On this page

Is it cheaper to rent or own property in the UK? Monthly housing costs data: Renting vs Mortgage across the UK Where in the UK is it cheaper to rent than own? It's cheaper to rent than own in England It's cheaper to rent than own in Wales It's cheaper to own than rent in Scotland It's cheaper to own than rent in Northern Ireland The current state of the UK rental sector The current state of owning a home in the UK ConclusionIs it cheaper to rent or own property in the UK?

Earlier this month, we asked if it was cheaper to rent or own in England.

We found that for the first time since 2010 renting in England is now cheaper than owning a mortgaged property. Base rate hikes have resulted in significantly higher mortgage costs for homeowners, and whilst rental costs are also increasing, this discovery that renting is cheaper than owning challenges the standard British assumption that buying is the better option.

Whilst renting in England is cheaper than owning, and this may only be a short-term state of play, we wanted to know how this looked across the other countries in the UK.

Analysing average monthly mortgage repayments vs rental payments, is it cheaper to rent or own property in Wales, Scotland and Northern Ireland? And how do they each compare to England, where it's £290 a month cheaper to rent than own?

Our blog reveals all...

Monthly housing costs data: Renting vs Mortgage across the UK

| Region | Property Price (average) | Monthly Mortgage Repayments (average) | Monthly Rental Payments (average) | £ Difference (Mortgage vs Rental Payments) | % Difference (Mortgage vs Rental Payments) |

| England | £311,309 | £1,434 | £1,144 | £290 cheaper to rent | 25.4% cheaper to rent |

| Wales | £216,960 | £999 | £863 | £136 cheaper to rent | 15.8% cheaper to rent |

| Scotland | £195,781 | £902 | £952 | £50 cheaper to own | 5.5% cheaper to own |

| Northern Ireland | £179,530 | £827 | £887 | £60 cheaper to own | 7.3% cheaper to own |

Source: HomeLet Rental Index October 2023, House Price Index 2023

Based on: An average property price, homeowner repayment mortgage at 75% LTV, with October 2023's average 5.5% interest rate, and a 25-year term.

Where in the UK is it cheaper to rent than own?

Looking strictly at average property prices and mortgage repayments vs average monthly rental payments, our analysis found the following:

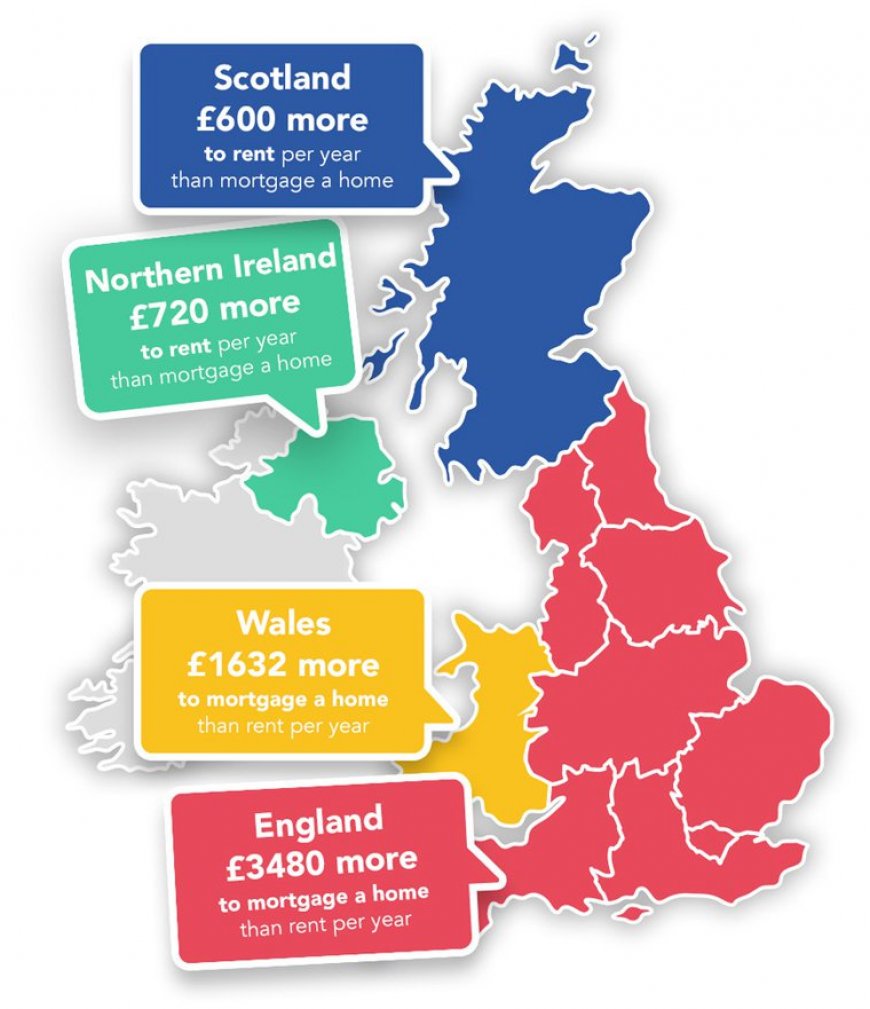

- On average, in England, it's cheaper to rent than own by £290 per month - Homeowners currently pay £3,480 more per year for their property than renters.

- In Wales, it's cheaper to rent than own by £136 per month - Homeowners pay £1,632 more per year than renters.

- In Scotland, it's cheaper to own than rent by £50 per month - Renters pay £600 more per year than homeowners.

- In Northern Ireland, it's cheaper to own than rent by £60 per month - Renters pay £720 more per year than homeowners.

Stephen Clark, from Finbri comments, "The property market continues to change rapidly. Landlords have recently faced unprecedented challenges, and because these property investors are historically well represented as Bridging Finance clients, it's critical to better understand the changes occurring to the rental market. This data analysis gives perhaps some welcome positive signs for Landlords as it appears renting could well be back in favour due to the new increased cost of mortgages."

It's cheaper to rent than own in England

As covered in our blog, 'Is it cheaper to rent or own in England?', for the first time since 2010, it's cheaper to rent than own a mortgaged property in England.

Monthly mortgage costs and rental payments differ from region to region, but renters pay £290 less per month on average than homeowners.

Currently, in the South East, the average monthly mortgage repayments (£1,815) are £456 more per month than the average rental payments (£1,359).

London is the most expensive location to rent. But even there, renting (£2,179) is £281 less per month than the average mortgage (£2,460).

Mortgages have increased due to the 14 consecutive base rate rises, and average mortgage payments have gone up 33% in the past year alone.

It's cheaper to rent than own in Wales

Currently, renting in Wales is cheaper than owning a property.

The latest Land Registry data shows the average property price in Wales is £216,960, the 2nd highest after England for property in the UK.

The average mortgage payment is just under £1,000 a month. This is £136 a month more than the average rental payment of £863, which means homeowners are paying £1,632 more than renters over a year.

It's cheaper to own than rent in Scotland

While it's currently more expensive to rent than own in Scotland (renters pay £600 more per year than homeowners), renters have the reassurance of the temporary rent cap that limits annual rises to 3%.

However, a loophole in the Scottish rent controls allows landlords to go higher if drawing up a new tenancy agreement.

Recent findings from Zoopla discovered that landlords have utilised this clause to maximise rent for new tenancies.

The monthly rental payments for these new tenancies increased 12.7% year-on-year. This increase was faster than the hottest markets of London and the north-west of England.

Renters in the most populated cities of Edinburgh and Glasgow saw asking rents rise by 15.5% and 13.7%, respectively—the highest rate of increases in cities in the UK.

It's cheaper to own than rent in Northern Ireland

Currently, it's cheaper to own than rent in Northern Ireland, as renters pay £720 more per year than homeowners.

Year-on-year rental prices in Northern Ireland have increased by 9.2%, with the highest costs on average in the capital, Belfast, at £908 per month.

Government data showed Northern Ireland has had the highest increase in private rent than any other country in the UK.

Latest figures show Northern Ireland house prices increased in Q3 by 3.1% compared to Q2 and were 2.1% higher year-on-year. The average price rose to £179,530, ranging from £160,396 in Fermanagh and Omagh to £207,824 in Lisburn and Castlereagh.

The current state of the UK rental sector

While monthly rental payments are cheaper in England and Wales than homeowner mortgage repayments, the UK rental sector requires closer examination.

Analysis has discovered that renting is increasingly unaffordable, especially in recent years.

Figures from property data company TwentiCi show that the average asking price for rent across the UK is up 22% since this time last year. Shockingly, these asking prices are up 56% since October 2019.

Recent rent rises are likely primarily driven by landlords that have faced increased monthly mortgage costs and their need to mitigate these increases and offset the cost of their buy-to-let property financing.

According to official figures from the Office of National Statistics (ONS), with rent taking 35% of household income in London, renting in the capital is deemed 'unaffordable'.

The most affordable location to rent in the UK is Yorkshire and The Humber, where rent is 23% of the average household income.

The current state of owning a home in the UK

Housing markets across the UK have been weakening as the rising interest rates have made mortgage payments more expensive.

Demonstrating the fewer property purchases from mortgaged buyers, in particular buy-to-let investors, overall property transactions in 2023 are expected to be 20% down year-on-year from 2022 at just over 1 million transactions. It's predicted they will stay at this level in 2024.

As more homeowners struggle to pay their mortgages, and it's harder for buyers to get a mortgage in the first place, house prices are predicted to fall. Varying expert forecasts predict the price decrease to range from 3% to 12% by mid-2024.

Conclusion

Whilst we've discovered it's currently cheaper to rent than own in England and Wales versus it being cheaper to own than rent in Scotland and Northern Ireland, the word that sticks out is 'currently'.

The difference between renting vs owning differs across regions and countries throughout the UK.

And one thing is for sure in the property market - change.

The scarcity of rental properties vs skyrocketing demand is causing rents to increase further; whether you're able to rent or own depends not only on your circumstances but also on where you live in the UK.

Interest rates are currently at 5.25%, a 15-year high, which has pushed up mortgage costs, and fewer people can afford to keep their homes, resulting in a time when property prices are predicted to drop over the next 12 months.

But despite UK inflation falling to 4.6% in October, down from 6.7% in September, the governor of the Bank of England, Andrew Bailey, has warned that interest rates will not be cut for the "foreseeable future".

However, despite the warning from Andrew Bailey, amid fears of a looming recession, the latest market predictions are that by the end of December 2024, UK rates will have been cut by a percentage point to end next year at 4.25%.

There are pros and cons for homeownership vs renting. And however you slice it, there are increasing costs for both homeowners and renters.

In the short term, it's cheaper to rent than own in England and Wales.

However, with rental demand continuing to outstrip supply and mortgage rates increasing causing landlords to pass on the costs, monthly rental fees look set to increase further, thereby reducing renters' ability to save and get on the property ladder should they wish to purchase a property.

So it may not be long before it's cheaper to own than rent, again, as it is currently in Scotland and Northern Ireland.

The era of higher rates makes it more likely that millennial renters may never own property and will rent for the rest of their lives.

There could be a generational shift away from a nation striving to own their own homes towards one accepting that renting may be the most likely way they live, marking a change in the UK's housing market dynamics.