Top 6 websites that offer instant online UK property valuations

Whilst the full extent of the predicted UK property market crash in 2023 remains to be seen, a clear downward trend is emerging - property prices are dropping. For those reliant on property-secured borrowing, discovering the current market value of their property is essential to understanding their current loan-to-value (LTV) ratio. In this article, we review the top websites that can help you gauge the current market value of your UK property - for free.

Nationwide put the average house price at £268,282 in October 2022, down 0.9% from the previous month. In November 2022, property website Zoopla said it expected prices to fall by 5% in 2023 and Lloyds Banking Group has said it expects house prices to fall by around 8% next year.

As lenders react to falling prices, they will be looking to minimise their risk exposure on property finance, potentially by lowering their current LTVs.

It's not just lenders who are spooked. Valuers are also acutely wary of the predicted price drops in their valuations.

If you're looking to raise finance secured on a property asset through a bridging loan, secured loan or mortgage product - ascertaining the current market value of your property is the first step in understanding how much you can borrow - and its easy to do as there are many free property valuation websites to choose from.

Online valuations are the quickest and easiest way to gauge your property's current market value. Although it will never be as precise as an RICS-assessed valuation, it’s a good starting point.

How do online property valuation websites work?

Online home valuation tools use millions of data points, including the uk house price index, sold house prices in your area from land registry data, current market trends and property size, to generate an estimated value for your property. Some websites require different levels of data to achieve their results, which may affect the accuracy of the valuation.

How accurate are online valuations?

The accuracy of an online property valuation tool will depend entirely on the individual website and what data and details they are using for their estimate. But as a general rule, every online valuation tool will give you an approximation of its current value based on its parameters.

So which house valuation sites are the best? We've compiled a list of the top 6 online property websites and listed the pros and cons of each to better understand how they work, which features are beneficial and which is best for you to use when trying to get an online valuation for your property.

The Top 6 Online Valuation Websites

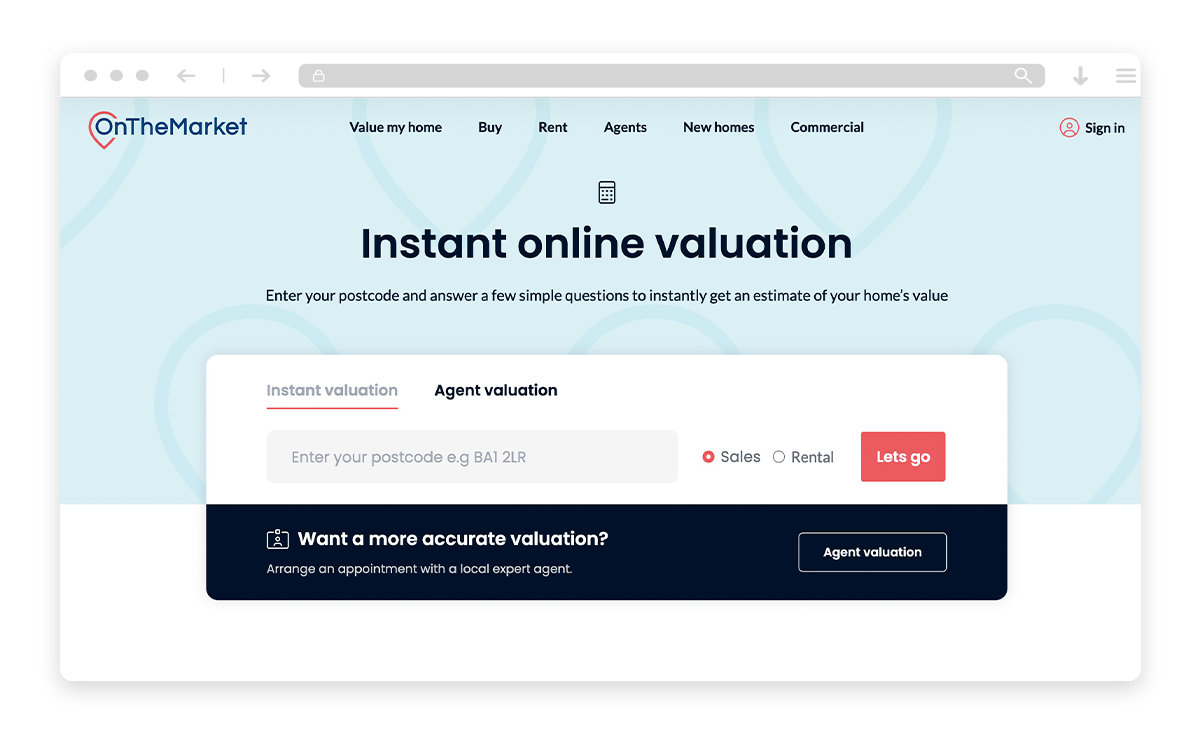

1. On The Market

As one of the top online property portals, On The Market has significant brand credibility, and its valuation landing page is quickly accessible. It's easy to use, straightforward and is one of the most comprehensive valuation tools available.

It offers much more insight than other property valuation websites by allowing you to input relevant data, such as whether your property has a garden or a garage, which enables the system to calculate a more accurate valuation.

What are the pros?

- This tool has detailed data logging, with extensive information such as property type, tenure, lease remaining and number of rooms to generate a more accurate valuation.

- Speed - it displays the results instantly.

- The results are also displayed with a local average valuation based on inputted area.

- The tool also displays the price a property was previously sold for and when, which could indicate how much the property has increased (or decreased) in value over a period of time.

- It provides details of local estate agents you can use for a more accurate valuation.

What are the cons?

- Although the data inputting is extensive, it would be good to have visual elements, such as year-on-year graphs (as with Get Agent's valuation website) or graphics which could help represent the data more interestingly.

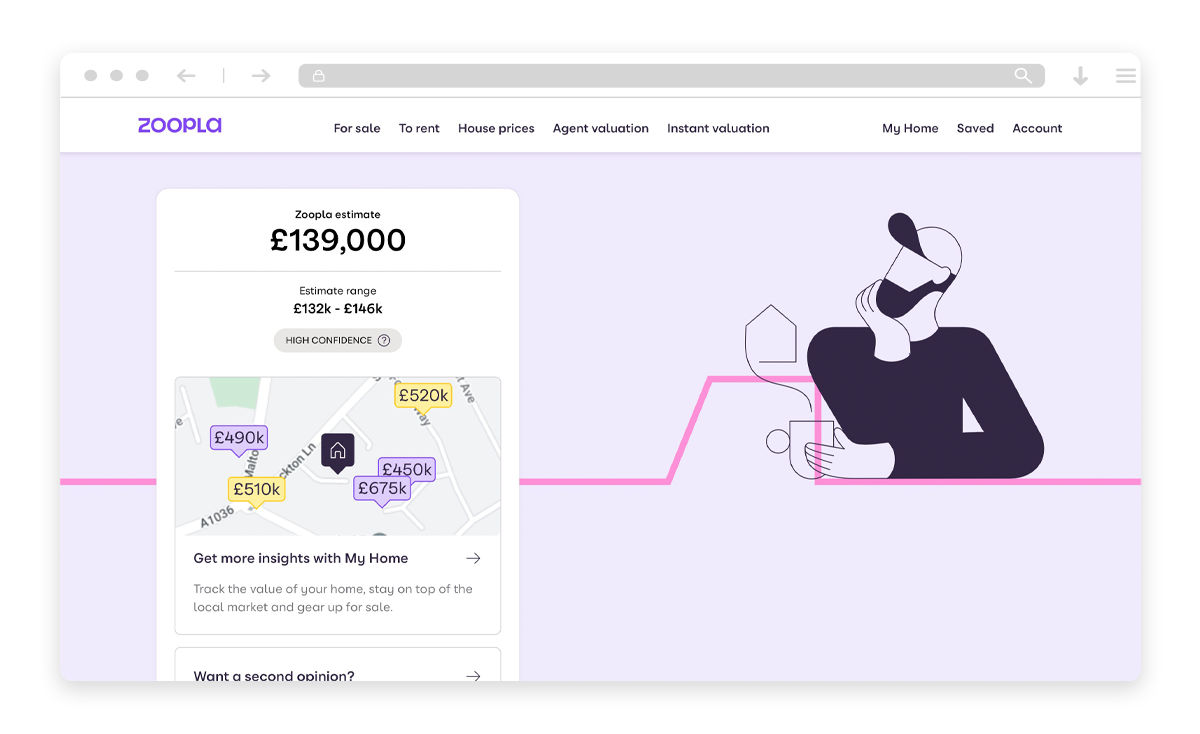

2. Zoopla

Zoopla is another big name in the online property market.

Simple to use, Zoopla's online valuation tool provides very fast estimations and the functionality to visually see the proximity and values of other properties in the area via a helpful map.

What are the pros?

- The results are instant.

- A area map visually displays other local properties and their estimated values.

- It gives you an estimated range, providing a rough guide to the lower and upper ends of the property price.

- Zoopla also provides a confidence level, allowing you to get a more accurate representation of the value.

- It allows you to sign up and get more insights into the property's value whilst enabling you to track changes in estimations.

What are the cons?

- Zoopla doesn’t ask you for information about the property such as the property type or property build date, which could alter the estimate's accuracy.

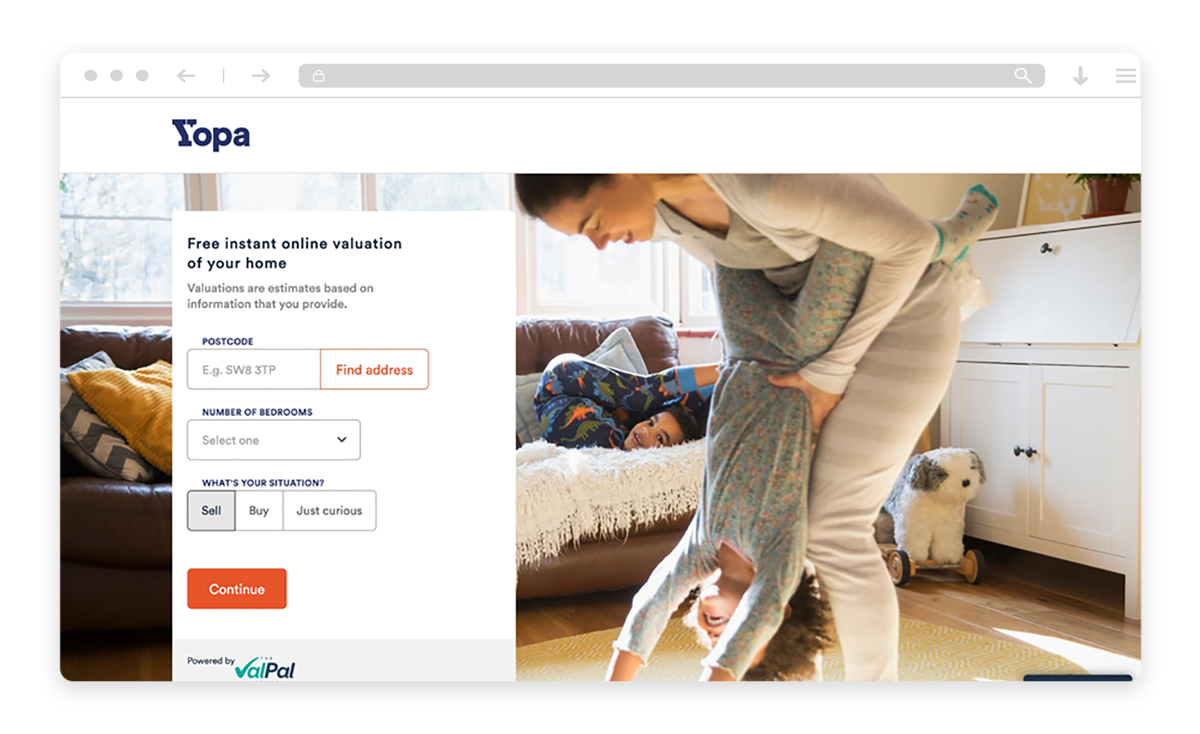

3. YOPA

YOPA's interface is similar in design and functionality to Zoopla, both lacking the ability to add extensive details about the property. Although you can still obtain a rough estimate with YOPA, the fact you only receive your valuation via email can be discouraging.

What are the pros?

- YOPA is easy to use.

- When you get your property valuation email, the estimates are shown as averages, higher and lower ends of the value spectrum.

What are the cons?

- There are no instant results; you need to wait to get an email which could be frustrating for some users. This is especially detrimental for YOPA when other websites offer instant results.

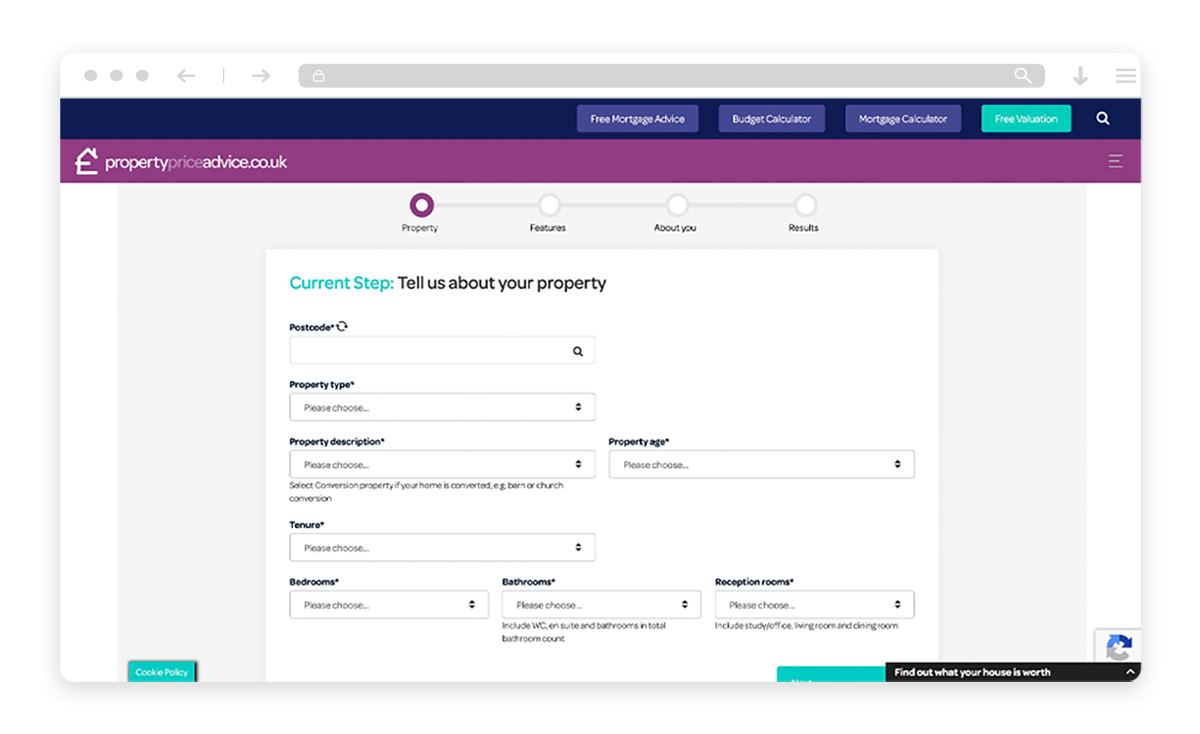

4. Property Price Advice

This online valuation tool is similar in functionality to On The Market, allowing you to input detailed data for a more accurate estimation.

What are the pros?

- This tool asks for detailed information on the property type, such as how many bedrooms and bathrooms and whether it has full or partial central heating. All of these factors will affect the value of a property, making this tool a more accurate representation of its value.

- It provides instant valuation, including the average property price in the area and averages of similar property types.

- It provides details of local estate agents to get in touch with for a more accurate valuation.

- Depending on the reason for sale, this tool offers personalised calculators for remortgaging or insurance.

What are the cons?

- There are no comparisons for property prices year-on-year, which could be a good indicator of the property value in the future. Having this functionality may be a useful feature for investors and developers.

5. Get Agent

Get Agent is a valuation tool with an easy-to-use interface and makes the most of icons to represent data options where necessary. It offers more data visualisation with graphs displaying prices year on year whilst still providing basic information such as average prices in the local area and instant valuation estimates.

What are the pros?

- Whilst less extensive in data inputting than other websites, Get Agent offers a more visual and simplistic approach to similar data.

- This website shows the minimum and maximum valuations expected from a property.

- Displays a graph that looks at the local market overview with details such as price changes, % of asking price and time to sell.

- This tool also displays nearby properties recently sold along with their sale price.

- It provides the option to contact nearby estate agents and displays interesting details about them, such as the percentage of the asking price they receive and the average selling time.

- This website also provides information on how they create their estimates which cannot be seen on other websites.

What are the cons?

- Fewer data inputting fields may create a less accurate valuation.

6. The Move Market

The Move Market is a unique tool that allows you to choose similar properties in the area to gain a more accurate valuation of your own. Unlike other websites that use databases to generate results, The Move Market allows you to input your own data, such as whether a similar property is in better condition or has a larger garden, which can provide better insights into the currency market value of your property.

What are the pros?

- The Move Market allows you to choose up to 5 properties that are similar to yours and use this information to give an up-to-date estimation of its value.

- You can input what you think your property is worth, which no other valuation website allows you to do.

What are the cons?

- This website only shows you one valuation and doesn’t provide you with upper and lower valuations or an average for the type of property you have.

- The Move Market doesn’t always have all sales data for particular areas and considering this is a more lengthy process than other websites, it’s frustrating to end up with no results.

What to look for in an online valuation tool

Each valuation website we have listed has its own specific features and pros and cons. Whilst they all aim to achieve the same goal, every website will differ in its approach and results. When you want to find out how much your property is valued online always look for a valuation tool that can…

Provide details of how they obtain their information

This information is important when reaching a valuation, so always look for a website that can showcase this with transparency.

Show averages in the area for a particular property type

Estimating the average price of any property in a certain location will not be as accurate as a particular property type in a specified area. A property valuation tool should be able to offer a more realistic valuation based on the property type, not just on its location.

Give more detailed information on the property’s value over time

By providing information on average selling times, percentage asking prices obtained and the price change year-on-year, you can receive a much more detailed view of what price you are likely to sell your property for. You may even see if your property is likely to increase or decrease in the coming years.

So which would we recommend?

We’ve reviewed some of the best and most well-known online property valuation tools currently available and the clear winner as the best overall online property valuation for 2022 is… On The Market.

As well as being one of the top online property portals available, On The Market allows you to input extensive data about your property, which can help provide a more accurate valuation result. It’s easy to use and navigate, with the interface being very consumer-focused. The valuation is displayed instantly, without needing to sign in or using your email to access the information, and it also shows previous property and local values.

Although On The Market is the most intuitive online valuation tool, we still recommend using at least two other online tools to check if there is a difference in valuations and use all three to determine your valuation average. Once you've got a good feel for the true value of your property it's also a good idea to common sense check it by inviting a local estate agent to give their appraisal. Estate agents always give free no obligation appraisals and will know what the active buying market is like in your area.

More lenders are now using online property valuation tools to improve their due diligence process and provide faster application turnarounds. Whilst it’s unlikely that lenders will solely use online valuations as a basis for every property’s market value, knowing whether the loan application is even in the right ballpark can be helpful to both the borrower and lender alike before paying more significant valuations from RICS-approved surveyors.

Residential Bridging Loan

A residential property bridging loan is fast, flexible bridging finance for property purchases. Buy-to-lets, HMOs, properties with short leases, property flips, investment purchases can all be financed, as can fixing chain breaks or mortgage delays, and refinancing an existing property loan. These loans require residential property or a group of properties as security.

Discover More