On this page

UK Landlords' Report 2024 Landlords' Report 2024 Key Findings UK landlords: the here-and-now How many investment properties do landlords own in the UK? How long have you been a landlord? What regions do landlords own rental property in? What type of property/properties are landlords currently renting out? Are landlords happy with their current tenants? In 2023, did landlords have any issues with non-payment of rent? Would landlords consider reducing rents in 2024 if it meant keeping the same, reliable, good tenant? How landlords invest in property When looking to purchase an investment property, how important do landlords consider the following factors? Typically, how do landlords source their property investments? Historically, why have landlords chosen to purchase their property investments via an estate agent? Who is the preferred estate agent for landlords sourcing their BTL properties? Who is the preferred estate agent for landlords sourcing their BTL properties - per region? Did landlords use a bridging loan or development finance for their property investments? What were the most important factors for landlords when deciding to use a bridging loan? EPC (Energy Performance Certificate) How important are EPC ratings to landlords when they purchase a rental property? How important do landlords think EPC ratings are to their tenants? Did landlords complete any EPC improvements in 2023? Do landlords intend to complete any EPC improvements in 2024? Looking back at 2023 Did landlords have any Buy-to-Let mortgages in 2023? Did any landlords' existing Buy-to-Let mortgages increase in 2023? Did landlords remortgage any of their Buy-to-Lets in 2023? Did landlords increase their rental fees in 2023? Did landlords buy any rental properties in 2023? Did landlords sell any rental properties in 2023? Did landlords experience an increase or decrease in demand for their rental properties in 2023? Did landlords experience an increase or decrease in rental yields in 2023? Did landlords experience an increase or decrease in void periods in 2023? Did landlords have to evict any tenants from their rental properties in 2023? Why did landlords evict tenants in 2023? Did landlords have trouble sourcing new investment properties in 2023? 2024, looking at the year ahead… How do landlords feel about the following in the UK? Inflation Cost of living Energy Prices Risk of Recession Borrowing Costs Mortgage Interest Rates EPC Ratings Property Crash Capital Gains Tax Allowance Property Market Property Investment Opportunities Regions with the best rental yield Upcoming UK General Election Anticipating a general election this year, how do landlords think they’ll be impacted by which party wins? Are landlords worried about the affordability of paying any of their Buy-to-Let mortgages in 2024? Do landlords think they'll buy an investment property in 2024? What will landlords do with their rental properties in 2024? ConclusionUK Landlords' Report 2024

51% of UK landlords are looking to invest in property in 2024, new survey discovers.

2023 was a tumultuous year in the UK, with ramifications felt throughout the private rental market. With increasing mortgage rates combined with product scarcity, property price uncertainty, an ongoing cost-of-living crisis, inflation woes, and one economic crisis followed by a seemingly worse one - if you owned or rented a property, you were undoubtedly impacted.

Building on from our 2023 Landlords Report, this January through to March, we surveyed 755 UK landlords to understand their feelings about 2023, get an accurate picture of the state of the UK BTL market, and discover how the rental market is shaping up in 2024.

If you're a landlord, a renter, an estate agent, or have any interest in property investment or the buy-to-let market, this 2024 UK Landlords' Report is a must-read.

The demand for rental property is outstripping supply, leading to increased rental prices for tenants. At the same time, increased mortgage rates and inflation are impacting landlords, too, at a time when their tenants may not be able to afford these rent increases, increasing the likelihood of landlords selling up. This, in turn, reduces rental supply, driving up competition amongst would-be tenants and further growing rental prices.

And round and round we go.

But what's clear is that both tenants and landlords are facing difficult times.

Despite the UK officially falling into a technical recession in the second half of 2023, there might be some glimmers of hope as predictions for the housing market aren't as gloomy as they were at the end of last year.

Even recently, global real estate consultancy and estate agency Knight Frank changed their prediction that house prices would decrease by -4% in 2024 and now forecast prices to rise by +3% this year.

Although there is understandable uncertainty, a feeling of cautious positivity for the year ahead permeates through many of our survey responses, as detailed in this report: the majority of landlords aren't worried about the affordability of paying their BTL mortgages in 2024, and there is an indication that half of UK landlords intend to further invest in property this year.

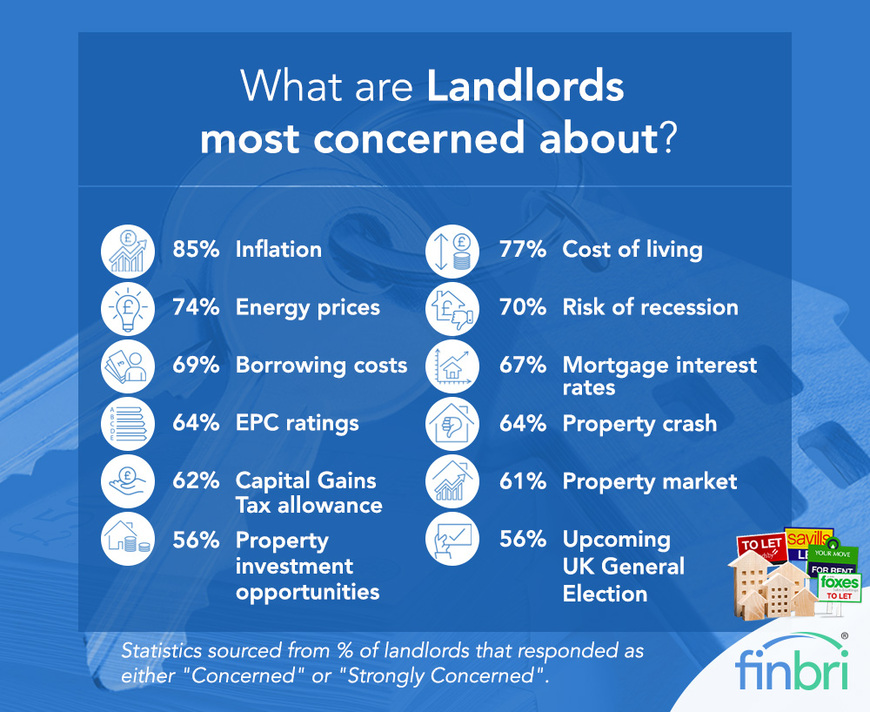

Notable concerns remain regarding inflation, the cost of living crisis, energy prices, recession, and mortgage and borrowing costs.

Stephen Clark from bridging loan broker Finbri said, "One year ago, we surveyed UK landlords to understand their feelings ahead of 2023. Our Landlords' Report 2023 revealed over half of landlords would raise rents to cover additional expenses, and just under half would sell their investment properties if the base rate reached 4.5% in 2023.

"Well, the base rate not only reached 4.5%, it did so in May - and then increased on two further occasions until it hit 5.25% in November.

"Over half of landlords did indeed increase their rental fees last year, but this survey has discovered that only a third of landlords ended up selling their rental properties, possibly due to potential buyers being unable to purchase due to fluctuating mortgage rates or a lack of available mortgage products.

"On the other hand, savvy landlords might have had a change of heart and decided to see what 2024 would bring before selling up.

"Now, as the first quarter of 2024 draws to a close and we enter Spring, the outlook appears somewhat mixed. 30% of landlords intend to sell their properties, while half want to invest further this year. Almost 60% aren't worried about their Buy-to-Let Mortgages, yet over 50% will be looking to raise rent to cover the additional expenses this year will bring.

"Understandably, it all feels uncertain. No matter what, with a General Election on the horizon, 2024 will likely be a significant year for landlords and renters in the UK."

LANDLORDS' REPORT 2024 KEY FINDINGS

- 51% of UK landlords looking to invest in property in 2024

- 20% are undecided

- Inflation is 2024's biggest concern for UK landlords - 85% are either concerned or strongly concerned

- 32% of landlords will sell up

- 58% of landlords aren't worried about their Buy-to-Let mortgage affordability in 2024

- 51% of landlords will put up rent to cover additional costs

- 70% of landlords will undertake EPC work in 2024

- 71% of landlords saw demand rise over the last 12 months

- 60% of landlords would consider reducing rents to keep reliable tenants

- Antisocial behaviour is the top cause of UK tenant evictions

UK landlords: the here-and-now

To better understand landlords in the UK and their present situation, we wanted to know how many rental properties they currently own, the types of properties they rent out and where they are located, how long they've been landlords, and how they feel about their current tenants.

How many investment properties do landlords own in the UK?

A combined 74% of landlords own 2 or more properties they actively rent out.

28% of landlords own 2 rental properties, whilst 26% own 1.

Across the UK, 89% own 1-5 properties, 8% own 6-10 properties, and just under 3% of landlords own more than 10 rental properties.

|

How many investment rental properties do you own in the UK? |

% of UK landlords |

|

1 |

26.23% |

|

2 |

28.21% |

|

3 |

16.42% |

|

4 |

8.61% |

|

5 |

9.54% |

|

6 |

4.11% |

|

7 |

1.72% |

|

8 |

0.79% |

|

9 |

0.79% |

|

10 |

0.93% |

|

More than 10 |

2.65% |

How long have you been a landlord?

The majority of landlords are experienced, long-term landlords. UK landlords have typically rented out properties for 5 or more years (a combined 59%). 14% of landlords have entered the rental market within the last 2 years.

|

How long have you been a landlord? |

% of UK landlords |

|

1 year |

4.24% |

|

2 years |

10.07% |

|

3 years |

15.10% |

|

4 years |

11.79% |

|

5 years |

19.21% |

|

6 years |

8.87% |

|

7 years |

5.30% |

|

8 years |

5.56% |

|

9 years |

3.05% |

|

10 years |

4.90% |

|

More than 10 years |

11.92% |

What regions do landlords own rental property in?

Unsurprisingly, 45% of landlords own property in London. Of those landlords in the capital, a combined 83% saw demand for their properties Increase (49%) or Significantly Increase (34%) in 2023.

The South East and the East of England are the 2nd and 3rd most popular locations for owning rental properties, accounting for 18% and 15% of the UK's ownership, respectively.

Whilst London has the highest percentage of renters and rental properties in the UK, it currently ranks as the location with the lowest rental yield at 4.92%. Landlords in the North East (7.34%), Scotland (7.32%) and the North West (6.52%) are currently performing the best for rental yield.

|

What regions do you own rental property in? Multiple choice |

% of UK landlords |

|

London |

45.17% |

|

South East |

17.88% |

|

East of England |

14.83% |

|

North West |

14.17% |

|

South West |

13.64% |

|

North East |

11.26% |

|

West Midlands |

11.13% |

|

Yorkshire & The Humber |

11.13% |

|

Scotland |

9.93% |

|

East Midlands |

7.55% |

|

Wales |

7.15% |

|

Northern Ireland |

6.75% |

What type of property/properties are landlords currently renting out?

To many, the difference between a flat and an apartment is simply terminology and that one is British and the other is American. Although this is somewhat true, there are more differences between these two types of rental accommodation.

At a fundamental level, flats and apartments are private living spaces within a larger building. There are no definitive rules, but there is typically a practical difference, as a flat is usually one storey, and an apartment can be multi-storeyed. Apartments are typically in purpose-built blocks.

There are also socioeconomic differences between flats and apartments. Flats can be considered standard or basic, working/middle-class accommodation, whilst apartments tend to be considered more luxurious, refined, modern, upscale and hence, more expensive living.

Our survey has discovered that 44% of landlords own one or more apartments, compared to 41% who own and rent out flats. 35% rent out semi-detached properties, 27% rent out terraces, and 27% rent out detached homes.

The different types of properties landlords own are:

|

What type of property/properties are you currently renting out? Multiple choice |

% of UK landlords |

|

Apartment |

44.24% |

|

Flat |

40.53% |

|

Semi-detached |

34.57% |

|

Terrace |

26.89% |

|

Detached |

26.62% |

|

HMO (House of multiple occupation such as a student house or renting a room in a shared house) |

10.20% |

|

PBSA (Purpose Built Student Accommodation) |

5.70% |

|

Other |

0.26% |

Are landlords happy with their current tenants?

It's pretty standard to hear stories of landlords and tenants at war.

It's a tale as old as time and easy tabloid fodder: Landlords vs Tenants engaged in an ongoing battle of frustrated disgruntlement vs wild unruliness.

However, our survey has found that an overwhelmingly cheery 94% of landlords are, in fact, happy with their current tenants.

This positive feeling is mutual, as, according to the latest national figures, over 80% of tenants said they were either satisfied (52%) or very satisfied with their landlords (29%).

|

Are you happy with your current tenants? |

% of UK landlords |

|

Yes |

93.77% |

|

No |

6.23% |

So it certainly seems landlords and tenants are in happier relationships than we've been led to believe.

In 2023, did landlords have any issues with non-payment of rent?

Almost 75% of landlords had no issues with non-payment of rent in 2023 - a surefire contributing reason why so many landlords are happy with their tenants.

But as costs are rising, so too rent is increasing, and a quarter of landlords did have issues with non-payment.

According to official government data, private rent at the end of 2023 was 6.2% higher than in December 2022. Zoopla has stated that the average rent for new lets has risen 9.7% since 2022. Rental fees are also predicted to rise 5-6% in 2024.

Perhaps in a sign that landlords understood their tenants' issues that resulted in non-payment of rent, 80% of landlords who had these issues still said they were happy with their tenants.

|

In 2023, did you have any issue with non-payment of rent? |

% of UK landlords |

|

Yes |

25.56% |

|

No |

74.44% |

Would landlords consider reducing rents in 2024 if it meant keeping the same, reliable, good tenant?

If you're currently renting and consider yourself a good tenant, pay close attention, as this puts you in a favourable negotiating position with landlords looking to raise your rent; 61% of landlords said they'd consider reducing rents if it meant keeping a reliable tenant. Of course, this also means that almost 40% wouldn't consider reducing rents, even for a good tenant.

58% of landlords with only 1 property would consider reducing rents for good tenants. So tenants who rent from a landlord in their only rental property should be aware that the likelihood they'll reduce their rent if they're a good tenant drops slightly compared to landlords with 2 or more properties.

Landlords renting properties for 5 years are the most likely to reduce rents for good tenants, as 70% said they would consider this. The more experienced landlords with 10 or more years of renting are the least likely to reduce rents, as only 44% said they'd consider it.

There is a balance to be found between increasing rent prices in line with rising mortgage rates, the increase of maintenance and general costs, and demand versus finding and keeping a good, reliable tenant. Indeed, when asked what their biggest challenge was as a landlord in 2023, 6% of UK landlords said it was balancing costs and rental prices with keeping their tenants happy, and 8% said finding suitable tenants was their biggest challenge last year.

|

Would you consider reducing rents in 2024 if it meant keeping the same, reliable, good tenant? |

% of UK landlords |

|

Yes |

60.79% |

|

No |

39.21% |

How landlords invest in property

When looking to purchase an investment property, how important do landlords consider the following factors?

What's most important to landlords when choosing a property to invest in?

Top 5 most important factors

- Location - 92.19% (either Very Important or Important)

- Price - 92.06%

- Marketability - 87.15%

- Capital return - 83.71%

- Rental yield - 82.52%

|

When looking to purchase an investment property, how important do you consider the following factors? |

Very important |

Important |

Moderately important |

Slightly important |

Not important |

|

Location |

66.36% |

25.83% |

7.02% |

0.79% |

0.00% |

|

Price |

56.03% |

36.03% |

6.62% |

1.06% |

0.26% |

|

Marketability |

54.83% |

32.32% |

10.73% |

1.59% |

0.53% |

|

Capital return |

50.86% |

32.85% |

12.85% |

3.05% |

0.40% |

|

Rental yield |

45.96% |

36.56% |

12.98% |

3.44% |

1.06% |

|

Property condition |

47.68% |

32.32% |

13.77% |

5.17% |

1.06% |

|

Accessibility |

41.59% |

36.69% |

15.23% |

5.56% |

0.93% |

|

Transport links |

36.56% |

39.87% |

17.35% |

5.30% |

0.93% |

|

Type of accommodation, i.e. flat/house |

35.63% |

40.40% |

17.48% |

5.17% |

1.32% |

|

Number of bedrooms |

28.74% |

43.58% |

21.59% |

5.03% |

1.06% |

|

Closeness to education centres (such as pre-school, schools, colleges or universities) |

29.27% |

38.41% |

21.59% |

7.95% |

2.78% |

|

Garden / outdoor space |

28.48% |

35.76% |

22.78% |

9.27% |

3.71% |

|

Off-road parking |

27.95% |

33.91% |

24.64% |

10.07% |

3.44% |

|

On-road parking |

22.38% |

36.16% |

27.81% |

9.27% |

4.37% |

|

Broadband speed |

19.47% |

36.95% |

29.67% |

7.55% |

6.36% |

Typically, how do landlords source their property investments?

Most landlords (68%) choose estate agents to source property investments.

This question was multiple-choice to account for landlords utilising different sources for different purchases. We found that 45% of property investments are completed via private sale, whilst 32% are via auction.

We recently discovered that the answer to "are auction properties cheaper?" is a resounding YES as in December 2023, on average, residential properties sold for £168,152 - over £116k and 41% less than the UK average house price of £284,691. 32% of landlords used an auction to source their property. And investors should be on alert as the number of residential properties available at auction is increasing. In 2023, 19% more residential lots were available at auction compared to 2022 (31,549 in 2023 vs 26,559 in 2022).

|

Typically, how do you source your property investments? Multiple choice |

% of UK landlords |

|

Estate agent |

67.68% |

|

Private sale |

44.50% |

|

Auction |

31.92% |

|

Contacting property owners directly |

28.87% |

|

Private network |

28.61% |

|

Other |

0.53% |

Historically, why have landlords chosen to purchase their property investments via an estate agent?

As estate agents were the most popular source of property investments, we wanted to dig deeper and find out why 68% of landlords use them for their property purchases.

Landlords could select as many reasons as they wanted, and the most chosen answer was ease and convenience (56%).

Other popular reasons to use estate agents were their local knowledge (51%), good reputation (49%), negotiating assistance (41%), understanding of requirements (40%), good communication (38%), the ability to hear about property first (37%) and close relationships (36%) - key USPs all estate agents should consider.

|

Historically, why have you chosen to purchase your property investments via an estate agent? Multiple choice |

% of UK landlords |

|

Ease and convenience |

55.77% |

|

Local knowledge |

50.68% |

|

Good reputation |

48.53% |

|

Negotiating assistance |

40.70% |

|

Understands my requirements |

40.12% |

|

Good communication |

37.77% |

|

Hear about property first |

36.59% |

|

Close relationship |

35.62% |

Who is the preferred estate agent for landlords sourcing their BTL properties?

As of November 2023, there were approximately 23,000 estate agencies in the UK, a 2% increase from 2022. We wanted to know which estate agents are the preferred choice for landlords when sourcing their BTL properties.

Whilst we couldn't provide 23K options for landlords to select their favourite, we did discover the top UK landlords in terms of size. Landlords could then choose their preference, or they could provide their own answer if their estate agent of choice is local rather than national.

We discovered that 18% of landlords' preferred estate agent is Martin & Co. While 15% of landlords picked Savills, followed by 11% selecting Hunters.

|

Who is your preferred estate agent for sourcing your BTL properties? |

% of UK landlords |

|

Martin & Co |

18.40% |

|

Savills |

14.68% |

|

Hunters |

10.18% |

|

Fine & Country |

9.98% |

|

Connells |

7.83% |

|

Pattinson |

7.05% |

|

haart |

6.26% |

|

Knight Frank |

6.07% |

|

Belvoir |

5.48% |

|

Strutt & Parker |

2.54% |

|

Other |

11.55% |

Who is the preferred estate agent for landlords sourcing their BTL properties - per region?

Estate agent preference differs throughout the UK. Across multiple regions, including London, Martin & Co are landlords' top choice of estate agent, whilst in the South East, East of England and South West, Savills is preferred. Here are the preferred estate agents according to where landlords own their properties:

|

Regions landlords own rental property |

Preferred Estate Agent |

|

London |

Martin & Co |

|

South East |

Savills |

|

East England |

Savills |

|

North West |

Other (local estate agents) |

|

South West |

Savills |

|

North East |

Martin & Co |

|

West Midlands |

Martin & Co |

|

Yorkshire and the Humber |

Martin & Co |

|

Scotland |

Other (local estate agents) |

|

East Midlands |

Martin & Co |

|

Wales |

Other (local estate agents) |

|

Northern Ireland |

Martin & Co |

Did landlords use a bridging loan or development finance for their property investments?

23% of landlords utilised development finance, and 13% used a bridging loan to acquire property investments.

The landlords who used development finance tend to own 3 properties (24%), have been landlords for 5 years (21%), and own their properties in London (59%).

Those that used a bridging loan are similar. 28% own 3 properties, 46% own properties in London, and they have been landlords for 3 years (26%).

|

Did you use a bridging loan or development finance for your property investments? |

% of UK landlords |

|

Development Finance |

23.05% |

|

Bridging loan |

13.25% |

What were the most important factors for landlords when deciding to use a bridging loan?

Of the landlords who used a bridging loan for their property investments, 64% said that lending criteria flexibility was the most important factor in deciding to use this type of short-term finance.

As bridging loans can provide borrowers with fast funding (£300k in 3 days, £750k in 7 days and even up to £250m from 2 weeks) and can ensure time-sensitive opportunities aren't missed, urgency/speed was the reason 54% of people utilised a bridging loan.

The other top reasons for using a bridging loan when buying a BTL property were maximising the loan amount, requiring a loan size that wasn't obtainable via traditional lenders, and purchasing an unmortgageable property.

|

What were the most important factors when deciding to use a bridging loan? Multiple choice |

% of UK landlords |

|

Needed a lender who was flexible in their lending criteria |

64% |

|

Urgency/speed |

54% |

|

Needed to maximise my loan amount |

47% |

|

Needed a large loan size that was not obtainable via traditional lenders |

41% |

|

Property was unmortgageable |

35% |

|

Difficult project to raise finance for |

28% |

|

Poor/adverse credit |

23% |

|

No credit history |

8% |

|

Foreign national |

3% |

EPC (Energy Performance Certificate)

77% of landlords said that when buying a rental property, EPC ratings were either Important (45%) or Very important (32%).

When asked how important they thought EPC ratings were to their tenants, a combined 70% said they were Important (39%) or Very important (31%).

Our survey results suggest that landlords are taking EPC ratings seriously, which, when considering current energy costs, is something renters should be pleased to hear.

In late 2021, the government updated the Minimum Energy Efficiency Standards (MEES) for England and Wales, stating that

- all rental properties will need an EPC rating of 'C' or above as of 2025

- similar changes will come into effect to include all tenancies in 2028

With potential fines of up to £30,000 for failing to meet the new standards, landlords were finding themselves under pressure to ensure their rental properties achieved the 'C’+ rating by 2025.

But in September 2023, Prime Minister Rishi Sunak scrapped the proposed energy efficiency targets for households and rental properties, which may have surprised some landlords (although it probably shouldn't have been too much of a shock at all).

With the proposed changes scrapped, landlords are (currently) under less pressure and will need their properties to have an EPC rating of 'C' or above as of 2028 (although this may change again in the aftermath of the next General Election).

Whilst this may have been cause for celebration for some landlords dreading the costs and inconvenience that would have come from the required improvements to reach the fast-approaching deadline for the new EPC standards, our survey discovered that 68% of landlords completed some form of EPC improvements in 2023 before the Prime Minister suddenly decided to scrap the proposed legislation.

Despite the legislation being scrapped, our survey has found that 73% of landlords still intend to complete EPC improvements to their rental properties in 2024. This demonstrates that landlords are taking energy efficiency seriously and are still looking to improve their properties despite there no longer being a fast-approaching deadline to do so. They may be anticipating the current government u-turning again or preparing themselves for a new government to reinstate the need to reach better EPC ratings over the next few years. Or it's a combination of the two.

Either way, the majority of renters can expect their homes to receive some form of EPC improvement this year.

EPC Importance

How important are EPC ratings to landlords when they purchase a rental property?

|

When buying your rental property, how important were EPC ratings to you? |

% of UK landlords |

|

Very important |

32.05% |

|

Important |

44.77% |

|

Moderately important |

17.35% |

|

Slightly important |

4.11% |

|

Not important |

1.72% |

How important do landlords think EPC ratings are to their tenants?

|

How important do you think EPC ratings are to your tenants? |

% of UK landlords |

|

Very important |

31.13% |

|

Important |

39.21% |

|

Moderately important |

20.40% |

|

Slightly important |

6.36% |

|

Not important |

2.91% |

EPC Improvements

Did landlords complete any EPC improvements in 2023?

|

Did you complete any EPC improvements in 2023? |

% of UK landlords |

|

Yes |

68.21% |

|

No |

31.79% |

Do landlords intend to complete any EPC improvements in 2024?

|

Do you intend to complete any EPC improvements in 2024? |

% of UK landlords |

|

Yes |

72.72% |

|

No |

27.28% |

Looking back at 2023

Our survey has discovered that 54% of landlords had BTL mortgages in 2023, 47% saw their mortgage rates increase, 36% had to remortgage, and 56% increased tenant rent.

This was the state of the UK rental market in 2023.

Did landlords have any Buy-to-Let mortgages in 2023?

|

Did you have any Buy-to-Let mortgages in 2023? |

% of UK landlords |

|

Yes |

54.17% |

|

No |

45.83% |

Most landlords (54%) had a Buy-to-Let mortgage on at least one property in 2023.

The BTL market amounts to about £300 billion of outstanding mortgage debt, almost a fifth of the overall mortgage market.

Did any landlords' existing Buy-to-Let mortgages increase in 2023?

|

Did any of your existing Buy-to-Let mortgages increase in 2023? |

% of UK landlords |

|

Yes |

46.49% |

|

No |

53.51% |

Currently, BTL mortgages are at their lowest levels since September 2022, when the cost of mortgages soared after the government's mini-budget.

Average fixed-rate BTL mortgages increased from May 2023 (5.56%) to peak in August (6.79%). They have since fallen back to an average of 5.50%.

Anyone on a 2-year fixed rate from 2021 that expired last year will likely have seen an increase, as average rates in September 2021 were just 1.2%.

Did landlords remortgage any of their Buy-to-Lets in 2023?

|

Did you remortgage any of your Buy-to-Lets in 2023? |

% of UK landlords |

|

Yes |

35.89% |

|

No |

64.11% |

Remortgaging is the process of switching your existing mortgage onto a new deal, either with the same lender or sourcing a different provider to find the best deal.

In 2023, 36% of landlords remortgaged.

Did landlords increase their rental fees in 2023?

|

Did you increase your rental fees in 2023? |

% of UK landlords |

|

Yes |

56.29% |

|

No |

43.71% |

Over half of UK landlords (56%) increased their rental fees in 2023, and rents in the UK are now at the highest level on record.

In December 2023, rents increased by 6.2% compared to the same period in 2022. This continues the trend of rising rents; compared to March 2020, when the first COVID lockdown began, rents are now 26% higher.

The reasoning for the dramatic increase in rent since Covid has focused on demand for rental properties outstripping supply. The rent increase is also blamed on the cost of borrowing following 14 consecutive interest rate rises.

Whilst 44% of landlords didn't increase their rental fees in 2023, the current market prediction is a further 6% increase in average rent in 2024.

Did landlords buy any rental properties in 2023?

|

Did you buy any rental properties in 2023? |

% of UK landlords |

|

Yes |

40.26% |

|

No |

59.74% |

40% of landlords invested in rental property in 2023, of which 60% had no trouble sourcing new investment properties.

Of the landlords who purchased a rental property, 57% were in London, 18% were in the North East (a smart move considering the North East currently has the highest UK rental yield), and 18% were in the East of England.

And the landlords that invested in 2023 are looking to invest further this year, with 76% stating they'll be looking to buy an investment property in 2024.

Did landlords sell any rental properties in 2023?

|

Did you sell any rental properties in 2023? |

% of UK landlords |

|

Yes |

32.05% |

|

No |

67.95% |

A third of landlords sold a rental property last year. Of the 32% sold, 61% were in London, 24% were in the East of England, and 19% were in the South West - however, a lower percentage of landlords sold in 2023 than predicted.

Last January, 45% of landlords said they would sell if the base rate reached 4.5% in 2023.

The base rate did reach 4.5% in 2023, and it did so in May. It then increased on two further occasions until it hit 5.25% in November.

The lack of actual sales compared to the previous intention to sell could be a result of the challenging market conditions in 2023. According to HMRC, there were 22% fewer sales in 2023 compared to 2022. The decline in sales can be attributed to increasing mortgage rates, fewer mortgage products and an imbalance between buyer and seller expectations. Buyers were seemingly looking for a bargain, and sellers were hoping for 2021 prices despite house prices decreasing by 1.8% throughout 2023.

Did landlords experience an increase or decrease in demand for their rental properties in 2023?

71% of landlords experienced an Increase (46%) or Significant Increase (25%) in demand for their rental properties in 2023.

The lack of rental property supply is a key reason for the increase in demand, with the number of homes available to rent in the UK falling by a third over the past 18 months. Landlords are leaving the market, not enough rental properties are being built, and tenants are finding it increasingly difficult to make the move from renting to home ownership, all contributing factors to the increase in demand for available properties.

26% experienced no change in demand, whilst just 2% had less demand. 0% experienced a significant decrease in demand.

|

In 2023, did you experience an increase or decrease in... |

Significantly increased |

Increased |

Stayed the same |

Decreased |

Significantly decreased |

|

demand for your rental properties? |

25.17% |

46.23% |

26.36% |

2.25% |

0.00% |

Did landlords experience an increase or decrease in rental yields in 2023?

61% of landlords experienced either an Increase (43%) or a Significant Increase (18%) in rental yields.

For landlords, the rental yield is the annual rental income of a property divided by its value. The higher the rental yield, the better the return on investment and a yield of 5%- 8% is typically considered reasonable or good.

32% of landlords saw no change in their rental yield in 2023.

|

In 2023, did you experience an increase or decrease in... |

Significantly increased |

Increased |

Stayed the same |

Decreased |

Significantly decreased |

|

rental yields? |

18.41% |

43.05% |

31.92% |

6.09% |

0.53% |

Did landlords experience an increase or decrease in void periods in 2023?

A void period is the time a property is vacant between tenancies. The recent average void period is 18 days.

Our survey discovered that 50% of landlords experienced no change in void periods in 2023, whilst 34% experienced an Increase or Significant Increase in the time between tenancies.

|

In 2023, did you experience an increase or decrease in... |

Significantly increased |

Increased |

Stayed the same |

Decreased |

Significantly decreased |

|

void periods? |

10.73% |

23.44% |

50.20% |

13.25% |

2.38% |

Did landlords have to evict any tenants from their rental properties in 2023?

The majority of landlords (82%) didn't evict any tenants from their properties in 2023, but 18% did.

|

Did you have to evict any tenants from your rental properties in 2023? |

% of UK landlords |

|

Yes |

17.75% |

|

No |

82.25% |

Why did landlords evict tenants in 2023?

Of the landlords that evicted tenants in 2023, antisocial behaviour (48%) and rent not being paid (47%) were the key reasons. Still, renters should be aware of other factors that can result in eviction.

Of the landlords that evicted tenants in 2023, this was why:

|

Why did you evict them? Multiple choice |

% of UK landlords |

|

Antisocial behaviour |

47.76% |

|

Rent not paid |

47.01% |

|

Exercised 'break clause' before end of fixed term |

42.54% |

|

Sold property |

20.15% |

|

Exercised Section 21 |

13.43% |

|

Other |

0.75% |

13% of evictions were the result of a landlord exercising Section 21. Section 21 allows evictions after a fixed term tenancy ends - if there's a written contract, or during a tenancy with no fixed end date - known as a 'periodic' tenancy.

In 2019, the Conservative Party pledged to end Section 21 evictions - a cause of great concern for landlords, but this legislation hasn't yet passed through Parliament.

When asked in our 2023 survey, 46% of landlords said they were Concerned (23%) or Strongly Concerned (23%) about stopping Section 21 evictions.

Did landlords have trouble sourcing new investment properties in 2023?

|

Did you have trouble sourcing new investment properties in 2023? |

% of UK landlords |

|

Yes |

18.81% |

|

No |

51.79% |

|

Wasn't looking |

29.40% |

Half of UK landlords said they had no trouble sourcing new investment properties in 2023, whilst 30% weren't looking. Almost 1 in 5 landlords did have trouble sourcing new investment properties.

If we remove the landlords who weren't looking to invest from our sample, we then discover that 73% of landlords had no trouble sourcing new properties, but more than 1 in 4 who were looking did have difficulties.

|

Did you have trouble sourcing new investment properties in 2023? |

% of UK landlords that were looking to invest |

|

Yes |

26.64% |

|

No |

73.35% |

Despite property prices falling by 1.2% on average across the UK, BTL mortgage rates are much higher than in 2022. BTL mortgage rates dropped as low as 3.06% in 2022 but hit 6.79% in August 2023.

Additionally, the number of BTL mortgage products available fell in 2023 compared to 2022. So, with higher rates and fewer BTL mortgages available, it's understandable that almost 27% of landlords looking for investments had trouble sourcing new properties in 2023.

2024, looking at the year ahead…

How do landlords feel about the following in the UK?

What are landlords most concerned about?

Inflation

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Inflation |

40.79% |

44.24% |

7.68% |

5.70% |

1.59% |

Inflation is the topic of discussion in the UK causing the most concern for landlords.

The level of concern is no wonder as inflation affects all aspects of the economy, from consumer spending, business investment and employment rates to tax policies and interest rates.

When the survey took place, the overall inflation rate had increased to 4.0% from November's 3.9%. Whilst this seemed like a slight increase, it was a reversal of the recent inflation decreases and a blow to the government and Bank of England in their attempts to hit their inflation target of 2%.

Although this increase in inflation is still significantly below the peak of 11.1% in October 2022, the increase was a surprise and was double the Bank of England's target.

As of March 20, 2024, the inflation rate has dropped to 3.4% - the lowest rate since September 2021, when it was 3.1%. The latest decline from 4% was more than predicted by economists and adds to speculation over interest rate cuts in the summer, but not before.

A combined 85% of landlords are either 'strongly concerned' (41%) or 'concerned' (44%) about inflation in the UK.

Despite the decrease, inflation remains high and directly impacts landlord expenses. As mortgage costs rise, so will solicitor/letting agent fees, gas safety certificates, boiler repairs/property repairs/insurance. And currently, rent inflation is 6.5%.

Should inflation continue to come down as predicted, the Bank of England has indicated it will cut the current 5.25% interest rate. This would be welcome news for borrowers.

Cost of living

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Cost of living |

40.26% |

37.09% |

10.20% |

9.14% |

3.31% |

Indelibly linked with inflation, not only does the cost of living immediately impact landlords and their own pockets, but it also impacts tenants and their ability to afford essentials, including their rent.

To illustrate how much the cost-of-living crisis affects people in the UK, we've examined the number of people searching for "cost of living."

How many people searched for 'cost of living' in the UK

|

Year |

Average UK monthly searches |

|

2021 |

2,400 |

|

2022 |

74,000 |

|

2023 |

165,000 |

In 2021, on average, there were 2,400 searches for "cost of living" on Google in the UK. In 2022, this had increased to 74,000 searches on average a month. And last year, average searches for "cost of living" in the UK increased to a staggering 165,000 searches a month.

In just 2 years, average monthly searches about the cost of living in the UK have increased by 6,775%.

And landlords are acutely aware of the problem. Second only to inflation in terms of concern, a combined 77% of landlords are either 'strongly concerned' (40%) or 'concerned' (37%) about the cost of living in the UK.

Energy Prices

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Energy prices |

32.98% |

41.19% |

12.32% |

10.73% |

2.78% |

Around 4 in 10 energy bill payers (41%) struggle to afford payments, and 44% use less gas or electricity in their homes because of rising costs.

In 2023, the average electricity bill was estimated to be £1,264, an annual increase of 9%. And gas bills increased by more as the average estimated bill was £1,328, an increase of 17%.

A major source of anxiety for tenants, our UK Renters' Report 2023 discovered that 66% of renters are Concerned or Strongly concerned about energy prices. The latest figures show that 55% of UK tenants would prefer utility bills included within the cost of their rent; however, just 12% of properties listed for rent currently offer energy bills included within the asking rent.

For landlords, those that include energy bills within their properties' rent must either pass on the costs to their tenants or bear the cost themselves.

There may be cause for cautious optimism about energy prices. Current predictions are that UK energy bills will fall by 16% in April, with further falls before a slight increase from October. Yet 74% of landlords are Concerned (41%) or Strongly Concerned (33%) about energy prices for the year ahead.

Risk of Recession

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Risk of recession |

30.60% |

38.94% |

16.29% |

10.99% |

3.18% |

70% of landlords were right to be concerned about the risk of recession, as what once was a risk is now official - the UK economy has fallen into a recession. In mid-February, it was announced that due to households cutting back on spending in the three months leading to the end of 2023, the UK had a second consecutive quarter of growth failure - the technical criteria for a recession.

When the economy shrinks during a recession, wages are typically lower, companies are less profitable, fewer benefits are available, and public services are cut.

Workers might lose their jobs, increasing the unemployment rate. Others may see minimal pay rises that fail to keep pace with price increases. Tenants may be unable to afford their rent, which is a significant concern for landlords.

But 14% of landlords retained some level of optimism about the risk of recession, and their outlook may be justified by the governor of the Bank of England stating, "This is the weakest recession by a long way" and that the UK was now showing "distinct signs of recovery."

According to the ONS, the economy grew by 0.2% in January, boosting the chances of the UK quickly emerging from recession.

Borrowing Costs

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Borrowing costs |

29.80% |

38.81% |

19.21% |

9.80% |

2.38% |

Borrowing costs have 69% of landlords Concerned (39%) or Strongly Concerned (30%) - in the top 5 of what landlords are concerned about most.

Last year, the Intermediary Mortgage Lenders Association (IMLA) discovered that the cost of landlord borrowing is set to jump by 80% over the next two years as they refinance away from deals with historically low fixed rates. Annual interest payments for buy-to-let owners are expected to rise by £7,700 on average by 2025.

Mortgage Interest Rates

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Mortgage interest rates |

32.98% |

34.17% |

18.54% |

10.07% |

4.24% |

Buy-to-let mortgage rates have fallen to their lowest point since September 2022. This is positive news for landlords looking to expand their portfolio and invest in property in 2024 and those with BTL mortgages expiring. However, the current average fixed BTL mortgage rate of 5.5% remains much higher than the 3.06% from February 2022.

67% of landlords are Concerned or Strongly Concerned about mortgage interest rates in 2024.

Landlords with mortgages expiring on their own homes can expect to pay more each month.1.6 million people are set to remortgage this year, and Nationwide, HSBC, NatWest and Virgin Money are all increasing the cost of new deals.

EPC Ratings

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

EPC ratings |

23.05% |

41.19% |

22.52% |

9.54% |

3.71% |

The EPC legislation changes set for 2025 have been scrapped, but 64% of landlords are still Concerned (41%) or Strongly Concerned (23%) about the ratings.

Installing smart meters and switching to LED light bulbs are actionable ways to improve property EPC ratings. Still, landlords will be aware of the more expensive methods, especially if they have multiple properties.

Upgrading the boiler is an option, but average boiler costs are set to increase by £120 in 2024, and a typical gas boiler replacement (boiler and fitting) in the UK costs around £4,000. And with 74% of landlords owning 2 or more properties, this is cause for concern.

Landlords have until 2028 to improve their properties' EPC ratings to C. Other more costly options to improve EPC ratings include installing underfloor heating, wall and roof insulation, investing in or improving double- or triple-glazed windows, and installing underfloor heating.

That is unless the rules are changed again.

Property Crash

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Property crash |

30.99% |

32.72% |

19.60% |

13.38% |

3.31% |

A property crash is when the price index falls by more than 10% from its 52-week peak value. The last UK property market crash was in 2008, with severe consequences as homeowners and investors found themselves in negative equity with their properties worth less than the mortgages they had.

As a result, 47,000 homes were repossessed, with property repossessions increasing by 68% in 2008 compared to the year before.

At the end of 2008, 377,000 mortgage accounts were in arrears, a 31% increase from the end of 2007.

And the fear of another property crash has 64% of landlords are either Concerned or Strongly Concerned.

The primary causes of a property crash can include a sudden rise in interest rates, making mortgages unaffordable for many, an economic recession causing job losses and falling incomes, and over-speculation in the property market leading to unsustainable house price inflation.

Ironically, as higher buy-to-let mortgage rates cause landlords to sell up, the Bank of England has warned that an increasing number of landlords selling their rental properties could contribute to a potential property crash.

Whilst there is concern and uncertainty, current predictions for house prices in 2024 range from a 3% decrease to a 3% increase, and as interest rates fall, house prices could be driven up.

Capital Gains Tax Allowance

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Capital Gains Tax Allowance |

25.83% |

36.29% |

22.78% |

11.66% |

3.44% |

Capital gains tax (CGT) is charged on the profits made from selling an asset, such as a property, but it could also include other investments or valuable non-essential assets (such as antiques).

The tax-free allowance was £12,300 for 2022-23, but it was then dramatically cut to its current allowance of £6,000. From April 2024, it will be reduced again to just £3,000 - effectively increasing people's tax bills and impacting landlords when selling investment properties that make a profit above £3,000.

The government aims to raise £440m in 2027-28 with this policy. And concern amongst landlords about the tax is increasing.

Last year, when we asked about CGT, 45% of landlords were Concerned or Strongly concerned.

This year, a combined 62% are Concerned (36%) or Strongly concerned (26%) about Capital Gains Tax.

Since the poll was taken, Chancellor Jeremy Hunt announced his Spring Budget, and he gave landlords some good news - at least those looking to sell: He was lowering the higher rate of property capital gains tax from 28% to 24%. This might raise landlords' optimism about Capital Gains Tax, but it could raise concern for tenants should this announcement convince landlords to sell up, something many mega BTL investors, such as Lloyds Bank, pension funds, and more, are eager to capitalise on.

Hunt, the owner of seven luxury flats, hopes the CGT change will encourage more landlords and second homeowners to sell their properties, increasing the number of properties available for buyers, including first-time buyers, while also raising tax revenue.

There is a belief that the CGT change may have short-term positives while missing the opportunity for long-term improvements to tackle the ongoing housing crisis.

Ben Beadle, Chief Executive of the National Residential Landlords Association, says: "The Chancellor has once again ignored calls to revitalise long-term investment in quality rented homes in favour of tinkering at the margins for short-term gain.

"With an average of 11 tenants chasing every home for private rent, social housing waiting lists at 1.3 million, almost 110,000 households in temporary accommodation and the number of first-time buyers slumping, the Budget needed to tackle the housing crisis once and for all. What we got was a deafening silence.

"This was a missed opportunity to make providing new homes to rent and buy the priority it desperately needs to be."

Property Market

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Property market |

29.01% |

32.32% |

17.35% |

15.89% |

5.43% |

61% of landlords are Concerned (29%) or Strongly Concerned (32%) about the UK property market. After the difficulties of 2023, it's easy to understand the concern.

The 21% of landlords who are Optimistic or Very Optimistic might have cause for validation in their positive outlook.

The average UK property price is now £291,699, just £1,800 off the peak recorded in June 2022 after an average increase of 0.4% in February, marking the fifth monthly rise in a row. And year-on-year, property prices have increased by 1.7%.

Falling mortgage rates since the end of 2023 have seen buyers and sellers return to the market, and current predictions are that UK property sales will rise by 10% this year.

Property Investment Opportunities

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Property investment opportunities |

24.64% |

31.66% |

19.60% |

17.22% |

6.89% |

57% of landlords are Concerned (32%) or Strongly Concerned (25%) about property investment opportunities.

Regions with the best rental yield

The 51% of landlords that are looking to invest in property this year might consider recent analysis from Zoopla that identified the top regions for rental yield in the UK when determining where their next property investment should be:

|

Region |

Average gross rental yield |

Average monthly rent |

Average price of a buy-to-let property |

|

North East |

7.34% |

£671 |

£109,715 |

|

Scotland |

7.32% |

£777 |

£127,326 |

|

North West |

6.52% |

£828 |

£152,369 |

|

Northern Ireland |

6.24% |

£746 |

£143,462 |

|

Wales |

6.23% |

£848 |

£163,283 |

|

Yorkshire and the Humber |

6.23% |

£781 |

£150,504 |

|

West Midlands |

5.78% |

£881 |

£182,947 |

|

East Midlands |

5.70% |

£845 |

£177,816 |

|

South West |

5.23% |

£1,058 |

£242,532 |

|

East of England |

5.17% |

£1,143 |

£265,351 |

|

South East |

5.17% |

£1,291 |

£299,890 |

|

London |

4.92% |

£2,125 |

£518,056 |

Source: Zoopla Rental Index, December 2023

Upcoming UK General Election

|

How do you feel about the following in the UK? |

Strongly concerned |

Concerned |

Neither concerned nor optimistic |

Optimistic |

Very optimistic |

|

Upcoming UK General Election |

26.75% |

29.27% |

23.18% |

14.57% |

6.23% |

56% of landlords are Concerned (29%) or Strongly Concerned (27%) about the forthcoming General Election, whilst 21% are either Optimistic (15%) or Very Optimistic (6%).

Which leads us to…

Anticipating a general election this year, how do landlords think they'll be impacted by which party wins?

The next general election can be no later than January 28, 2025, although it's considered almost certain that it will take place in the second half of 2024.

The Conservative Party have been in power for 14 years, during which time there have been 5 Conservative Prime Ministers (3 since mid-2022 alone).

In our 2023 Landlords' Report, we discovered that 41% of landlords felt the Conservative government supported them. 59% of landlords either weren't sure if they felt supported by the government (22%) or said they didn't feel supported (37%).

Historically, the Conservatives have been considered the party of property ownership and free enterprise; recent policies, taxes, costs, and legislation have led to many feeling this government is 'anti-landlord'.

But when it comes to voting, landlords appear torn.

Almost half of landlords (48%) think the Conservatives winning the next election would be 'good' for them. 30% consider this result' bad' for landlords, and 22% are unsure.

As of writing (March 11, 2024), YouGov's Westminster voting intention figures (March 6-7, 2024) show the Conservatives at 20% to Labour's 47%.

Reform UK have 13% of the voting intention, the Liberal Democrats have 9%, and the Greens have 7%.

The current voting intention suggests a victory for Labour, a result that 43% think would be good for landlords and 34% think would be bad. But much can change between now and the forthcoming election.

|

Party |

Good for landlords |

Bad for landlords |

Not sure |

|

Conservative |

47.81% |

30.46% |

21.72% |

|

Labour |

42.78% |

33.77% |

23.44% |

|

Reform UK |

34.70% |

26.75% |

38.54% |

|

Liberal Democrats |

32.05% |

31.52% |

36.42% |

|

Green |

30.86% |

33.11% |

36.03% |

|

SNP |

26.75% |

24.77% |

48.48% |

Are landlords worried about the affordability of paying any of their Buy-to-Let mortgages in 2024?

|

Are you worried about the affordability of paying any of your Buy-to-Let mortgages in 2024? |

% of UK landlords |

|

Yes |

42.91% |

|

No |

57.09% |

The results were close, but our survey discovered that 57% of landlords aren't worried about the affordability of their BTL mortgages in 2024.

43% of landlords are worried, and this is at a time when landlord mortgage arrears have doubled in a year.

At the end of 2023, there was a pronounced increase in Buy-to-Let mortgages in arrears compared to the end of 2022. There were 13,570 BTL mortgages in arrears in the final three months of 2023, an annual increase of 124%.

In the same period, the increase of private homeowners with mortgages in arrears increased by 25%, showing a significantly higher percentage of landlords have fallen into arrears either as a result of unaffordable refinancing costs or an increase in void periods (34% of landlords experienced an Increase or Significant Increase in void periods in 2023), possibly due to higher rents.

Do landlords think they'll buy an investment property in 2024?

The number of landlords looking to invest in property has increased year-on-year.

Last January, 45% of landlords said they would invest in 2023. 30% didn't think they'd invest, and 24.58% didn't know. Our survey has discovered that 40% of landlords did buy rental properties last year.

This year, landlords' intentions to invest in property have increased, as 51% said they think they'll buy an investment property in 2024.

Of those who think they'll invest further in property this year, 85% already own 2 or more properties. They tend to have 3 or more years of experience (88%) as landlords, and 57% already own properties in London.

Since the poll was completed, the Chancellor has abolished multiple dwellings Stamp Duty Land Tax (SDLT) relief from June 1 2024. Whilst the abolition intends to remove claims that abused the relief (investors claiming a luxury house was a multiple dwelling due to an annexe or "granny flat"), at first sight, its removal could prevent legitimate investment from landlords from investing.

|

Do you think you'll buy an investment property in 2024? |

% of UK landlords |

|

Yes |

50.99% |

|

No |

29.14% |

|

Don't know |

19.87% |

What will landlords do with their rental properties in 2024?

As landlords' costs increase, over half of tenants should anticipate their monthly rent increasing, as 51% of landlords said they'll raise rents to cover any additional expenses.

But what is more worrying for renters is our discovery that 32% of landlords anticipate selling their rental properties this year.

This is one of the most pressing issues in the UK property market. During this cost-of-living crisis and with rental fees increasing, renters are finding it harder to save enough for a deposit or meet the criteria for a mortgage.

Landlords' costs are increasing. Whether it's increased mortgage rates or any number of price increases such as property maintenance or renovation, as a result of inflation, landlords have to balance these increased costs with rental price increases.

With more landlords looking to sell their BTL properties, rental availability is decreasing, leading to increased demand for rental accommodation. Indeed, our survey discovered that 71% of landlords experienced an Increase or Significant Increase in demand for their properties from would-be tenants. This, in turn, increases monthly rental costs and further exacerbates renters' inability to save enough money to get onto the property ladder.

A third of landlords (33%) believe there will be no change with their rental property this year, and they won't increase rent or look to sell their BTL properties.

|

What will you do with your rental properties in 2024? Multiple choice |

% of UK landlords |

|

Raise rents to cover any additional expenses |

51.26% |

|

No change |

33.11% |

|

Sell rental property/properties |

31.66% |

|

Other |

0.40% |

Conclusion

The private rental market is vital in the broader UK housing market. It provides accommodation for those unable to get on the property ladder and landlords with an income.

Landlords are under significant pressure, though. With increasing rates and tax rises, many are looking to leave the market altogether. Renters are experiencing anxiety and fears over rent increases, their cost of living, and the UK economic outlook.

These are uncertain times for the UK rental market, and landlords and tenants may have no choice but to work together to navigate the current climate. Whilst landlords and tenants haven't always been considered equals, it's clear that in today's housing market, their relationship is more symbiotic than ever before; both require the other to survive.

| Poll Title: | UK Landlords' Report 2024 |

| Poll Objective: | To gain insights into the UK private rental market from landlords of at least one UK property that is not their main residence which they rent to tenants |

| Conducted: | January 5 - February 21 2024 |

| All Respondents: | 11,768 randomly sampled people in the UK |

| Qualified Respondents: | 755 |

| Screening Question: | Which of the following best describes your connection with property ownership? I own at least one UK property which is not my main residence of which I am a landlord |

| Respondent Age: | Aged 18+ |

| Respondent Location: | UK |

| Author: | Finbri |

| Source website: | https://www.finbri.co.uk/ |

| Platform: | Pollfish |

| Methodology: | A randomised sample of 11,768 throughout the UK's 67,898,805 population (worldometer), of which 755 respondents qualified. 95% confidence. 4% margin of error. |

| Copyright: | © 2024 Finbri Limited |

| Media Contact: | Georgia Galloway [email protected] 01202 612937 |

| Credit Requirement: | You must credit Finbri when republishing any part of these statistics. If you have any media enquiries, please email [email protected] |

| Open License Information: | https://www.finbri.co.uk/syndication |

| Source URL: | https://www.finbri.co.uk/bridging-loan/uk-landlords-report-2024 |