On this page

UK Business Owners’ Report 2023 How do UK business owners feel about the following... Energy bills Cost of living for yourself Cost of living for your employees Interest rates (base rate increase from 4% to 4.25%) Economic stagnation Property investment opportunities Business investment opportunities Employment tax Personal tax Fuel costs Food costs How do you feel about the following in the UK and their impact on your business? Labour shortages COVID Supply chain issues Wage inflation Employee pension contributions Remote working 4-day working week UK economy Revenue growth in your business Business rates Employee productivity Interest rates (business loans, property finance, overdrafts) VAT Corporation tax (as it rises from 19% to 25% in April) In the last 12 months, what financing did any of your businesses use? In the next 12 months do you anticipate changes to the following for your business... Does your business own property? If so, how many properties? Do you believe now is a good time to invest in the property market? Do you think you'll invest in property in 2023? How many businesses do you own in the UK? How many employees do you have? What industry is your business in?UK Business Owners’ Report 2023

The upcoming Corporation Tax increase has three-quarters of business owners Strongly Concerned or Concerned whilst increasing interest rates ranks amongst the biggest fears for their businesses.

In the days leading up to the Spring Budget, we surveyed 843 UK business owners to find out how they feel about the year ahead for their companies. We’ve discovered enormous concerns over labour shortages, taxes, rates and supply chain issues. However, business owners overwhelmingly believe now is a good time to invest in the property market.

With direct responses from UK business owners, this report will show you exactly how they feel about the current state of the economy, its impact on their businesses and their outlook on the 12 months ahead...

As Stephen Clark from Finbri, a property bridging loan broker, comments, “The recent Spring Budget and its corporation tax rise and the replacement of the ‘super-deduction' with the ‘full capital expensing' policy, is likely to be welcomed by only a very select amount of the biggest corporates, yet detrimental to smaller- to medium-sized businesses.

“The depth of concern amongst business owners, whilst anticipated, is alarming, but optimism regarding staff increases and the potential economic boost due to the determination from business owners to invest in the property market are positive discoveries.

“With the current state of the UK economy, some of the results may come as little surprise, but certainly many of the responses were alarming!

“Business owners are desperate for assistance from the government and many will feel their pleas have not been answered. Some changes proposed by the government, such as dealing with labour shortages by persuading thousands of people back into work may help - but will they be enough? ”

Key findings

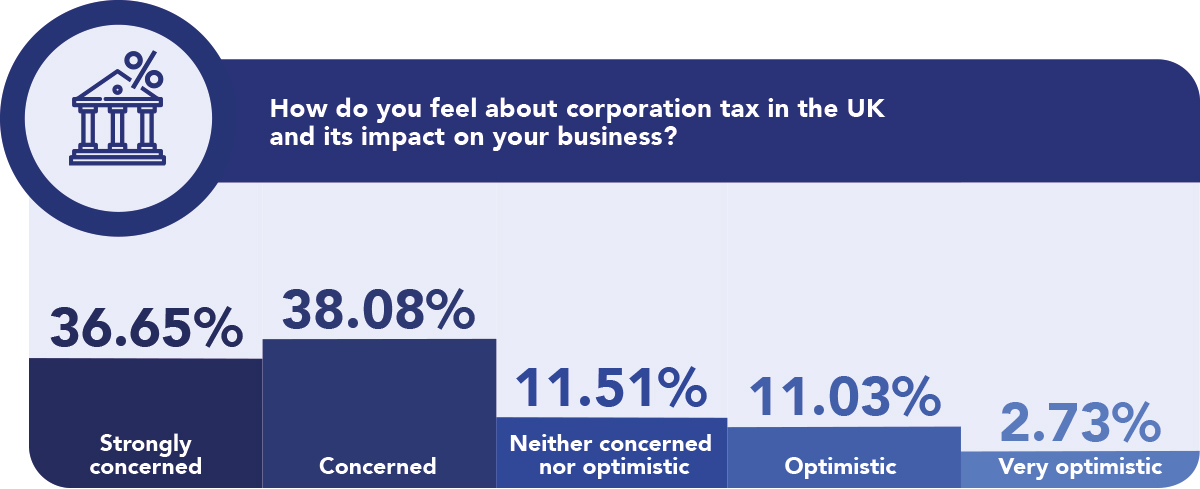

- Three-quarters (74.73%) of business owners are ‘Strongly concerned’ or ‘Concerned’ about the recently announced corporation tax increase from 19% to 25% effective from April.

- 71.89% of owners are ‘Strongly concerned’ or ‘Concerned’ about the impact of interest rates on their businesses.

- Labour shortages and their impact on their business are the biggest concern for owners with 83.51% ‘Strongly concerned’ or ‘Concerned’.

- Energy bills, economic stagnation, corporation tax, interest rates and business investment opportunities top the list of general concerns for business owners.

- In addition to labour shortages, the most significant concerns are increased corporation tax, interest rates, VAT and supply chain issues, and their impact on businesses.

- UK business owners are more concerned about the cost of living crisis for their employees than they are about themselves.

- Despite concerns about the UK economy and economic stagnation, business owners show strong intent to invest in residential, commercial and semi-commercial property in 2023.

How do UK business owners feel about the following…

We wanted to know what’s most important to UK business owners regarding current affairs, cost of living and other crises, different economic situations and upcoming changes. Asked to choose about the topics below if they were Strongly concerned, Concerned, Neither concerned nor optimistic, Optimistic or Very optimistic, we discovered these key findings about how UK business owners feel in regards to…

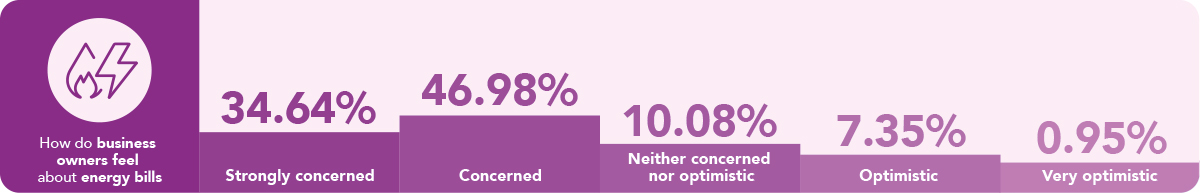

Of all the topics UK business owners were asked their feelings about, energy bills concern them the most. 81.62% of business owners are Strongly concerned or Concerned about the price of energy.

As announced by the government, energy bills for a typical household in Britain will remain at £2,500 until the end of June. They had been due to rise to £3,000 a year from April. And despite wholesale energy prices falling, electricity and gas bills have never been higher.

The government has U-turned on their plan to cut energy support, a plan that had warnings would force thousands more households into poverty. However, the one-off support of £400 that has been available over the winter in monthly instalments is still due to end on 1 April.

Whilst household energy bills are impacting households for company owners and employees, there is a significant cause for concern for businesses as the government will scale back support for businesses with energy bills after warning that the current level of help was too expensive.

A new Energy Bills Discount Scheme (EBDS) for businesses will begin in April. The new scheme will provide firms with a discount on wholesale prices. This is instead of costs being capped.

Total funding for the previous Energy Bill Relief Scheme is estimated at around £18 billion over the six months it ran. However, support from the new EBDS will be capped at £5.5 billion over the 12 months it will run. A considerable cut.

Heavy energy-using sectors such as mining and manufacturing are likely to get a bigger discount from the new scheme than others (equivalent to about £700,000 of support over 12 months). It's likely that only companies with the highest bills are likely to benefit.

And smaller businesses are at risk of closing as they can't afford the mounting energy costs.

The Federation of Small Businesses has warned that this reduced level support could leave hundreds of thousands small businesses which signed up for fixed tariffs facing huge hikes in their energy bills without sufficient government support to keep them afloat.

As a result of the impending rise in energy costs, Martin McTague, national chair of the Federation of Small Businesses said, “We estimate over 350,000, or 28% of small businesses who signed fixed tariffs last year, could need to shrink, restructure or close.”

A government spokesperson said: “The government has provided an unprecedented package of support, enabling some businesses to pay around half of predicted wholesale energy costs last winter, and we’ve pledged further energy support from April onwards through our Energy Bills Discount Scheme.

The jump on energy bills this April will be damaging to hundreds of thousands of small businesses who signed up to fixed contracts when the government discount was guaranteed under EBRS.

As businesses face higher bills and fight to survive, it's likely they will have to raise prices to cope, which will hit consumers and further drive up inflation.

Despite the uncertainty and rising costs, 7.35% of business owners remain optimistic about energy bills - perhaps because of the reduced amount of heating required as we begin Spring and approach warmer months ahead (in theory), or a lack of awareness of the end of the discount scheme.

The UK is in the midst of a cost of living crisis. From increasing supermarket prices and energy bills to transport costs, households are struggling to pay for everyday goods and their monthly bills.

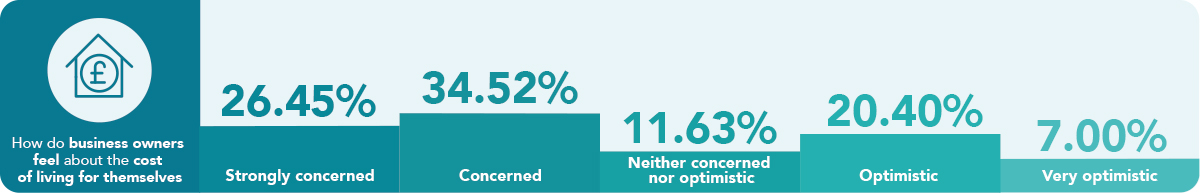

60.97% of the respondents said they were Strongly concerned or Concerned about their cost of living. 11.63% were neither concerned nor optimistic, whilst 27.40% were actually Optimistic or Very optimistic about their current cost of living circumstances.

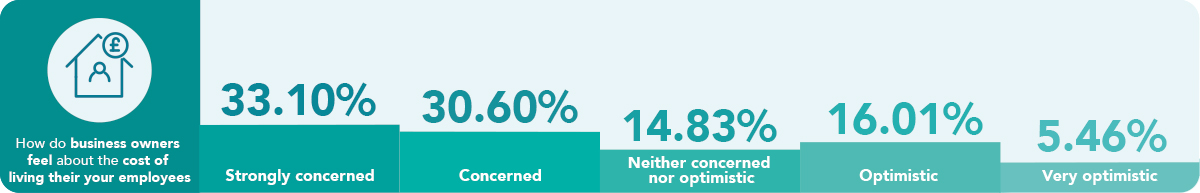

However, we have discovered that business owners are more concerned about the crisis for their employees…

Cost of living for your employees

Inflation has soared and is now at its highest level since the 1990s. And as a result, prices are rising with poorer households being hit the hardest as energy and food essentials account for a larger proportion of their bills than discretionary items.

Indeed according to an independent British think tank focused on improving living standards for those on low to middle incomes, the Resolution Foundation, on average the lowest-income families spend twice as much proportionately on food and housing bills as the richest.

And employers recognise that it’s impacting their staff more than themselves, as 63.70% of business owners are Strongly concerned or Concerned about the impact of the cost of living on their employees (vs 60.97% concerned about their own situation).

The cost of living has impacted UK consumers with more than half (55%) cutting back on discretionary spending since the start of the year. And the rise in utility bills has meant 63% of consumers have reduced their dining out, severely impacting business owners of pubs and restaurants and other hospitality companies.

Interest rates (base rate increase from 4% to 4.25%)

UK interest rates rose to the highest level in 14 years at the start of the year. That increase from 3.5% to 4% was the 10th time in a row interest rates increased.

Since then, rates have further increased to 4.25%.

Rising interest rates can significantly impact businesses' revenue. During a period of slower economic activity there is likely to be lower demand for goods or services and people are more reluctant to shop on credit.

Additionally. businesses will face higher borrowing costs, further eating into any profit margins and companies that own property will likely face increased monthly mortgage bills.

Since 2020, over 1.6M UK businesses have secured government-backed finance. And our survey discovered that 99.4% of businesses had utilised some form of finance over the last 12 months ranging from up to £10k to over £10m. This borrowing will be significantly impacted by the interest rate rise.

And even if companies are not directly impacted, they may still incur knock-on repercussions due to suppliers' increased prices for their goods, forcing them to raise their own prices or causing supply interruptions. This could increase inflation and further weaken sales.

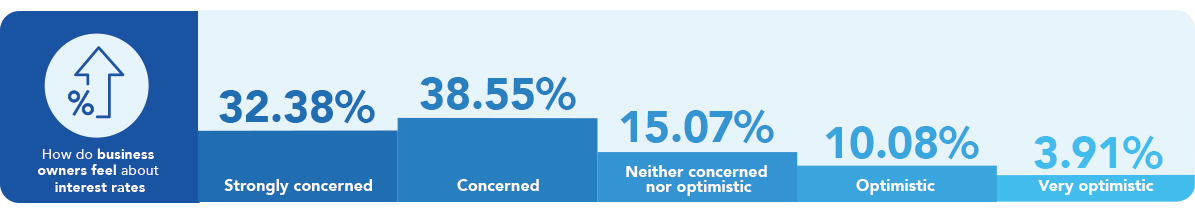

With the UK base rate predicted to peak at 4.5% in mid-2023, we asked UK business owners how they feel about base rates increasing from 4% to 4.25%.

And we’ve discovered that 70.93% of business owners are either Strongly concerned (32.38%) or Concerned (38.55%) about interest rates and the prospect they’ll increase to 4.25%. Just 10.08% are Optimistic and 3.91% are Very optimistic about interest rates.

Whilst a rebound across the UK’s services sector in February has meant an official recession has narrowly been avoided, consumer spending is down and the economy is flatlining - we’re in a period of economic stagnation with zero growth.

There are predictions that the economy may not grow until 2025 and there is still the possibility of a recession later in the year. Worryingly, the UK remains the only G7 member with an economy smaller than before the Covid-19 crisis.

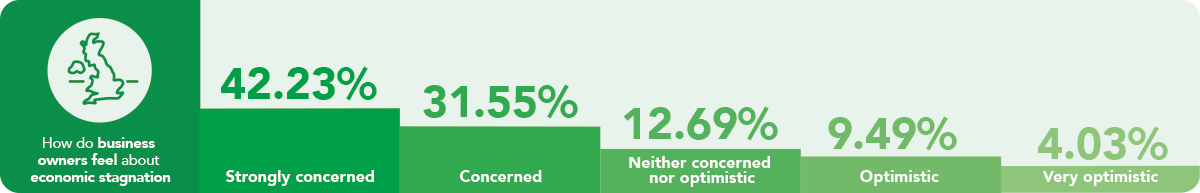

Economic stagnation has 73.78% of business owners Strongly concerned (42.23%) or Concerned (31.55%). The only item respondents were more worried about was energy bills.

There is an argument that whilst technically the UK has avoided recessions, we are in one in all but name. Whilst households and most businesses are suffering, corporate bank and energy company profits are booming - and both are in GDP, which will have been a reason we aren’t officially in a recession.

Property investment opportunities

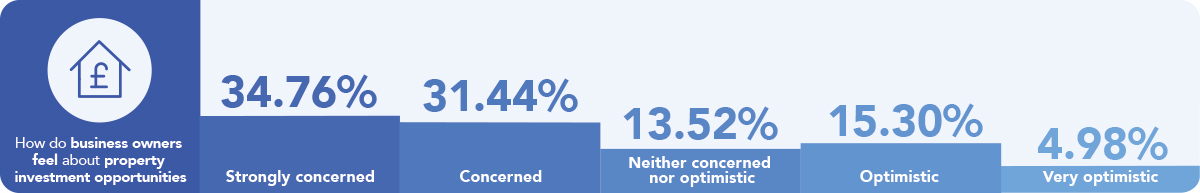

66.20% of business owners are Strongly concerned (34.76%) or Concerned (31.44%) about property investment opportunities.

However, we have discovered that whilst there are concerns over the opportunities to invest in properties, respondents believe that now is a good time to invest in the property market.

Perhaps because nearly 30 years of buy-to-let opportunities has cemented it as the go-to investment of choice. Despite reduced support from the government and many BTL landlords actively leaving the market.

From the mid-1990s the Labour government of Tony Blair promoted BTL to boost investment in the private rented sector. Rented accommodation at the time was too often of poor quality, and demand outstripped supply. The Association of Residential Lettings Agents (ARLA) launched the buy-to-let concept in September 1996 and it soon took off, thanks to generous tax breaks and helpful banks.

Today, there are more than 2 million buy-to-let mortgages active in the UK.

After the global financial crisis of 2008-9, banks became wary of lending to BTL customers, partly because they themselves were in trouble – some banks had to be rescued. By 2016, the government decided to prioritise home ownership and help first-time buyers, so it switched the focus of fiscal policy, abolished some of the tax benefits and made life more difficult for buy-to-let investors. A special Stamp Duty Land Tax levy of 3 per cent over standard rates came in for buy-to-let properties and you could no longer write off as much mortgage interest against tax.

The culture of BTL had become so engrained in British commercial and social life, with TV shows devoted to renovating old properties to let out, and millions of people getting involved, that it has outlasted government support.

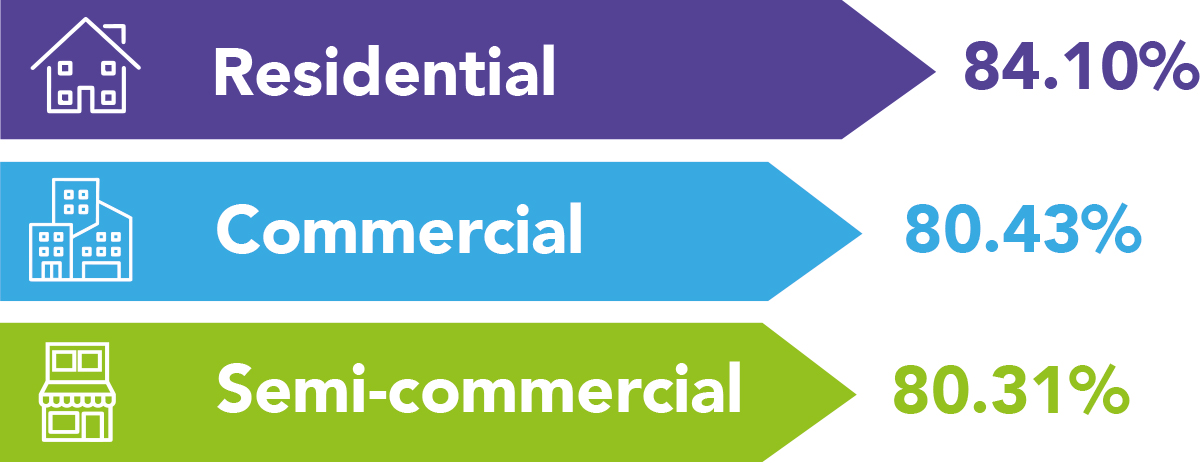

As we will cover in more depth later in the report, 84.10% said now is a good time to invest in residential property, 80.43% in commercial property and 80.31% in semi-commercial property. There may be insufficient available property stock for business owners to invest in.

Business investment opportunities

Whilst the rise in corporation tax will be a bitter pill to swallow for business owners, in an attempt to cushion the blow, businesses will be encouraged to invest via incentives.

Jeremy Hunt has said companies could offset 100% of their capital expenditure against profits. He said "full capital expensing" would run for three years and the intention is to make it permanent.

The government have announced the following:

- From April 2023 until the end of March 2026, companies can claim 100% capital allowances on qualifying plant and machinery investments - up to £1m.

- Full expensing allows companies to write off the cost of investment in one go.

But which companies will benefit from full capital expensing? The UK is estimated to have around 5.47 million small businesses, which account for 99.2% of the total business population. Those businesses have an average turnover of £286,482. So it’s unlikely small companies will spend enough on plant and machinery to go through the process of deduction. So this new rule appears only to encourage investment for the largest companies.

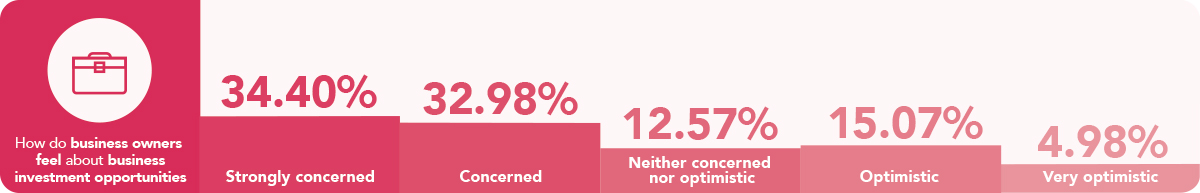

We’ve discovered 67.38% of business owners are Strongly concerned (34.40%) or Concerned (32.98%) about the investment opportunities they have for their businesses. 15.07% are Optimistic and 4.98% of business owners are Very optimistic.

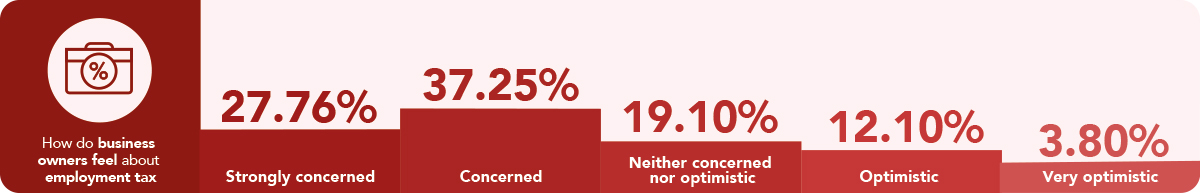

Employment tax has a combined 65.01% of UK business owners either Concerned (37.25%) or Strongly concerned (27.76%).

The proposed employer National Insurance measures announced in the Autumn Statement have been confirmed to take effect from 6 April 2023. This will freeze the rate at which employers start to pay Class 1 Secondary NICs for their employees at £9,100 per year from April 2023 until April 2028.

Just 15.90% feel Optimistic (12.10%) or Very optimistic (3.80%) about the tax.

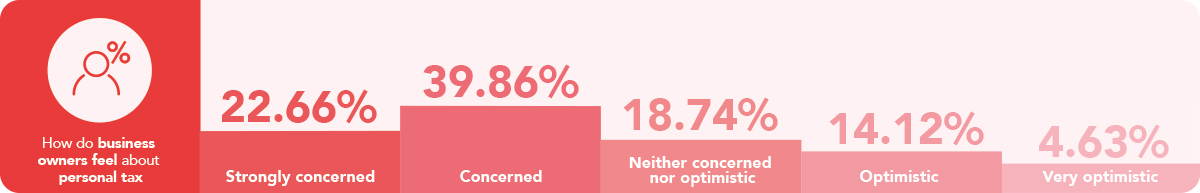

The changes to income tax rates and allowances that come into effect from 6 April 2023 were previously announced in the Autumn Statement and these will now be legislated for. There will be a freezing of personal allowances, a reduction in the threshold for the 45% additional rate to £125,000, and a reduction in the capital gains tax annual exempt amount to £6,000.

A combined 62.52% of UK business owners are either Concerned (39.86%) or Strongly concerned (22.66%) about personal tax.

18.75% feel Optimistic (20.40%) or Very optimistic (7%) about their personal tax situation.

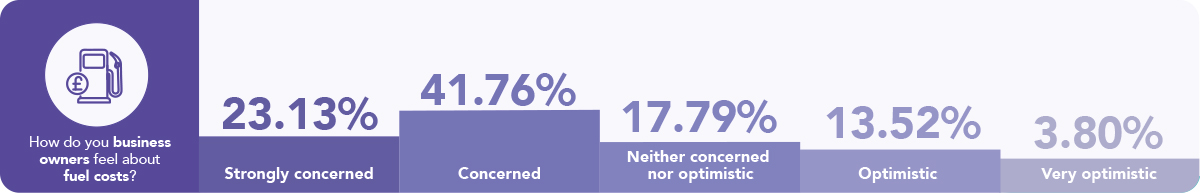

Fuel duty has been frozen for a 13th year as the government has extended the 5p-a-litre cut for 12 months.

It's estimated the freeze will save drivers around £6billion-a-year, with the RAC calculating that the 12-month extension to the 5p-a-litre fuel duty will save motorists around £3.30 each time at the pumps.

Whilst the freeze will be seen positively for daily motorists, it will also come as a welcome relief to business owners that rely on transporting goods by road for their businesses.

As fuel prices have a direct effect on transport costs and therefore any businesses' distribution costs, these drive up production costs and hence lower profits. Transportation companies are likely to be impacted the most.

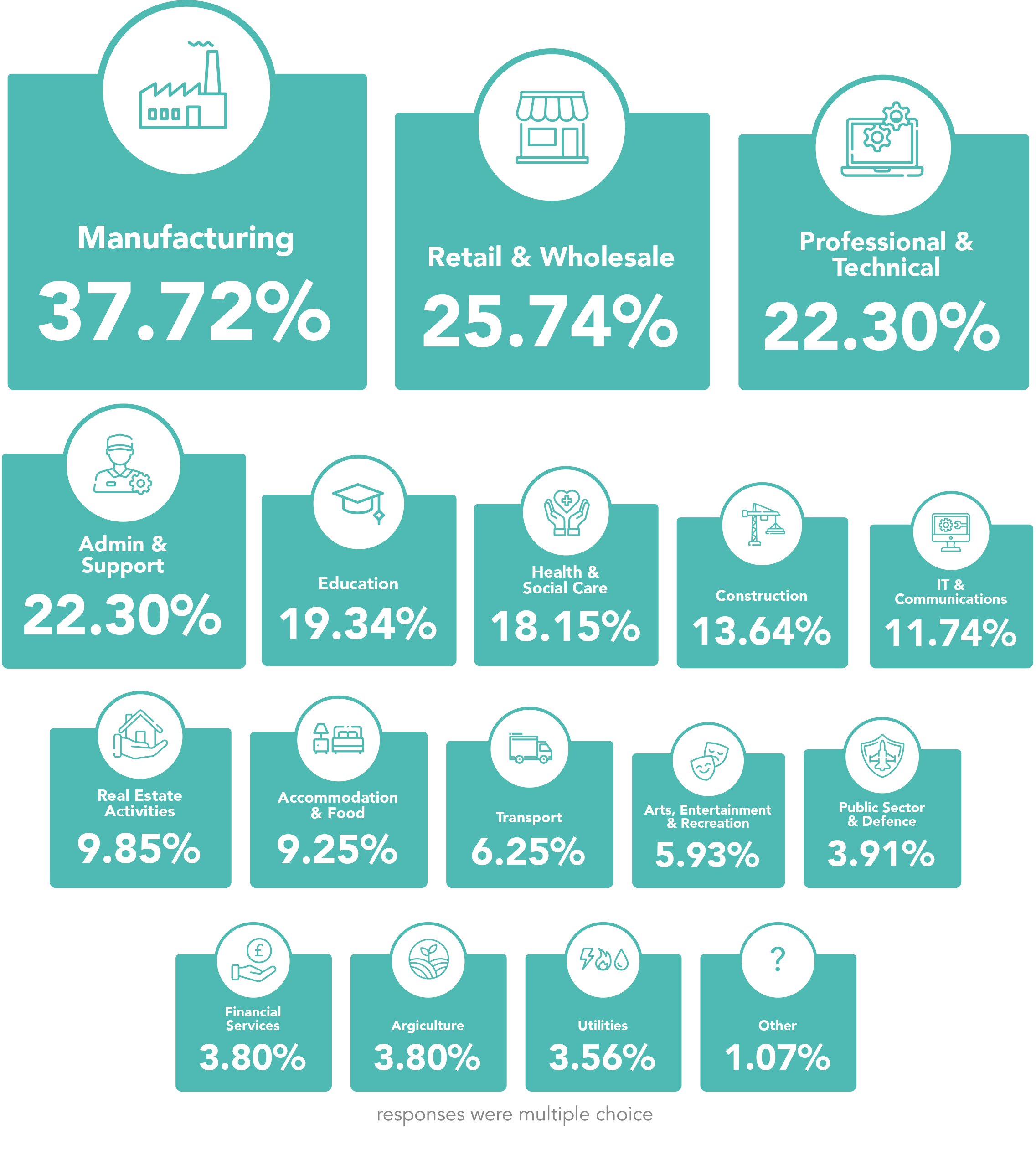

Our poll has discovered business owners of manufacturing, professional & technical and retail & wholesale, are the most concerned about fuel costs and their impact on their businesses.

There remains concern amongst business owners about fuel costs with 64.89% either Strongly concerned (23.13%) or Concerned (41.76%). Just 17.32% are either Optimistic (13.52%) or Very optimistic (3.80%).

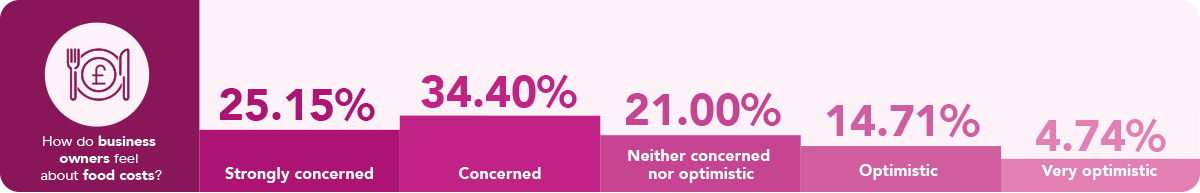

Food inflation is at a 45-year high, with supermarkets predicting grocery prices will remain elevated this year. And households are paying £811 a year more on grocery bills than 12 months ago. Households are now buying fewer items and changing buying habits to limit shopping bills.

The hospitality sector is being hit hard by the rising cost of food. with soaring inflation hitting the sector "as bad as COVID" according to the Hospitality Market Monitor.

Whilst 59.55% of respondents said they were Strongly concerned (25.15%) or Concerned (34.10%) about food costs, of all the current affairs, food costs concerned business owners the least. There was hope to be found within the results as 14.71% said they were Optimistic and 4.74% were Very optimistic about food costs.

How do you feel about the following in the UK and their impact on your business?

What is impacting owners and their businesses the most? What are owners concerned or optimistic about?

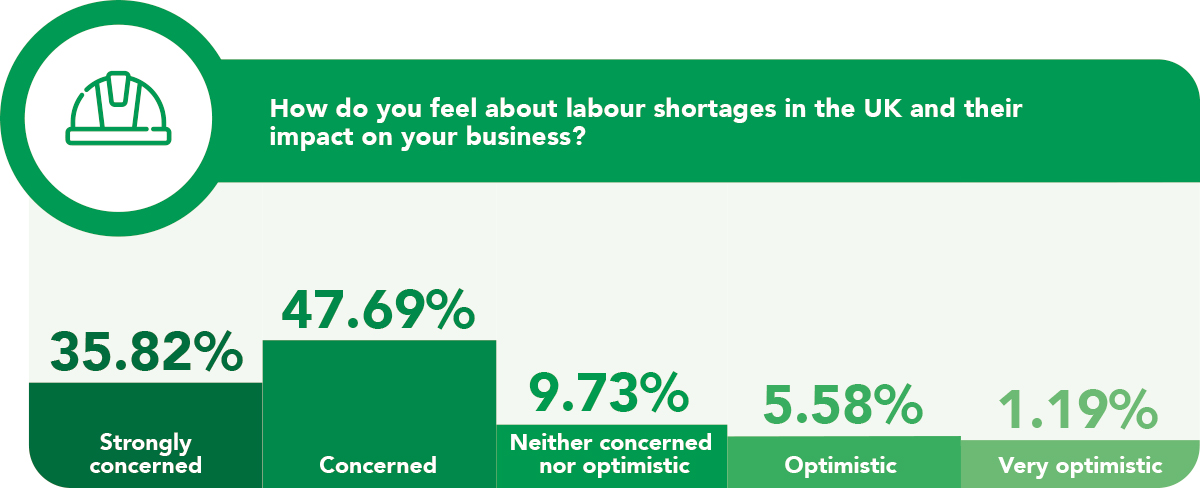

The impact of labour shortages on their businesses was the top concern for owners. 83.51% were Strongly concerned (35.82%) or Concerned (47.69%) about the lack of available labour.

Research from thinktanks, the Centre for European Reform (CER) and UK in a Changing Europe have reported that Brexit has led to a shortfall of 330,000 people in the UK labour force, mostly in the low-skilled economy, a report by leading researchers has found.

Accommodation and food services have been hit the hardest by labour shortages with 35% of businesses reporting a shortage in workers. 21% of construction firms reported labour shortages.

According to the most recent figures from the House of Commons, the sectors experiencing the greatest shortage in workers was:

- Accommodation and food services - 35% of businesses experiencing a shortage in workers

- Construction - 21%

- Human health and social works - 19%

- All businesses - 13%

- Education - 12%

- Manufacturing - 12%

- Administrative and support services - 12%

- Wholesale and retail trade - 11%

- Transportation and storage - 11%

- Other services - 10%

- Professional, scientific and technical… - 8%

- Arts, entertainment and recreation - 8%

- Real estate activities - 6%

- Information and communication - 4%

In the Spring Budget, the chancellor unveiled measures to improve labour availability for businesses. The plan? Persuade thousands of people back into work.

The budget introduces reforms to support disabled people, those with long-term health conditions, parents, the over 50s and people on Universal Credit in an attempt to get them to return to the workforce.

Whether these reforms are enough to persuade people back to work remains to be seen. Still, we do know that labour shortages top the list of concerns for businesses and a mere 6.77% of owners are Optimistic (5.58%) or Very optimistic (1.19%) about the current levels of labour available for their companies.

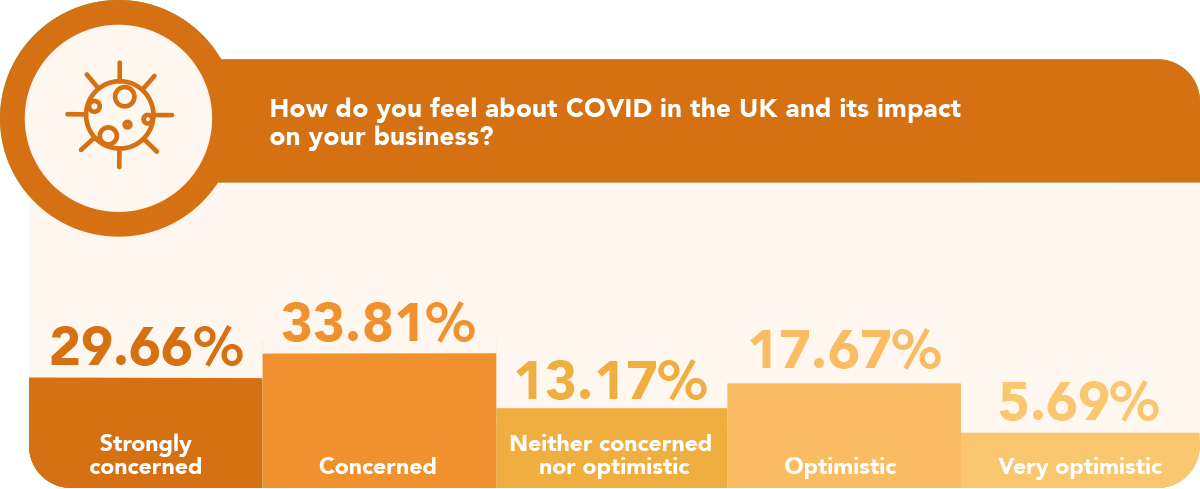

3 years on from the COVID-19 outbreak, business owners continue to worry about how the disease could still affect their businesses.

When asked about current situations in the UK and their impact on businesses, COVID was chosen as the item owners were most optimistic about. Nearly a quarter of business owners (23.36%) were either Optimistic (17.67%) or Very optimistic (5.69%) about COVID.

However, apprehension remains. 63.47% were still either Concerned (33.81%) or Very concerned (29.66%) about how COVID could still impact their business. It's possible this continued worry could be the fear of another pandemic and the prospect of future lockdowns, loss of revenue, furlough schemes and further risks to their business livelihoods.

70.70% of owners are Strongly concerned (37.72%) or Concerned (32.98%) about supply chain issues and their impact on their business.

Our survey discovered the industry most worried about supply chain issues is manufacturing, followed by retail and wholesale businesses. Industries that rely on efficient supply chains.

The causes of supply chain disruptions in the UK are complex. Labour shortages, Brexit trade barriers, global supply problems, and panic buying have all contributed, whilst the invasion of Ukraine has exacerbated supply chain issues.

Recent research from Barclays Corporate Banking claims that due to supply chain issues, essential parts and components, ingredients, and materials are being delayed. As a result, products with a total value of £3.6 billion are currently sitting in the warehouses of UK manufacturers waiting to be utilised. In an attempt to handle supply chain concerns, manufacturers are investing more money on storage space and attempting to source suppliers closer to their operations.

Despite high inflation and the cost of living crisis affecting millions of households, the latest data has shown UK wage growth slowed in the 3 months to January.

Wages growth fell to 5.7% from a revised 6% in December to leave the average pay rise 3.2% below the rate of inflation, the Office for National Statistics (ONS) said.

Pay growth in the private sector fell on average for the first time in a year from 7.3% to 7%.

Pay in finance and business services grew the most by 7.7%, followed by wages in the construction sector growing by 5.8%.

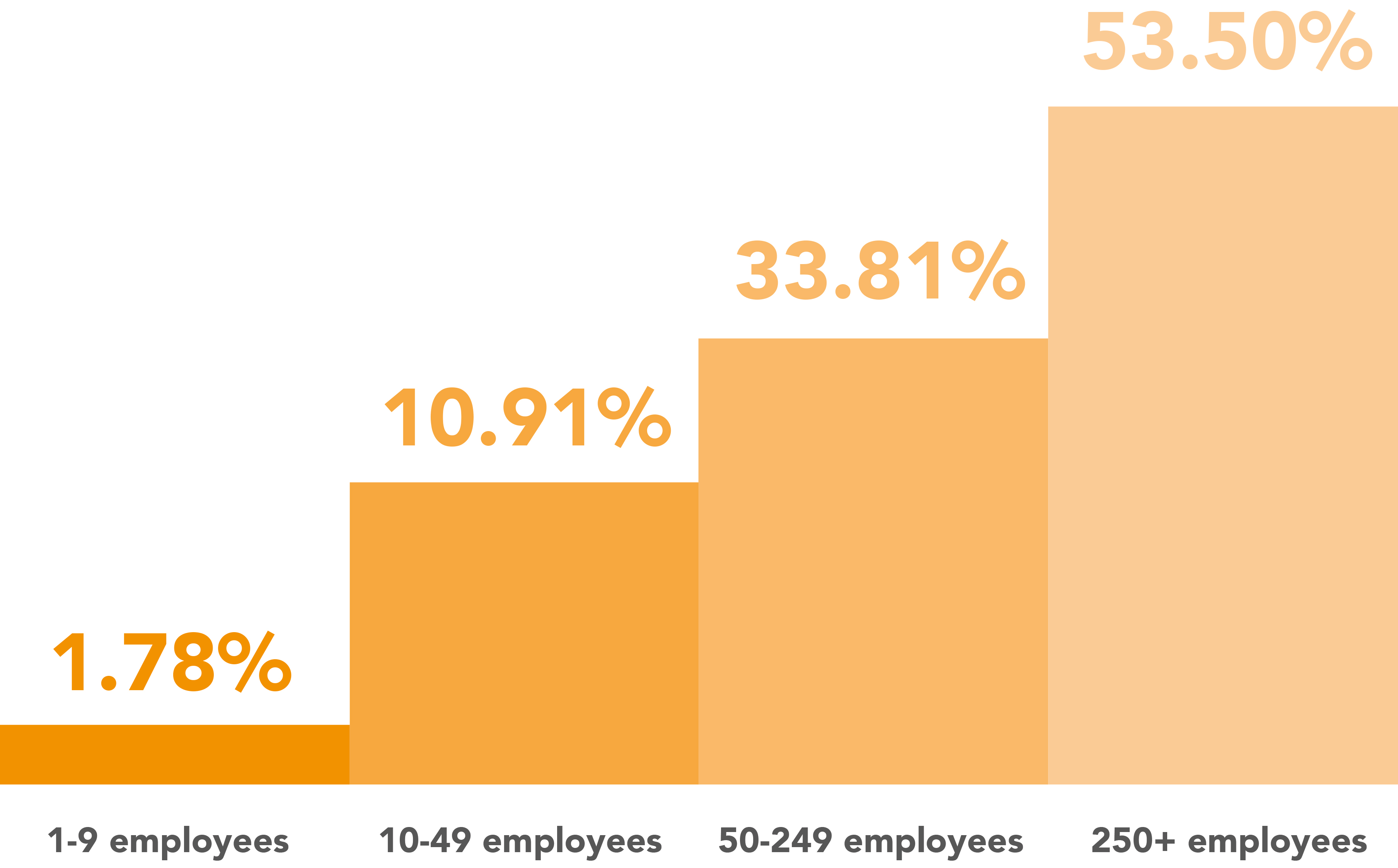

61.33% of owners are Concerned (37.25%) or Strongly concerned (24.08%) about wage inflation. Our survey discovered that most business owners employed 250+ employees (53.50% of owners), so any wage increase will be considerable.

19.10% of owners were neither concerned nor optimistic, whilst 16.48% were optimistic about wage inflation.

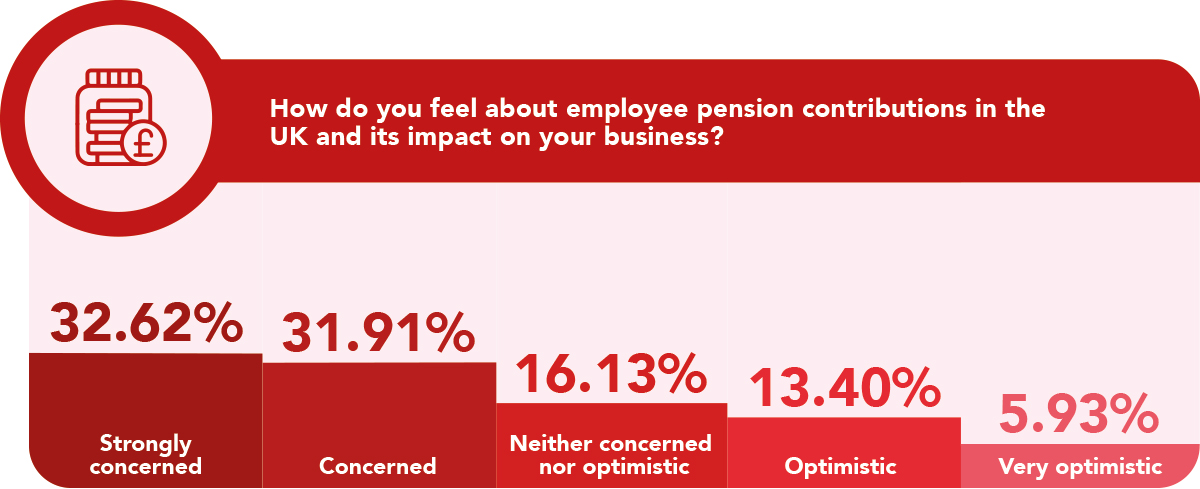

Employee pension contributions

The amount an employer pays towards their employee's pension depends on the type of workplace scheme and whether the employee has been automatically enrolled in a workplace pension or one the staff member has joined voluntarily (‘opted in’).

64.53% of business owners are Strongly concerned (32.62%) or Concerned (31.91%) about the current state of employee pension contributions. 16.13% are neither concerned nor optimistic. Whilst 19.33% are Optimistic (13.40%) or Very optimistic (5.93%).

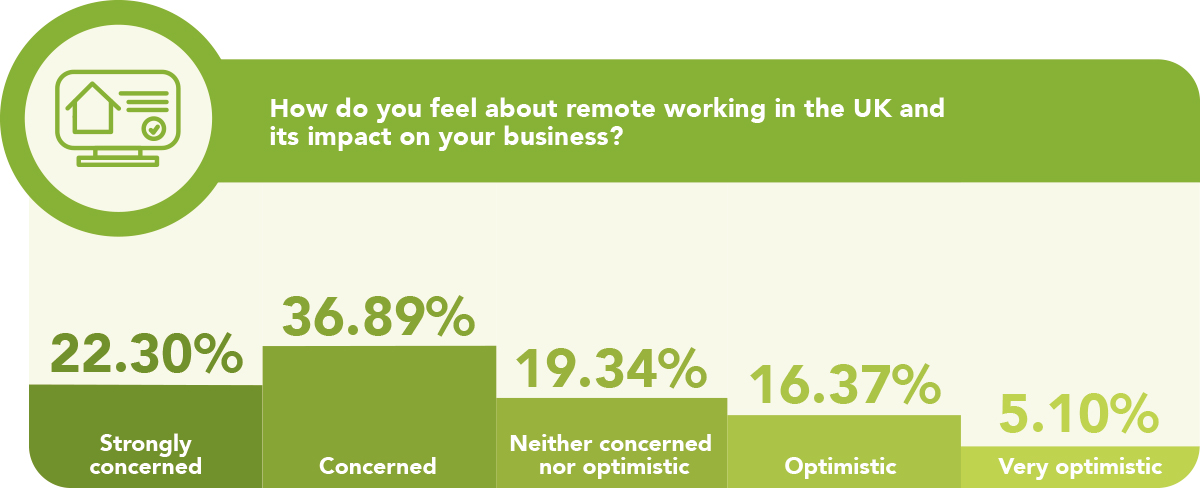

Simply put, the practice of remote working is being employed by a company but working outside of a traditional office environment, at home or elsewhere.

How we look at traditional working environments has changed dramatically since COVID-19. This March marks three years since the first UK lockdown started, prompting many previously exclusive office-based workers to immediately transition to home working.

A recent study on Linkedin combined with multiple worker surveys found that more than a third of UK workers would quit their job if they were forced to return to the office full-time.

And whilst remote working has been adopted by many businesses, there remains some doubt for owners who feel their companies are better suited to the collaborative environment of an office.

Whilst demand for remote roles is outstripping supply, almost half (49%) of company leaders in the UK and abroad have said they would prefer their employees to work more frequently from the office.

Remote working received the lowest negative responses to our survey. However, 59.19% of respondents said they were Strongly concerned (23.30%) or Concerned (36.89%) about the impact of remote working on their business.

Along with remote working, 4-day working weeks are a hot topic with many trials ongoing to test their effectiveness.

61 companies entered into a six-month trial to test the productivity and staff well-being associated with working a 4-day, 32-hour week. Of the companies involved, 56 have continued with a 4-day week, including 18 that have made it permanent.

2,900 employees across the UK have taken part in the pilot. Surveys of staff taken before and after found that 39% said they were less stressed, 40% were sleeping better and 54% said it was easier to balance work and home responsibilities.

The number of sick days taken during the trial fell by about two-thirds and 57% fewer staff left the firms taking part compared with the same period a year earlier.

The trial and survey findings will be presented to MPs.

However, UK businesses as a whole do not appear convinced or keen to change.

When the Chartered Institute of Personnel and Development (CIPD), representing human resources professionals, surveyed members last year, it found only a few employers expect to move to a four-day week in the next three years and two-thirds of employers expected no change in the next decade.

Our survey of discovered that, at least currently, business owners are concerned about the impact of a 4-day week on their companies.

60.86% said they were Concerned (32.98%) or Strongly concerned (27.88%) about the shift to 4-day working weeks. 19.57% of employers were neither concerned nor optimistic, whilst a combined 19.57% were Optimistic (14.47%) or Very optimistic (5.10%) about the move away from a 5-day working week.

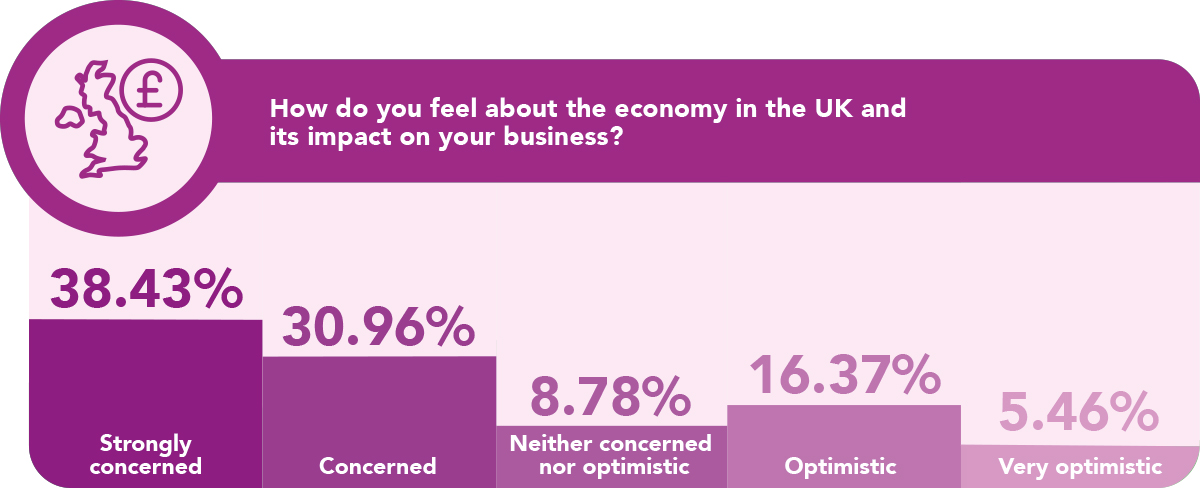

69.39% of business owners are Strongly concerned (38.43%) or Concerned (30.96%) about the state of the UK economy.

With the economy set to shrink in 2023, the British Chambers of Commerce (BCC) forecasts it will not return to its pre-pandemic size until the final quarter of 2024. But others are predicting a bleaker forecast.

In his budget, the chancellor announced the UK would avoid recession in his budget this year. However, whilst projections show the economy is set to avoid a technical recession, the chancellor also said the economy will shrink by 0.2% this year.

The surging cost of living is hitting households in the pocket and eating into wages. As a result, we are facing the biggest fall in spending power in 70 years. The government’s independent forecaster warned living standards won’t recover to pre-pandemic levels until 2027.

69.39% are Strongly concerned (38.43%) or Concerned (30.06%) about the UK economy.

Whilst the majority of business owners are concerned, one-fifth remain optimistic. 21.83% said they were Optimistic (16.37%) or Very optimistic (5.46%) about the UK economy.

Half of the companies (47.83%) that are looking on the brightest side about the UK economy and said they were Very optimistic are surprisingly in the retail and wholesale industry.

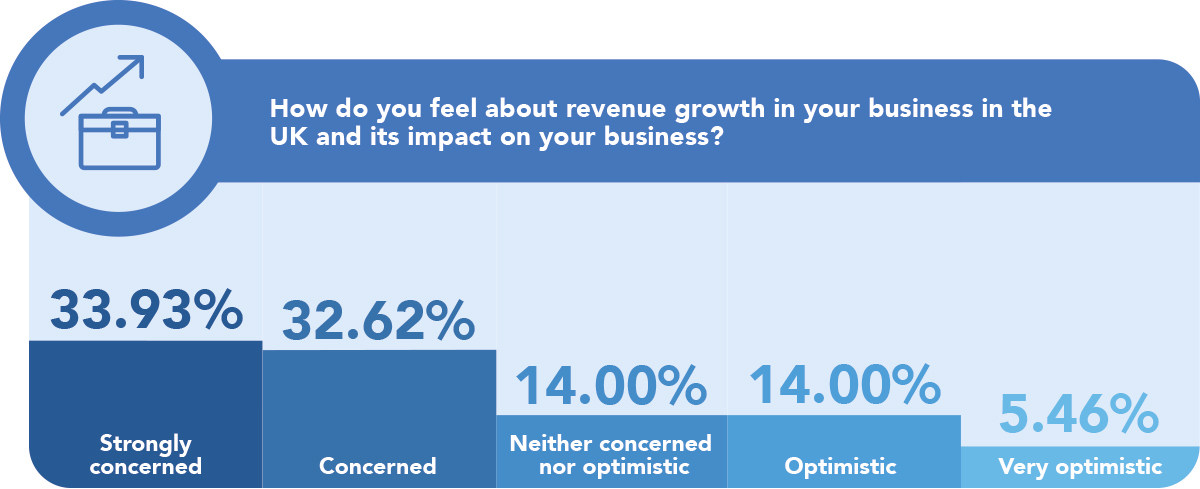

Revenue growth in your business

According to the British Chambers of Commerce, the UK GDP growth forecast for 2023 is -0.3%, 0.6% in 2024 and 0.9% in 2025.

66.55% of owners are Strongly concerned (33.93%) or Concerned (32.62%) about revenue growth in their business.

Only 5.46% are Very optimistic and 14.00% have an Optimistic outlook on revenue growth.

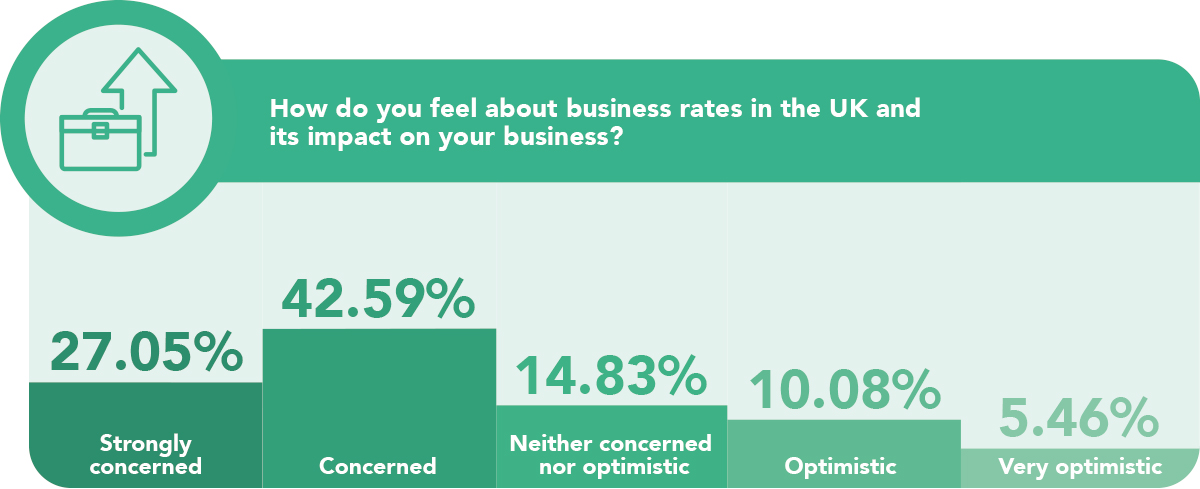

69.64% of owners are Concerned (42.59%) or Strongly concerned (27.05%) about business rates.

As business rates are a tax levied on business properties based on the property ‘rateable value’, with 92.76% of business owners we surveyed owning more than 1 business, it's easy to see why there is concern.

However, 15.54% of respondents were Optimistic (10.08%) or Very optimistic (5.46%) about business rates.

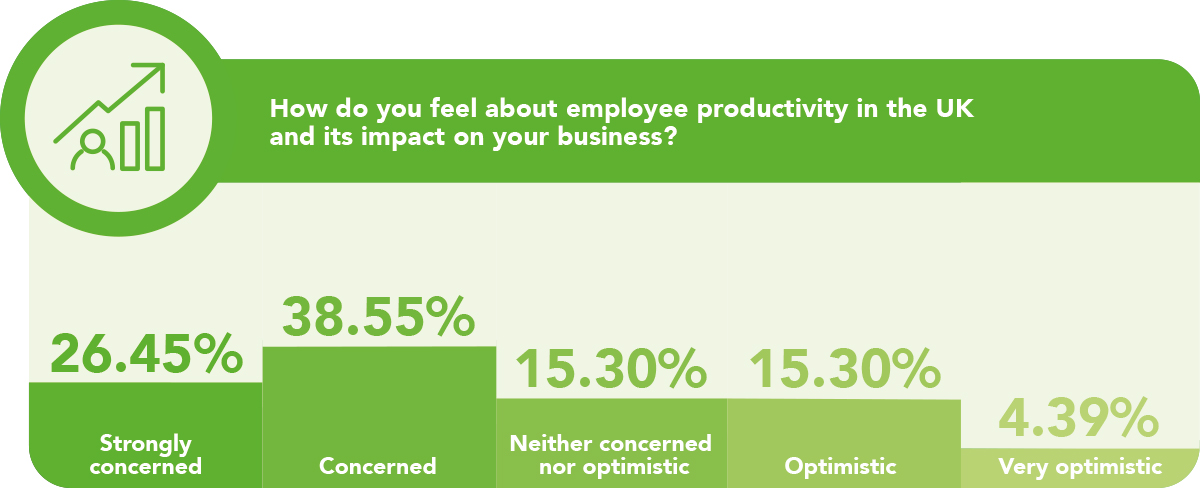

Just under a third (29%) of the UK workforce, or roughly 8.2 million people, say that financial concerns related to the cost of living have harmed their productivity at work, according to a study of more than 3,000 workers by one of the top employee benefits providers in the UK, Unum.

The poll discovered that financial concerns (29%), work-life balance (23%) and mental health difficulties (22%) are the top three problems influencing productivity this year.

And whilst we have already covered business owners’ feelings towards a four-day working week, studies indicate that this shift either maintains or improves worker productivity.

Our survey has discovered 65% of owners are Concerned (26.45%) or Strongly concerned (38.55%) about their staff productivity.

15.30% of employers are neither concerned nor optimistic, whilst 19.69% are Optimistic (15.30%) or Very optimistic (4.39%) about the productivity of their employees.

With the combination of labour shortages, the movement towards a 4-day work week, plus the increased use of AI, and the impact of cost-of-living on the wellbeing of workers, employee productivity will be a hot topic over the next 12 months.

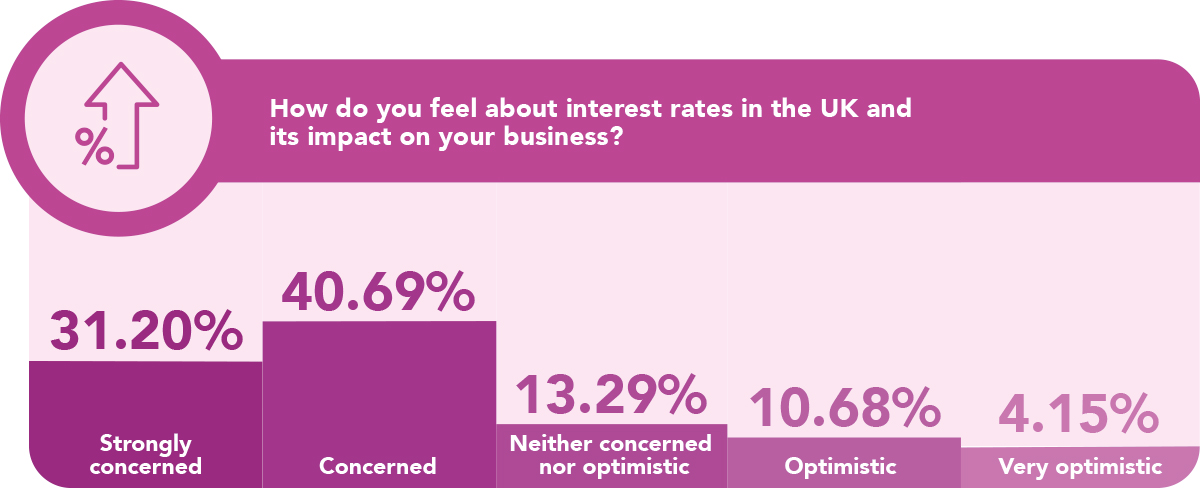

Interest rates (business loans, property finance, overdrafts)

With interest rates currently at 4.25%, the impact of the rise on business loans, property finance and overdrafts is being felt by business owners.

Some economists predict that interest rates could now be at their peak, but others suspect rates will rise again to 4.5% by this summer, and it’s one of the top reasons for concern amongst business owners. An alarming 71.89% of owners are either Concerned (40.69%) or Strongly concerned (31.20%) about interest rates and their impact on their businesses' finances.

Just 14.83% of owners were Optimistic (10.68%) or Very optimistic (4.15%) about interest rates.

The standard VAT percentage rate is 20% and applies to the vast majority of products and goods. However, there is a reduced rate on some children’s products and certain foods.

Whilst there were VAT exemptions on medical services in the recent budget, it’s a case of ‘as you were’ for VAT and its impact on businesses.

And owners are concerned.

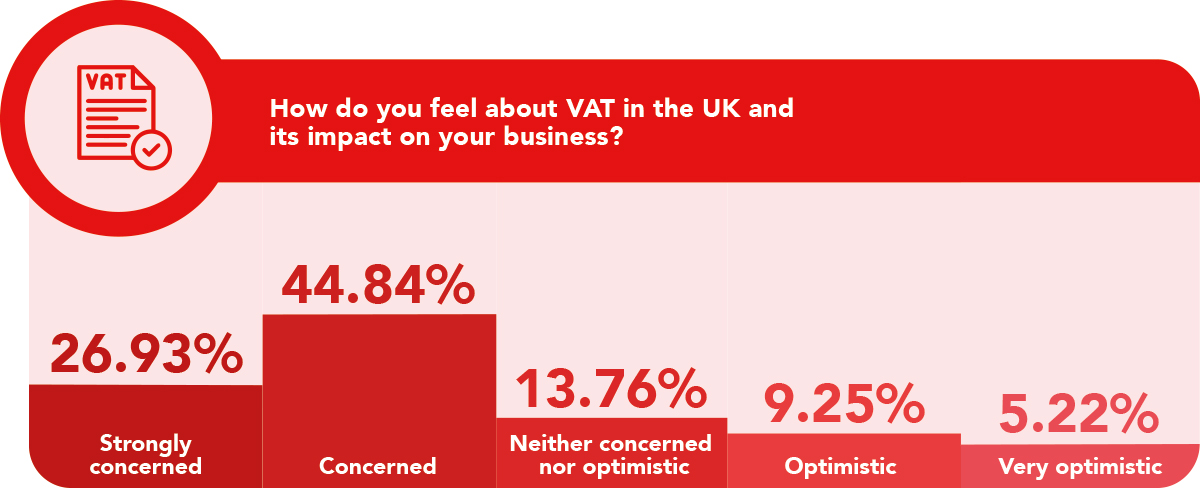

71.77% of owners are Concerned (44.84%) or Strongly concerned (26.93%) about VAT.

14.47% are Optimistic (9.25%) or Very optimistic (5.22%) about the impact of VAT on their business.

Corporation tax (as it rises from 19% to 25% in April)

The chancellor announced during the Spring Budget that the rate of corporation tax, paid on company profits, will rise in April - from 19% to 25% - the highest it's been in 12 years.

And this increase has three-quarters of business owners Strongly concerned (36.65%) or Concerned (38.08%). Only 13.76% of respondents claimed to be Optimistic (11.03%) or Very optimistic (2.73%) about the increase.

A possible reason for the optimism amongst business owners may come from new schemes aimed at encouraging investment. The chancellor’s “full capital expensing” policy will allow companies to deduct every pound invested in IT equipment, plant, or machinery from profits for the next three years. Still, as we’ve covered, this is likely only to benefit the largest companies in the UK.

The sector most concerned about the rise in Corporation Tax is manufacturing. Of the business owners Strongly concerned, 42.39% were in manufacturing. The next most concerned industry was professional & technical, with 20.71% strongly concerned - less than half the level of worry of manufacturing companies.

Of the 2.73% of business owners that are somehow optimistic about corporation tax increasing to 25%, 56.52% were in retail & wholesale.

In the last 12 months, what financing did any of your businesses use?

Of the 843 UK owners surveyed, we discovered how many had used the following types of financing to some degree for their business over the last 12 months:

- Commercial property finance - 94.54% of business owners had used commercial property finance

- Property development finance - 94.19%

- Asset finance - 92.88%

- Secured business finance - 92.65%

- Bridging finance - 89.91%

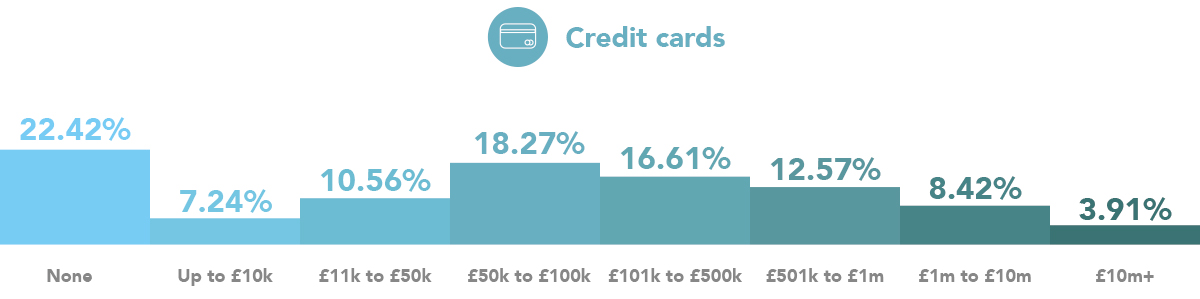

- Credit cards - 77.58%

- Invoice factoring - 77.47%

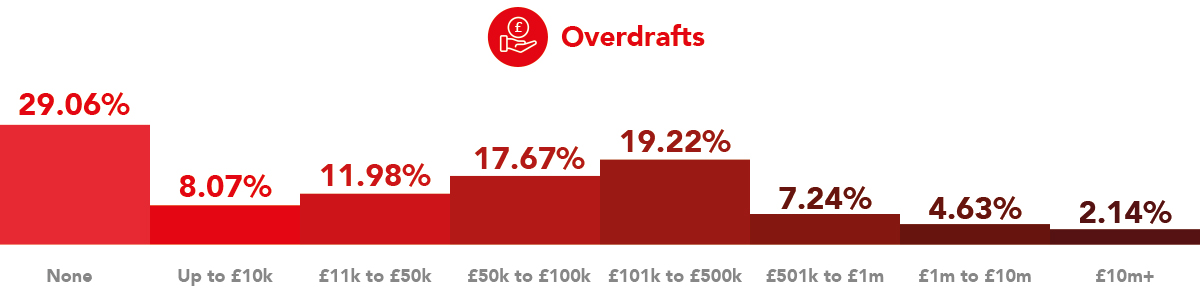

- Overdrafts - 70.95%

99.4% of business owners used at least one type of finance to support their business over the last 12 months. Only 5 business owners out of the 843 surveyed didn’t require any type of additional financing for their company. And each of these owners had just 1 business.

The amounts used per financing type is as follows:

Overdrafts

Credit cards

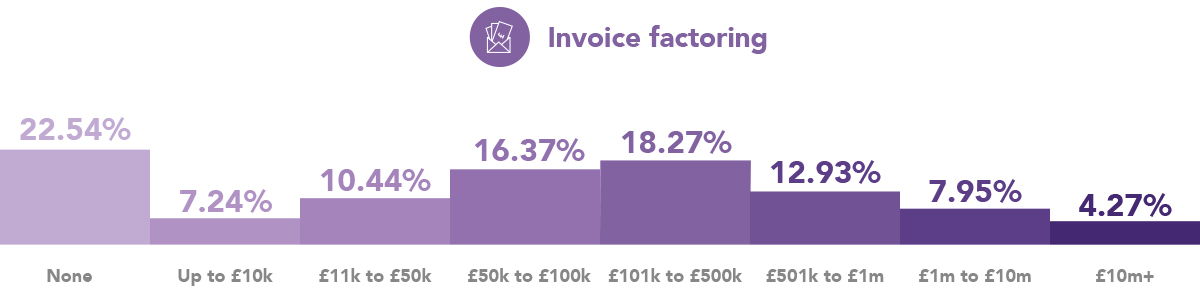

Invoice factoring

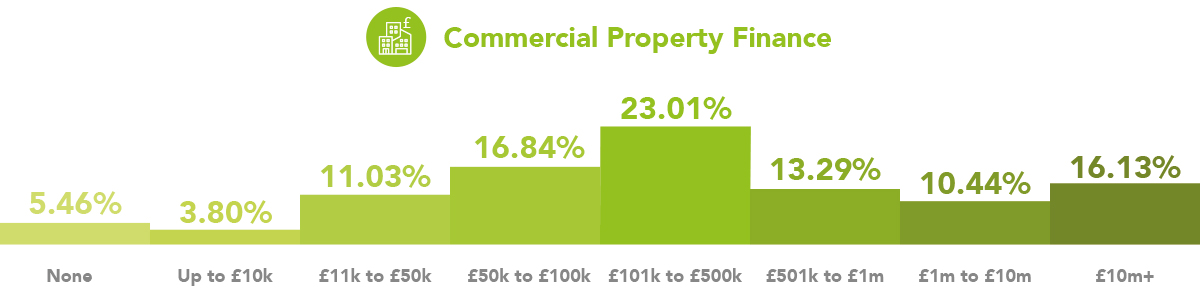

Commercial property finance

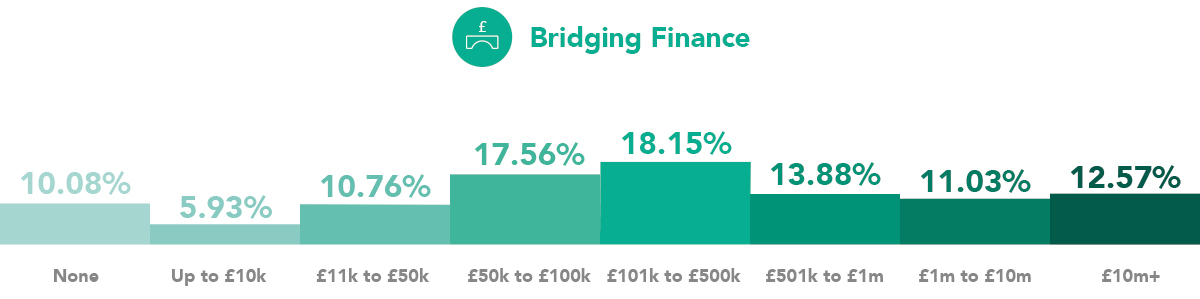

Bridging finance

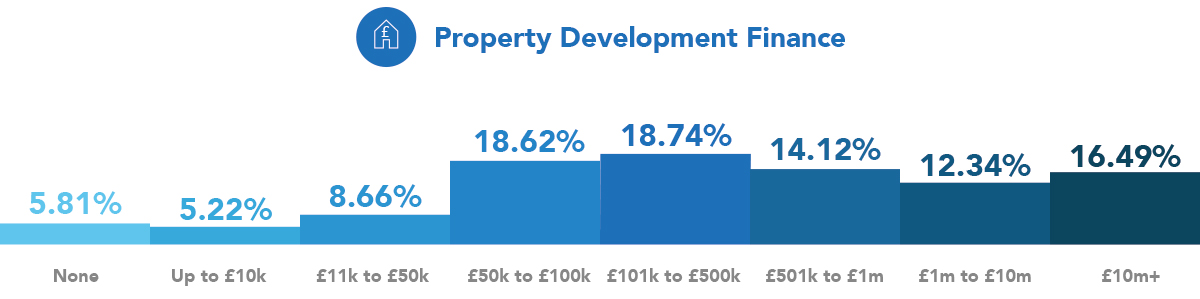

Property development finance

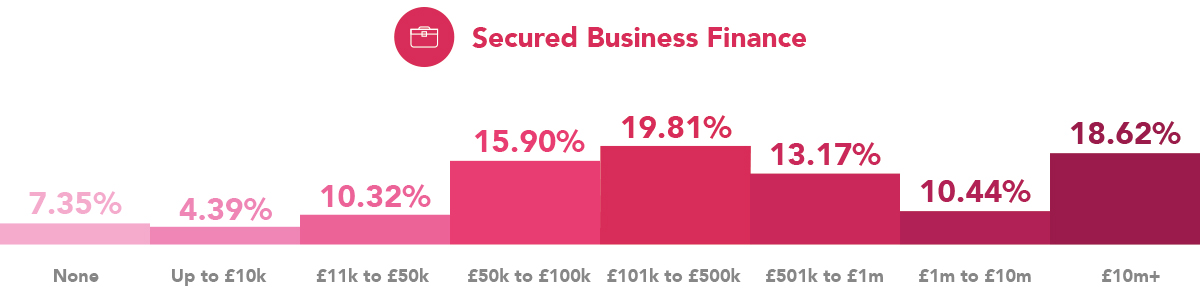

Secured business finance

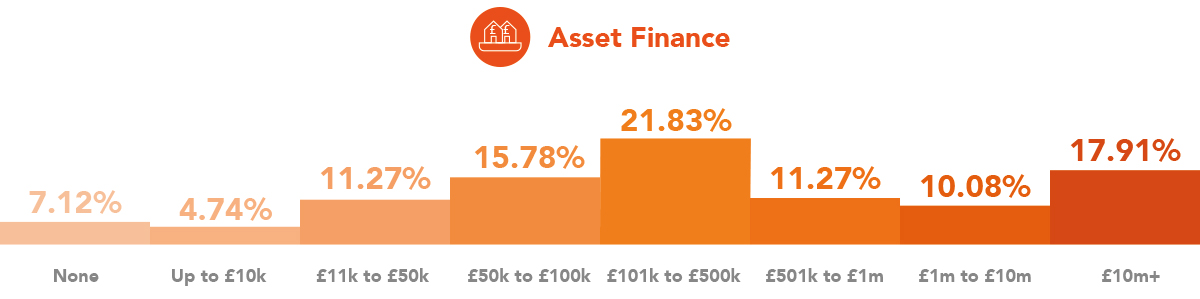

Asset finance

In the next 12 months do you anticipate changes to the following for your business…

Change is inevitable, but where do owners see their businesses' most significant increases or decreases over the next year?

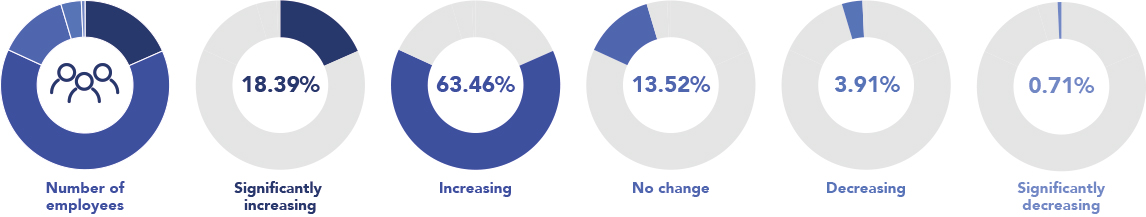

Owners believe the biggest change to their business over the next 12 months will be the increase in their number of employees. 81.85% of respondents said their number of employees would Increase (63.46%) or Significantly increase (18.39%) over the next year.

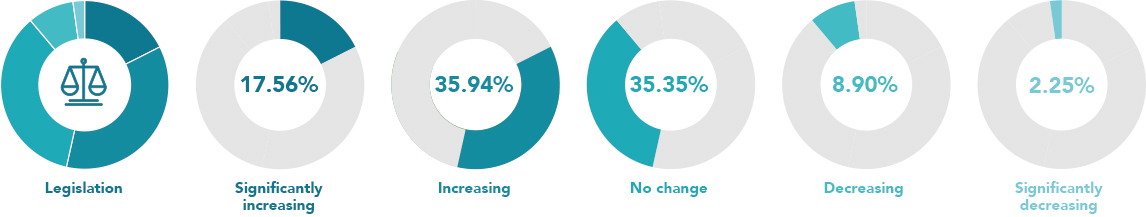

The most significant decrease anticipated by business owners was fuel costs with 13.28% expecting these costs to come down. The most selected No Change option was legislation which 35.35% of business owners feel will stay the same.

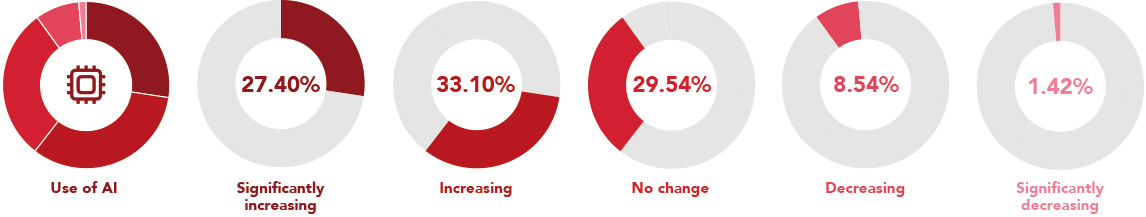

With ChatGPT and its rival from Google, Bard, artificial intelligence tools are a hot topic currently, and 60.50% of owners feel AI will be used more in their business over the next 12 months. However, possibly a sign that the implementation of AI will take more time than some predictions, 29.54% of business owners said there would be no change to their use of AI over the forthcoming year.

But change is on the horizon and the government is investing in the development of AI.

Government funding of around £1 billion has been committed towards the development of supercomputing and AI.

The new Quantum Strategy from the UK government, backed by £2.5 billion over the next ten years, is claimed to "pave the way for bringing new investment, fast-growing businesses and high-quality jobs to the UK."

Microsoft has invested billions of dollars into ChatGPT and the development of artificial intelligence (AI), according to Microsoft co-founder Bill Gates, is the most significant technological achievement in decades.

In a blog post, he compared it to the development of the microprocessor, personal computer, Internet, and the mobile phone.

According to Gates, "It will change the way people work, learn, travel, get health care, and communicate with each other".

Meanwhile, Elon Musk has called Bill Gates' understanding of AI as, 'limiited'.

Musk, who co-founded artificial intelligence research laboratory OpenAI, has signed an open letter with signatories including engineers from Amazon, DeepMind, Google, Meta and Microsoft, to urge a delay on the creation of "giant" AIs until world can be confident ‘effects will be positive and risks manageable’.

The letter says, “Recent months have seen AI labs locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one – not even their creators – can understand, predict, or reliably control."

But as with most things Musk-related, this open letter has sparked controversy after researchers cited in the letter condemned use of their work in the letter, some signatories were revealed to be fake, whilst others backed out on their support.

How AI will impact business owners and their companies will inevitably differ by industry. But with concerns ranging from Terminator 2-esque apocalyptic events, to programmable biases, to employees' concerns about whether AI will make their job obsolete, the role of AI is certain to remain a topic of much discussion and controversy over the next 12 months.

Number of employees

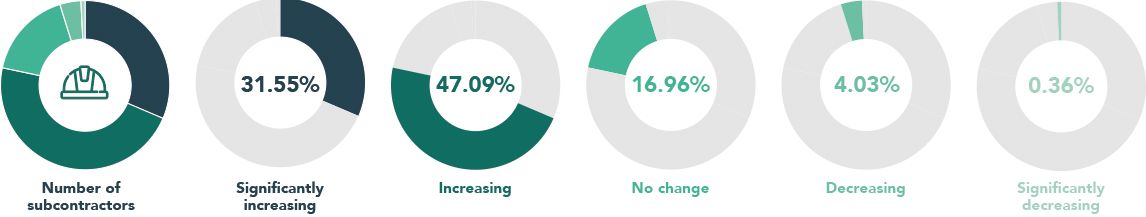

Number of subcontractors

Use of AI (artificial intelligence)

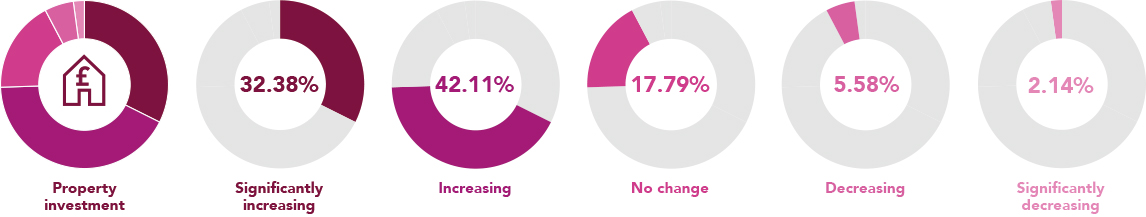

Property investment

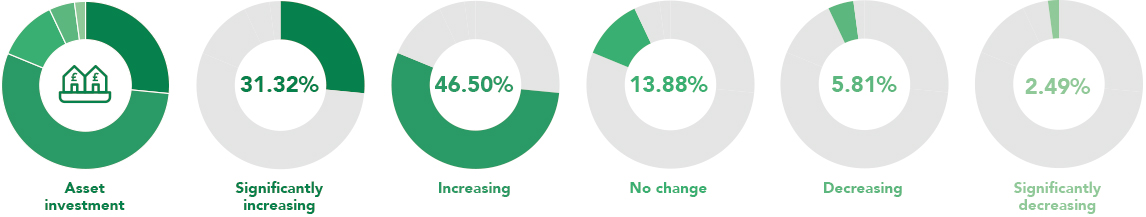

Asset investment

Legislation

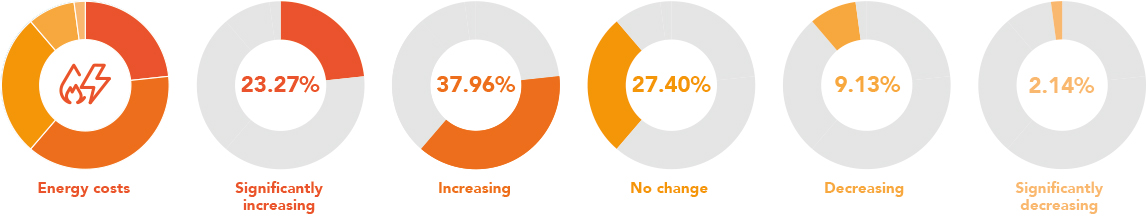

Energy costs

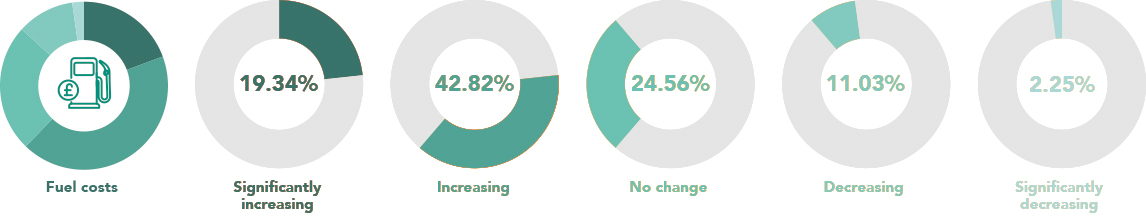

Fuel costs

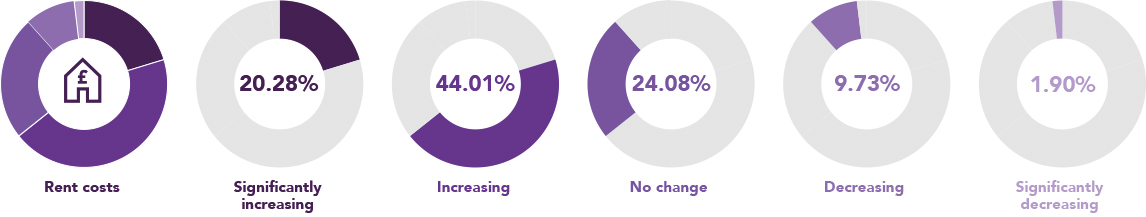

Rent costs

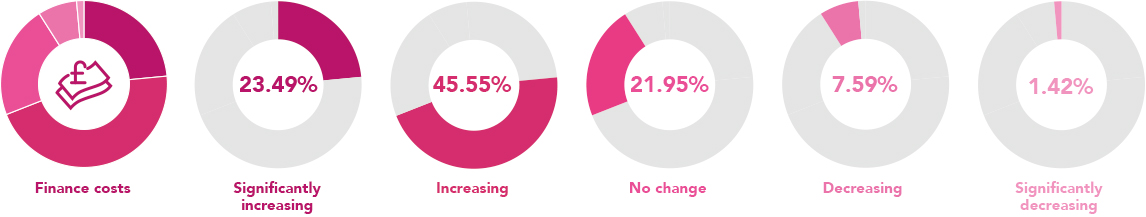

Finance costs

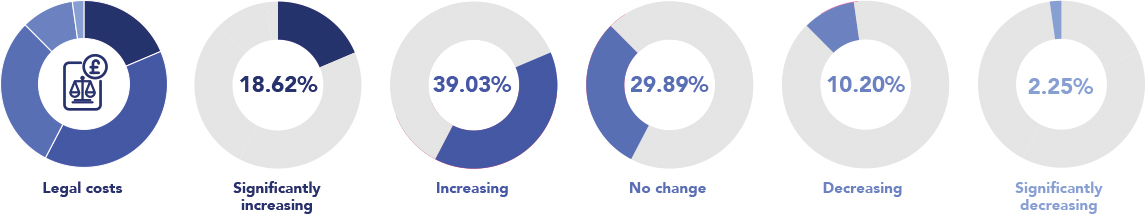

Legal costs

Food costs

Does your business own property? If so, how many properties?

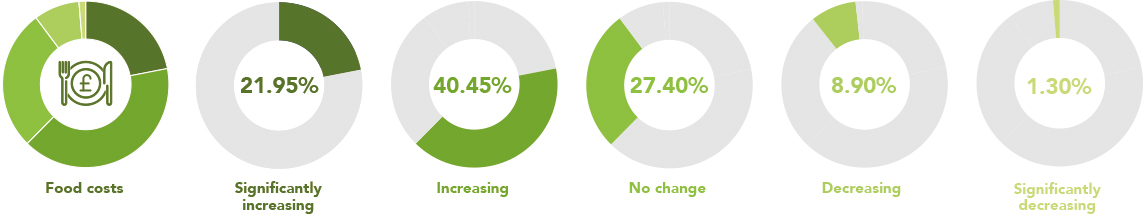

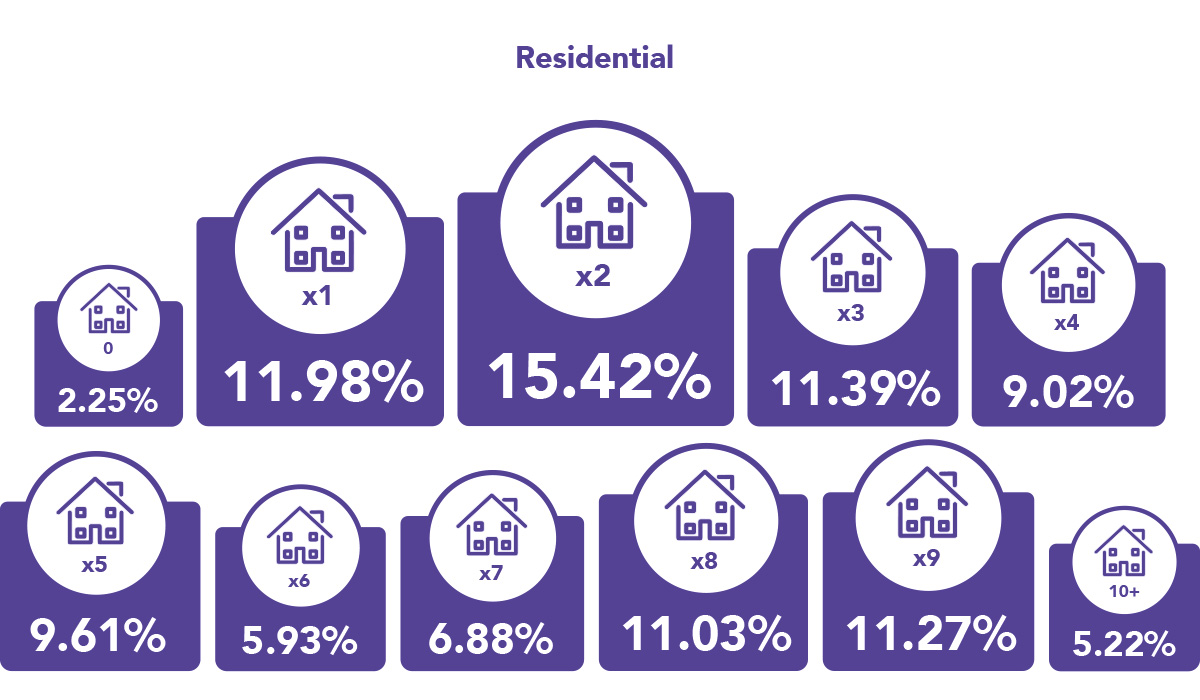

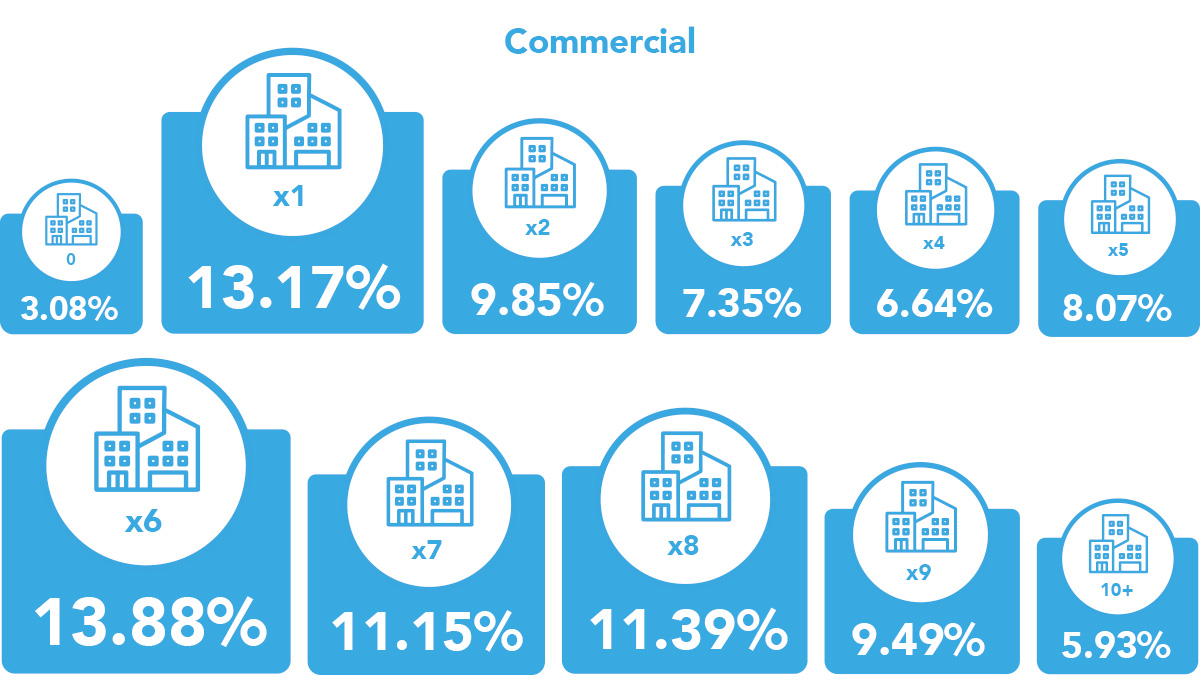

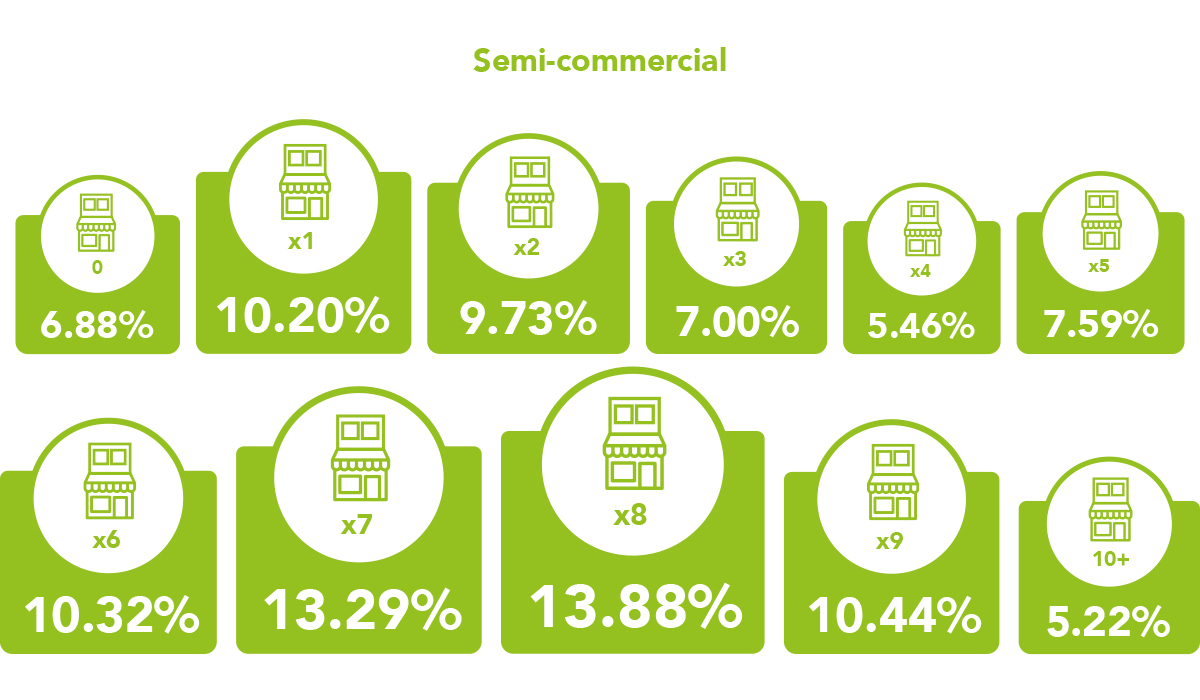

The majority of businesses own property. Of the company owners surveyed, 97.75% own one or more residential properties via their business, 96.92% own commercial property and 93.13% own semi-commercial property.

The full breakdown of the number of properties owned by UK businesses is as follows:

Residential

Commercial

Semi-commercial

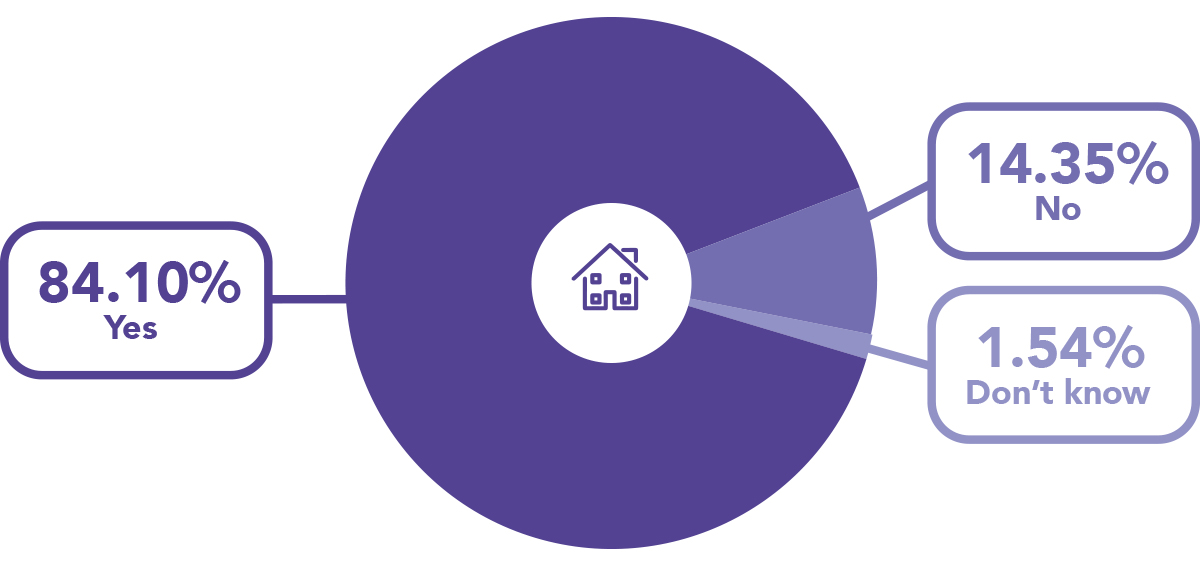

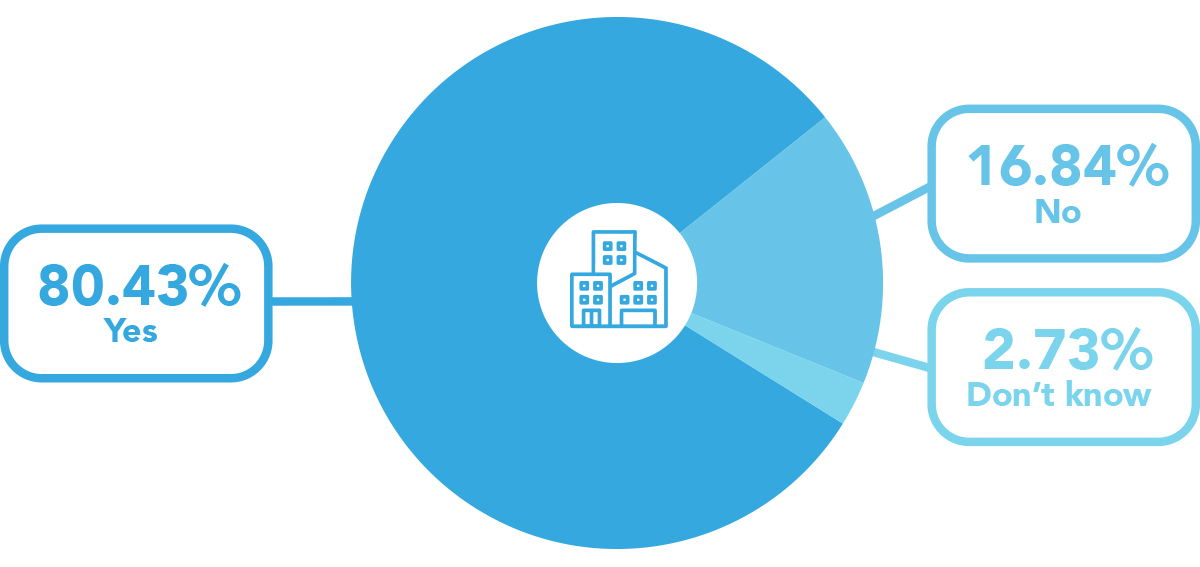

Do you believe now is a good time to invest in the property market?

Despite the concerns over the opportunities to invest, overwhelmingly, business owners in the UK believe that now is a good time to invest in the property market.

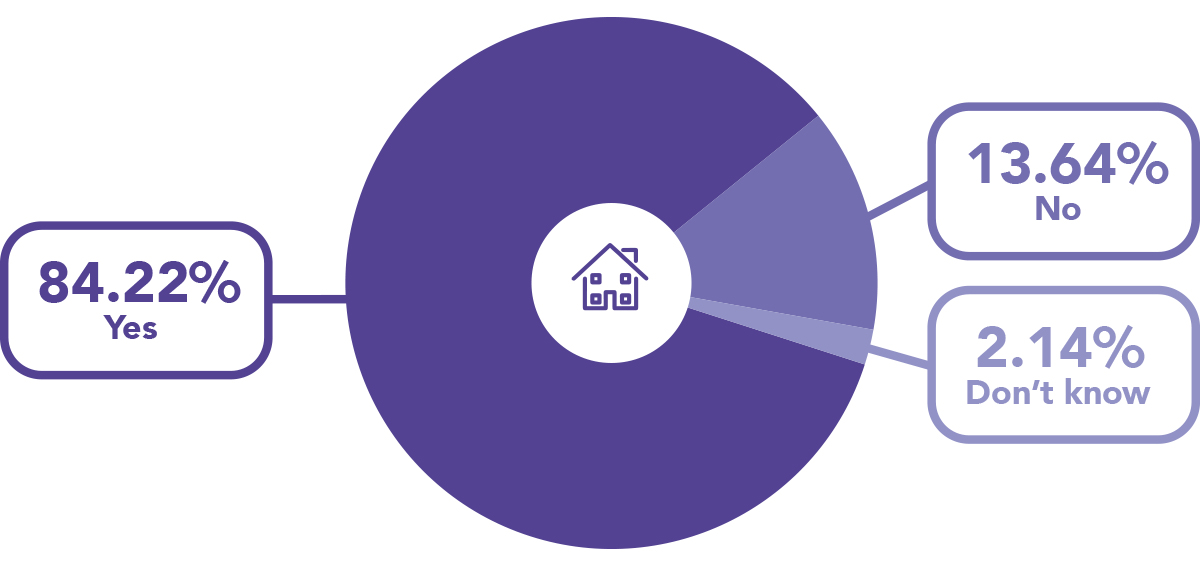

- Residential - 84.10% (said Yes, it’s a good time to invest)

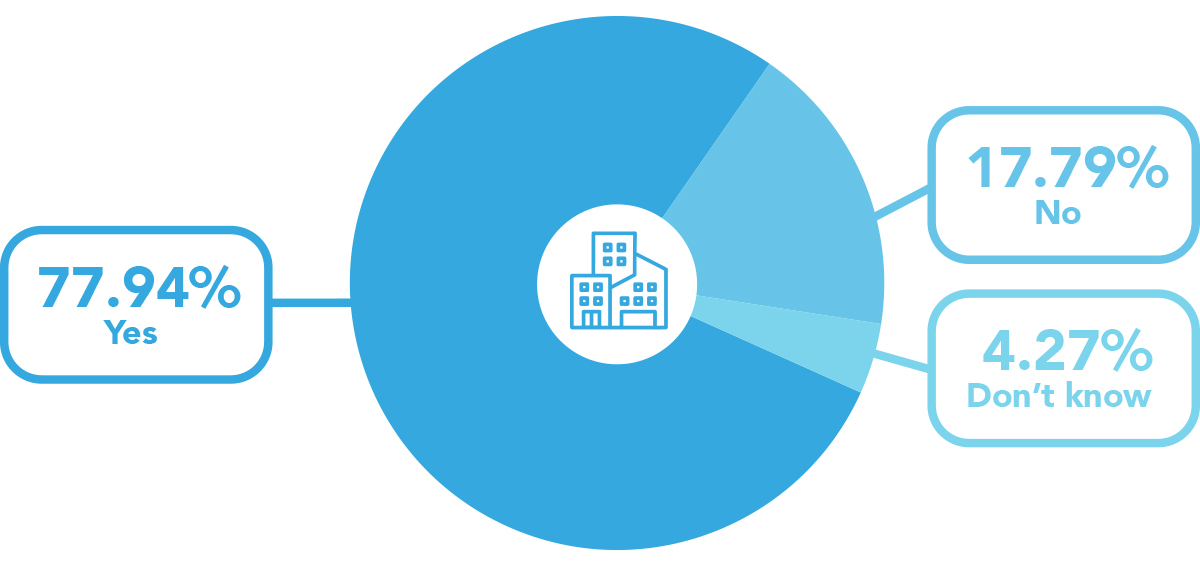

- Commercial - 80.43%

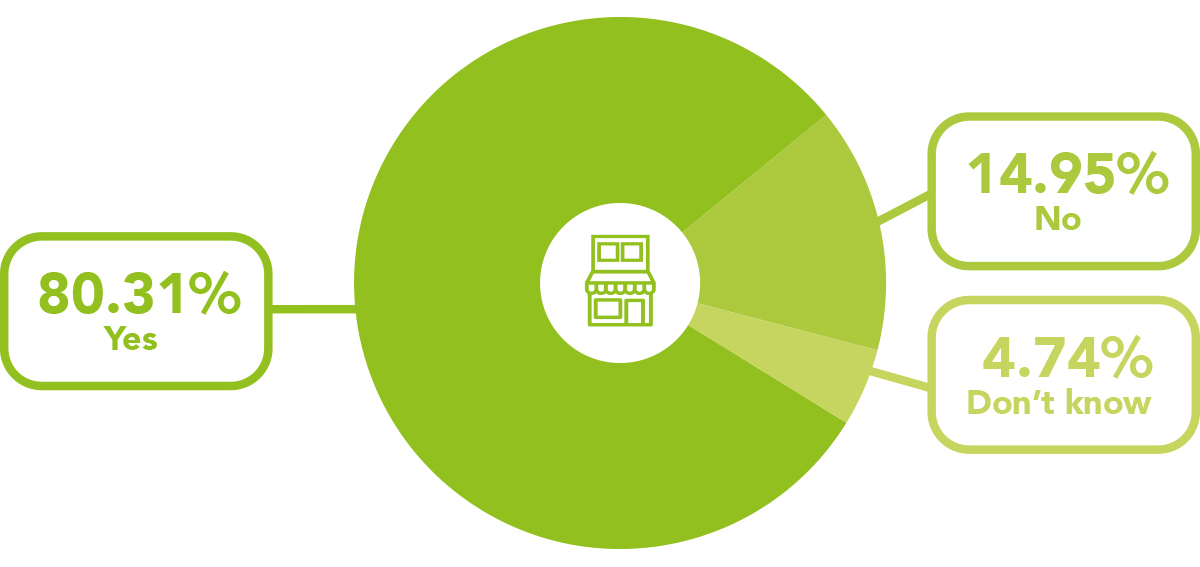

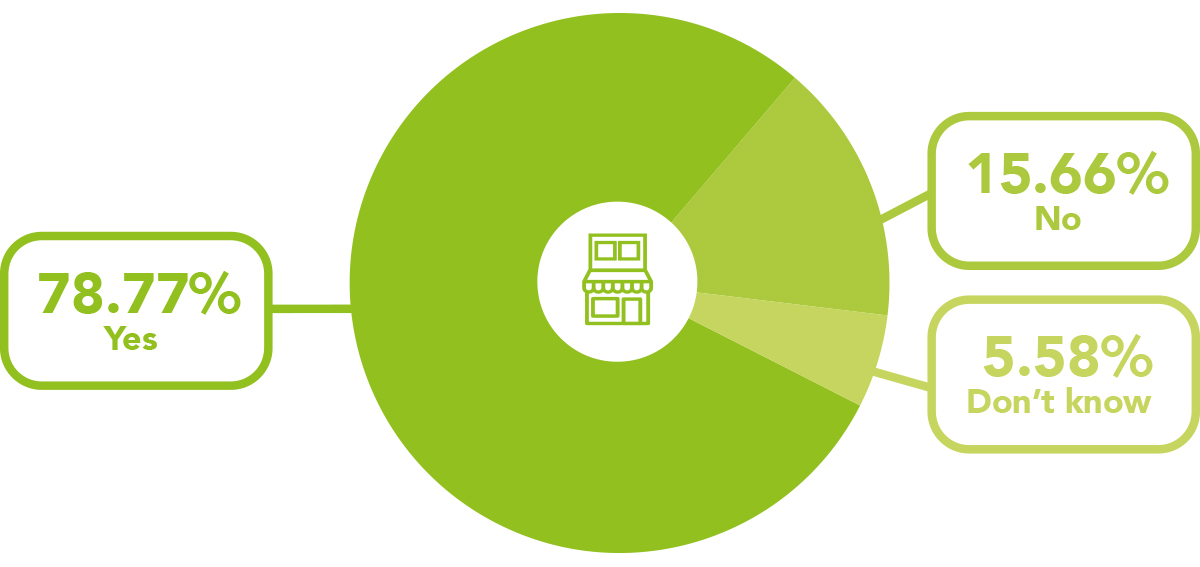

- Semi-commercial - 80.31%

Residential

Commercial

Semi-commercial

Do you think you'll invest in property in 2023?

To back up their beliefs that it’s a good time to invest in property, business owners have categorically stated that they intend to invest in 2023.

Residential property was the most likely investment as 84.22% said they’d invest in residential. 78.77% said they’d invest in semi-commercial and 77.94% said the same for commercial properties.

Residential

Commercial

Semi-commercial

We also found out…

How many businesses do you own in the UK?

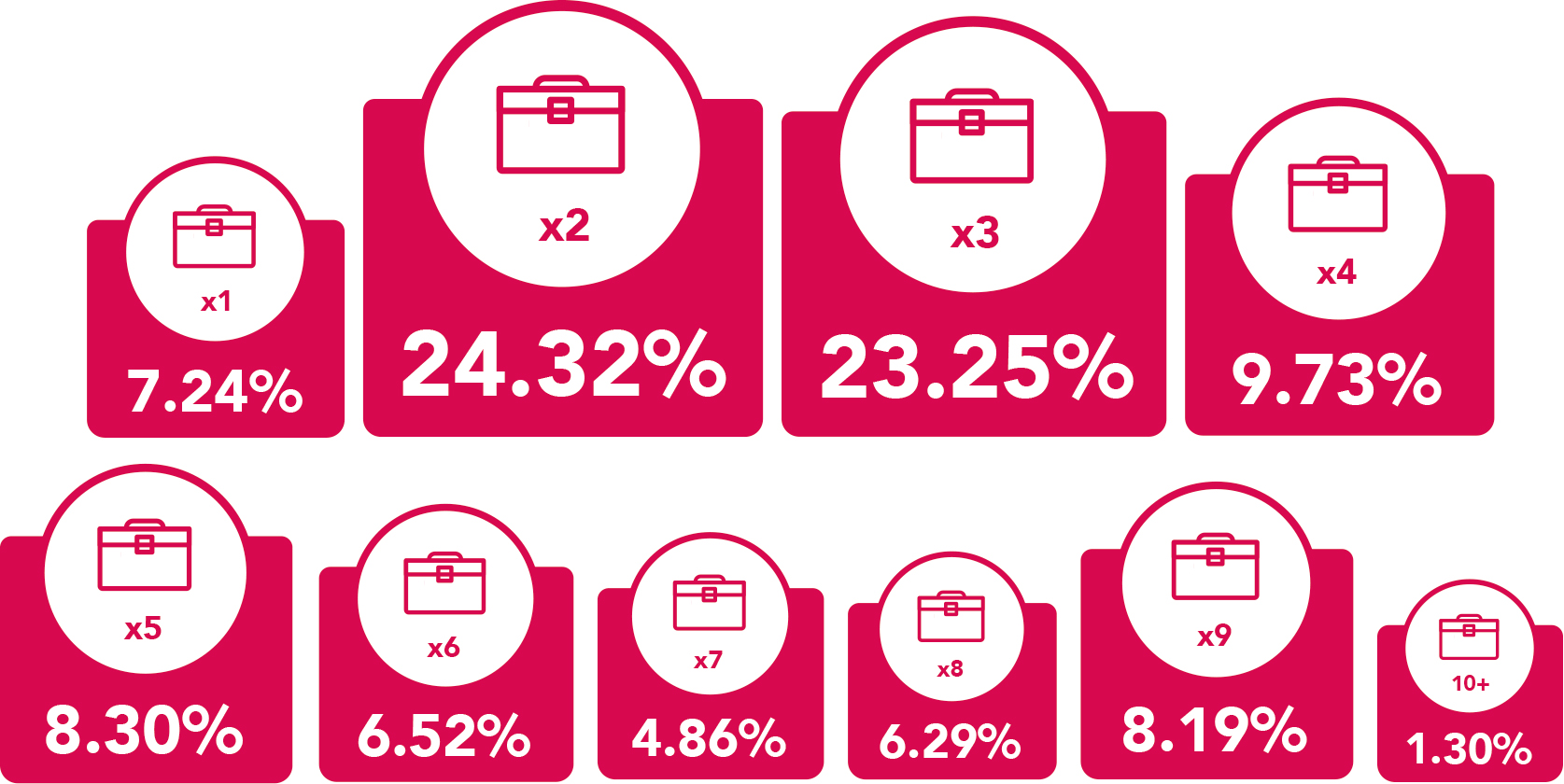

We discovered 92.76% of business owners in the UK own more than 1 business. Just 7.24% of owners have 1 business, whilst 24.32% own 2 and 23.25% own 3.

A combined 27.16% own 6 or more businesses.

How many employees do you have?

What industry is your business in?

Access this survey's raw data in Excel format

Our survey statistics are available in the Microsoft Excel format. To access this please use the form below

| Poll Title: | UK Business Owners' Report 2023 |

| Poll Objective: | To gain insights into the UK economy from business owners |

| Conducted: | Mar 9 2023 |

| All Respondents: | 1,662 randomly sampled people in the UK |

| Qualified Respondents: | 843 |

| Screening Question: |

What best describes your employment status? Unemployed |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 1,662, throughout the UK’s 68,873,188 population (worldometer) of which 843 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2023 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, or require an accessible unlocked version of this excel file, please in the first instance email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/bridging-loan/uk-business-owners-report-2023 |