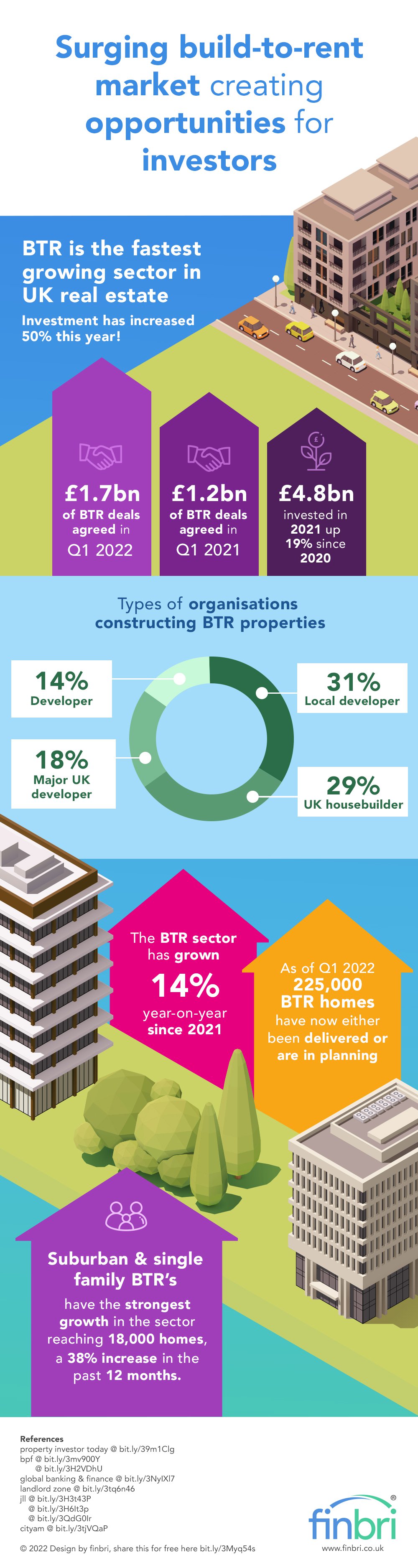

Surging build-to-rent market creating opportunities for investors

Despite being introduced a decade ago, the build to rent (BTR) market is in its infancy but it is showing signs of significantly growing in maturity as an asset class with recent trends.

BTR properties are new build developments designed specifically for renting. They come with a range of perks from longer tenancies to dedicated on-site managers, gyms and designer built communal spaces. These perks also come with a premium price tag.

With the rise of international companies realising the growth and potential of the BTR sector, UK investors need to act swiftly to avoid missing out on BTR opportunities. Meanwhile, buy to let private landlords may see this as a wake-up call to improve and refurbish their properties to stop private renting from being considered ‘second-class’ accommodation.

Growth has been particularly strong for Suburban or Single Family BTR. The total planning pipeline for this segment of the market has grown to reach 18,000 homes, an increase of 38% over the past 12 months.

When you combine the cost of living crisis increasing the number of people that can't afford to purchase with the expectation that BTR property investors are set to escape new Residential Property Developer Tax (RPDT) ), it looks like the BTR sector's time has arrived.

References

property investor today @ bit.ly/39m1Clg

bpf @ bit.ly/3mv900Y

bpf @ bit.ly/3H2VDhU

global banking & finance @ bit.ly/3NyIXl7

landlord zone @ bit.ly/3tq6n46

jll @ bit.ly/3H3t43P

jll @ bit.ly/3H6It3p

jll @ bit.ly/3QdG0Ir

cityam @ bit.ly/3tjVQaP

© 2022 Design by finbri, share this for free here bit.ly/3Myq54s