrowed for?

The majority of bridging loan terms are 12 months or less. However, the maximum duration available is up to 24 months and, in very specific circumstances, 36 months.

A bridging loan is always intended as a short-term financial product that helps you to get from A to B. Our recent survey showed that six months was the most popular bridging loan term (22% of respondents).

What can a bridging loan be used for?

Bridging loans are versatile short-term financial products used for almost any purpose.

Here are just a few of the popular uses, both in the UK & in Europe:

Property Purchases & Refurbishments

A bridge loan is used to finance the purchase and refurbishment of residential, business or commercial property.

Auction Purchases

Bridge finance is well-suited to auction purchases due to the fast arrangement of bridging finance and the speed of the drawdown of funds that help you complete your purchase within the 28-day time limit.

Fixing a property chain break

If you're purchasing your next home but your sale has fallen through, and you don't want to lose your next property, property bridging loans are used to finance the purchase of the property before yours sells and save the property chain from falling apart.

Buying a property to flip

The process of purchasing a property, completing renovation work and then selling on for a profit - all possible via bridging because of the short-term nature of bridge loans.

Buying a property to convert

Whether converting a residential property into apartments, an HMO, or a commercial property into dwellings, bridging loans finance both the purchase and conversion of the property.

Buying a property to rent out

Purchasing a property, possibly completing a refurb, and then refinancing onto a buy-to-let mortgage - a bridging loan makes this possible.

Buying an unmortgageable property

A property that's not at the standard that a traditional mortgage would require, yet it's possible with a bridging loan. Once the refurbishment or renovation is completed, the property will either be refinanced using a traditional mortgage or other cash will be used to repay bridging finance.

Buying a property at auction

Typically, an auction purchase requires you to purchase the property within 28 days. You wouldn't be able to do this with a traditional mortgage. Auction finance is a bridging loan used to purchase property at auction.

Buying a property with a short lease

Mortgage lenders will typically decline to offer a mortgage on a property where the lease remaining is less than 80 years. As such, sellers of properties with short leases often fail to realise the property's true market value because they only attract ‘cash-buyers’. Buying a property with a short lease offers both first-time buyers and property investors a good opportunity to buy below market value and then, relatively quickly, increase the property's value.

Bridging loans are used to purchase property with short leases remaining as well as financing the lease extension itself.

Buying land

Bridging loans are used to buy Land with or without planning, including potential development parcels, commercial, brownfield and agricultural land. Purchasing land is often a time-critical opportunity, and as bridging loans are quick, their use appeals to land speculators and developers alike.

Downsizing your property

A bridging loan facilitates the purchase of a lower-value property before the sale of your current property.

Paying care fees

Clients are often required to pay substantial care fees while their property is sold. A bridging loan helps by raising cash quickly until the property is sold.

Non-property purposes

Bridging loans are often used for raising cash for business or commercial uses, such as:

- purchasing equipment or stock

- investing in infrastructure and plant

- financing a management buyout

- paying VAT bills or settling Corporation Tax.

Personal uses might include:

- paying unexpected bills

- paying self-assessment tax or capital gains tax bills

- paying inheritance tax

- arranging a divorce settlement.

These examples aren't exhaustive but give you some idea of the versatility of bridging loans.

How much can I borrow with a bridging loan?

How much you're able to borrow using a bridging loan varies case by case, but there are a few basic concepts worth familiarising yourself with.

Bridging loans typically range in size from £25,000 up to £10 million, but there's no actual upper limit. Some bridging loans have been more than one billion, but these are few and far between.

Your bridging loan amount will largely depend on:

- how much you want to borrow

- the available equity in your property

- the maximum loan-to-value (LTV) for your property type, as each has different LTVs

- and what your lender is willing to lend in your specific circumstance.

Usually, the most you’ll be able to borrow will be 80% LTV secured on one property. Another way to put this is for every £100,000 of equity you have in a property, the maximum borrowing is up to £80,000. Use our bridging loan calculator to determine a bridging loan's indicative costs.

Our recent survey showed that 7% of bridging loan borrowers received their loan within one week, but the most frequent length of time (20% of borrowers) it took to complete was 2-3 weeks from application.

How to maximise your bridging loan borrowing

According to our recent survey, 98% of bridging loan users want to maximise their borrowing - the most important factor. So, it's good to know that we help you maximise your borrowing potential. If you're looking to borrow as much as possible, then as a bridge loan broker, our job is to maximise your borrowing potential and source the right lender for you so your rates are as low as possible. Where you’ve multiple properties to put up as collateral, 100% of your bridging finance requirements are achievable.

What does a bridging loan cost?

The cost is typically comprised of interest on the loan, normally calculated monthly, plus a range of fees.

There are hundreds of lenders in the UK, including private investors, equity firms, high street banks, and family offices, and each has different requirements for bridging loan criteria. Some lenders finance specialised loans in niche circumstances, whereas others only provide bridge loans for low-risk clients. The bridging loan cost will be determined by which lender you choose, how many lenders are vying for your deal, your specific needs and your borrowing profile.

What are bridging loan interest rates?

The interest rates for bridging loans in the UK currently range from 0.44% to 2% per month.

Higher-value loans, such as those above £700,000, attract better rates, as do lower LTVs that are sub-50% due to the reduced risk of the loan.

What are the interest options with a Bridging Loan?

The cost of the loan will also be influenced by the type of interest you choose. There are three interest options:

Typically, in all instances, the capital sum is only repaid at the end of the term. The reason for this is that the purpose of the loan often means the borrower doesn't have the cash to service the debt each month but instead relies on the sale or refinance of an asset to pay off the loan. Repaying the debt at the term end is known as the exit strategy. A viable bridging loan exit strategy is a requirement of the loan before taking out the finance.

Let’s take a look at the interest options.

Serviced interest

Serviced interest is possibly the easiest to understand, as the interest is paid monthly, similar to many traditional high street mortgages. As the interest is paid off each month, it doesn’t compound, reducing the total cost of the loan.

Retained interest

Retained interest means the borrower isn’t required to make monthly interest payments. Instead, the lender adds all the interest to the loan balance from the outset and effectively pays the interest when it falls due at the end of each month. So, the borrower is borrowing both the capital sum and the interest, as such interest is applied to both.

Rolled-up interest

Like retained interest, the lender rolls up the interest and adds that interest to the loan balance at the outset, so again, there are no monthly interest payments. The difference between rolled-up and retained interest is that the lender doesn't charge interest on the interest already added to the loan.

What are bridging loan fees?

Aside from the interest of a bridging loan, these loans typically come with additional charges in the UK.

These include:

Let’s look at each of these bridging fees in more detail:

Arrangement fees

Lenders charge Arrangement Fees (facility fees) at the start of a loan agreement to cover the work involved in setting up the loan. These fees are typically 1-2% of the loan amount.

Broker fees

Brokers securing the best bridging loan from the market will charge broker fees. Broker fees cover preparing the borrower's application, sourcing the most competitive options, and liaising between the parties to complete the loan in the timescale that the borrower needs at the term they want.

Advantages of using a Bridging Loan broker

A bridging loan broker will aim to generate a competitive marketplace for the deal between multiple lenders by creating interest in the loan with the "best-fit" lenders. This offers the borrower the most beneficial outcome, the best rates and terms within the timescale that the borrower needs. To do this, the broker will first package the deal so lenders more easily understand its value. Source multiple potential lenders, approaching only those whose criteria match the borrower's requirements.

It's important to acknowledge that with bridging loans, the most beneficial outcome isn't necessarily the cheapest cost. Maximising loan amounts, meeting an urgent deadline, or where the borrower has specific requirements, all could be prioritised over cost.

Valuation fees

Valuation fees cover the cost of assessing a property's value and condition, which is done to determine how much the lender is willing to lend against it. Fees vary depending on the size and complexity of the property but range from two hundred pounds to one thousand pounds or more.

In most cases, the lender will require an RICS-assessed valuation report to determine whether the property meets its lending criteria. Automated (desktop) valuations are adequate for some lenders for specific properties. For example, residential property of standard construction in a prime location with a low loan-to-value loan and low loan amount.

The lender will require an RICS-assessed surveyor to complete every in-person property valuation. Lenders will also require the valuation to be completed by a company from their pre-approved valuation panel. For this reason, knowing which surveyor your lender will want to use is worthwhile before getting a valuation on a property.

Requesting a copy of the valuation report will benefit you should your lender decline your application due to a valuation that makes them unwilling to lend. In this instance, having a copy of the report negates further valuation fees from a new lender subject to their valuation requirements. For example, some lenders are willing to use valuations provided they're within a certain time frame, i.e., less than three months old. This is typically only applicable for residential property as commercial property will always require a valuation.

Legal fees

Legal fees cover the cost of legal advice and customary paperwork associated with a loan. Depending on the situation's complexity, these fees range from several hundred to several thousand pounds. Speak to us to find out the exact costs in your circumstances.

Early repayment charges

Early repayment charges (ERC) are imposed by some lenders when you pay off your loan before its due date. Depending on how early the loan is repaid, these range from 1-5% of the loan amount.

Exit fees

Exit fees are charged by some lenders when you pay off your loan. These are typically 1% of the amount outstanding at the time of repayment. It's also worth noting that not all lenders charge all fees, and some lenders have different ways of charging the fees outlined here.

Property types & their LTVs

Typically, the types of property that attract the lower interest rates for bridging loans are (in this order):

- Residential property LTVs

- Mixed-use or semi-commercial property LTVs

- Commercial property LTVs

- Land that has planning LTVs

- Land without planning LTVs

Lenders typically only offer a maximum loan-to-value of 80% on one property. You'll need to add more collateral to the deal to achieve a higher loan amount, usually in the form of another property. With additional properties in the loan, achieving 100% of your bridging finance requirements is possible.

Let's look at the different property types and LTVs they offer.

LTVs For Residential Property Bridging Loans

Residential property is considered the safest property asset in the UK. Over the long term, a residential property appreciates and is considered a safe investment. Many people are in the market to purchase or rent dwellings. As such, this is also why lenders will often be willing to lend up to higher LTV ratios on residential property - typically up to 80%. Not all residences are created equal, though. A property in a prime location will always attract better rates than one next to a major trunk road or motorway.

LTVs For Mixed-use (Semi-commercial) Property Bridging Loans

For the same reasons as residential properties being attractive security for a loan, mixed-use property (also known as semi-commercial) has an element of a residential dwelling incorporated into the building. The actual LTV will vary from lender to lender, but as a guide, it's similar to Commercial Property at 65% LTV.

LTVs For Commercial Property Bridging Loans

Commercial property varies greatly as to whether a lender deems it desirable security, hence why only up to 65% LTV are typically offered. Even then, the type of use class it has, whether it's a restaurant, hotel, cafe, forecourt, golf club, etc, all impacts its value to the lender. Of course, the location and demand for that property type will significantly affect its resale ability.

LTVs For Land with Planning

Land with planning is typically sought after, with developers eager to snap up the opportunity. Developers tend to look for undeveloped land for speculation. Many companies in the UK specifically seek out these 'land-banking' opportunities, so they’re usually appealing to lenders. However, it's unrealised potential, and lenders aren't developers, so they will price their interest rates accordingly and only typically go to a maximum of 70% LTV - but that will depend on whether the planning is for residential or commercial use.

LTV For Land without Planning

Land without planning isn't as attractive as land with planning at first glance. However, that largely depends on what kind of opportunity the land presents. Half an acre of agricultural land will not be as desirable as half an acre of land for potential development. Each will hold a value, and finding the right specialist lender will make all the difference to the loan amount you'rea able to achieve.

There are many opportunities with land, be it potential garden plots for development, parcels of land adjacent to farms for developing additional revenue streams such as equestrian centres or farm shops, or even strategic purchasing of brownfield plots. Since the Environment Act 2021, the UK has seen a gold rush for brownfield sites, too, due to developers now being required to offset the green spaces they build upon reducing the environmental impact of their builds.

Land without planning tends to attract a maximum of 50% LTV.

What's the difference between 1st or 2nd-charge bridging loans?

A charge on a property contains the details of any burdens affecting that property,

This could be restrictive covenants (such as restrictions on the use of the property), positive covenants (such as obligations to maintain a fence or driveway), or debt obligations such as loans and mortgages. Mortgage comes from Latin and means 'death pledge’, a pledge to repay the debt until the debt’s death. Mortgages are legal agreements by which a lender lends money at interest in exchange for taking the title of the debtor's property, with the condition that the conveyance of title becomes void upon the payment of the debt.

When it comes to bridging, the charge will be a type of mortgage and whether the mortgage is a 1st, 2nd or 3rd charge infers which lender gets repaid first should the borrower default. There’s no limit to the number of charges you could have on a property, but it’s typically not more than three. A 1st charge bridge is the principal loan on a property, taking precedence over all other charges. A 2nd charge loan, meanwhile, is secured against a property that already has a loan or mortgage outstanding.

How do I apply for a bridging loan?

Applying for bridging loans beaks down into the following five steps.

Step 1. Initial consultation call

This is where we understand what you're trying to do and your circumstances. During this call, you'll receive an indicative proposal outlining this finance's costs, timeline, and fees.

Step 2. Application

We work with you to collate all the documentation the lender will require from you. We'll only approach the lenders we know will be interested in your loan. We'll present your case in the best possible light to our lending panel, ensuring that the lenders we approach see the value in your loan. We aim to find multiple lenders to provide offers to you and create a competitive market for your deal.

Step 3. Decision in principle.

Our lenders confirm they're happy with the terms we've provided you, subject to valuation and legal work.

Step 4. Valuation & legal work.

We'll confirm whether a desktop or physical valuation will be required for your property to be used as security and then instruct surveyors if necessary. Next, the solicitors will complete legal due diligence, including any searches on the property.

Step 5. Payout.

In conjunction with you and your solicitor, your lender will confirm the date and time of completion and organise the transfer of funds for that date.

Step 6. Exit.

Our team will contact you three months before you exit your bridging finance facility to check your exit strategy is still viable. Ideally, you'll look to repay your bridging loan within the term. If your original exit looks unlikely, we help re-bridge your bridging loan facility to buy more time.

How long does it take to arrange a bridging loan?

One of the real advantages of bridging loans is that they’re often incredibly quick to arrange. They're the quickest form of short-term finance for large sums accessible in the UK.

From initial enquiry to receiving the finance in your account, the average time frame for a bridging loan to complete is two to four weeks. In urgent scenarios, however, we complete bridging loans in hours. For example:

- For bridging loans up to £300,000, we complete these in just 72 hours

- And for up to £750,000, we complete these in just five working days.

How are we able to turn around bridge loans so quickly?

We're strong at all key aspects of securing your short-term finances. But three critical factors matter in urgent cases:

- We know which lenders want which bridge loans. For fast bridging loans, we have several lenders focusing on purely time-sensitive lending.

- We're good at packaging a bridge loan, so the lender doesn't have to do much groundwork to understand the value of lending to you.

- Our tried and tested processes cut out the red tape and delays from Surveyors and Solicitors.

For example, According to Ernest & Young's latest 2023 survey, 81% of bridging loan providers said protracted legal work was the biggest cause of bridging loan delays. So, in urgent finance, we use joint legal representation, also known as dual representation, that almost entirely mitigates that issue.

The same EY survey also showed that 37% of bridging loan providers cited Valuer response times as the third biggest cause for bridging loan delays. To overcome this, we replace in-person valuations with automated valuations, which shave an incredible two weeks or more from the process. Close contact with all parties and effective case management helps ensure your bridging loan application stays on track.

With a combination of these options, automation tools, knowledge, and expertise, we help speed up obtaining a bridging loan.

Bridging loan criteria & your eligibility

If you're unsure whether you'd be eligible for a bridging loan, the good news is that the eligibility criteria are very straightforward.

Here's the summary.

- Bridging loans are available to UK residents and non-residents, including ex-pats and foreign nationals.

- They’re available to Individuals and Companies such as Special Purpose Vehicles.

There are just three key conditions that need to be met:

- You'll need to own or part-own a property.

The majority of bridging loans are secured against property. Although the property could be located outside the UK, more lenders are willing to lend on UK property than overseas.

- The property must have enough available equity to achieve an LTV ratio within the bridging loan lender's LTV limits.

Typically, the highest LTV is 80%. So, if you own a property that's worth two hundred and fifty thousand pounds, and it has no other borrowings on it, then the maximum bridge loan amount would be two hundred thousand pounds.

Another way to look at it is for every hundred thousand pounds of equity you have in your property, the maximum you could borrow would be eighty thousand pounds.

- You must have a realistic exit strategy.

An exit strategy is how you intend to repay the bridging finance at the end of its term. Unlike mortgages, with a bridging, there are typically no monthly repayments. Instead the full repayment is usually made at the end of the bridging loan term, in one lump sum. As such, the lender will expect the borrower to have a reliable method of repaying the debt when the bridge loan ends to avoid default.

Non-status & bad credit bridging loans

The good news is that your credit history isn't necessarily going to stop you from obtaining a bridging loan.

This includes bad credit or adverse credit and non-status.

Non-status credit means you don’t have much in the way of a credit history.

Whilst non-status lending isn't an issue for bridging lenders, if you have a lighter credit history, some lenders will perceive you as having a higher risk of default, which reflect in slightly higher interest rates being offered.

Bankruptcy, CCJs, or adverse credit are not necessarily a big problem for bridging lenders, but again, be prepared to pay a higher rate of interest, as lenders will perceive you as having a higher risk of default.

If you’ve bad credit, adverse credit or even no credit history, our advice is to be open about your circumstances.

We often find a way to position your case with lenders where the merits of your application shine through and help you get the best rates.

Is proof of income required for a bridging loan?

Proof of income isn't usually a requirement for obtaining a bridging loan, although there are some exceptions.

The few instances where you will need proof of income when it comes to obtaining a bridging loan are:

- if your exit strategy is linked to your income,

- where you choose a serviced interest option,

- or the bridge loan is a regulated product.

In most other cases the application won’t rely on your income because your bridging loan will more likely be repaid through the sale of a property or refinancing it.

What's the difference between a regulated bridging loan and an unregulated one?

Put simply: a regulated bridging loan is regulated by the Financial Conduct Authority (also commonly known as the FCA), whereas an unregulated bridging loan is not.

Unregulated bridging loans

If the security you intend to use is an investment property, such as a tenanted residential property or a commercial property, then an unregulated bridging loan is suitable.

Regulated bridging loans

If the property being used as security for the bridging loan is your main residence or where close family members reside, then the bridge loan must be regulated.

Regulated bridging loans typically take longer to arrange simply because of the additional checks that must be carried out for the applicants.

Open or closed bridging loans explained

Closed bridging loans have a set date upon which the finance will be repaid, typically up to twenty-four months.

Most bridging loans are closed bridging loans.

Open bridging loans don’t have a set repayment period. This means you decide how much to pay off and when. You'll still need an exit strategy, but not a fixed date.

What are bridging loan exit strategies?

To take out a bridging loan in the first place, you'll need a viable, robust exit strategy.

This is typically either the asset's sale or the asset's refinancing onto a longer-term finance such as a mortgage. If you have an alternative repayment proposal, we'll work hard to find a lender to accept it.

We're financial experts who arrange short-term bridging loans for property owners, securing you the best rates and terms from over 200 UK bridging loan lenders, including private equity firms, investors and family offices.

Get expert assistance today, we're on hand to answer any questions about bridging loans.

Call our friendly team on 01202 612934, we're ready to help.

What types of property can a bridging loan be secured on?

Bridging loans be secured on all types of property including:

- Houses

- Bungalows

- Maisonettes

- Flats or Apartments

- Self Builds

- Development project

- Restoration projects

- Commercial or mixed-use

Why use a bridging loan broker?

We offer experience-based, impartial information, accessing quotes from the whole of the market to ensure your rate is as low as possible for your specific circumstance. We're experts in the complicated and package your requirements in such a way that our lending panel understands and are able to lend against.

Are bridging loans a secured loan?

Yes, they're a type of secured loan. This means in order to get a bridging loan to borrow money, the bridging loan will be typically secured upon:

- residential property

- commercial property

- land

Can I buy an uninhabitable property using a bridging loan?

Yes, bridging loans can be used to buy uninhabitable property such as one that is in need of repair or is missing a bathroom or kitchen. They can also be used for property which is unmortgageable for other reasons such as a property having a short lease.

Questions to ask your broker

Questions to ask a bridging loan broker about interest:

- Is interest calculated monthly? (or daily?)

- Is the interest the same throughout the whole loan term?

- Is there a charge in the interest rate if I default, if so what is it?

- Are there any charges applied for a late payment during or at the end of the loan term. If so, are these backdated to the beginning of the month or even from start of the loan?

- Is the interest rate you've been given specific to you or is it a general ‘rates from…’?

Questions to ask a bridging loan broker about product fees

- Is there an arrangement fee, if so what is it?

- Do exit fees apply, if so what are they?

- If exit fees apply are they based on the loan amount?

- If you exceed the loan term what fees are applied and what are?

- Is there broker or packager fee?

- Are insurance fees are being charged, if so what are they?

- Is there an Asset Manager Fee, if so what is it?

- Are there any other fees are in the small print?

Questions to ask a bridging loan broker about property valuations

- Are there valuation fees, if so what are they and are you marking up the valuation fee?

- Is the loan-to-value (LTV) of the loan based on Open Market Value or ‘90 day’ valuation?

- If offered a ‘Free Valuation’ are you actually paying a valuation indemnity insurance premium instead that often exceeds the cost of a valuation and you do not benefit from an independent RICS survey of the property?

Questions to ask a bridging loan broker about legals

- If you are offered ‘free legal’ - what indemnity insurance premiums are you being asked to pay for?

- Does the legal price quoted include disbursements?

- Is a separate title indemnity premium charged?

- Does the lender accept search indemnities or do they have to wait for them to be provided?

- How quickly can the lawyers turn the paperwork around?

Questions to ask a bridging loan broker about the term

- Is a minimum interest period applicable if you pay back the bridging loan early?

- Where the term less than 12 months and should you exceed the term, what fees and what interest rate is applied?

- Are you free to make repayment early without penalty?

- What default fees apply if you exceed the agreed term?

Questions to ask a bridging loan broker about how quickly the bridging loan can be mobilised

- Is the lender able to complete this specific bridging loan in 7-10 days?

- What delays do you envisage with my bridging loan and how can I avoid these delays?

- Does the lender have valuer/lawyer service level agreements in place?

- What experience does your lender have in your type of project?

- How long has the lender, valuer and legal representative been operating?

- Do you have a personal named point of contact who will make decisions without having to refer to credit committees?