On this page

Bridging Finance Report 2023 How many times have you used bridging finance? When did you last use bridging finance? Of those that have used bridging finance more than once, what were the funds used for? When people used bridging finance for residential investment properties, what did they use the funds for? Of those that have only used a bridging loan once, what did they use it for? When people purchased a main residential property, was the finance required to avoid a property chain from collapsing? The last time respondents used bridging finance, what type of bridging finance did they use? The last time they used bridging finance, how much did they need to raise? How long was the loan term the last time respondents used bridging finance? How many weeks did it take to arrange the finance and draw down the funds? What were the most important factors when deciding to use bridging finance? Would you use bridging finance again? Are you likely to need bridging finance this year? How did you source your bridging finance?Bridging Finance Report 2023

Financial lending via bridging finance is increasing. Recent market analysis has shown that £4.94bn was lent via bridging loan completions in 2022, an increase from the £4.2bn lent in 2021.

And there are predictions bridging finance completions will rise to £5.59bn annually by 2025.

Interest and awareness in this fast access to funds are increasing too. Search trend analysis has shown that searches for “bridging loans” within the UK have increased by over 80% in the past year.

The analysis has shown there were 27,100 searches for “bridging loans” this April, marking an annual increase of 83% from the 14,800 searches a year ago.

But why has there been such an increase in demand and the amount of gross lending? And why have 90% of people that have used bridging finance used it more than once?

With direct responses from 1,001 people that have used bridging finance, this report will show you exactly what they used the finance for, the key reasons for choosing bridging loans, if they’re likely to need to bridge this year and if there’s a preference between using a broker or going straight to the lender...

As Stephen Clark from Finbri bridging loan broker says, “During a time of such financial difficulties and one economic crisis followed a seemingly worse one, bridging finance has proved to enable people to complete projects and achieve their goals via fast funding.

“Whilst last autumn’s disaster of a mini-budget sent rates and mortgages into meltdown, the impact of which we’re still feeling the brunt of, bridging rates stayed relatively the same.

“Our survey has discovered the most common use of bridging finance for borrowers is to purchase a primary residential property, and the most significant drivers for using bridging loans are to maximise the loan amount and access funds urgently.

“Nearly 95% of survey respondents who have used bridging finance said they would use bridging again in the future and over 85% said they’re likely to require bridging finance this year.

“It looks like the bridging market is set to have a busy, and possibly record-setting, year ahead.”

Key findings

- Our survey discovered that over 90% of people that have used bridging finance have used it more than once.

- The most common reason for respondents' last use of bridging was to purchase a main residential property.

- Of those purchasing a residential property, 61% required bridging finance to prevent a property chain from collapsing due to a mortgage delay.

- 31% were due to existing property sales being delayed

- The amounts required were diverse, but the most common funding via bridging was for £500,001 to £600,000.

- The most common length of respondents bridging loans was 6 months.

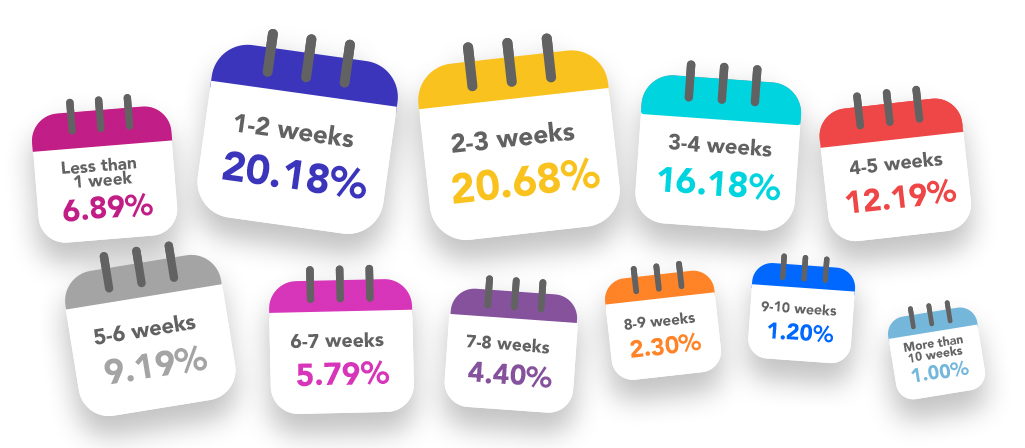

- 21% of loans took 2-3 weeks to arrange the finance and draw down the funds.

- 20% took 1-2 weeks.

- The need to maximise the loan amount was selected as the most important reason for choosing bridging finance.

- Accessing finance urgently was the 2nd most important reason.

- Three-quarters of respondents' last use of bridging was regulated finance secured against a main residence.

- 95% of respondents would use bridging finance again.

- 86% are likely to need bridging finance this year.

- 64% sourced their bridging finance via a broker.

- 36% went direct to the lender.

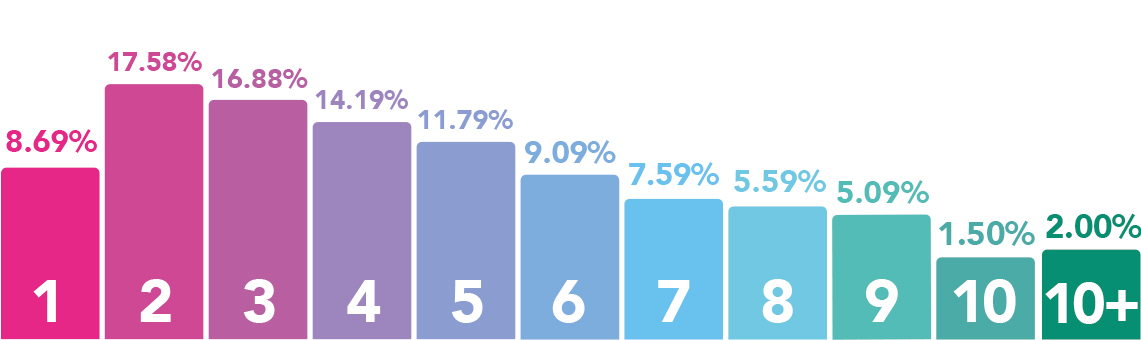

How many times have you used bridging finance?

As a clear indicator of its effectiveness in resolving financial predicaments, most people in the UK who have used bridging finance use it more than once.

Over 90% of people that have used a bridging loan have done so 2 or more times (91.31%).

The most common usage of bridging loans:

- 2 occasions - 17.58%

- 3 - 16.88%

- 4 - 14.19%

Just 8.69% have only used bridging finance once. But of those respondents that have only had 1 bridging loan (so far), 54% had their first bridging loan in 2022 and therefore may have yet to require subsequent funding since. 90% would use bridging finance again and 69% anticipate the need to do so this year.

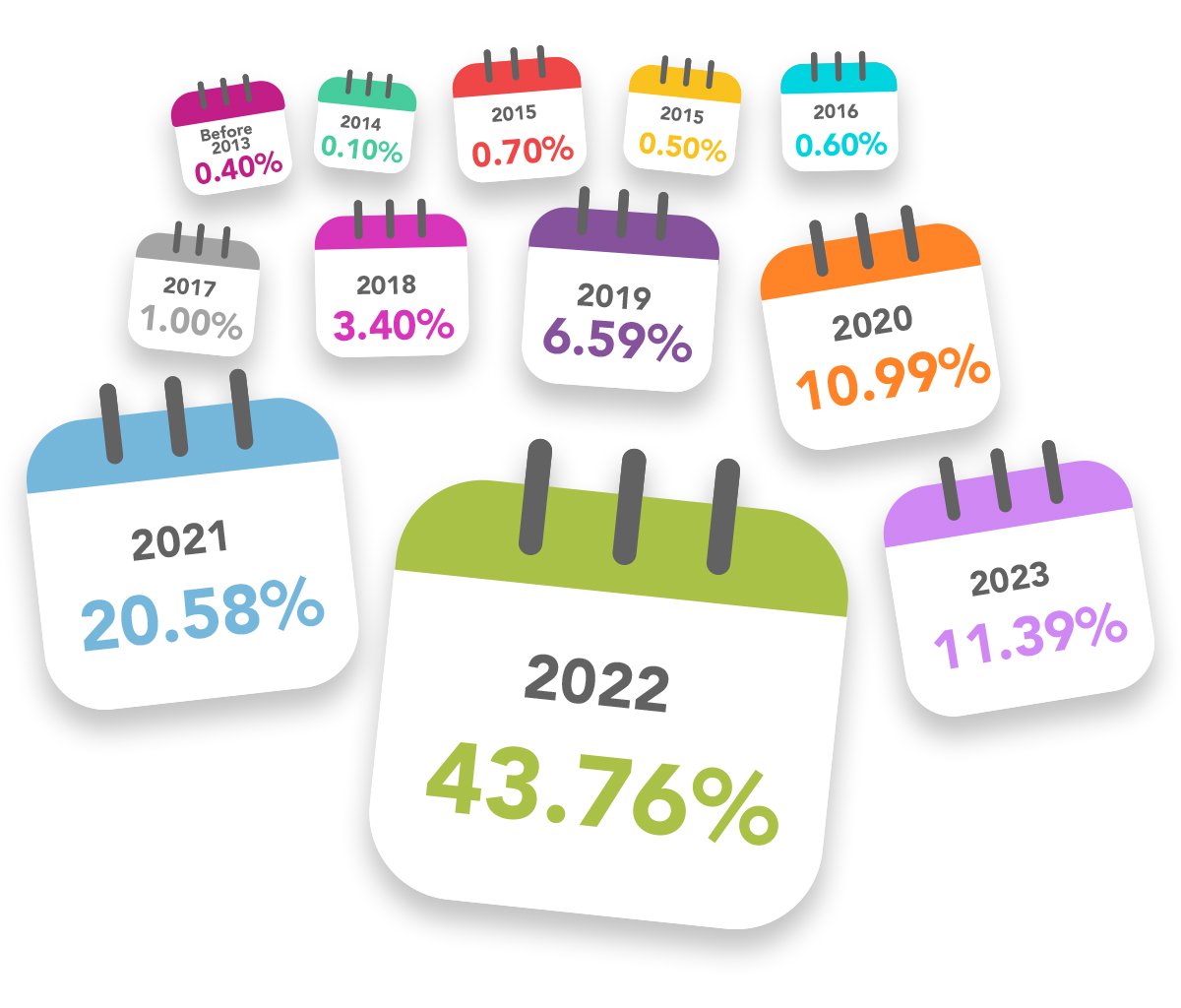

When did you last use bridging finance?

Most respondents last used bridging finance in 2022, with 44% using bridging last year.

A combined 87% last used bridging between 2020 and 2023. 11.39% have utilised bridging finance already this year.

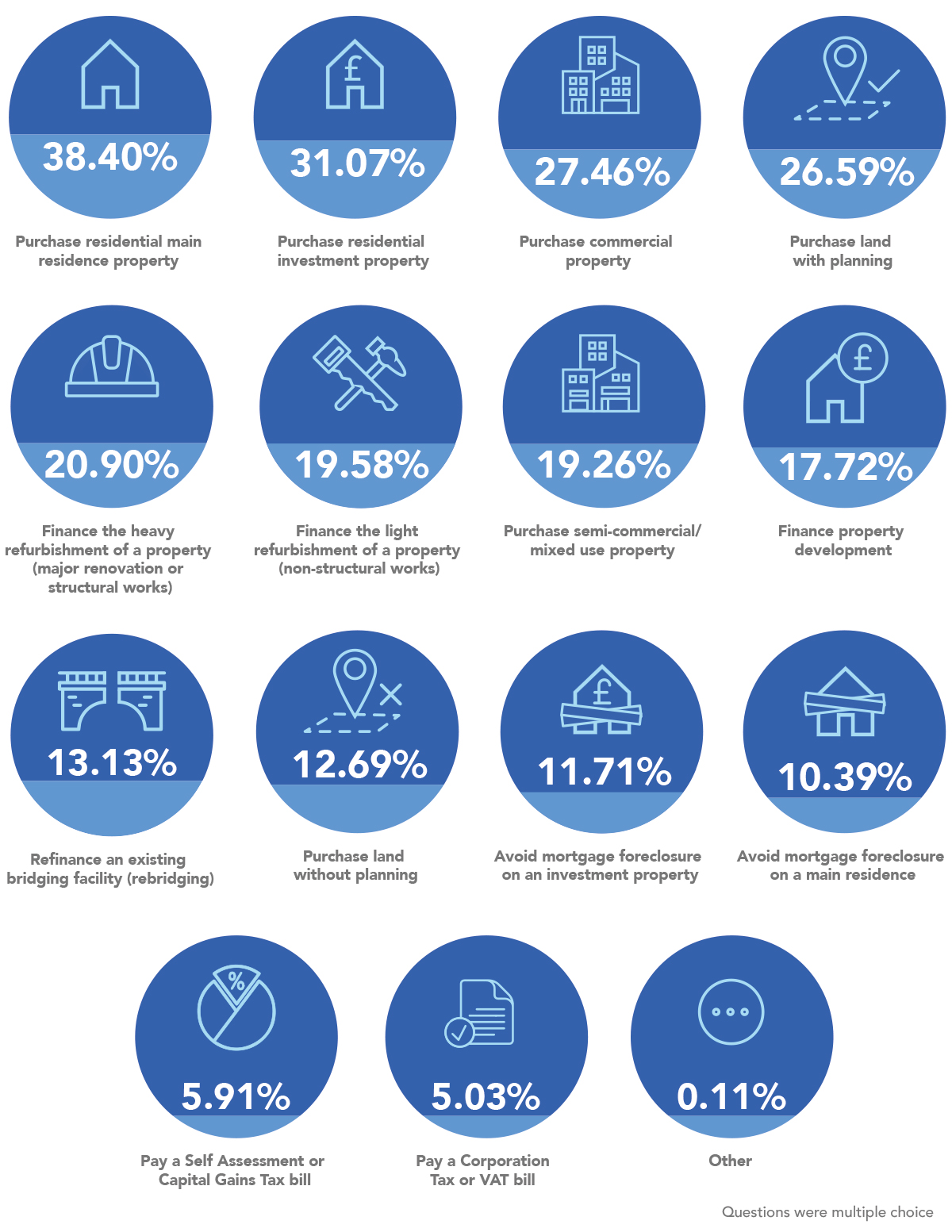

Of those that have used bridging finance more than once, what were the funds used for?

914 respondents (91.3%) have used bridging more than once.

Of those people, the most frequent use (38% of respondents) was to purchase a property as a main residence, followed by 31% of people using bridging finance to purchase a residential investment property.

As we will cover later in this report, chain breaks and mortgage delays have become prominent reasons people use bridging loans to secure properties.

The top 5 uses of bridging loans (for people that have used them more than once):

- Purchase residential main residence property - 38.40%

- Purchase residential investment property - 31.07%

- Purchase commercial property - 27.46%

- Purchase land with planning - 26.59%

- Finance the heavy refurbishment of a property (major renovation or structural works) - 20.90%

Aside from residential property purchases, the flexibility of bridging finance is demonstrated by its diverse uses such as light refurbishment of a property (non-structural works), heavy refurbishment of a property (major renovation or structural works), finance property development, purchase land without planning, refinance an existing bridging facility, avoid mortgage foreclosure on a main residence, avoid mortgage foreclosure on investment properties, pay a Self Assessment or Capital Gains Tax bill, and paying a Corporation Tax or VAT bill.

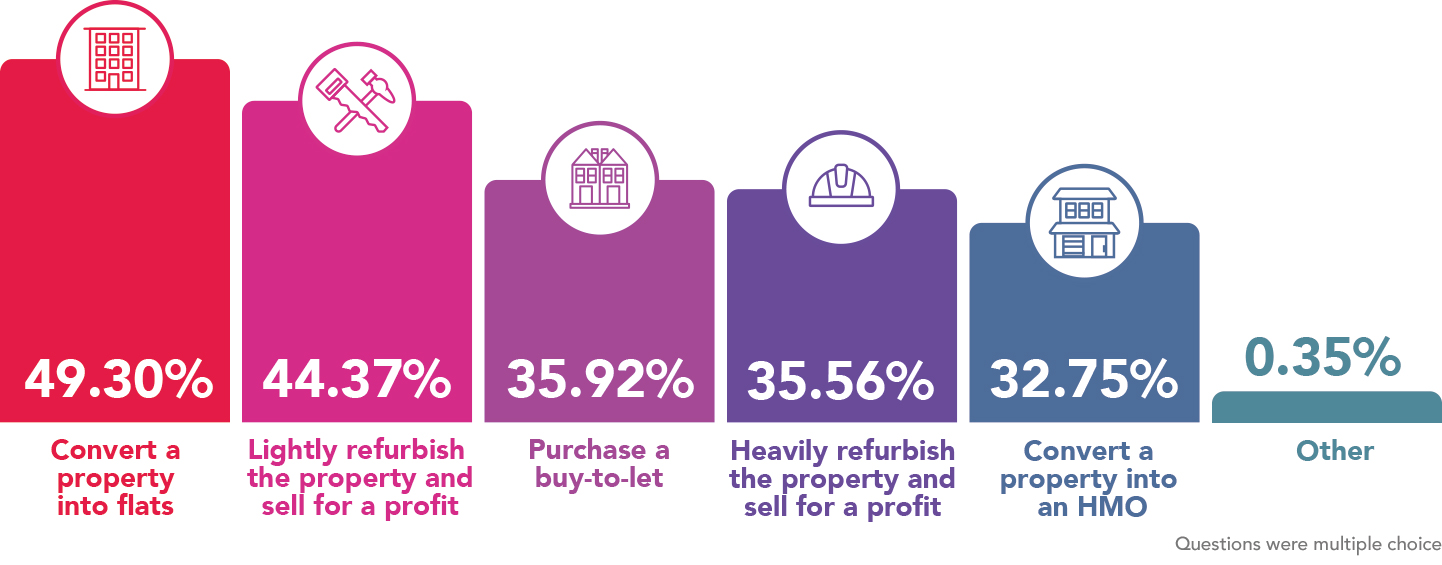

When people used bridging finance for residential investment properties, what did they use the funds for?

Whilst there is significant unrest in the private rental sector due to increasing rates and the incoming Renters’ Reform Bill, which some have described as “anti-landlord”, utilising bridging funds for rental properties accounted for a combined 85% of residential investment bridging loans.

Of the 284 respondents that used bridging to purchase a residential investment property, converting a property into flats was the most common use of the funds (49%) and 36% purchased a buy-to-let.

The refurbishment of property was a significant use for bridging loans. A combined 80% of people that used bridging when investing in property completed either light (44%) or heavy refurbishment (36%) to sell the property for profit.

33% of residential investment loans were used to convert a property into an HMO (house in multiple occupation).

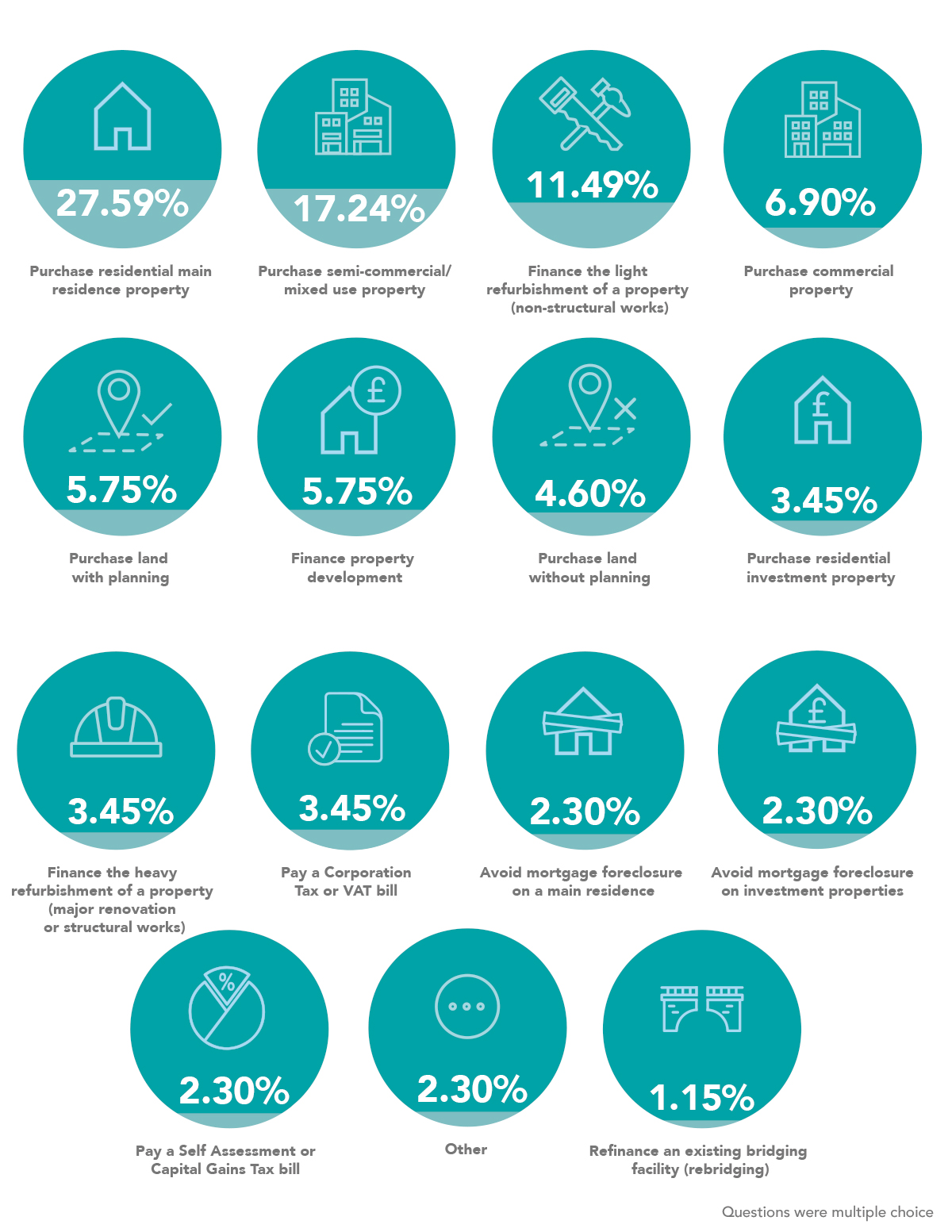

Of those that have only used a bridging loan once, what did they use it for?

91% of people utilising bridging finance have done so more than once. But of the 87 respondents who have used bridging finance just once (so far), purchasing a main residential property was the most common use (27.59%).

The top 3 1st time uses of bridging finance are:

- Purchase residential main residence property - 27.59%

- Purchase semi-commercial/mixed-use property - 17.24%

- Finance the light refurbishment of a property (non-structural works) - 11.49%

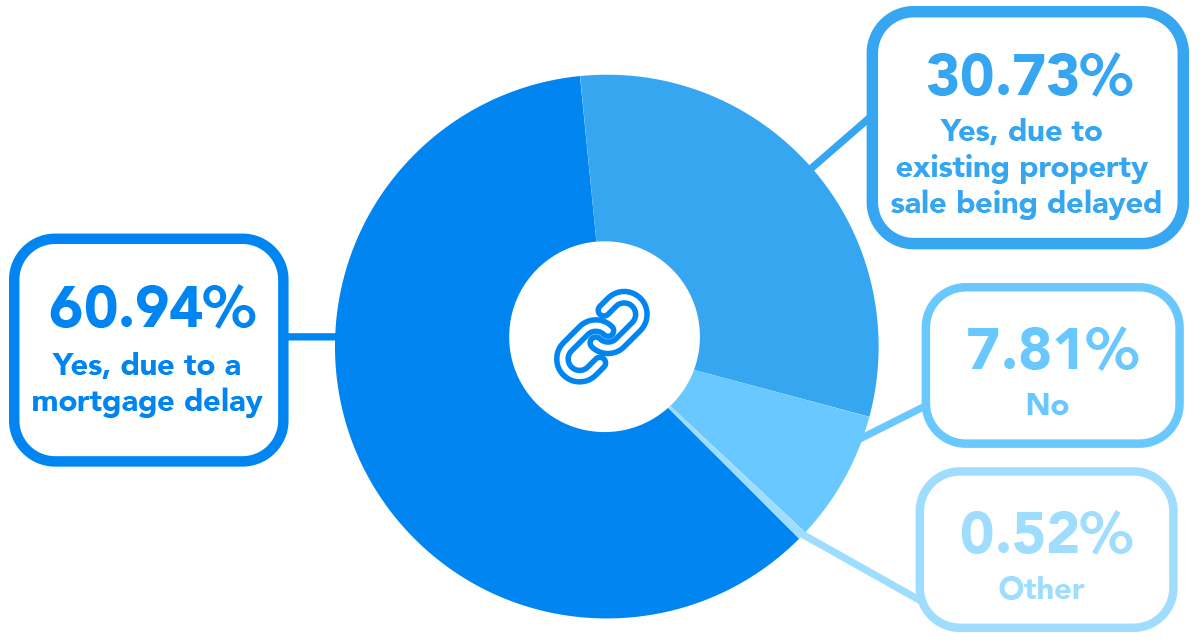

When people purchased a main residential property, was the finance required to avoid a property chain from collapsing?

Mortgage rates, delays to mortgages plus delays to existing property sales have all increased since the damaging effects of September 2022’s mini-budget. The slowdown in the mortgage market has been a source of increased demand for residential property bridging loans.

A combined 92% of bridging finance used for purchasing a main residential property was to prevent a property chain from collapsing.

Of the 192 respondents that used bridging to buy a residential property, 61% used bridging finance to stop the property chain from collapsing due to a mortgage delay.

31% prevented the chain from breaking due to the existing property sale being delayed.

The last time respondents used bridging finance, what type of bridging finance did they use?

A regulated bridging loan is when the finance is secured on your main residence or that of your close family. Unregulated is secured on investment properties and land.

Our poll discovered that most recent bridging loans were overwhelmingly more likely to be regulated (74.83%) than unregulated (25.17%).

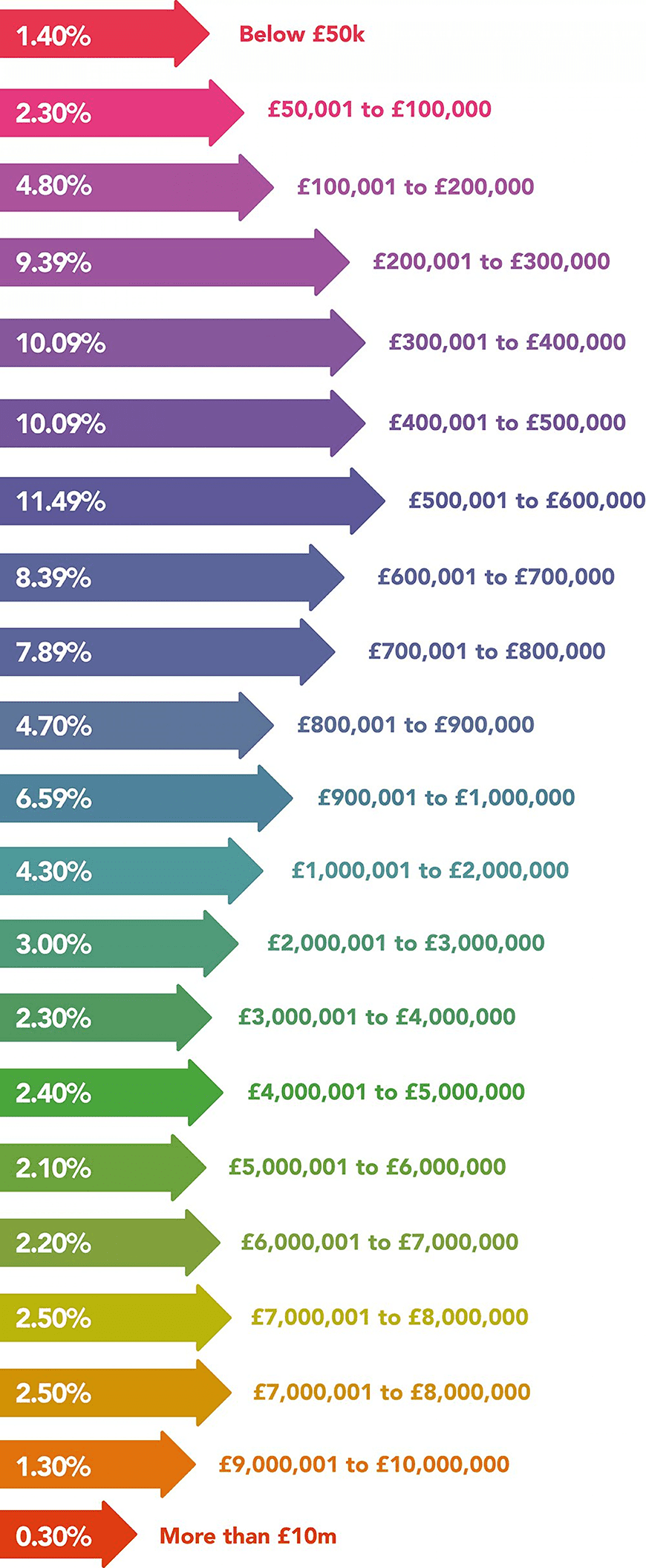

The last time they used bridging finance, how much did they need to raise?

Most respondents (11.49%) cited that their last bridging loan size is between £500k-£600k. This was closely followed and matched in use by both £300k-£400k (10.09%) and £400k-£500k (10.09%).

The top 5 most common amounts required the last time people used bridging finance:

- £500,001 to £600,000 - 11.49%

- £300,001 to £400,000 - 10.09%

- £400,001 to £500,000 - 10.09%

- £200,001 to £300,000 - 9.39%

- £600,001 to £700,000 - 8.39%

Larger loan sizes are in demand too, with a combined 26.57% of respondents' last use of bridging required loans of over £1m.

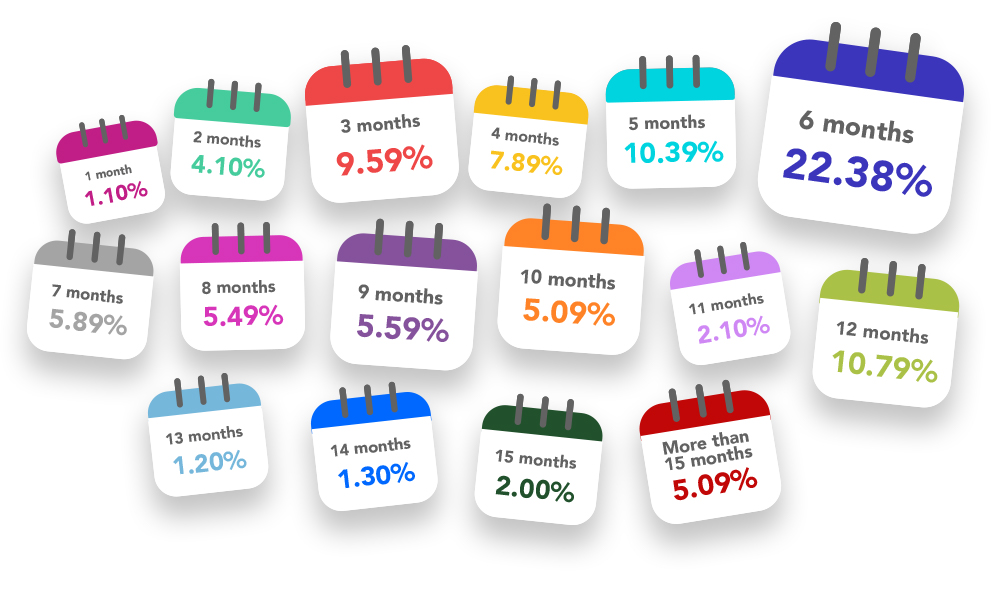

How long was the loan term the last time respondents used bridging finance?

The most common loan term the last time respondents used bridging finance was 6 months.

The top 5 loan lengths were:

- 6 months - 22.38%

- 12 months - 10.79%

- 5 months - 10.39%

- 3 months - 9.59%

- 4 months - 7.89%

The short-term nature of bridging loans is demonstrated but the combined loan term lengths. Over half of the last bridging loans utilised were for 1-6 months (55%), 35% were 7-12 months and 10% lasted over 13 months.

How many weeks did it take to arrange the finance and draw down the funds?

Known and utilised for their speed and ability to provide funding in urgent situations, bridging loans are possibly the quickest form of short-term finance for large sums you can access in the UK.

20.68% of funds were drawn down in 2-3 weeks, and a combined 57.04% were completed within 1-4 weeks.

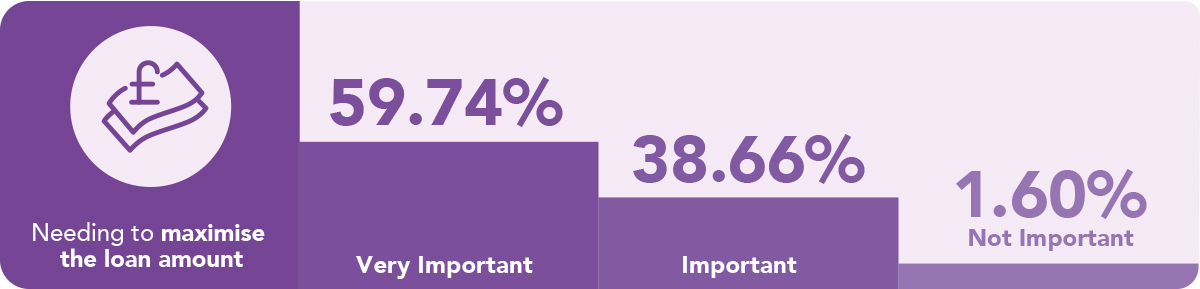

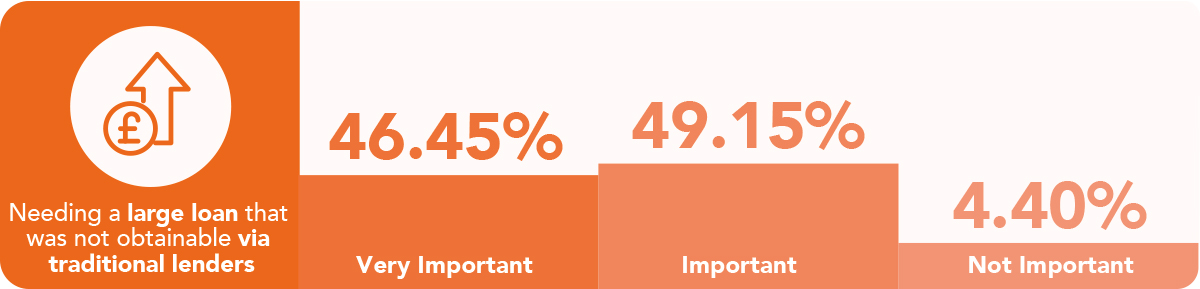

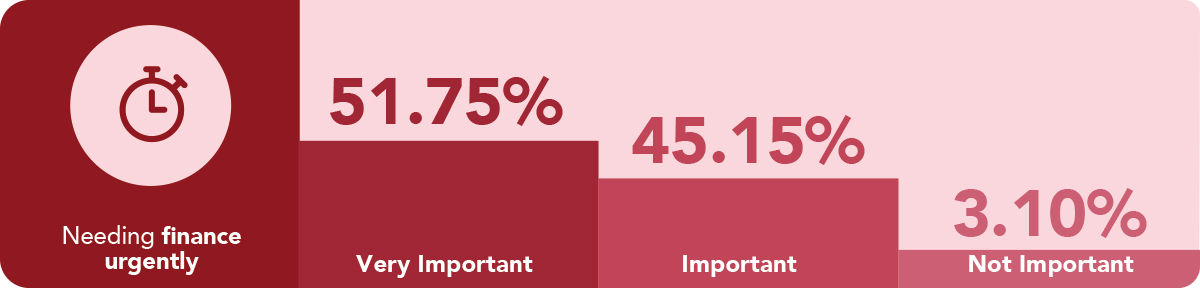

What were the most important factors when deciding to use bridging finance?

Maximising the loan amount was the most important reason for choosing bridging finance. A combined 98.4% said this reason was either Very important (59.74%) or Important (38.66%). Just 1.6% said maximising the amount wasn’t an important factor.

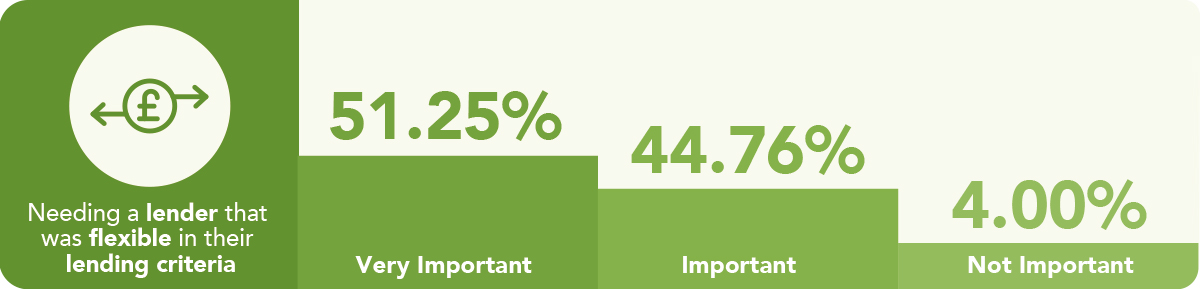

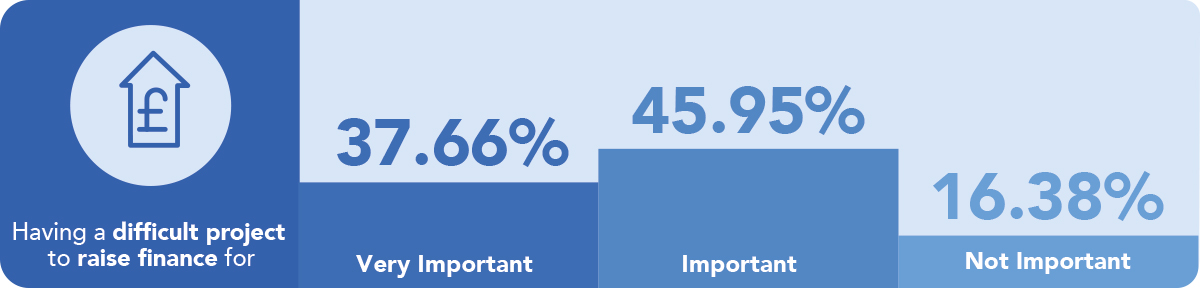

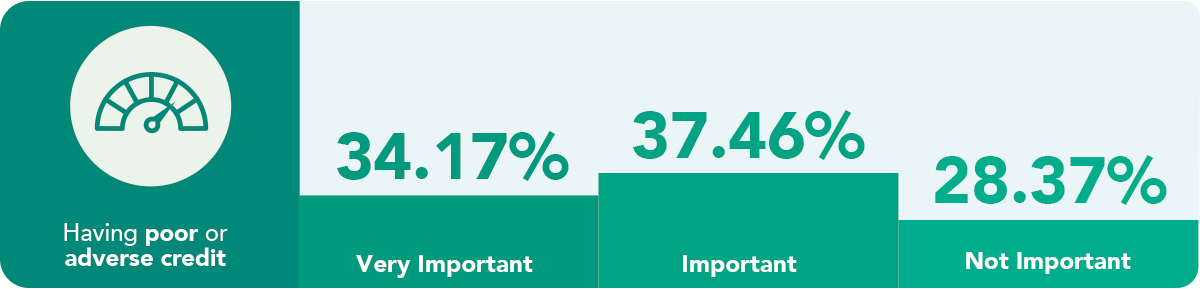

Urgency, lending flexibility, loan size and project difficulties were also important factors. And whilst bridging finance is an ideal option for people with poor or adverse credit, 28.37% of respondents said this wasn’t an important factor when choosing a bridging loan.

The most important factors for people when deciding to use bridging finance:

- Needed to maximise my loan amount - 98.40%

- Urgency - 96.90%

- Needed a lender who was flexible in their lending criteria - 96.01%

- Needed a large loan size that was not obtainable via traditional lenders - 95.60%

- Difficult project to raise finance for - 93.61%

- Poor/adverse credit - 71.63%

Needing to maximise the loan amount

Needing a large loan that was not obtainable via traditional lenders

Needing the finance urgently

Needing a lender that was flexible in their lending criteria

Having a difficult project to raise finance for

Having poor or adverse credit

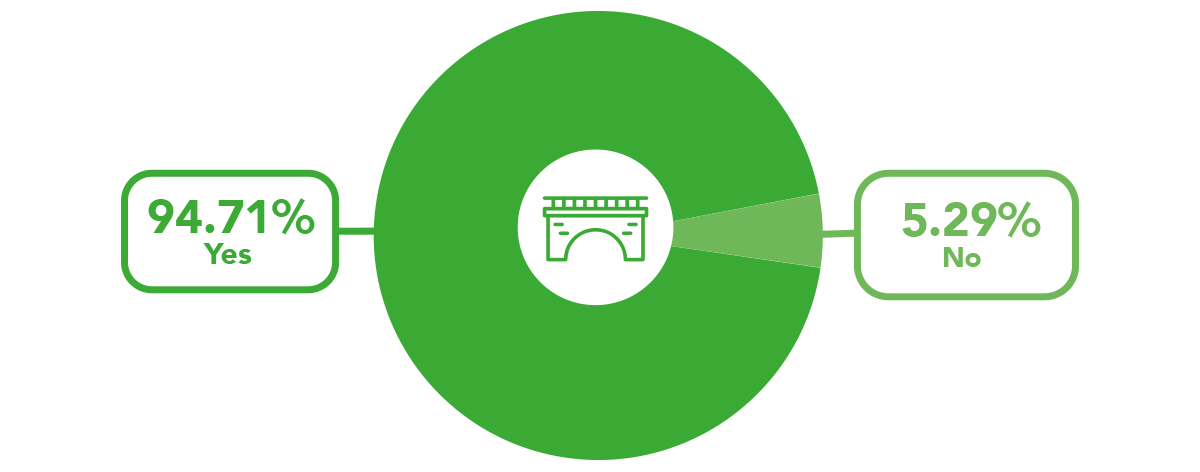

Would you use bridging finance again?

Overwhelmingly, 95% of people who have used bridging finance said they would use it again.

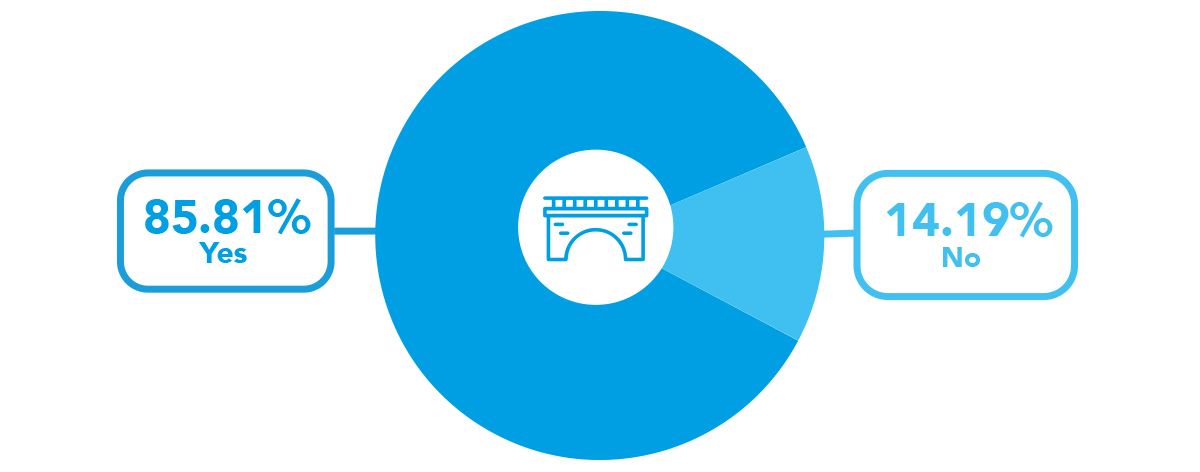

Are you likely to need bridging finance this year?

Brokers and lenders should be on alert! The expectation amongst people who have used bridging finance is that they will need it again this year.

Over 85% of respondents anticipate needing bridging finance over the forthcoming year.

With more and more homeowners turning to bridging due to the increasing requirement to fix broken property chains, uncertainty regarding interest rates and mortgage market difficulties, this comes as little surprise.

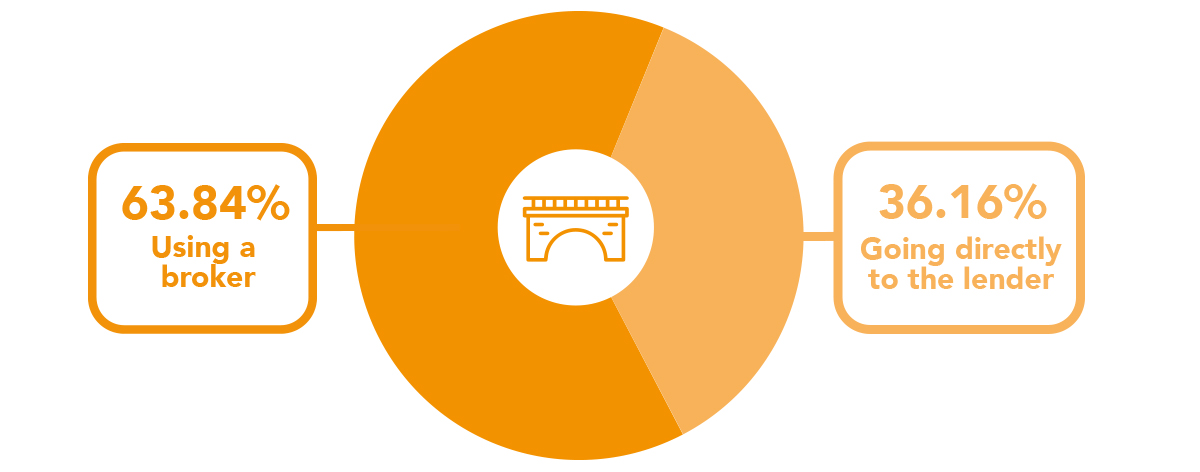

How did you source your bridging finance?

Bridging finance is more likely to be sourced via a broker vs going directly to the lender.

64% of bridging finance was sourced via a broker, and 36% was via a lender.

The most common reasons people chose to utilise a broker were the broker’s advice, the ability to get the best deal available in the market with more favourable terms and rates, speed and efficiency, and the help, understanding and comfort of a broker truly knowing the borrower’s needs and circumstances.

Those that chose to go direct to lenders tended to do so via recommendation, the perception that it’s quicker to get a loan approved, direct communication, and bypassing the fees that come with using a broker.

Access this survey's raw data in Excel format

Our survey statistics are available in the Microsoft Excel format. To access this please use the form below

| Poll Title: | Bridging Finance Report 2023 |

| Poll Objective: | To gain insights into the bridging finance market |

| Conducted: | April 20, 2023 |

| All Respondents: | 4,385 randomly sampled people in the UK |

| Qualified Respondents: | 1,001 |

| Screening Question: |

What types of finance have you used? Bridging finance - respondents qualified for survey |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 4,385, throughout the UK’s 68,926,840 population (worldometer) of which 1,001 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2023 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, or require an accessible unlocked version of this excel file, please in the first instance email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/bridging-loan/bridging-finance-report-2023 |