Property Development Finance for experienced and first-time developers

Development finance (property development loan) is short-term funding property developers use to finance a development project. Available at any stage of the development, it's designed to assist with land purchase, site clearance, construction, and marketing costs for residential, commercial, and semi-commercial developments.

We arrange property development finance for both new and seasoned developers. Typically used for new build ground-up developments, our development finance can fund property renovations, change of use, conversion or cash-out equity of an existing development.

Our experts offer the best rates for property development finance from private equity firms, specialist development lenders, family offices & private investors.

When you need finance for property development, contact us first for a no-obligation quote. We're ready to help.

Our Development Finance service

- Market-leading property development finance from £200,000 to £250m

- LTVs up to 60% of purchase price

- LTCs (Loan-to-cost) up to 90%

- LTGDVs up to 70% (up to 100% development funding with additional security)

- 100% Build costs

- Joint venture finance available

- Terms up to 24 months

Development Finance uses

The finance we arrange is for UK residential, semi-commercial and commercial development.

Development finance:

Used for pre-planning finance, financing Land purchases, ground-up development finance, airspace development and development exit finance.

Light refurbishment bridging loans:

Our property refurbishment loans are used for purchasing property such as residential property investments, including uninhabitable and unmortgageable, financing permitted development, modernising, doer-uppers, property flips or buy-to-lets.

Heavy refurbishment loans:

Used for purchasing residential and commercial property investments and financing heavy refurbishment, typically as a bridging loan for property development, including Change of use, HMO conversion, extensions, basement developments, rooftop development, loft conversions, commercial to residential conversions & barn conversions.

What are the types of Development Finance?

Land Bridging

Loan

A Land Bridging Loan is a fast financing solution for purchasing land, with or without planning. It enables investors, developers and speculators seize time-critical land opportunities, such as: purchasing Residential land, Commercial land, Agricultural land (pasture and arable) and Development land (including Greenfield and Brownfield sites, garden plots, ransom strips, woodland and carparks).

Property Refurbishment Loans

Property Refurbishment Bridging Loans finance both light and heavy property refurbishment projects, including: Loft conversions, Airspace/Rooftop development, Extensions or Basement digs on residential investment properties such as Student Let, HMO refurbishments and renovations. This finance is also suitable for commercial renovation projects such as Hotels, Offices, Pubs, Retail and Warehouses.

Property Conversion

Financing

Property conversion finance is specialised short-term finance enabling developers to purchase and transform a building's use or structure, commonly used for converting commercial or agricultural properties into residential dwellings. Offices, Barns, Outbuildings, Hotels, Warehouses, and Utility Buildings can all be converted into dwellings, and this finance can cover purchase costs and 100% of build costs.

Ground Up Development

Finance

Ground-up Development Finance is secured short-term debt-based or equity-based lending for the purpose of the construction of new buildings on bare land, providing a finance facility to developers for projects involving the construction of a property from the ground up. Typically we arrange ground-up development finance for residential development, but we do also source finance for semi commercial and commercial developments, covering all stages from pre-planning finance, financing Land purchases, ground-up development to exit finance.

Senior Debt

Finance

Senior debt development finance is the highest prioritised form of debt-based finance for the purpose of property development, used by developers at any stage of a development project. Senior debt development finance is popular with lenders as it provides the lower risk due to its repayment prioritisation being above all other debt obligations for repayment in the case of bankruptcy, and as such attracts the lowest interest rates. Suitable for funding one or multiple small to large scale property developments in the UK.

Mezzanine

Finance

Our mezzanine finance is a niche type of property finance available to ‘top up’ an existing loan on a development, which can be secured faster than equity financing, allowing for quicker project commencement. Using mezzanine finance, developers and business owners can reduce the amount of equity they need to give away, retaining more control over their project or company. Many UK developers use mezzanine development finance to fund various stages of their projects. If you need additional funding quickly, we're likely to be able to help.

100% Structured

Finance

We can arrange 100% Structured Finance. With our flexible and tailored finance approach for each project, 100% structured development finance allows for more complex projects with limited access to senior debt. Access to larger sums of money than senior debt finance alone.

Build To Let

Finance

We arrange fast build to let finance for landlords and property investors for residential, commercial and mixed-use rental properties who need access to both the finance for the initial build of their rental property and access to longer term refinancing options.

Developer Exit

Finance

Our development exit finance, also known as Sales Exit Finance, allows you time to finish up your project, market the development & complete the sale of your asset or obtain longer term financing. Refinancing a completed development enables developers to negotiate more favourable interest.

Development finance lending criteria

| Loan to gross development value (LTGDV) | 70% maximum (100% with additional security) And 100% Build financing |

| Loan term | 3 to 24 months |

| Loan amount | £200,000 up to £250m |

| Interest options | Rolled-up, retained or serviced |

| Interest rates | From 0.44% |

| Decision | Immediate decision in principle |

| Completion | From 3 days to 3 months (Depending on the type of finance required - call us today for more info) |

| Early repayment fees | None |

| Availability | England, Scotland, Wales and Northern Ireland & in some cases parts of Europe Individuals, Companies, SPVs No credit & adverse credit considered |

| Exit strategy | Sale or refinance |

Financing Property Development

Property Development Finance is commonly used when a normal bridging finance is either too short a term or cannot offer the capital needed to progress a project, it is a specialist financial product designed around the timescales and requirements specific to the construction sector.

Development finance also enables you to undertake multiple projects simultaneously or avoid waiting until an existing project is sold or is entirely sold before commencing your next development.

At the end of the building or renovation project, the property finance facility is repaid through the sale of the properties or a refinance product.

Interest rates on property development loans vary, depending on:

- The size of the project which is being funded

- Value of the security

- Value of the development scheme once building work is completed

- Amount of money being borrowed

- Experience of the developer

Experienced property developers with more established track records will generally benefit from the most competitive interest rates for development finance due to the lender's reduced risk. However, we're happy to work with first-time property developers and will make a lending decision based on the strength of the proposed developer's project.

Find the best rates on your development finance

We offer experience-based, impartial information and access quotes from the whole of the market. Because we have an extensive network of the UK's development finance lenders, we're also able to move fast, giving decisions in principle within 24 hours and terms within days.

Get expert assistance today.

To find out the exact costs of a property development loan

call our expert team on 01202 612934 today - we're ready to help!

A comprehensive guide to Property Development Finance

Contents

What is Property Development Finance?

Property development finance is a financial debt or equity-based product to fund large-scale property construction or heavy renovation.

Available to developers with construction projects in England, Scotland, Wales and Northern Ireland, development finance typically involves using a credit loan facility to support the site acquisition, ground-up construction, or development of a new project.

This financing comes in two different funding types—debt-based, equity-based, or a combination of both.

The differences between Light Refurbishment, Heavy Refurbishment and Ground-up Development

What is Light Property Refurbishment?

Light refurbishments are when the building is in good condition but needs minor work. This is usually in the form of repairs or minor modernisation such as installing a new kitchen or bathroom, moving a bathroom upstairs or decoration.

It is usually used to increase the value of a property to its optimum level or to be ready for sale or rental.

This is the simplest and quickest form of property development finance. If you've heard the term "property flipping", this typically involves buying a property in poor condition below market value, completing light refurbishment, and then selling it quickly for a profit.

What is Heavy Property Refurbishment?

Heavy Refurbishments are when more significant work is required to optimise the property's value.

Heavy refurbishment typically involves structural works such as raising a level, digging out a basement, extending the property, converting a loft, replacing a roof, or other significant work. Depending on the severity of the work, Development Finance might be more suitable.

What is Ground-up Development?

Ground-up developments are when the land is either undeveloped or where a site is intended to be cleared of existing structures and requires extensive development works to build a new property.

The work involved would likely include groundwork, levelling, drainage and construction. Property development finance typically pays for the land procurement, planning costs and materials, and the construction and fit-out of the property.

How does Property Development Finance differ from a Bridging Loan?

Property development finance is typically a longer-term financing solution for large-scale projects, such as new builds, conversions, and ground-up developments.

They're typically used to cover the site acquisition and development costs associated with the property and the construction and fit-out.

Finance tends to have much longer repayment terms than Bridging Finance, a short-term option that enables quick access to capital. A bridging loan could be used for the initial land purchase if the site isn't going to be developed immediately; once the site begins being developed, development finance will come into play.

The repayment terms for Property Development Finance typically range from anywhere between one to three years because it's likely that the project will be refinanced multiple times as the development progresses to minimise the interest on the loan. If you include the longer-term refinancing, the total loan duration could be as long as 30 years.

The two parts to Development Finance

Development finance comes in two parts:

1. To purchase the site

The first stage is typically used to finance the site acquisition. This might be land where several new properties will be constructed or an existing property that will be renovated.

2. To fund the building costs

The second part funds the project's associated build works. This will be typically drawn overtime over a series of stages that could be once per month or according to the build schedule.

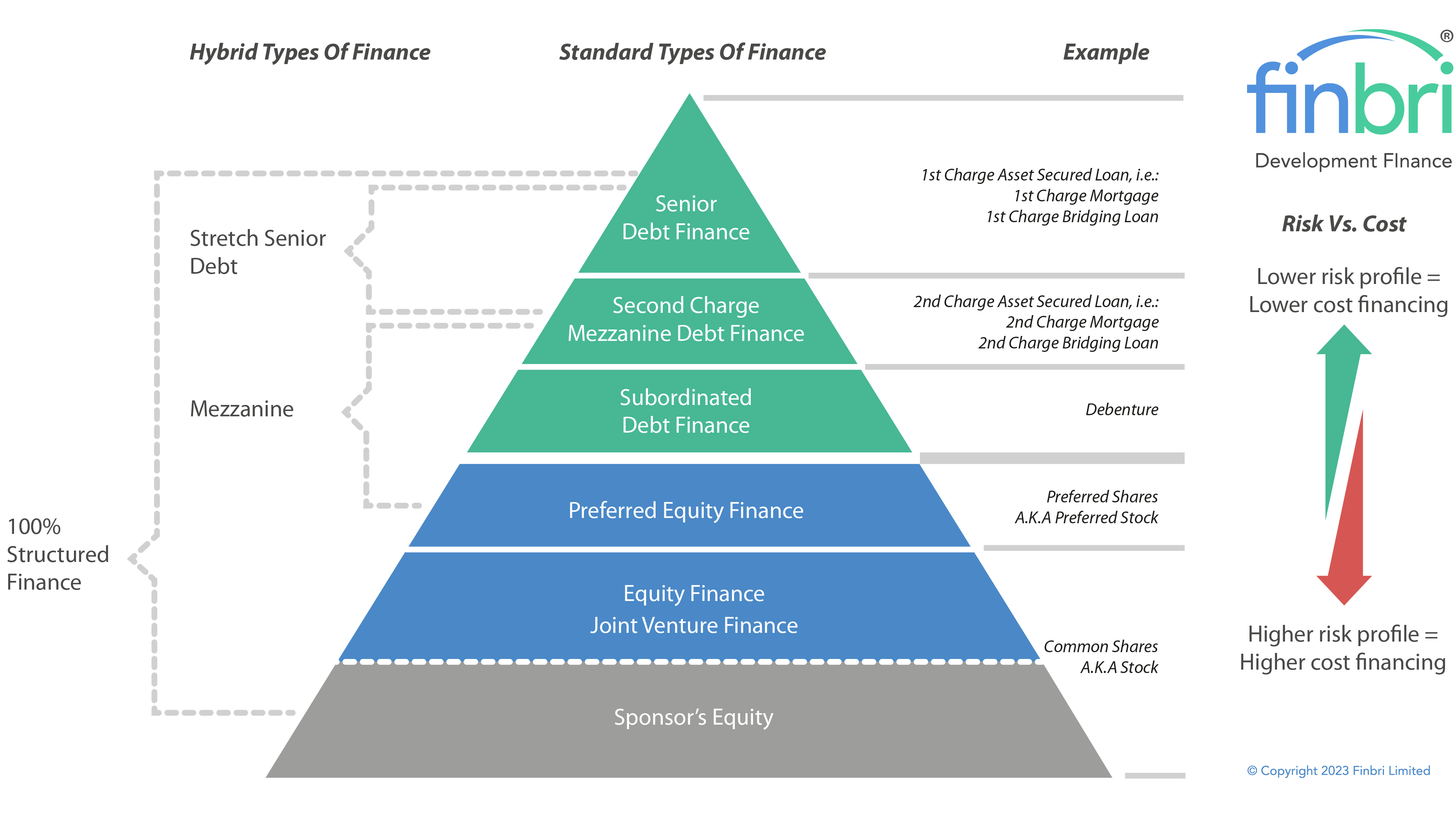

Types of Property Development Finance

The types of finance a developer chooses will depend on their specific needs and how they wish to structure their finance. At a glance, this development finance graphic shows how each type of finance work together.

A broker can help developers understand which types to use in which circumstances. However, as this type of finance is typically only available to experienced developers, the borrower will have at least a basic understanding of the required finance.

What is debt-based finance?

Debt-based finance describes a loan facility where the developer will pay interest and fees for the finance and then repay the capital sum at the end of the term. Debt-based finance may include any single type or a combination of Senior Debt, Stretched Senior Debt, Mezzanine and Subordinated Debt finance.

What is equity-based finance?

Equity-based finance describes a partnership approach to development finance where the developer will offer a stake in the company that owns the development instead of using debt-based finance. Equity-based finance may include any type or a combination of Preferred Equity, Equity and Joint Venture.

What is 100% Structured Finance?

100% Structured Finance combines any debt or equity-based finance to achieve 100% of the required finance.

Property development finance comes in a variety of different forms, these include:

- Senior Debt Finance

- Stretched Senior Debt Finance

- Mezzanine Finance

- 100% Structured Finance

- Subordinated Debt Finance

- Preferred Equity Finance

- Equity Finance

- Joint Venture Finance

Senior Debt Finance

Senior debt finance is the most common form of property development finance, providing funds for the purchase of land, construction and/or the refurbishment of property.

The funds available are agreed between the lender and the borrower, and the borrower is typically required to place a security against the loan (typically the resulting property asset being developed). This finance type is typically the most secure type of property development finance, and the lender will have a first claim on the development’s cash flow and proceeds from the sale.

Stretched Senior Debt Finance

Stretched Senior Debt Finance is a variant of the above senior debt finance, except that it is typically provided at higher loan-to-value (LTV) levels and can incur higher interest rates than traditional senior debt finance. These higher loan amounts and interest rates increase the lender's risk, so they are provided only to more established or experienced property developers with solid track records and impeccable credit histories.

Mezzanine Finance

Mezzanine Finance is a hybrid form of debt and equity finance, where the lender provides both a loan and equity investment to the borrower, with the loan being subordinate to the more senior security provided by the lender.

In return for providing the loan to the borrower at higher LTVs and typically at a higher interest rate, the lender receives shares in the borrower’s business.

100% Structured Finance

100% Structured Finance is a form of 100% of the property development cost provided by the lender, who lends based on the end value of the development (when complete) rather than the inherent risk of the development itself.

The lender will typically place more stringent requirements on the borrower and will likely require additional security (e.g. additional land or assets) to justify the loan.

Subordinated Debt Finance

Subordinated Debt Finance is a form of debt finance where the lender provides the loan but takes a ‘second seat’ to the more senior debt provider regarding loan repayment priority.

This type of funding is only provided to borrowers who have obtained first-charge debt from a senior lender, and the subordinated debt lender will take a lower priority in repayment terms. The subordinated debt lender will typically be provided with equity in the borrower’s business.

Preferred Equity Finance

Preferred equity finance provides equity investment in the borrower’s business with certain predetermined rights (‘preferred’) over the equity deliverers of the equity in terms of repayment, dividend payments, etc.

The terms of the preferred equity arrangement are pre-agreed and often give the lender greater control over the project than possible through traditional equity investment.

Equity Finance

Equity Finance is a form of investment used in property developments whereby the investors place funds in the form of equity, allowing them to take a share of the profits and any potential losses resulting from the development.

As the lenders are taking a greater risk in this form of finance, they are typically compensated in proportion to the risk taken.

Joint Venture Finance

Joint Venture Finance is a form of development finance in which two or more parties pool their funds to finance a property transaction.

The joint venture partners pool their resources and funds to purchase assets or finance developments and typically receive a proportion of the returns. This form of finance is often used when development is too significant for a single investor or group of investors to finance independently.

Considerations for Financing a Property Development

When considering which type of financing to use, some of the key considerations include:

Risk Profile: Before applying for financing, you need to assess the project's risk. This includes examining factors such as the property's location, the type of development, the expected returns, and the timeline for the project.

Asset Strength: The financial strength of the underlying asset is another key consideration. A strong asset can help to secure financing on more favourable terms.

Loan Term: It is important to understand the repayment terms of the loan and ensure that it is in line with the project's timeline.

Timeframe for Project: The length of the project timeline will affect the type of financing you need and the loan terms. If the project is expected to take a long time, then loan financing may not be suitable.

Understanding the Banking Landscape for Property Developers

Banks were the traditional source of funding for property development finance. Today, however, banks may be reluctant to lend to developers because of the perceived increased risk of defaults due to the downturn in the global economy.

Developers can still apply for development finance with a bank, but they should know that the terms and conditions may be more stringent.

In addition to the traditional banking sector, several specialist property development finance providers exist, such as property investment firms, private lenders, and other alternative lending sources.

These lenders are usually more flexible in their lending criteria and may offer more competitive rates and terms than banks.

What are the benefits of Development Finance?

Development finance allows developers to access funds for a range of projects, including the building of housing, offices, industrial units, retail units, and other commercial projects.

Developing a property from scratch can have enormous potential but is often cost-prohibitive without external financial support. Development finance enables property developers to access the funds necessary to complete their projects while providing them with a range of financial benefits that can help offset the costs of securing a loan and ensure the successful completion of the project.

Development finance can help developers manage costs, as funds are usually released as the project progresses, with an initial lump sum on day one, followed by additional release of funds as development milestones are passed.

What are the features of Development Finance?

Development finance typically has a long repayment period, allowing borrowers to benefit from additional time to repay the loan and potentially lower interest rates when compared to bridging loans. In addition, lenders often offer flexible repayment plans, enabling developers to get the best terms to suit their individual needs.

Development finance can also be used to finance various related expenditures, including the purchase of materials, construction costs, professional fees, and taxes.

Depending on the agreement between the lender and the borrower, funds may also be released in stages, ensuring that funds are distributed based on the project's progress, which is critical to reducing interest costs.

Development Finance criteria

Borrowers must typically meet certain criteria to be eligible for development finance, including a solid track record of completing successful developments, an honest and reliable financial history, and a good credit record.

Lenders usually also consider the project's projected revenue and expected completion time, as well as any feedback from planners and local authorities.

Generally speaking, lenders will not typically consider a development finance project if the loan-to-value ratio (LTV), loan-to-cost (LTC) or loan-to-gross-development-value (LTDGV) exceeds a certain threshold, and it's best to speak with a broker to understand how much you can borrow using these different ratios. This means that buyers must have some form of collateral, such as land or property, that can be used as security for the loan and may also need to provide a personal guarantee.

How does Development Finance work?

When taking out development finance, the borrower will typically require a land asset or, if the site hasn't yet been acquired, a certain amount of money or other collateral to go into the project.

The amount required depends on the lender’s criteria. It will vary based on many factors, such as the type of security being offered, loan duration and the risk presented by the borrower.

Depending on the agreement between the lender and the borrower, the finance will be released in two ways. The initial advance will be paid on day one, and the subsequent stages of finance will be released based on the project's progress.

The loan amount and repayment terms will also be agreed upon in advance, with interest rates often fixed for the duration of the loan period.

The repayment schedule may also be staggered, and once the project has been completed, the entire loan plus interest and other fees must be repaid.

How are the stage releases agreed?

The stage releases of development finance are typically agreed upon in advance, with the exact release structure and any penalties for failing to meet specific phase completion deadlines, as well as meeting the agreed exit strategy deadline, detailed in the contract between the borrower and the lender.

Generally, the loan is released in three stages – the development loan (or advance), the stage release, and the completion loan.

Depending on the target returns of the project, the lender may also agree to a further release once the project has been sold or rented out; this is referred to as the ‘rental or sale release’.

This final stage of finance is usually determined by either the arithmetic of the lending application or an assessment of the value of the finished development.

How much can I borrow?

The amount of money you can borrow will depend on various factors, such as the value of the project, the expected profits, the loan-to-value ratio (LTV), and the loan-to-cost (LTC) ratio.

The LTV ratio is the amount of property value that can be used to cover the loan amount, while the LTC ratio is the amount of money being borrowed compared to the project's total cost.

The LTV and LTC ratios are important factors in determining the maximum development finance amount and should always be considered when applying for a loan. The maximum loan amount will also depend on the terms and conditions of the specific offer, such as the repayment terms, the interest rate, and the amount of deposit required.

How are LTGDV, LTC and LTVs Calculated?

The Loan To Gross Development Value (LTGDV) is the ratio of the total loan amount to the total Gross Development Value (GDV) of the project; this is the estimated value of the finished development once it has been completed and fitted out.

The Loan to Cost (LTC) is the ratio between the total loan amount and the estimated total costs of the project. At the same time, the loan-to-value (LTV) is the ratio between the loan amount and the property's current market value.

To calculate the maximum loan amount a lender can provide for a development finance project, the LTGDV, LTC, and LTV ratios must be considered.

A higher LTGDV, LTC, and/or LTV will leave the developer with less profit potential and increase the lender's risk, so each lender has a maximum LTGDV, LTC, and/or LTV they're willing to lend to.

How is the maximum loan calculated?

The maximum loan amount for a development finance project is usually determined by a combination of the loan-to-gross development value (LTGDV), loan-to-cost (LTC), and loan-to-value (LTV) ratios. The minimum loan amount is usually determined by the estimated costs of the project and the target returns.

The maximum development finance amount is also affected by market conditions and the rate of development, so lenders will often also take into account any feedback from planners or local authorities and the estimated completion time of the project. In addition, lenders may impose additional criteria, such as having collateral to offer as security for the loan.

What are the costs of development finance?

The costs of property development finance can be broken down into two main categories: interest payments and loan fees.

Regarding the interest payments, this will depend on the loan size, the borrower's creditworthiness, the loan term, and the specific type of loan requested. Various short-term, long-term, or fixed-rate loans can have different interest rates.

When it comes to loan fees, a series of fees must be taken into account, such as setup fees, application fees, and miscellaneous administrative costs. This is why it is important to know all the costs associated with property development financing when attempting to secure such a loan.

What are the fees for development finance?

When researching a loan, borrowers must consider all the associated fees besides the interest rate since these fees can increase the total cost of the loan.

Fixed-cost charges are typically paid upfront and can include the application fee, the arrangement fee, the exit fee, and the valuation fee. Additional miscellaneous fees may include late payment fees, administrative costs, and more. Fees can vary from lender to lender, depending on the type of development finance and the specific terms of the loan agreement.

Development finance rates

The development finance rates offered by lenders can be significantly different between them. For instance, short-term development finance typically has higher interest rates, while longer-term loans tend to have lower rates.

Additionally, different properties may attract different interest rates, depending on the risk associated with such a loan. Some lenders may offer different repayment structures, such as deferred payments or variable repayment terms.

We advise you to approach a broker who can guide you on what rates might apply to your project.

Conclusion

Property development finance provides investors and developers the necessary capital to construct new properties. By understanding the costs and fees of this loan, developers can better evaluate their options and make an informed decision.

With a development finance broker on board, borrowers can more easily source and compare different options, accessing the best overall deal.

We're property and development finance experts who arrange financing for developers, sourcing and securing you the best deal from UK specialist lenders, private equity firms, investors and family offices.

Get expert assistance today. We're on hand to answer any questions about development finance.

Call our friendly team on 01202 612934 - we're ready to help.

What is development finance?

Development finance is a type of loan facility that borrowers use to fund developments and works significantly different to other types of financing such as bridging finance. A developer typically borrows money from a lender in order to purchase property investment opportunities such as buying land (with planning permission or without planning permission) to build upon or acquiring an existing building with a view to renovate, refurb or change its use.

Due to their high returns, the opportunities in the UK are quite often focused on creating new residential dwellings. Whilst this may be the primary use of the finance, there are many other uses such as: to fund regeneration initiatives, build new commercial properties or mixed-use projects.

Whether its converting a historic building, changing the use of a high street landmark department store, renovating a local pub, creating a new leisure and hospitality complex or developing a holiday park, property development finance is used for all sorts of property ventures.

Who takes out property development finance?

Borrowers are typically, but not always, property developers who have been working in the sector for a number of years and have expertise in knowing what property investment opportunities deliver the best yields. These developers are also able to understand the property finance market place and how they can access different types of finance from a variety of lenders.

Why use property development finance?

New properties, refurbishments and regeneration initiatives all require a substantial amount of money before you can realise any return on your investment.

Developers need significant capital up front in order to buy property investment opportunities such as land, existing buildings or businesses that they want to convert into new property developments. In addition, developers intending to create a tenanted property must have large amounts of cash available for initial construction costs which incur during what is known as pre-let. The pre-let period covers the time from when construction starts until it's ready to receive its first tenant.

When would it require a specialist lender?

Quite simply every development loan is as unique as the developer's specific circumstances at that moment in time and their project. Combine this with each lender's preference for funding certain types of developments and not others, their specific lending criteria and current appetite for risk, these all factor into their decision-making process.

Securing development loans can be a complex and nuanced process as the solution is not one-size-fits all. This is where broker who deal with specialist lenders come into their own as they're often able to quickly arrange finance for each project at the best rates.

Who can use this finance facility?

Anyone looking to fund property development projects from ground up to refurbishment projects will likely need property development loans.

Developers often work with banks or traditional lenders such as building societies, but they also are increasingly needing to access specialist lenders for either more flexible terms and conditions - particularly if you don't meet current lending criteria due to a lower credit score, lack of track record or where their project is not straight forward.

A great example is the current high demand for financing brownfield sites or new requirements such as air space developments, many main stream lenders will steer clear of these projects as they are considered too high risk.

What finance facilities are available?

There are a number of finance options that developers can consider.

The options available for developers varies according to the type of venture whether it's residential or commercial property, as well as what stage of projects has been reached.

In addition different lenders have their own preference so before going anywhere else it’s important to speak to a broker who understands the property finance market place and know where to go in order to get the most appropriate property development finance for your specific needs.

Light development finance

This is often the development loan of choice for property renovation projects where you are retaining most if not all the property’s current tenants. This property finance option is typically more commonly used on small renovations projects so can be accessed quickly without too much difficulty.

Heavy refurbishment finance

This is designed for borrowers whose renovation project is likely to result in significant property renovation and remodelling such as structural works etc.

Ground up development finance

This type of finance is usually secured against an unencumbered site so in essence its financing 100% of the land value itself without any property attached to it. This option is used during the development stages of building work taking place on the property. Borrowers looking for this type of finance must be aware that they will need ‘Planning Permission’ to commence any property construction so you will require an integral part of the property development finance solution to actually get planning permission.

Senior debt finance

This option is designed for property renovations or developments where there are no current tenants and it may not even have planning consent yet. It can be used but it's often subject to a lender looking at several other criteria before agreeing to lend money. The most important factor in securing senior debt development financing is your track record as a developer.

Stretched senior finance

Borrowers use this term to refer to instances where they offer a property as security, but the property is not solely owned by them. In this case developers can become tenant in common with their lender and co-owners of the property whose value may be used as collateral for finance.

1. What percentage of funding does a property developer typically require for a new build property development?

Usually experienced developers will require between 20% and 35% of the total value of the property, but this will vary from project to project.

For example if a property cost £100k to refurbish then loans could provide up to 70%, but if it costs £500k then loans could provide up to 50%. It all depends on the lender's requirements and the risk profile of the property.

2. What can you use development finance for?

Development finance has many uses, and can include:

- Residential property development

- Commercial or Mixed-use Commercial property development

- Renovations & refurbishment

- Change of use & property conversions

- New builds

- Single unit developments to large multi-unit

- Finish & Exits

- Exit Financing

- Sales Period Funding

3. Can you get 100% development finance?

Its completely possible to obtain 100% development financing however, you'll need to provide additional security, usually in the form of property or land.

So how does financing a property development project work?

If a borrower is looking to purchase land with planning permission, or obtain a change of use on an existing building and develop it into 10 residential dwellings, they may first consider a bridging loan.

However the costs of construction would exceed the value of the only asset they have (the land or the building), and the short time scales inherent in bridging loans would not offer the time needed to successfully finish the construction – meaning that a bridging loan would not be a suitable choice for finance in this scenario.

Development finance allows up to 65% LTGDV to be raised against the initial asset, the land or existing building or 100% where the borrower offers additional security, and in addition to this up to 100% of the build costs for the actual development.

The build costs are divided into tranches and released/drawn down as the build schedule progresses. As the build schedule progresses the gross development value increases relative to the loan being drawn down ensuring that the LTGDV remains within the agreed lending criteria.

At the end of the construction, the property is usually either sold or refinanced using long term refinancing should the developer plan to keep the finished development for themselves to use or let.