On this page

UK Renters’ Report 2023 Do you want to own a property in the future? Do you think you'll own a property within the next 12 months? How long have you been renting the property you currently live in? What type of tenancy do you have? Do you work from home? Rental cost Location Length of the rental period (tenancy) Deposit cost Number of bedrooms Transport links Pets allowed Garden How important was EPC rating when you chose your current rental property? Do landlords intend to complete EPC improvement-related works to their investment properties in the next 12 months? Food costs Rent increases UK economic outlook Fuel costs Interest rates Rent deposit costs Property security Job security COVID-19 When renting a property have you experienced any of the following: Have landlords had to evict tenants from their rental properties? Do you think you'll move into a different rental property within the next 12 months? Where do you rent your property? How many different rental properties have you lived in since you were 18 years old? How many bedrooms does the property you currently live in have? Does your current property have a garden? Are pets allowed in your current property's tenancy agreement? How many dogs live in your current property? How many cats live in your current property?UK Renters’ Report 2023

Over 80% of renters in the UK want to own a property. But why do three-quarters of them think they won’t be able to purchase in the next year? The key reason is that they can’t save enough for a deposit, which is hardly surprising given the current economic landscape. But with only 14% of tenants preferring to rent over the prospect of owning, renters are also unable to purchase due to mortgage rates, the inability to secure a mortgage and fears over a property crash.

We surveyed over 1,000 UK renters and discovered their feelings, and concerns, about rent increases, energy costs, problems in their rental property such as damp or mould, the key factors tenants consider when choosing where to live, and the problems they’ve faced securing rental accommodation.

Stephen Clark from Finbri bridging loan broker says, “Renters are struggling. Demand for rental property is outstripping supply, rental costs are increasing and over three-quarters of UK tenants are resigned to not being able to own property within the next 12 months.

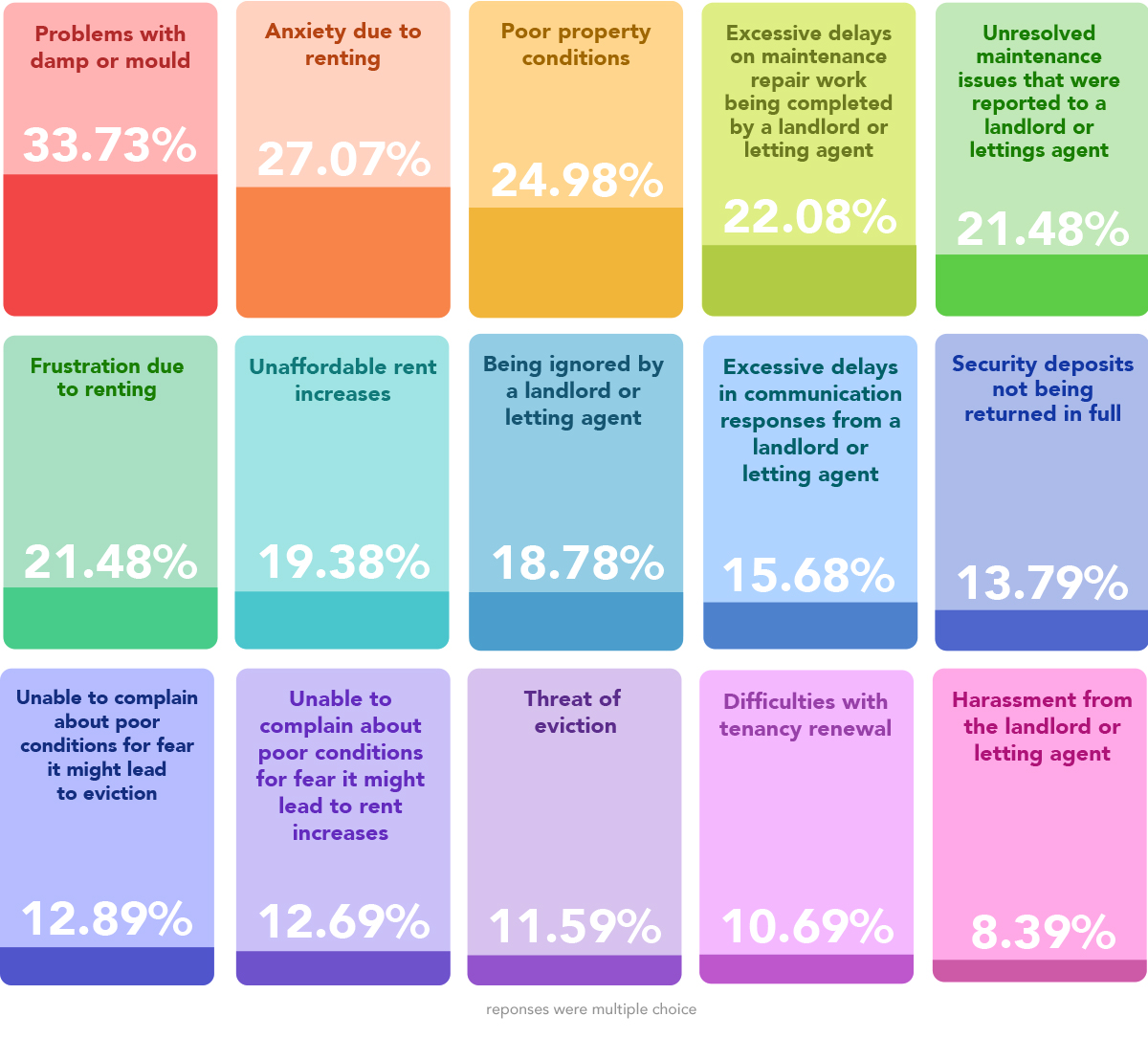

“There is an ongoing cost-of-living crisis, and when combined with rising energy prices and a precarious economy - renters are deeply concerned. Over 27% have experienced anxiety as a result of renting and nearly 20% have had unaffordable increases in their monthly rent.

“Our survey of over 1,000 UK renters, in addition to our UK Landlords’ Report, has discovered how tenants are feeling during a time of significant economic uncertainty and the current mood about the UK rental market.”

Key data

- 83.82% of renters in the UK want to own a property.

- However, 75.92% of tenants don’t think they’ll own a property within the next 12 months with 53.82% unable to save enough for a deposit

- 79.92% of renters are either Concerned (33.27%) or Strongly concerned (46.65%) about energy costs (gas and/or electricity).

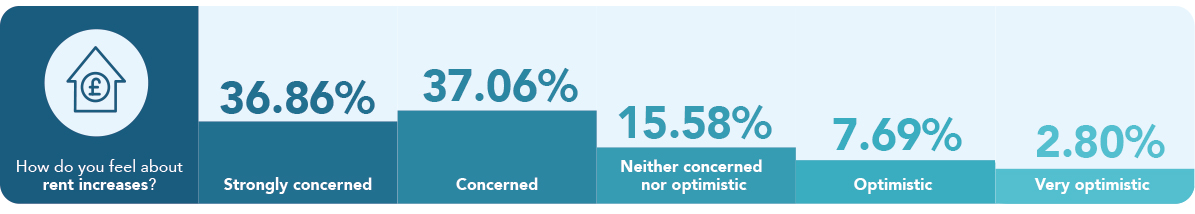

- 73.93% of renters are Concerned (37.06%) or Strongly concerned (36.86%) about rent increases.

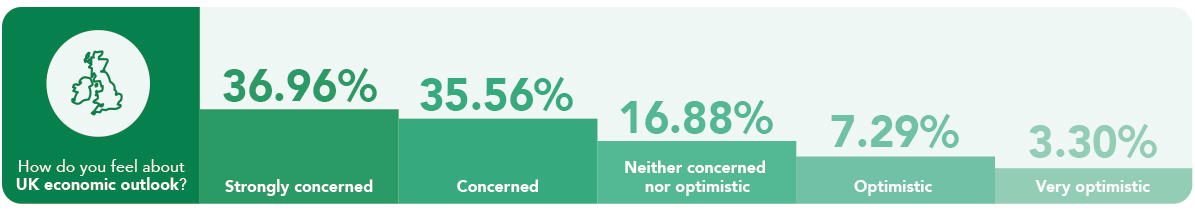

- 72.53% of renters are Concerned (35.56%) or Strongly concerned (36.96%) about the UK economic outlook.

- When renting a property, 33.37% have experienced problems with damp or mould, 27.07% have experienced anxiety due to renting, whilst 19.38% have had unaffordable rent increases.

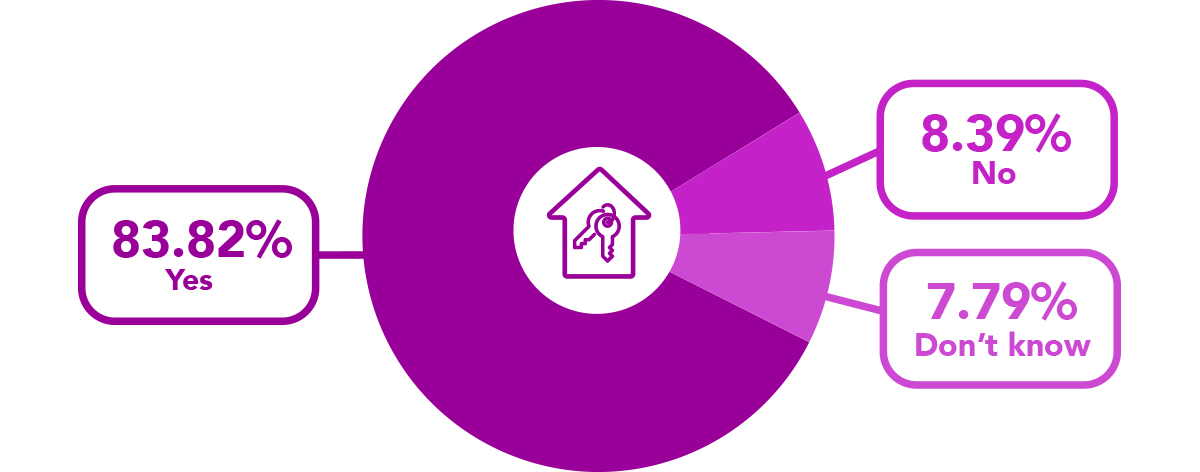

Do you want to own a property in the future?

83.32% of UK renters want to own a property in the future.

13 million people in the UK rent from a private landlord, that’s 1 in 5 people that currently rent. Whilst over 83% of renters want to own a property in the future, 8.39% said No, they don’t want to enter the property market and faced with the current precariousness of the UK economy and housing market, the remaining 7.79% don’t know if they want to own in the future.

However, for those that want to own in the future, there is uncertainty...

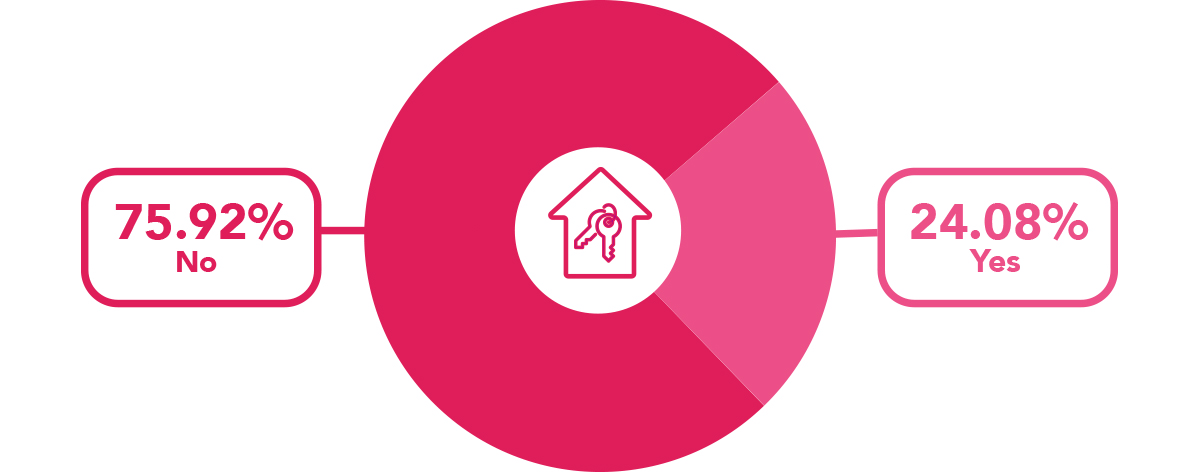

Do you think you'll own a property within the next 12 months?

Whilst 83.82% of renters would like to own a property in the future, over three-quarters of tenants don’t think that will happen anytime soon.

75.92% of UK renters don’t think they’ll be able to own a property within the next 12 months just 24.08% believe they are in a position to buy a home within a year.

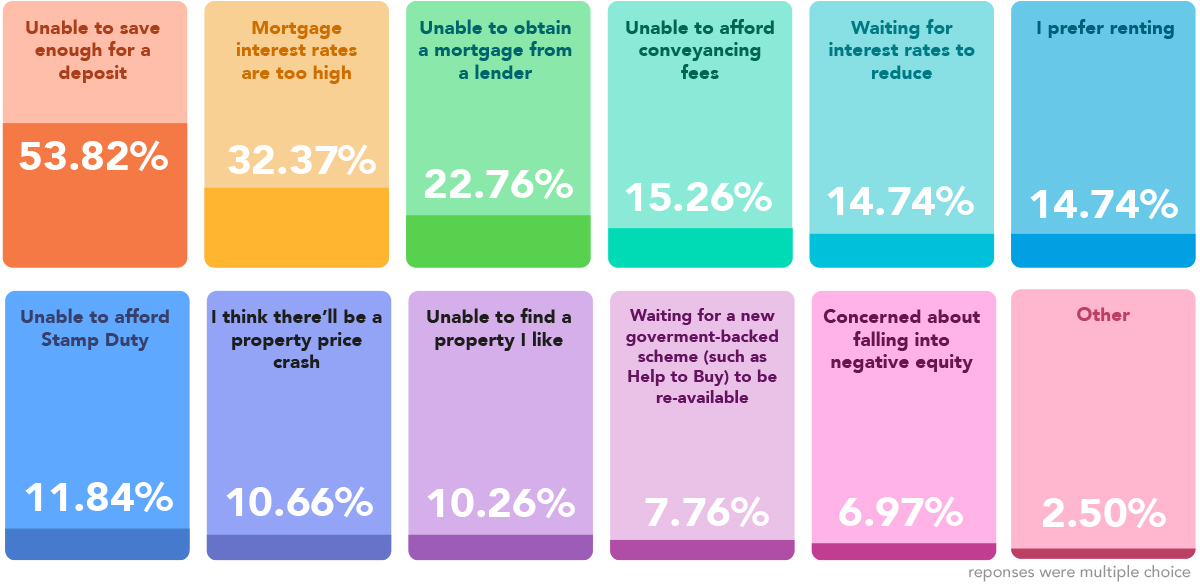

If not, why not?

The main reason renters don’t think they’ll own a property this year is that they cannot save enough for a deposit.

With monthly rent prices increasing (private rental prices paid by tenants in the UK rose by 4.2% in the 12 months to December 2022), a cost of living crisis driven by rising inflation and 79.92% of renters concerned (33.27%) or strongly concerned (46.65%) about energy costs, over 50% of renters are unable to save for a property deposit.

Rising interest rates have deterred potential homebuyers, which has seen demand for mortgages hit their lowest levels since 2020, a time of crisis and lockdowns.

Additionally, 22.76% of renters said they have been unable to obtain a mortgage from a lender which is supported by the Bank of England saying the number of mortgage approvals had dropped to 35,600 in December from 46,200 in November – the fourth monthly fall in a row.

Further reasons renters don’t think they’ll own property in 2023 include unable to afford conveyancing fees (15.26%), waiting for interest rates to reduce (14.74%), unable to afford Stamp Duty (11.84%), the anticipation of a property price crash (10.66), whilst 14.74% stated they prefer renting.

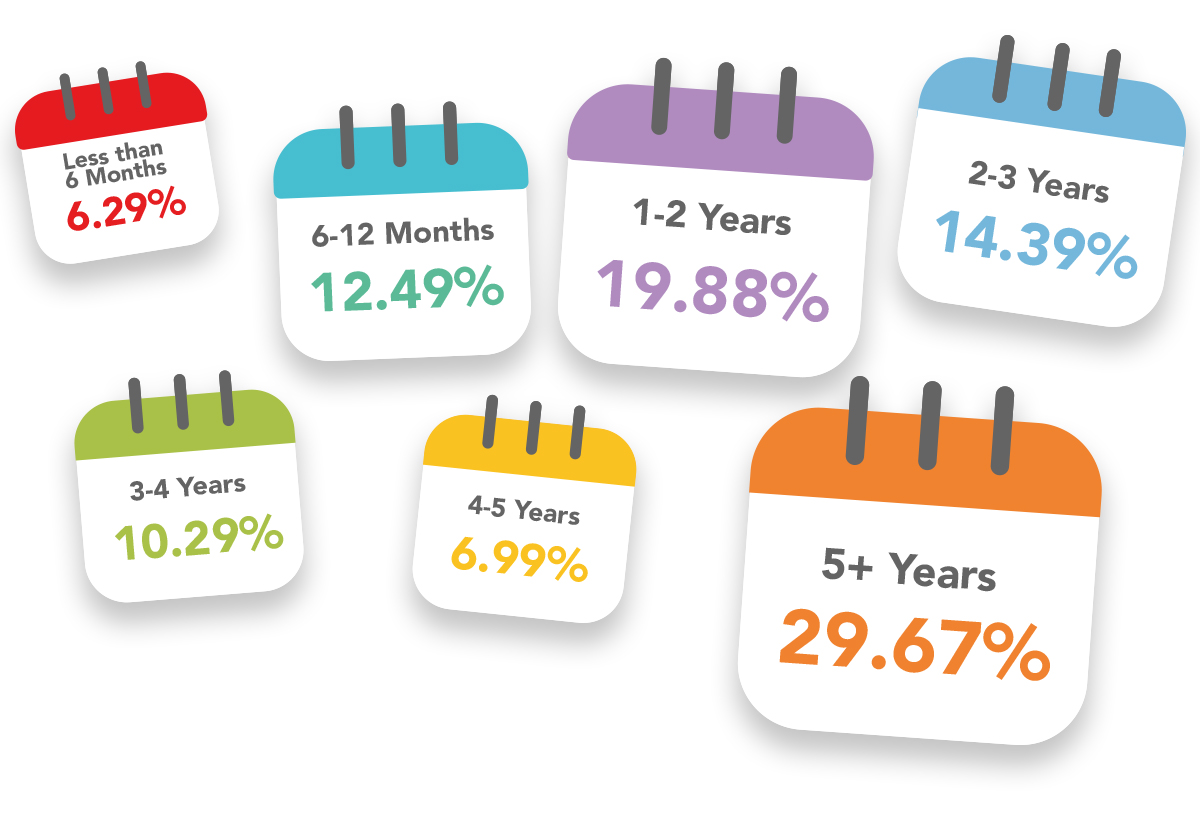

How long have you been renting the property you currently live in?

Our survey discovered that the most common tenancy length for renters in the UK was 5+ years. 29.67% of renters responded by saying they’d been in their current property for 5 years or more. The 2nd most common tenancy length was 1-2 years.

6.29% had been in their property for less than 6 months, 12.49% said 6-12 months, 14.39% said 2-3 years, with 10.29% at 3-4 years and 6.99% at 4-5 years.

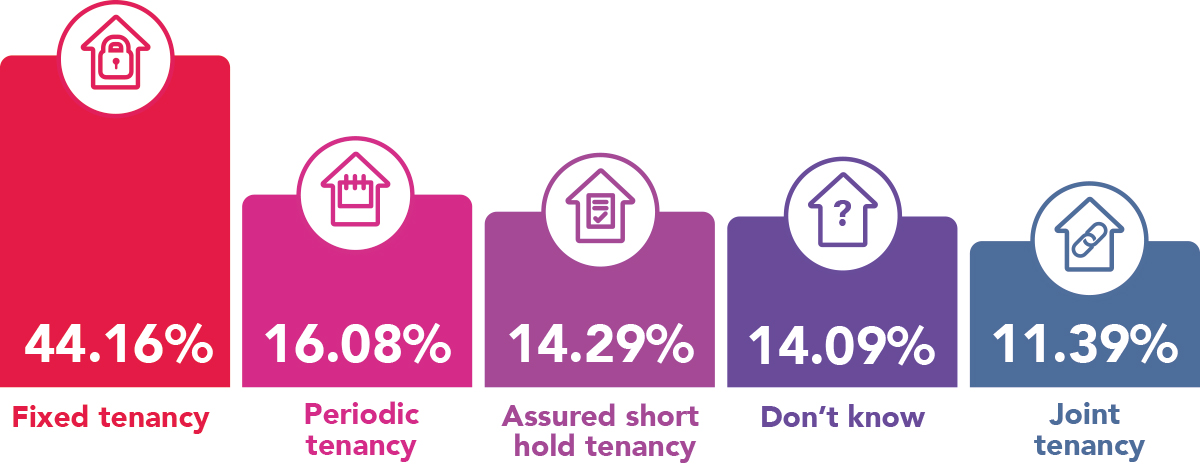

What type of tenancy do you have?

44.16% of renters have fixed tenancy, 16.08% have a periodic tenancy, 14.29% have assured short hold tenancy, 11.39% have a joint tenancy, whilst 14.09% of renters don’t know what type of tenancy they have!

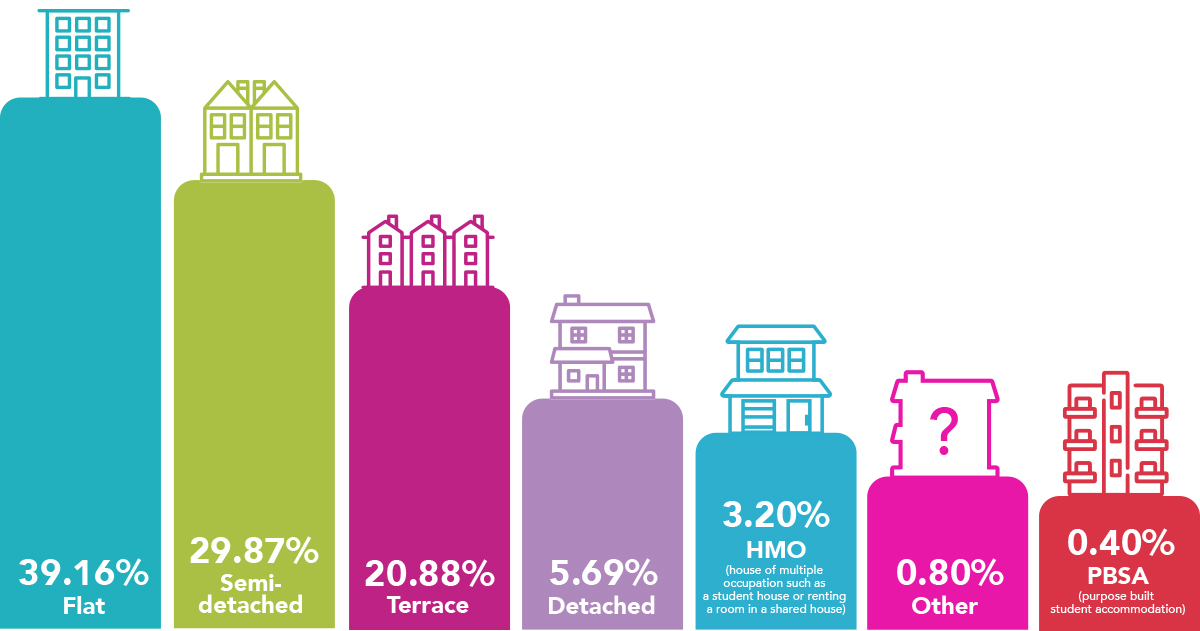

What type of property are you currently renting?

Flats and apartments are the most common type of property that’s rented in the UK. Nearly 40% of tenants are currently in a flat or apartment, followed by 29.87% in semi-detached properties and 20.88% in terraces.

5.69% are in detached properties, 3.20% have a room in a house of multiple occupation, 0.40% in purpose-built student accommodation and 0.80% are in other types of properties (including bungalows).

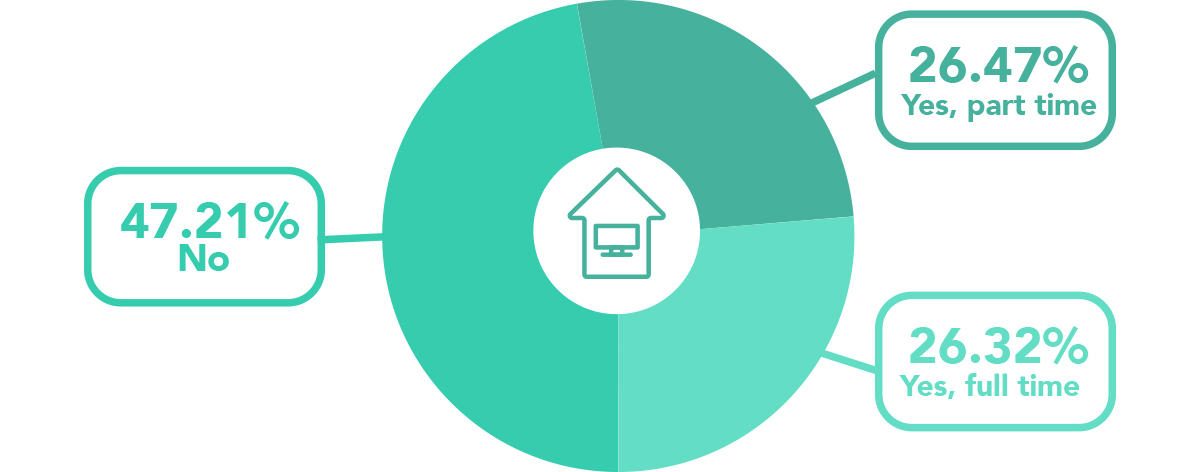

Do you work from home?

Pre-pandemic, 12% of working adults in the UK worked partly or fully from home. This increased to nearly 50% when the pandemic hit.

680 of our survey respondents selected that they are currently employed. And of those, 47.21% don’t work from home, 26.47% work from home part-time, whilst 26.32% work from home full-time.

The rate of working from home varies by age but our survey discovered those aged 25-44 are more likely to spend all or part of their week working from home. Of those renters that work from home part-time or full-time, 40.11% were aged 25-34 and 32.03% were 45-54.

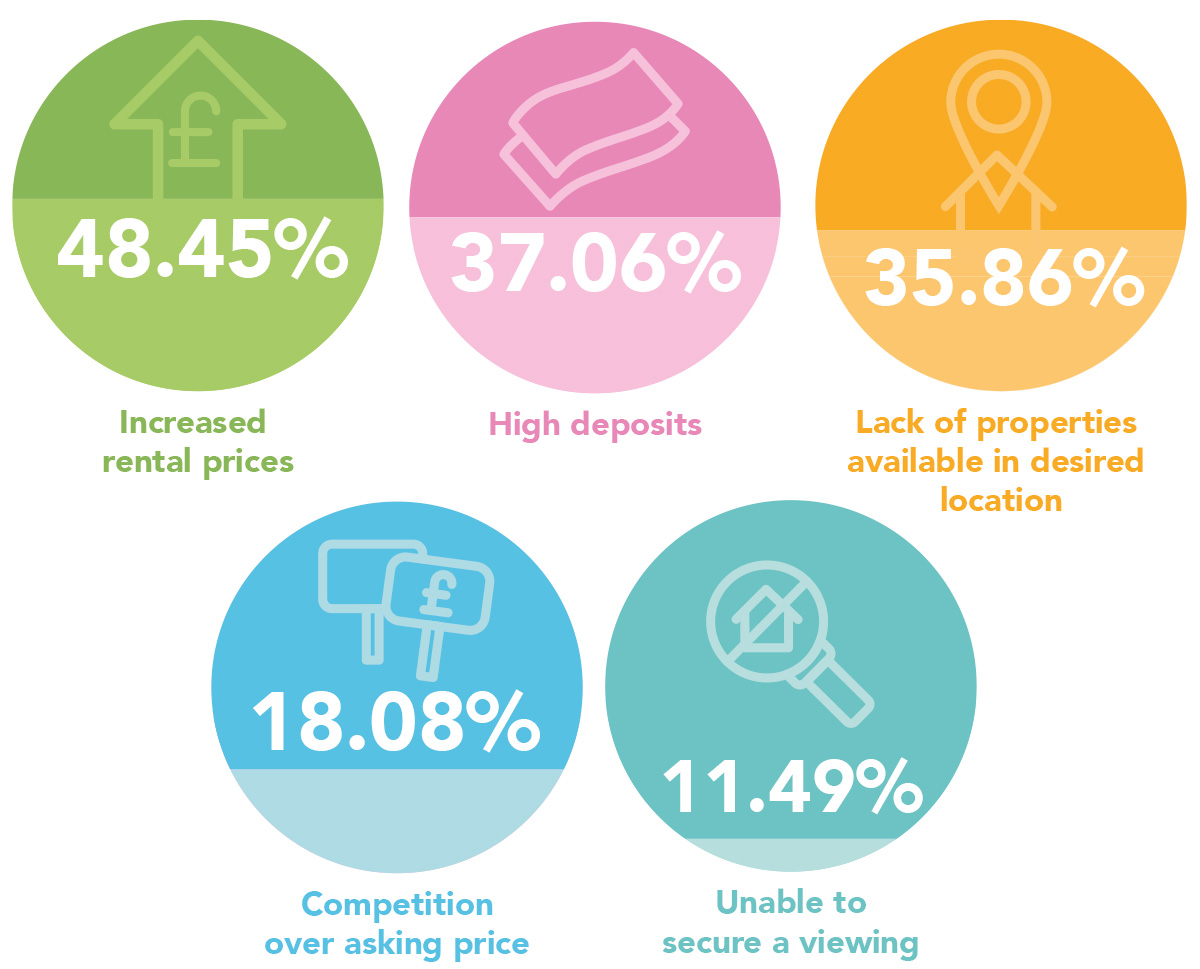

Have you experienced any of the following issues when securing a rental property?

There is increased demand for rental properties across the UK. Rental prices are increasing and the competition to secure a property is fierce. Some properties have been reported to have been snapped up before viewings and bidding wars amongst prospective tenants are not uncommon.

We’ve discovered that when looking to secure a property, 48.45% of renters have experienced increased rental prices, 37.06% have seen high deposits as a recent issue as well as a lack of properties available in their desired location (35.86%), tenant competition offering over the asking price to secure the property (18.08%) and those that have been unable to secure a viewing before the property has been rented out (11.49%).

When choosing your current rental property, how important was each of the following criteria in influencing your decision:

- Rental cost

- Location

- Length of the rental period (tenancy)

- Deposit cost

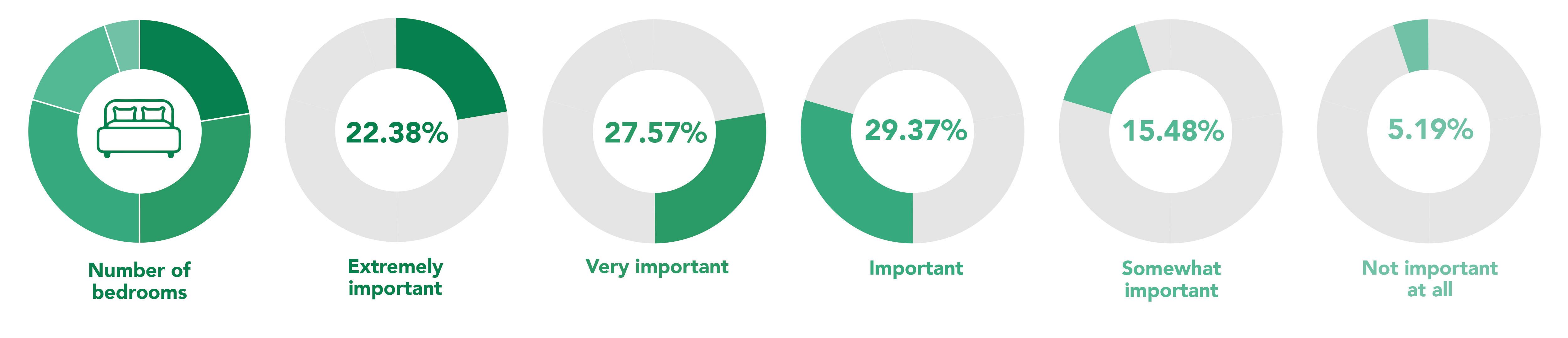

- Number of bedrooms

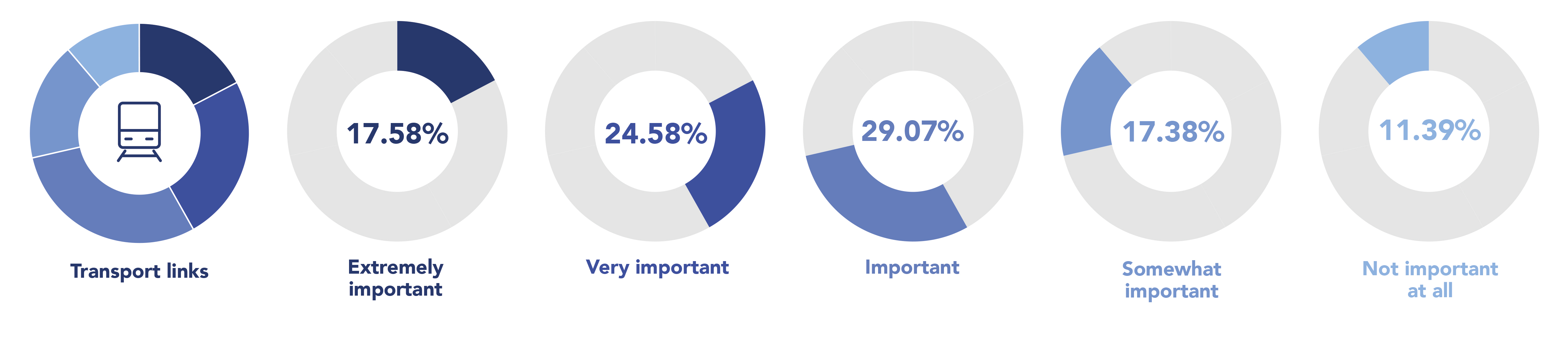

- Transport links

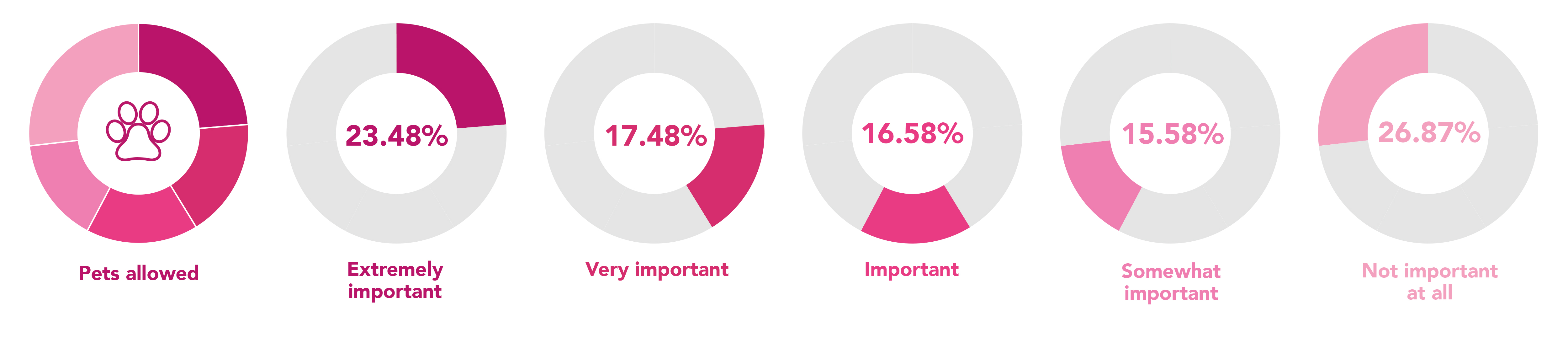

- Pets allowed

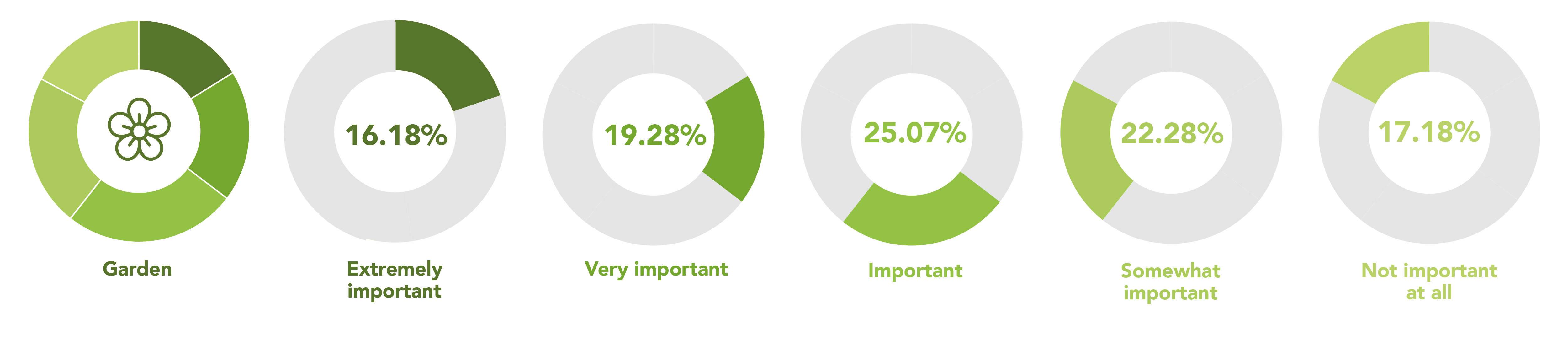

- Garden

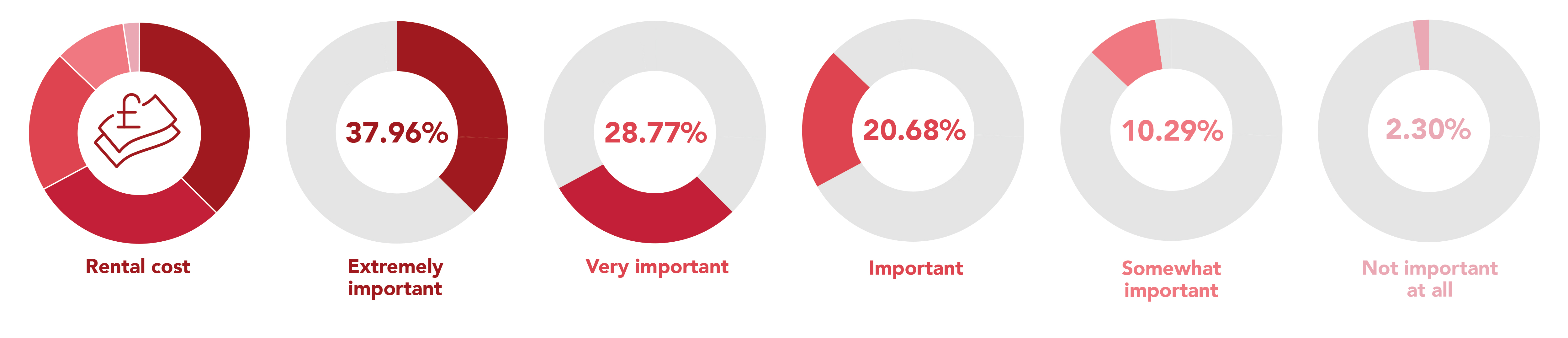

The most important factor for tenants when choosing their rental property is the monthly cost. 65.13% of renters said this cost was Extremely important (37.96%) or Very important (28.77%), with an additional 20.68% saying it was Important.

Just 10.29% felt it was Somewhat important, with only 2.30% of all renters feeling rental costs were Not important at all.

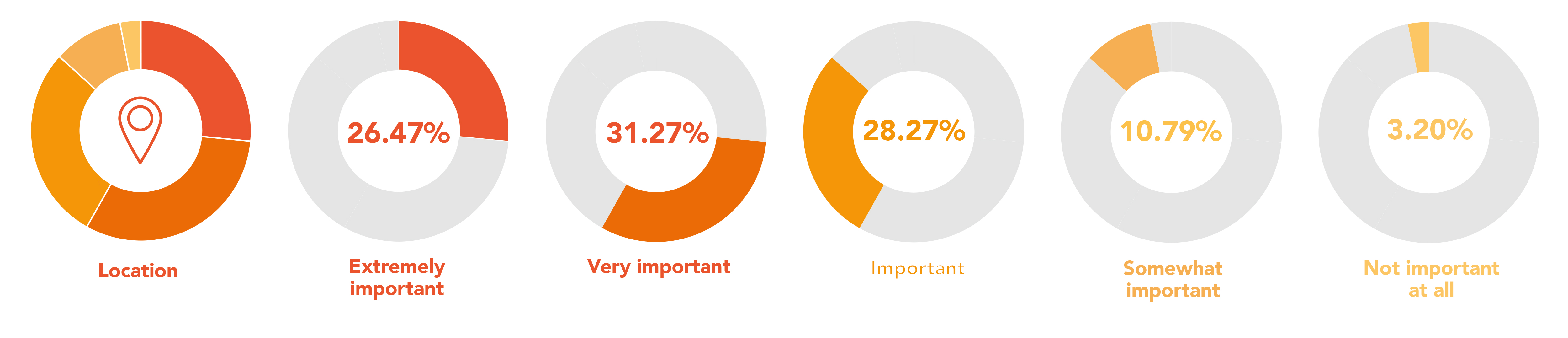

Location is second only to rental costs in importance when choosing a rental property. 57.74% said that the property location was Extremely important (26.47%) or Very important (31.27%).

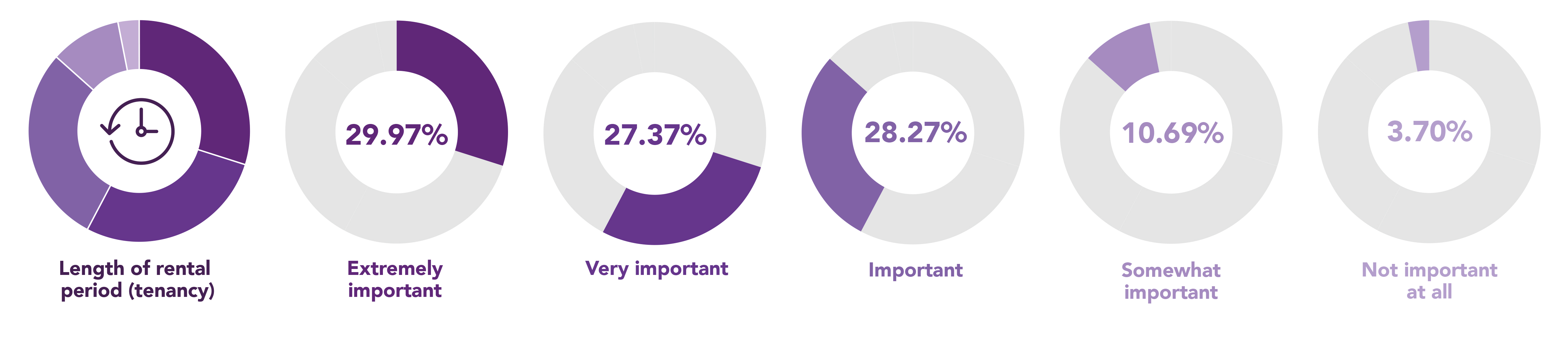

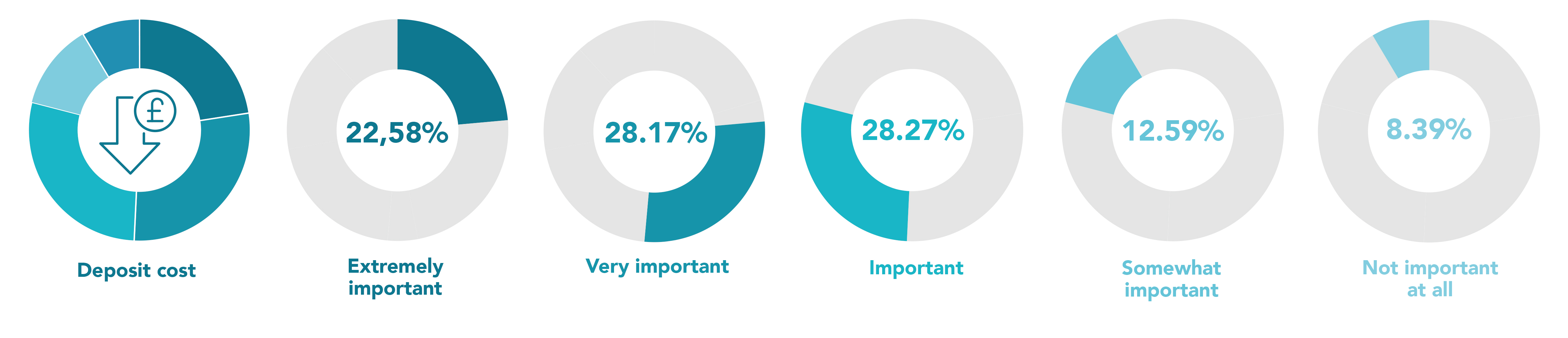

Other top factors that renters considered Extremely important or Very important when choosing where to live were the length of the rental period (57.34%), deposit cost (50.75%), number of bedrooms (49.95%), transport links (42.16%), whether pets were allowed in the property (40.96%) and if there was a garden (35.46%).

Length of the rental period (tenancy)

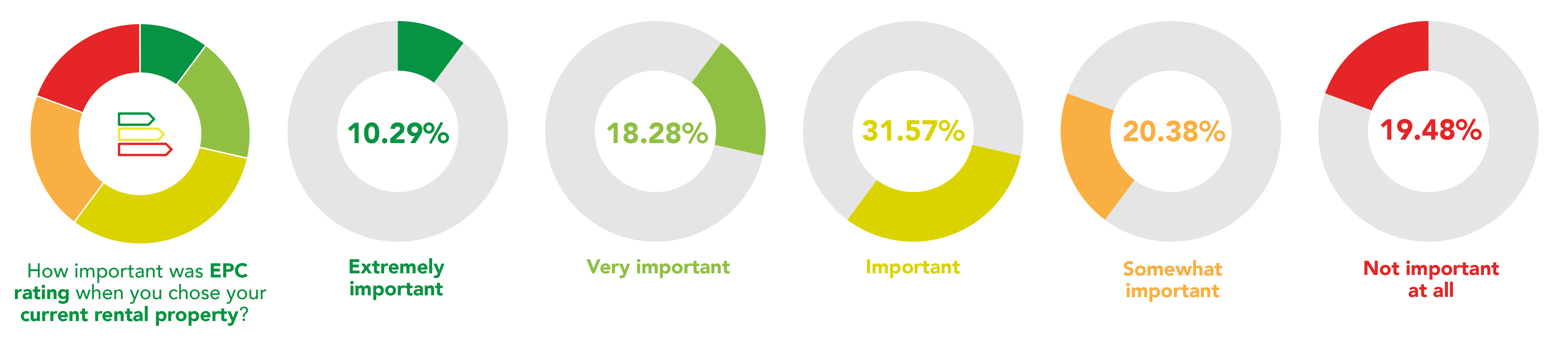

How important was EPC rating when you chose your current rental property?

31.57% of renters felt EPC ratings were Important when they chose their current rental property. A combined 28.57% felt the rating was Extremely important (10.29%) or Very important (18.28%).

Surprisingly though, 39.86% felt EPC rating was only Somewhat important (20.38%) or even Not important at all (19.48%). However, of those respondents that didn’t feel EPC was important, most had lived in their rental properties for 5+ years so it’s perhaps understandable that EPC ratings weren’t an important consideration for them at the time.

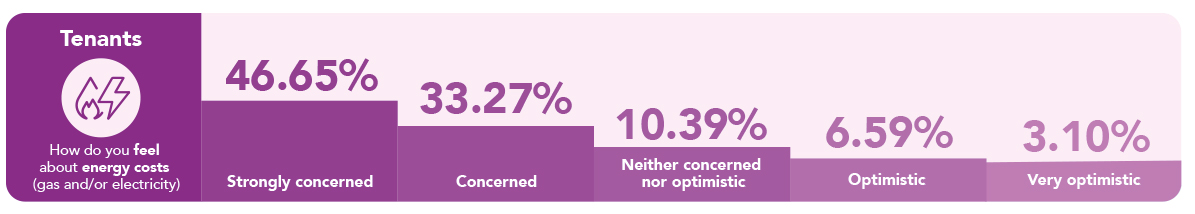

How do you feel about energy costs (gas and/or electric)?

We discovered that the greatest concern for renters currently is their energy costs. A combined 79.92% of UK renters are Strongly concerned (46.65%) or Concerned (33.27%) about their gas and/or electric costs.

During what has been referred to as an energy crisis, energy bills have soared for UK households, worsening the cost-of-living crisis. It is a definite and growing concern with UK household budgets hit harder than any country in western Europe. Electricity prices in the UK rose by 65.4% and gas prices by 128.9% in the 12 months to December 2022 - and households are set to see costs soar further by about 40% from this April.

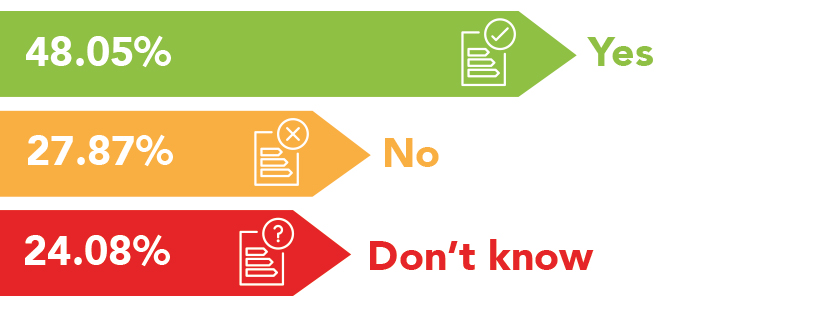

Tenants may take some comfort that 48.05% of landlords intend to complete energy-performance improvements to their properties over the next 12 months.

To address the rising costs and concerns of tenants, 48.05% of landlords intend to complete energy-performance improvements to their properties over the next 12 months.

How do you feel about the following?

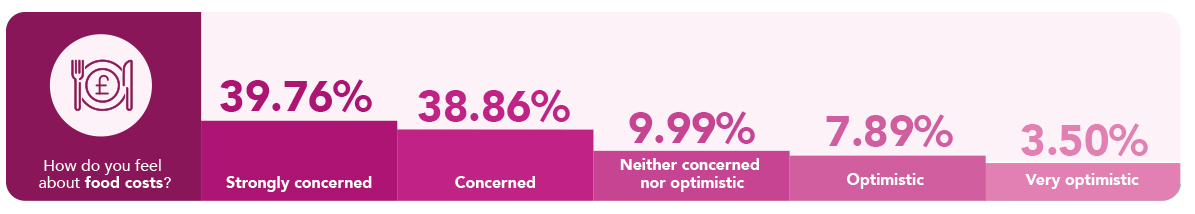

Whilst energy costs are currently the biggest cause for concern for tenants, food and fuel costs, rent increases, interest rates, and the economic outlook in the UK, are amongst other concerns felt by UK renters,

Data from the Office for National Statistics show that food and non-alcoholic beverage prices rose by 16.4% in the 12 months to October 2022, with households set to face an additional £788 hit to their annual grocery bill in 2023.

These rising costs have 78.62% of UK renters Strongly concerned (39.76%) or Concerned (38.86%).

According to recent reports, rental costs in the UK have hit the highest rates on record. Increased demand for rental properties combined with rising rates has resulted in record-breaking rental costs. And renters are worried.

73.93% of UK renters are Strongly concerned (36.86%) or Concerned (37.06%) about recent rent increases. Our recent UK Landlords’ Report may give renters additional cause for concern.

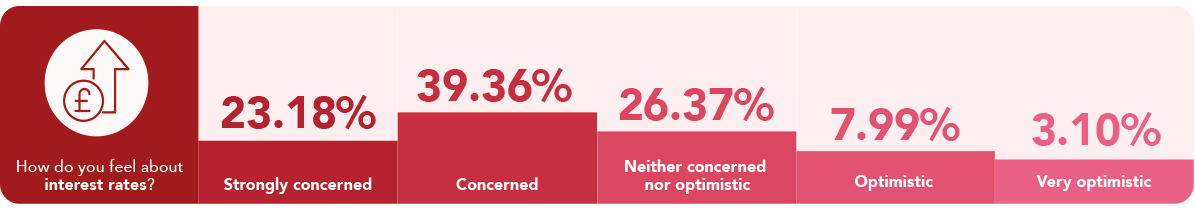

This month, UK interest rates raised to the highest level in 14 years. The latest increase from 3.5% to 4%% was the 10th time in a row interest rates increased, leading to higher mortgage payments for homeowners.

With the UK base rate predicted to reach a peak of 4.5% in mid-2023, we asked landlords how they intend to react to the increasing rates, and their responses will be difficult for renters.

52.75% of landlords plan to raise rents further to cover the additional expenses resulting from the increasing rates.

As the cost-of-living crisis continues to hit households, the International Monetary Fund (IMF) expects the UK to be the only major economy to shrink in 2023.

A shrinking economy typically means companies make less money and the number of people unemployed rises.

Whilst a recession has been widely predicted, with economic growth of 0.1% last November, the UK may avoid a recession - for now.

Indeed, forecasts from the Bank of England are likely to be more positive than they were two or three months ago.

However, the glimpses of optimism from the IMF stating the UK is now "on the right track", are not shared by renters. 72.53% are Strongly concerned (36.96%) or Concerned (35.56%) about the UK economic outlook. Only 10.59% either feel Optimistic (7.29%) or Optimistic (3.30%).

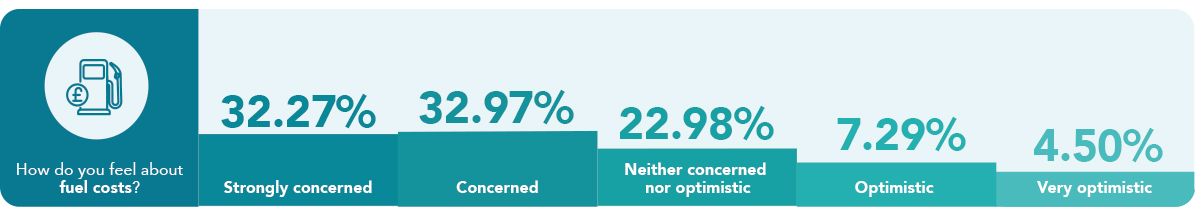

Volatile oil prices could see petrol prices quickly soar after three months of falling costs. The price we pay for fuel is the direct result of wholesale oil prices. At the beginning of January, oil was $68 a barrel. At the end of the month it was around $88 a barrel with analysts predicting further increases due to increased demand from China.

Whilst 65.23% of renters are Concerned (32.97%) or Strongly concerned (32.97%), 22.98% are neither concerned nor optimistic.

Global fuel giant Shell's annual profits have more than doubled, reaching a record £68.1 billion last year as a result of skyrocketing oil prices and drivers are being warned to expect fuel price increases.

The Bank of England base rate has recently increased to 4%, the highest level since 2008. This will directly impact renters looking to get on the property ladder.

The disastrous mini-budget in September sent the average two- and five-year fixed mortgage rates up sharply, from 4.74% and 4.75%, respectively, to peak at 6.65% and 6.51% in October. Whilst there have been signs of mortgage rates coming down more recently, they still remain higher than the lows seen in recent years. 62.54% of renters stated they were Concerned (39.36%) or Strongly concerned (23.18%) about interest rates.

With over 52% of landlords looking to increase rents as rates rise, most UK tenants will be paying more every month.

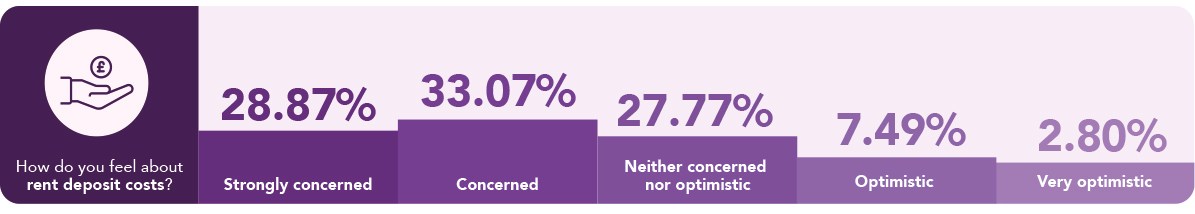

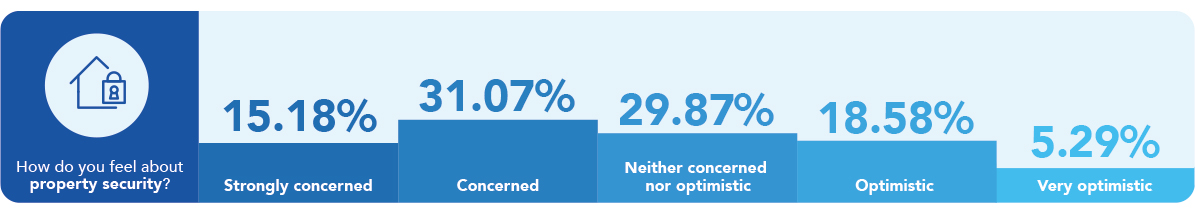

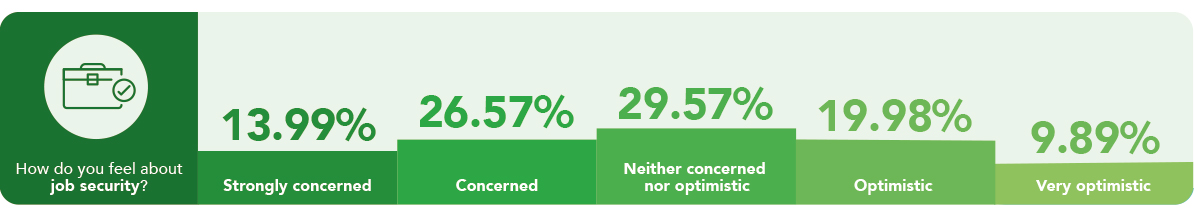

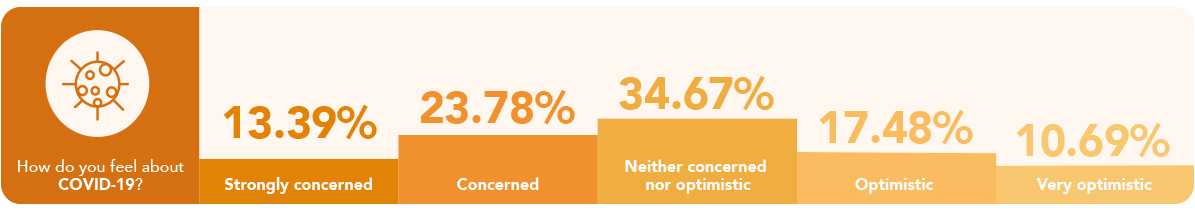

Additionally, rent deposit costs are a concern for 61.94% of renters, with property security (46.25% concerned) and job security (40.56%), amongst other worries for UK tenants. COVID-19 is now a concern for 37.16%, with 36.47% neither concerned nor optimistic about the disease.

Additional concerns...

When renting a property have you experienced any of the following:

Over 33% of renters have experienced problems with damp or mould. A result of excess moisture, damp and mould can affect your health and safety, and can even result in death.

Instances of damp or mould must be reported to landlords for an inspection and any repairs to be completed.

Our survey has also discovered 27.07% of UK tenants have experienced anxiety due to renting. According to research from poverty charity the Joseph Rowntree Foundation, there is clear evidence of the links between financial insecurity and poor mental health, with private renters are twice as likely as homeowners to suffer anxiety symptoms.

We have found out that UK renters have experienced the following:

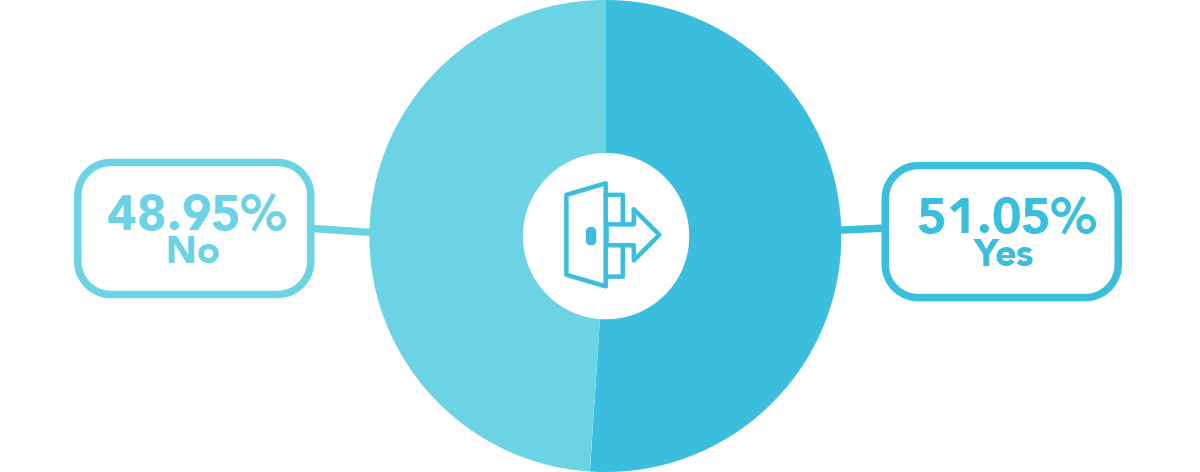

Have landlords had to evict tenants from their rental properties?

When we surveyed over a thousand UK landlords, just over half (51.05%) said they’ve had to evict tenants from their properties.

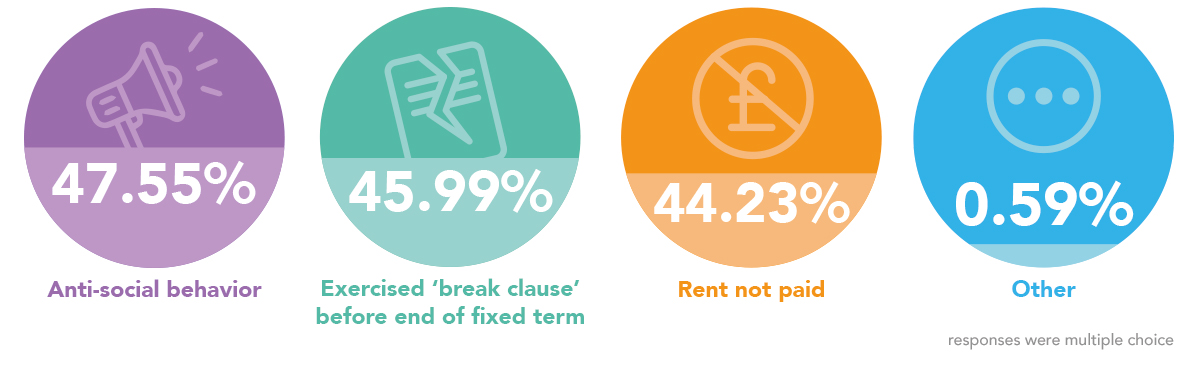

Of those landlords that have evicted tenants, the most common reasons chosen were antisocial behaviour (47.55%), the exercising of a ‘break clause’ before the end of the fixed term (45.99%) and rent not being paid (44.23%).

We discovered that 11.59% have experienced the threat of eviction, whilst 12.89% have felt they’ve been unable to complain about poor property conditions for fear that it might lead to eviction.

If Yes, why

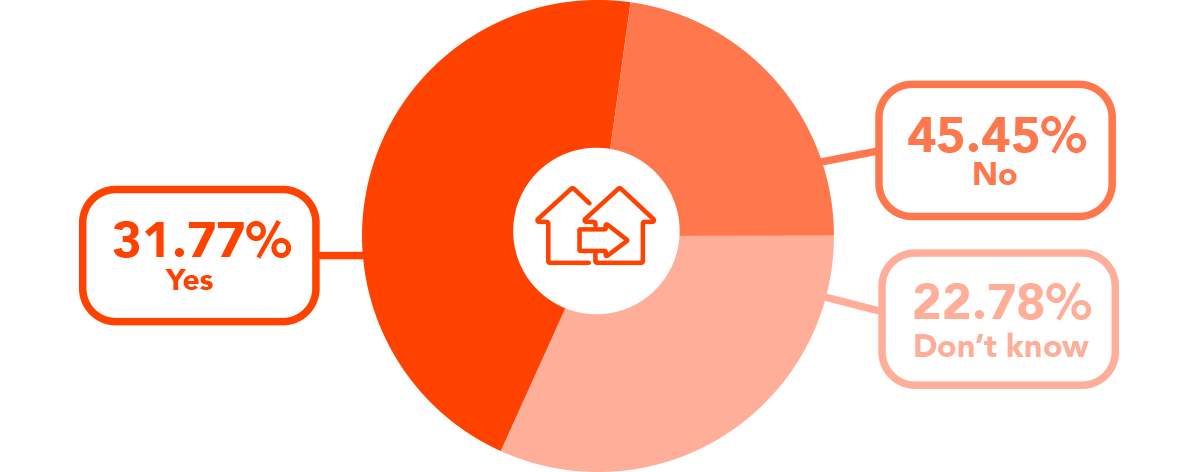

Do you think you'll move into a different rental property within the next 12 months?

45.45% of renters think they’ll be in the same property within the next 12 months. 31.77% think they’ll move and 22.78% don’t know if they’ll move or stay where they currently are.

We also found out…

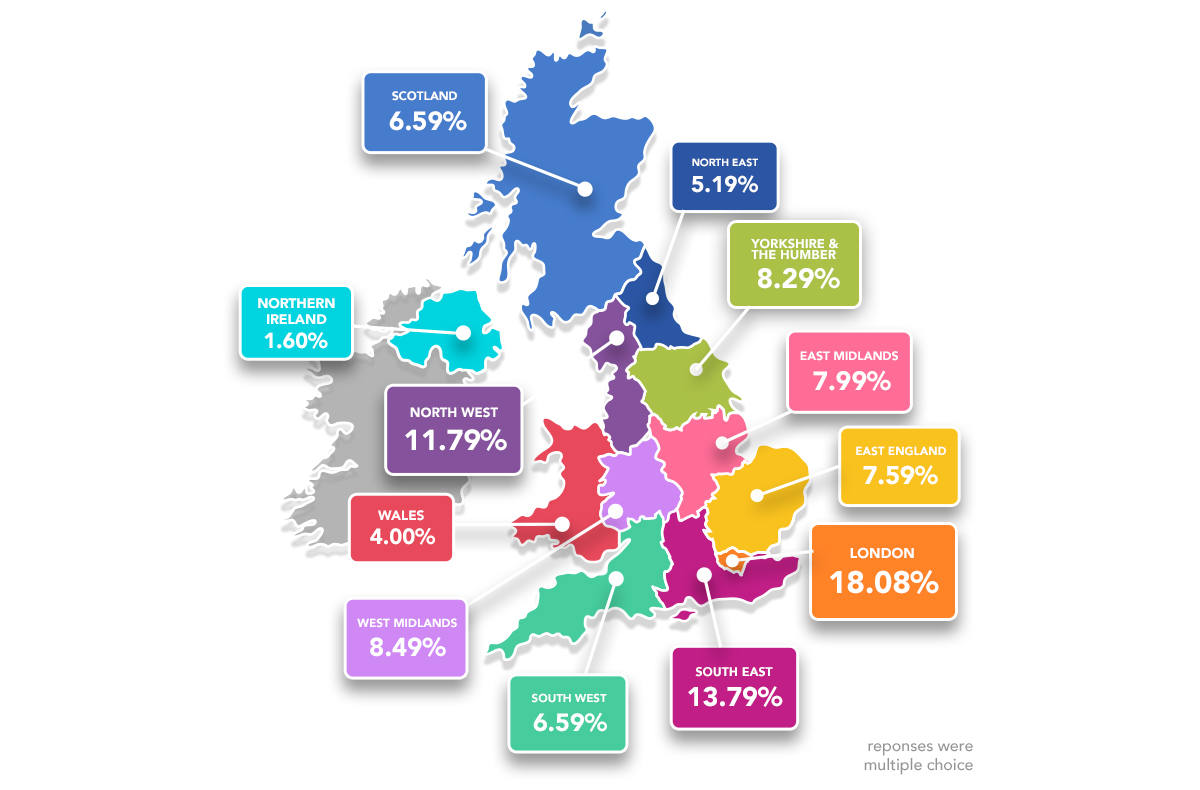

Where do you rent your property?

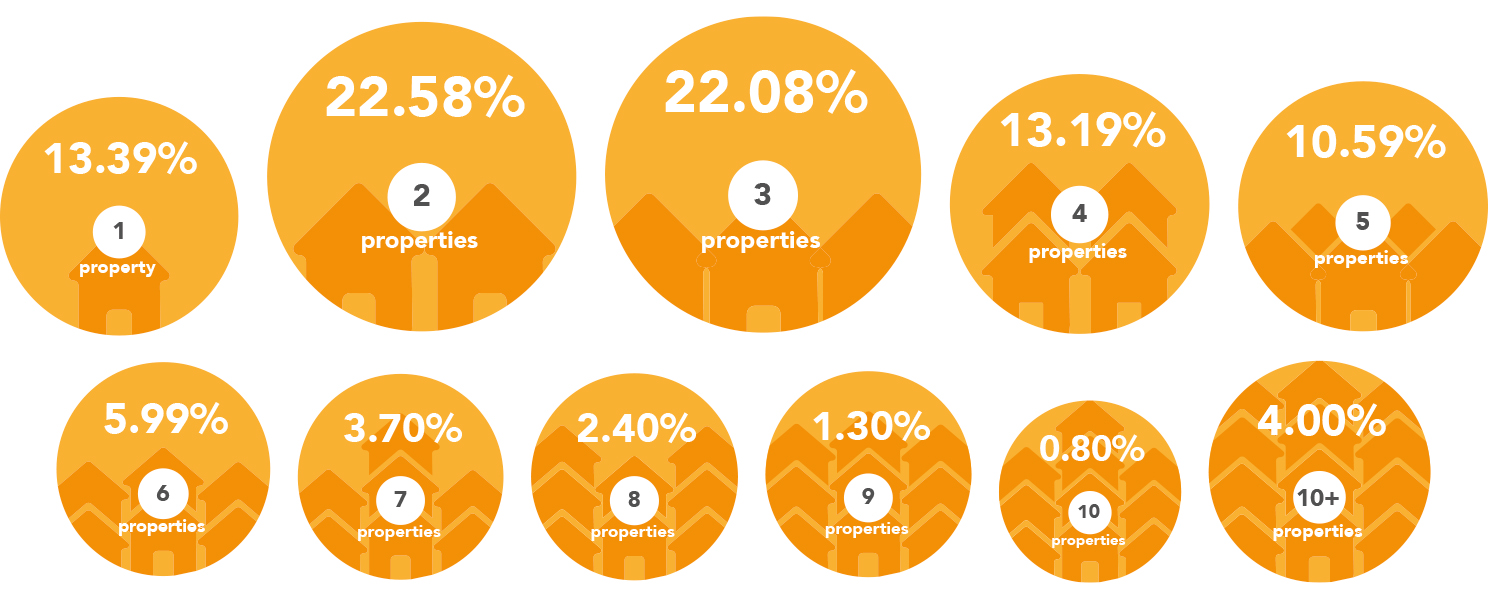

How many different rental properties have you lived in since you were 18 years old?

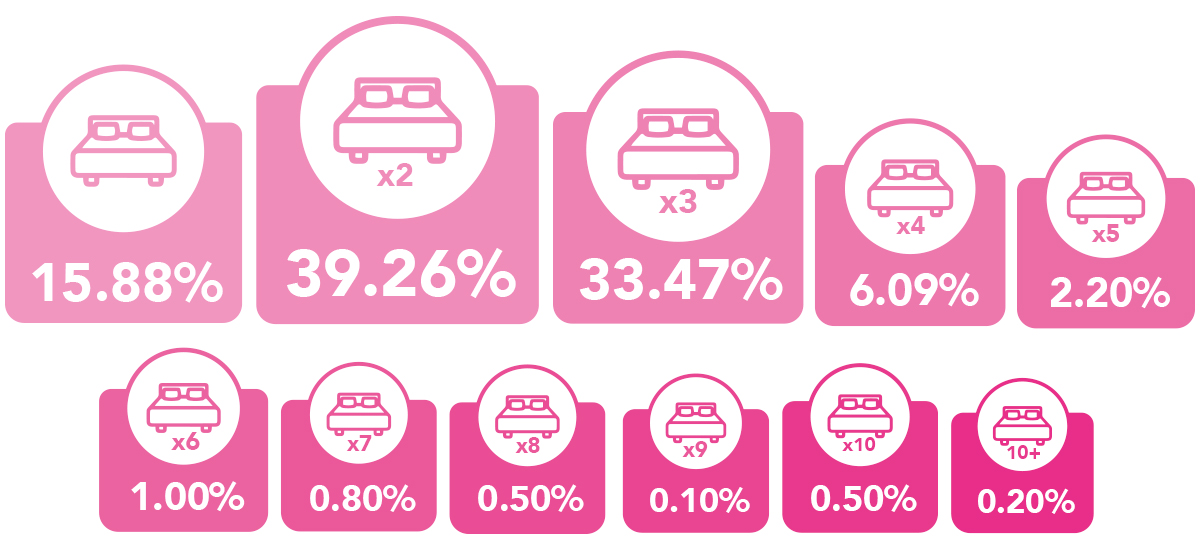

How many bedrooms does the property you currently live in have?

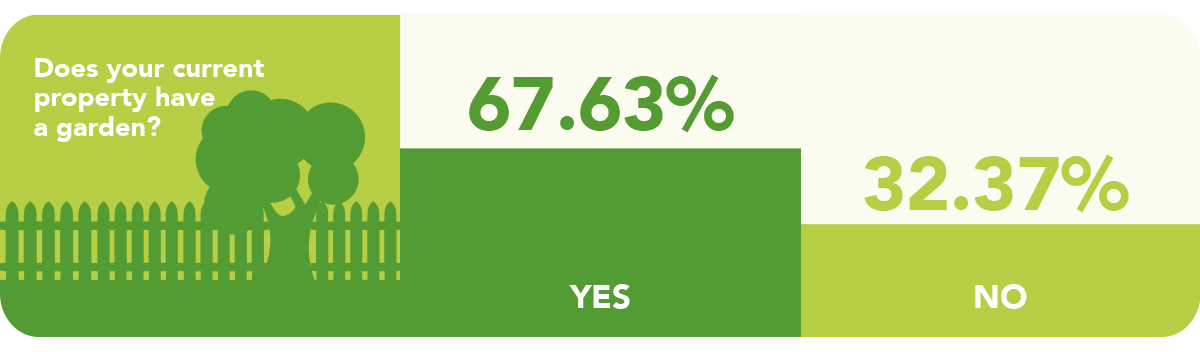

Does your current property have a garden?

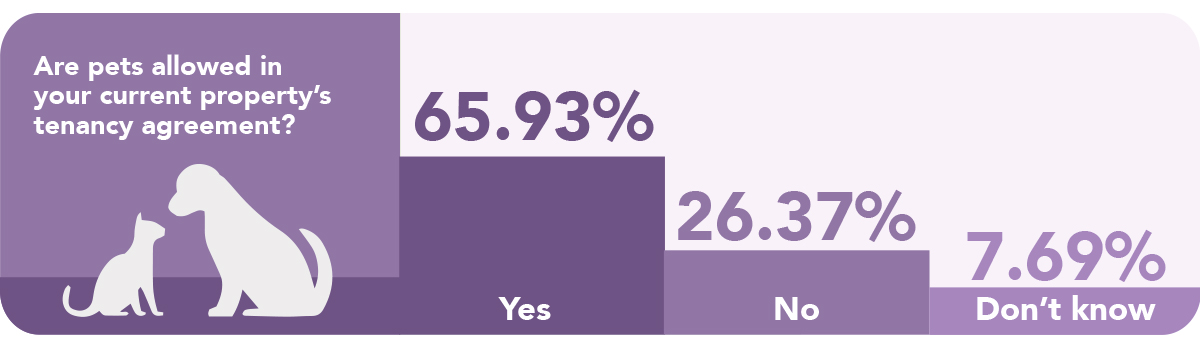

Are pets allowed in your current property’s tenancy agreement?

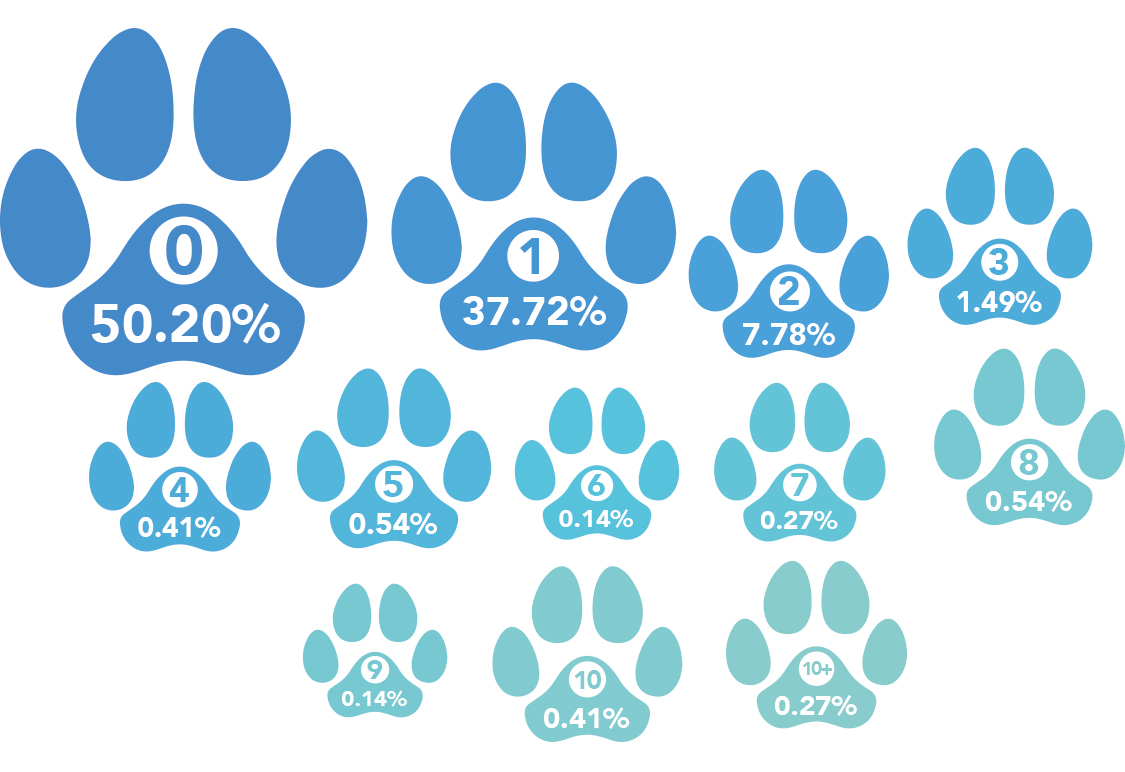

How many dogs live in your current property?

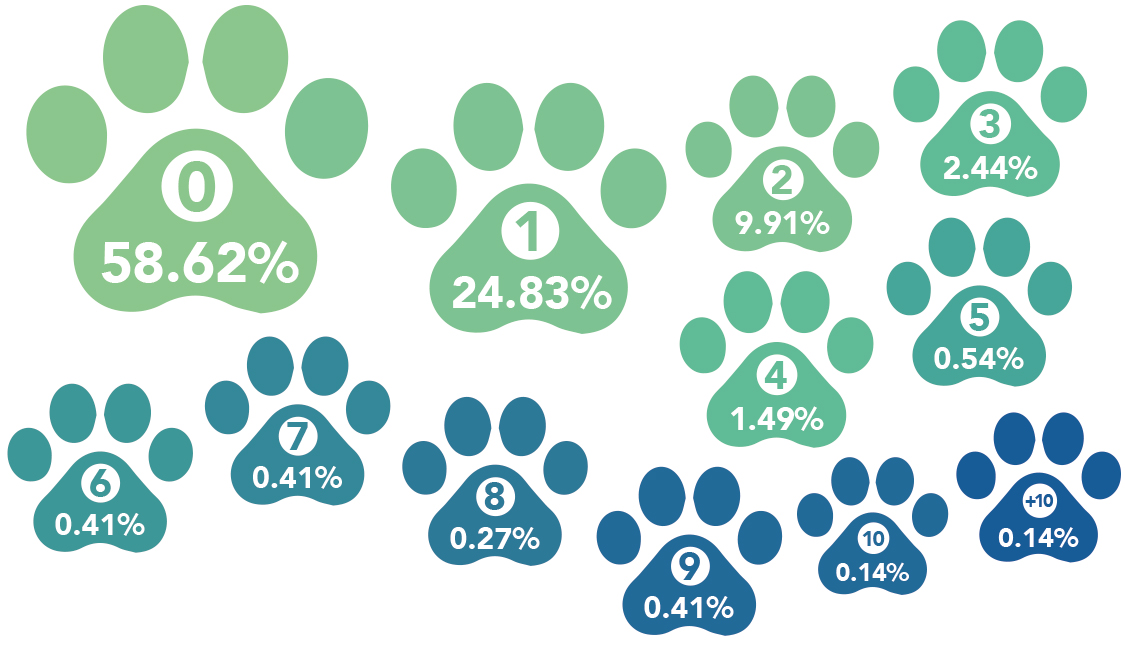

How many cats live in your current property?

Access this survey's raw data in Excel format

Our survey statistics are available in the Microsoft Excel format. To access this please use the form below

| Poll Title: | UK Renters' Report 2023 |

| Poll Objective: | To gain insights into the UK private rental market from tenants that currently rent a UK property |

| Conducted: | Jan 13 2023 |

| All Respondents: | 2,431 randomly sampled people in the UK |

| Qualified Respondents: | 1,001 |

| Screening Question: |

Do you live in a property that... You or your partner rent from a private landlord |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 2,434, throughout the UK’s 68,823,514 population (worldometer) of which 1,001 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2023 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, or require an accessible unlocked version of this excel file, please in the first instance email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/bridging-loan/uk-renters-report-2023 |